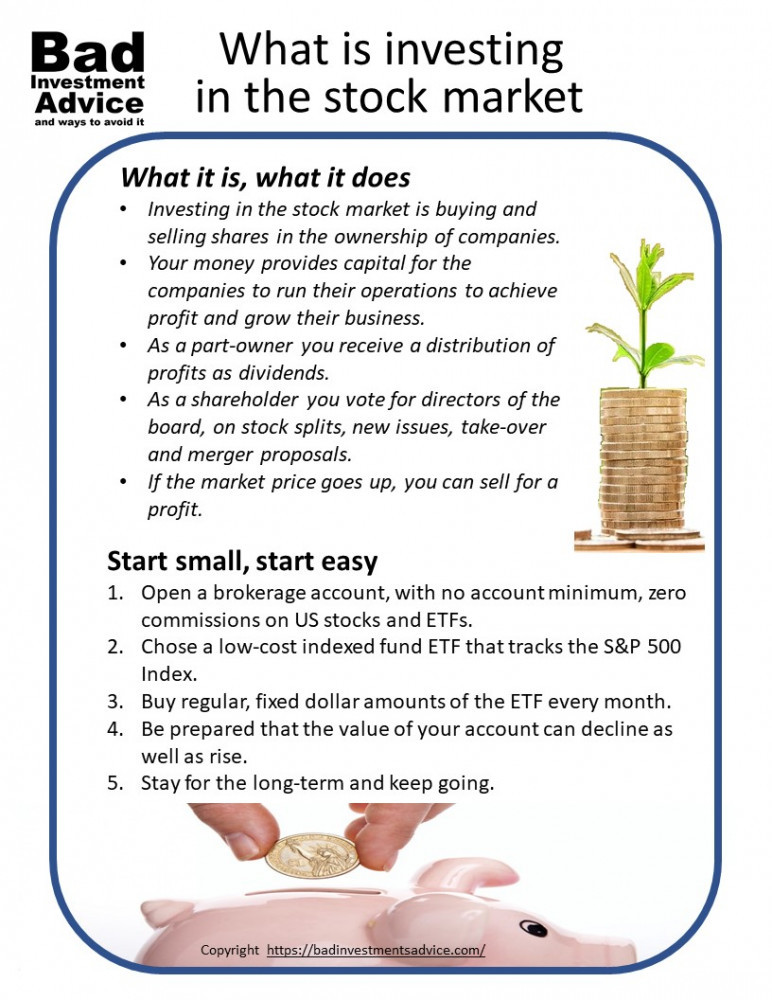

What is investing in the stock market? This is a very direct question and deserves a direct answer.

Investing in the stock market is buying and selling shares in the ownership of companies. When you buy shares, the money you hand over provides capital for the companies who use these funds to run their operations to achieve profit and grow their business. As a part-owner of the companies you are entitled to a distribution of profits in the form of dividends and if the value of the companies goes up, you can reap greater profits by selling the shares you bought at a price higher than you paid for them.

That was arguably a bit of a long-winded explanation but I tried to avoid using any stock market jargon and just stick to the basics.

Savings vs investing

There have been many wise words spoken and written about investing. Here are some ideas combined to illustrate a point.

Most of us embark on our economic lives as young adults when we start earning. At some point, we start saving. If we can, we will transition from saving to investing. If we are able to take things further we move on to multiplying our investments.

That can sound like dangerous pie-in-the-sky thinking but I did want to put it out there. For the moment let’s focus on the transition from saving to investing.

From a saver to an investor

I made my first cautious steps into stock investing in my late 20s after my father-in-law said to me.

You are someone who should look into investing in stocks.

That was a fairly straightforward suggestion. I thought about it and realized that he was right. So I started reading and when I had accumulated some money in my savings account I went to see the investment advisor at the retail bank where I had my checking and savings accounts.

After the usual conversation about my investment goals and risk-tolerance he suggested a rather bland selection of about half a dozen stocks that “he liked”. I remember they were mostly large companies from different industries including a heavy machinery manufacturer, some high-tech, a financial services provider, and a few others.

For each of these upright organizations, he had a story to tell about how their products were doing well or they were gaining market share, etc. I guess he thought that was the kind of thing I needed to hear to feel comfortable with where I had entrusted by funds.

What happened then

This was a long time ago, before the internet and online brokerage platforms. If you wanted to watch what the prices of your shares were doing you had to check the daily financial papers. Of course, I did, every day, religiously. Some went up a bit, some went down a bit and some didn’t do much of anything at all.

Every so often I’d get a call from my broker guy at the bank inviting me to follow some hot stock tip he’d just received. Sometimes I did, sometimes I didn’t have the money. Strangely these were always tips about what companies to buy into. I don’t recall him ever calling me to suggest selling any of my positions.

Before I left for a new job in a different country, I went to see him to say goodbye. We shook hands and he said how we had enjoyed some winners and some losers in our time together. I think it was the pat speech for the occasion though not insincere. All pretty much par for the course back then I think.

The development of stock exchanges

The world of stock markets and investing is very different now. You no longer have to go and sit with some guy in a bank and persuade anyone of anything. But first, let’s look at what stock markets and publically listed companies are.

Some hundreds of years ago, the power of kings, queens, and the nobility was being challenged by burgeoning merchant classes. These merchants realized that they could spread their business risks by getting other people to invest in their enterprises. Joint-stock companies were born. Then came the notion of limited liability, whereby if you invested or were the owner of a limited liability company, the bailiffs wouldn’t try to throw you out of your home and auction your furniture if the company went bankrupt. You would only risk the money that you paid in as capital.

Wealthy merchants and members of the nobility who had already been taking shares in each other’s enterprises started buying and selling or transferring these shares in ownership between themselves. These markets in business debt and ownership went through many developments and permutations.

The first market that was recognizable as a stock market was founded in Amsterdam in 1611. Rules, regulations, and laws governing the activities of companies and the people who traded in them all evolved over time.

Stock exchanges today

Today public stock exchanges are markets where any member of the public can buy shares in the companies listed on the exchange.

Companies listed on the stock exchanges are also called publically-listed companies. To achieve and maintain a public listing there are many criteria that have to be met. The larger exchanges like the New York Stock Exchange have more stringent requirements than smaller exchanges like the NASDAQ.

There are many thousands of companies listed on the stock exchanges in the US and similar numbers in other countries. Laws, rules, and practices differ between countries. One common feature is the fact that control is exercised by large and powerful groups.

In some situations, relationships between controlling groups are reinforced by complex cross-ownership and board representation arrangements. All that is hardly surprising and could be the subject of extensive discussion but not for now.

What is means to own shares

Shares have a face value and a market value. When the shares of a company are first issued the face value and the market value may be close. Though this differs from country to country, the face value of a share is really just a number printed when the certificates are first issued. After they have been bought and sold even for a short time the market price will likely move further away from the face value.

The face value or nominal value of a bond, on the other hand, has much more significance. The nominal value of a bond is the sum returned to you when the bond is redeemed.

Let’s say XYZ company when it was first listed on the stock exchange issued 10 million shares with a face value of $10 each. You bought 10 shares each now worth on the market $100 per share, so your position cost $1,000. You have effectively purchased a millionth-share of the company.

The fact that you own those shares gives you rights of ownership. Those rights mean you get a share of the profits and voting rights for the duration of time that you own them.

Profits will come to you in the form of dividends usually paid out every four months. Not all companies pay dividends and those who do can choose to increase or decrease the amounts they payout. In today’s world of low-interest rates, dividends amount to a few percents of the cost of shares at best. So relying on dividends from companies isn’t really a great way to earn much from shares. The real gains come through appreciation if you are able to sell them for a price higher than the price you bought them for.

It is also possible to benefit from movements in the market price of shares through trading derivatives such as options or futures. You can benefit from price appreciation but also from price declines if you take positions in options or futures. These have greater profit potential but also greater potential for loss and if you are not careful and things go really against you, you may get an unwanted visit from the bailiffs.

Voting rights

The other benefit of owning shares is that you get to vote. Of course, your vote is proportional to your ownership. If you have a millionth-share your vote will count a millionth towards the outcome of a vote. Matters that get referred to a shareholder vote include, the election of the board of directors, whether to undertake a stock split or issue new shares, and in some cases whether to accept a take-over or merger proposal.

The practical implication, if you own shares, is that you will get mail inviting you to vote on issues. It might sound like fun but it quickly becomes tedious as the paperwork that comes with these things is turgid in the extreme and seems to be written by humorless automatons who harbor an intense dislike for anyone trying to read and actually understand them.

So what shares to buy?

As noted already, there are thousands of shares listed on the stock exchanges and whichever country you live in, with some exceptions, it is likely to mean you will be faced with a bewildering array of possibilities. This is one of the most common problems of people who want to invest in stocks but don’t know where to start, or how to build a portfolio.

Sectors and industries

There are so many ways to look at shares on the stock market. I should add here that I am using the terms “share” and “stock” to mean the same thing.

Firstly there are companies from different industries. And the industries are grouped into sectors. An example would be the Technology sector, which in turn divides into the industries of Semiconductors, Software, Internet, and Computers.

But let’s imagine that you don’t want to get into all that detail, you are just looking for a simple way to start investing with a small amount of spare cash.

Market indexes and what they mean

Anyone who has listened to financial headlines will be familiar with newscasters talking about the DOW gaining or losing a number of points in a day. The Dow Jones Industrial Average or the Dow for short is a headline figure that tracks the prices of 30 of the largest companies on US Exchanges. If you want a more detailed explanation, check here.

The Dow Jones though is really just a headline figure, most investors and financial professionals look at other indicators or broader market representation, such as the Standard and Poor’s 500 Index or the S and P 500 for short. The S and P 500 tracks the prices of 500 of the largest companies on US exchanges and is weighted by the market capitalization, or size of each company. The Dow on the other hand is just the numerical sum of all the component stock prices at any one time.

One tried and tested approach to long term stock investing is to invest in a portfolio of stocks that is or at least mimics the S and P 500. To see the long-term performance of the S and P 500 and what you can expect this to do for your investments, check here.

It would be easy to think that all you have to do to mimic the S and P is to build a portfolio that looks like the index. So you would need shares in 500 companies with positions in each weighted by their respective market capitalizations. That would cost you millions. Fortunately, there is an easier way through Exchange-Traded Funds or ETFs for short that do all the work for you.

Baskets of shares – funds

The easiest and in some ways safest way for someone looking to invest in stocks starting with a small sum of money is to start buying into one of the many ETFs that track the Standard and Poor’s 500 market index.

Many household name investment companies offer such funds that track the S and P 500. Here are some of the most popular.

- Fidelity 500 Index Fund, symbol FXAIX. Annual cost 0.02%. It tracks the S and P 500 closely but not exactly.

- iShares Core S&P 500 Index Fund, symbol IVV, Annual cost 0.03%

- Schwab S&P 500 Index Fund, symbol SWPPX. Annual cost 0.02%. Like the Fidelity fund, it tracks closely but not exactly the S&P 500.

- State Street Global Advisors 500 Index Fund, symbol SPY. Annual cost 0.09%

- PortfolioPlus S&P 500 EFT, symbol PPLC. Annual cost 0.36%

- Vanguard 500 – symbol VFINX, annual cost 0.14%

As you can see they differ in annual cost. They also adopt different approaches. Some are actively managed and tend to have higher annual costs. Some are passively managed and tend to have a lower annual cost. For a detailed explanation of the difference between active and passive fund management, check here.

A brokerage account

You will need a brokerage account to buy and sell shares and ETFs. There are a number of these available today that require no account minimum and charge no commissions on US stocks and ETFs. For a comparison of some of the main brokerage providers, check here.

Many of these will also allow you to trade fractional shares. This could be important if you are starting out with a small amount of money that you will be adding to regularly.

Many of the S&P 500 Index Funds have share prices around $300. Let’s say you have $100 a month that you want to use to build a portfolio, by opening an account with a broker that allows fractional shares, you don’t have to wait to accumulate whole mutliples of the price of the individual shares in the funds you are buying.

Clever stuff

As already noted, for stock market investing you can make use of options and futures contracts and you can buy and sell shares and derivative on margin if your broker is willing to let you. Of these, options are probably the safest to start with and can be used to give you leverage and manage your risk within bounds that work for you.

Starting small

In a nutshell, the simple and easy way to start investing small sums of money in the stock market is to buy regular dollar amounts of an indexed ETF like one of the ones listed above. You can buy as little as $100 or $50 each month if your broker will allow that.

You always have to remember, prices can go down as well as go up. So there is every possibility that at the end of the first year, you will look back on your account and see that the total value is less than the sum you have put in. That is going to happen in some years. Other years your account will show a total value that is more than all you have put in. You have to ask yourself whether you will accept seeing the value of your account decline as well as increase. If you are not willing to see declines then stock investing is probably not for you.

To find out more about Exchange-Traded Funds, check here.

Some questions answered

Q. What does it mean to invest in the stock market?

A. Read this article, it explains exactly what it means to invest in the stock market.

Q. How do I begin to invest in the stock market?

A. The last four paragraphs of this article explain exactly the easiest and safest way to begin investing in the stock market.

Q. Can I make money in the stock market?

A. Yes, you can make money in the stock market though it is best to expect long-term gains. Another article explains this you can check here.

Q. Is it a good time to invest in the stock market?

A. Now is a good time to start as any. If you make regular purchases of one or more index-linked funds as summarized in the last four paragraphs of this article, then you will minimize any major adverse effects of starting when the market is high and heading for a decline.

Here is a single-page PDF summary of investing in the stock market.

I hope you found this article interesting and useful. Do leave me a comment, a question, an opinion or a suggestion and I will reply soonest. And if you are inclined to do me a favor, scroll down a bit and click on one of the social media buttons and share it with your friends. They may just thank you for it.

Disclaimer: I am not a financial professional. All the information on this website and in this article is for information purposes only and should not be taken as investment advice, good or bad.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you!

I am very interested to know about the stock market but I really hate numbers. The moment I see numbers and figures in any article ,my interest will suddenly dwindle. Terminologies make my head spin. This has changed.

Congratulations to your patiently well researched article written in a way to keep my attention glued to the screen. I learned a lot about stock market through your awesome post.

Hi and thanks for your comment. I am glad that I did manage to hold your attention to the end. Sorry, it was quite a long piece. If you really do have an unwavering aversion to numbers, be careful looking at other articles on this site, as many of them do get into numbers, figures and charts. Unfortunately, it is somewhat inherent in the business of stocks, investing, and trading. I did my utmost in this article to avoid jargon and just work with the basics from the ground up as it were. It is all too easy for me to get into the various merits or otherwise of different chart indicators and such and forget that there is a large number of people who have no time or inclination for such things and just want simple straightforward information on how to invest simply, safely and profitably. That was the goal here. Thanks for your comment and best regards, Andy

Hi, Very interesting article. I liked the history about anything, never thought about Amsterdam,as the first Stock Market location.

Your explanation about how markets work is very clear, which means you know how it work. If I open a brokerage account and go for ETF´s for fractional shares thinking in appreciation bases in options, how would you manage with this scenario:

I have kept an eye with GE which is now at 7.04; a 52wk range of 5.48 – 13.26. GE have changed their CEO which they changed about a year and a half. Most investors are waiting a little bit more to go down to 6.5 and buy. Is it time to see what could be done with a fractional share, say 50.00 dollars and see what happens?

Thanks for your wonderful explanation about the markets, I will be reading your post about them.

Hi and thanks for your comments. If you are thinking of opening a brokerage account and investing in ETFs then you should decide what ETFs would match your investment strategy. Broadly speaking you could adopt an approach that either matches one or more market indexes or a different strategy such as growth or emerging or developing markets or you could pick a mixture. Some people, for example, would choose to invest maybe 40% in a broad index-linked fund, 20% in a momentum fund, for example, 10% in biotech and 10% in high-tech. This is just an example. It is really a question of you choosing what works for you. As regards options there are different ways to use them. If you have decided what ETFs you want to buy and hold in the long term you could sell out-of-the-money covered calls as a way to generate additional income, noting that some times you may be obliged either to close out those positions before expiry at a cost or sell the ETFs at the strike price. If you have a particularly bullish sentiment regarding a particular ETF over a specific time frame then, for example, you may want to take a long position in a call option that is in-the-money with some time to go to expiry, maybe 5 to 6 months out. That would leverage your position so would also have downside risk. There are other options approaches and much depends on what you project and how you want to protect your downside.

As regards GE, I am not sure where the earnings are heading. It had negative earnings over the last few years and may be heading into positive territory. Their second-quarter earnings report is due out next week and unless there is very good news the stock may move lower. If you have a long-term bullish sentiment regarding GE it may be a good point to buy as you say it is at a low. On the other hand, as a big industrial stock, it is in a sector where many institutions are reducing their positions. That means for a while you would be swimming against the current. It is a bit of a behemoth but if you really think the new CEO is going to drive the enterprise into better times then it may be a good time to take a position. If you are really hoping for a low price, then put in a limit order to catch it if you think it will dip.

Disclaimer – all of the above is for discussion and should not be taken as personalized investment advice. I hope this helps and thanks again for your engaging comments. Best regards, Andy

Are ETFs the same as mutual funds? I have a retirement fund that I invested in Fidelity OTC. This seems to rise and fall with the DOW. Is that normal? It is a type k fund. Do you know what that means? I would also like to start investing in individual stocks. Do you have any advice for this?

Hi and thanks for your comment. Mutual funds and ETFs are similar. Mutual funds have been around longer than ETFs. Mutual funds are only traded after the market closes whereas ETFs are traded on the exchanges during trading hours. Mutual funds tend to be actively managed to deliver a specific strategy while ETFs can be either actively or passively managed, so costs for mutual funds can be higher than passively managed ETFs for example. Mutual funds were designed and set up to be held for a long time. You pay fees, and sometimes substantial fees to buy sell mutual funds, but many brokers allow you to buy and sell ETFs online with no commission or fees. K class funds were established as a way of controlling and reducing expenses and achieving tax advantages, they are designed for and only used by institutions.

If you want to start investing in stocks you should first decide what kind of investment strategy works for you. Here is an article that could help

https://badinvestmentsadvice.com/how-to-begin-investing-in-stocks-steps-to-take-before-you-invest/

Let me know how you get on with this article and I’d be happy to answer any other questions you may have. Best regards, Andy

Great post Andy,

I’ve been hearing a lot about stock market investment but I keep getting confused between stocks and the other markets, investing in companies is the real deal! A lot of people say that investing in stocks is a gamble but if we study and understand a company’s trends, that’s golden!

Hi Riaz and thanks for the comment. There is no reason why investing in stocks should be a gamble if you take the time to learn how to do it safely and in the long-term profitably. Best regards, Andy

I think this is a great article for people that know nothing but the stock market. I do get frustrated when experienced people in this area talk about it as if everyone understands it then look down their nose at you afterwards when you don’t!

This is a step by step and although I don’t fully understand it I did learn a lot more than I knew before. I take it this can also apply to the FTSE 100 in the UK or do different principles apply?

My only real experience of shares is company shares where you were given them as a profit incentive and I have to say it worked well and you could see you direct effort in a company making a difference and then of course getting more financial reward for doing so rather than just your salary.

Really interesting and if anything filled me with a bit more confidence in this area.

Hi Phil and thanks for the comment. Yes, this all applies equally well to the FTSE 100 and the UK stock market which is one of the most varied and active in the world. Some rules differ slightly from the US. If I recall correctly it is a little easier in the US to suddenly find a stock disappear off your portfolio because of some takeover activity that can seem to come out of nowhere. This used to really irritate me as I was also tracking and planning all my positions on a spreadsheet. In the UK that is not so easy as I think shareholders have to be consulted regarding most takeover bids before they can proceed. When I first came to the US this was a bit of a shock. The other cause of irritation if this happens is that if the takeover happens after the stock has appreciated well and you haven’t held it for 12 months yet, the gain is taxable as income, whereas if you hold for more than 12 months as I usually planned to do the gain is taxed as a capital gain which is usually around half the rate.

As regards the FTSE 100 that is calculated from the market capitalizations of the 100 underlying companies so in many respects it is similar to the S&P 500 and a better barometer of the UK market than the DJIA is of the US markets.

As you so rightly say, distributing stock to employees is a very good incentive especially when the company is growing and they are increasing their capital base.

Thanks again for the comment. Best regards, Andy

Hello there, I am delighted to have come across this really nice article and it’s really nice to know more about investing in the stock market. Today I am more someone who has to save money rather than invest it. Now I wished I had made investments with it instead of saving. I would love to see more of such articles and learn more as time goes on.

Hi and thanks for the comment. I am very glad you found it interesting and informative. Please do come back you will find other articles and let me know if you have any questions issues or suggestions. I will be pleased to answer. Best regards, Andy

Hello there! this is an amazing review you have got here, I’m sure the quality information in this post will be of great help to anyone who comes across it as is to me. Indeed, investing in stock has a lot benefits; the stock market gives chance to grow your money.

Thanks for educating me with this quality info.

Hi and thanks for the comment. I am glad you found it informative and I hope useful. Best regards, Andy

Hello there, Thanks for sharing this awesome article I know it would be of great help to the public as it has been of help to me. investing in the stock market is very lucrative and has proven to be the best way to invest in recent times but it comes at a risk as one wrong move could make you lose all your investment.

Hi and thank you for your positive remarks and comments. As regards the possibility of losing the total value of your portfolio, that would only be a real possibility if you invested all your money in a few highly speculative financial instruments. On the other hand, if you build a diversified portfolio of stocks, while the total value of your holdings can and will decline when the market declines, you reduce the risk of being completely wiped out to near zero. You may find it helpful to check this other article on diversification.

https://badinvestmentsadvice.com/how-to-have-a-diversified-portfolio-a-simple-approach-to-picking-stocks/

Please do let me know if you have any comments, questions, or suggestions and I would be pleased to respond. Best regards, Andy

This is a great article. Since the virus attack on our nation, I’ve been researching about some ways to make money online. Stock investing is one of them. However, I never done it previously, so your article here gave me a quite good insight to start investing. Do you think stock investing is a bad idea for someone who doesn’t like to take high risk? Thanks for your answer

Hi and thanks for your comment. I personally think that investing in stocks is the best way for most people to build a financially secure future. There are ways to manage risk down to acceptable levels. The very simple approach suggested in this article is low-risk as you will only be facing the overall risk of the stock market. If you are new to stock investing I would suggest that you check out this article too.

https://badinvestmentsadvice.com/how-to-begin-investing-in-stocks-steps-to-take-before-you-invest/

Please do comment again if you have any further questions, concerns, or suggestions. Thanks and best regards, Andy

Nice article I tried stock investing before I wasn’t sure what i was doing but I still tried and lost some money but after going through your article I think I am going to buy in again and see if I can so something with stocks thank you very much for writing this. I learned a lot from your article.

Keep writing and educating people on investing in stocks!

To Your Success,

Alberto Lazaro

Hi Alberto, thanks for the kind comments and positive feedback. I am glad you found it informative and I hope you will come back. I’d be happy to hear any concerns, suggestions, or questions you may have and I” respond soonest. Best regards, Andy