In this second part of an introduction on how to do technical analysis of stocks, we look at more tools to analyze stock price movements. If you missed the first part it’s right here.

Trending indicator types

Trending – indicates confirmation of the movement i.e. continuing in the same direction.

Oscillators – indicates a reversal of the trend

Volume – indicates the strength or weakness of the trend

Other tools

Moving averages. When the current price moves above the moving average this is usually an indicator to buy. When the price moves below the moving average this is usually an indicator to sell. A common practice is to use a few moving averages with different periods. When the moving averages cross each other as in the earlier example that is a signal to enter the market.

Bollinger Bands. Bollinger bands are additional lines added above and below a moving average. The upper and lower Bollinger Bands are the standard deviation from the moving average line in the middle. When the price stays in the upper band and the band and the price are both moving up, that is confirmation that the uptrend in price will likely continue. When both the price and the moving average are moving down and the price stays in the lower band that is confirmation that the price downtrend will continue.

Average Directional Index (ADX), Directional Movement Index (DMI)

The +DMI is the positive Directional Movement Index. It is a moving average usually with a 14-day period which measures how strongly the price moves upwards

The -DMI is the negative Directional Movement Index. It is a moving average also with a 14-day period which measures how strongly the price moves downwards.

+DMI and -DMI show the relative strength of bulls against bears.

The Average Directional Index, ADX is non-directional and just shows the strength of the movement, whether up or down.

During an uptrend, the +DMI indicates the strength of the price movement. When the +DMI crosses the -DMI in an upward direction that is a buy signal.

During a downtrend, when the -DMI crosses the +DMI in an upward direction that is a sell signal.

Theoretically, ADX varies from 0 to 100 but practically it will move between 0 and 60. It shows the strength of the trend regardless of the direction.

When ADX falls below 20 this indicates that the movement is weak. When the ADX rises above 40 that indicates a strong trend, either upwards or downwards. When the ADX rises from below above 20 then the price trend has some strength and will continue. When the ADX falls from above 40 to below 40 this indicates that the price trend has lost its strength.

The ADX is best used to confirm signals from other indicators.

Stochastic Oscillator. Consists of two moving averages that move between 0 and 100. From 0 to 20 indicates oversold and therefore is a buy signal. From 20 to 80 is in the middle or neutral ground and from 80 to 100 indicates overbought and therefore is sell signal.

Moving Average Convergence/Divergence – MACD – shows the strength of a trend and indicates its further direction. MACD takes two moving averages, with different time periods, subtracts the longer moving average from the shorter moving average to produce an oscillator. The MACD oscillates above and below zero. It is usual to add a histogram to the MACD chart which tracks the distance between the MACD oscillator and the price. The histogram also oscillates above and below the zero mark.

When the shorter period moving average is above the longer period moving average and the histogram is above zero, this is a strong indicator of rising prices. When the shorter period moving average moves below the longer period moving average and the histogram is below zero, then this is an indicator that the price trend is weakening and the price will fall.

For a more in-depth look at Moving Average Convergence divergence, check here.

Relative Strength Index, RSI – shows the strength of the trend and the probability of its change. RSI moves between 0 and 100. An RSI from 0 to 30 indicates the stock is oversold. This indicates that the price will rise and is a strong buy signal. Once the RSI goes above 70 that indicates that the stock is overbought. That suggests that the price is about to fall. This is a sell signal.

Volume Indicators

Volumes -. Volume is displayed as bars which indicate the number of trades executed during the period. When the volume bars increase and the price increases this indicates that the price trend will continue. When the price rises but the volume falls that is called divergence. This means any rise is weakening and the price will likely soon fall.

When the price falls and the volume increases this is called convergence and indicates that the price will soon go up.

Money Flow Index (MFI) – displays the volume and intensity of trading at a particular point in time. MFI moves from 0 to 100. When the MFI moves from the high side down below 20 this indicates that the stock is oversold and suggests that the price will rise. When the MFI moves from below to over 80 this indicates that the stocks overbought and will soon fall.

When the MFI and the price converge this indicates that the price will rise. When the MFI and the price diverge this indicates that the price will fall.

When the price and the MFI move in parallel then you can detect levels of support and resistance. A breakout of the MFI from a rising pattern in parallel with the price indicates that the price will soon fall. A breakout of the MFI from a declining pattern in parallel with the price indicates that the price will soon rise. Often the MFI breaks before the price which is why MFI can be a good indicator for trading.

Accumulation/Distribution (A/D) – looks at price movement and compares with volume trends. When the volume moves in parallel with the price this confirms the price direction. This means that the trend will continue in the same direction.

When volume and price diverge this indicates that the price direction will soon change. This is a strong indicator of price trend reversal – in this case, decline. When the volume and price converge this is a strong indicator that of a trend reversal and that the price will soon rise.

Elliot Wave Theory

Elliot wave theory seeks to identify repetitive wave patterns in price movement. Elliot himself was an accountant and first developed and published his theory in the 1930s. He linked market price movements to human behavior and natural rhythmic cycles.

Elliot’s wave theory says that the wave patterns of stock price movements display fractal patterns, following Fibonacci ratios at each level of analysis much like the structures of ferns, leaves, seashells, and snowflakes.

The theory divides each wave into two parts. The first part is called the impulse section and a second part called a correction section.

Following the principles of waves within waves, the impulse section of the wave consists of five legs and the correction section of the wave consists of three legs.

Like a fern or a snowflake, the same fractal pattern repeats the closer you look.

The Elliot wave patterns can be found with both up trending prices and with down-trending prices. On price downtrends the impulse section is a downward trend with five shorter waves and the corrective section is an upward trend with three shorter waves.

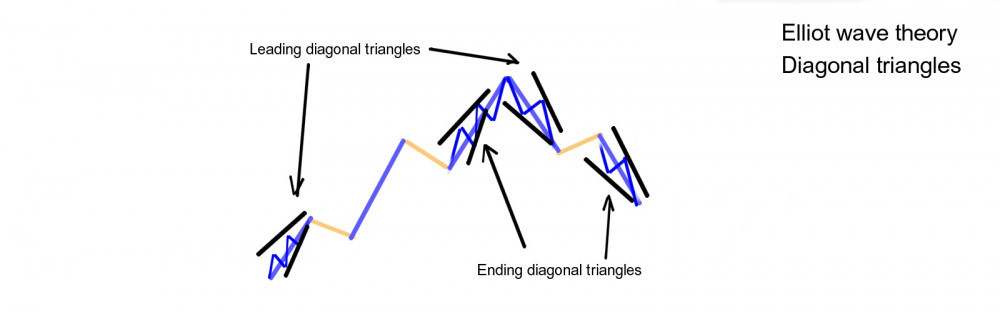

The theory says there are patterns called diagonal triangles at the beginning or at the end of impulse and correction waves.

So was do all these confusing lines mean. The importance of the diagonal triangles is that identifying where the impulse wave reverses into a corrective wave is a key point to enter the market.

Elliot waves today

Since Elliot published his theory there have been adherents and those who have challenged and refuted the theory. But still today Elliot wave theory is considered a core component of technical analysis and is used by many analysts to help identify trends and market entry and exit points.

To find out more about Elliot wave theory, check here.

Other considerations

This has just been a simple introduction to technical analysis applied to stock prices. There are many other indicators that are used to determine which stocks, which industries, which sectors or which asset classes to take long or short positions, and when to enter those positions and when to exit. Here are more reference materials on technical analysis.

Can you beat the market?

Some say you can, some say you can’t and some say that without powerful tools and nerves of steel it is more likely that your emotions will take over just when you needed to get in earlier, wait longer, bale out sooner or hold on longer.

I hope you found this introduction to technical analysis interesting and useful. Leave me a comment or any question and I will get back to you soonest. And if you want to do me a favor, please share a link on your social network. You just have to scroll down a bit to find the buttons.

Affiliate Disclosure: This article contains affiliate links, if you purchase through a link on this site, I may receive a commission.

Are you ready to get serious about investing in your own financial education? Then check out membership of the American Association of Individual Investors, the AAII.

The AAII is a nonprofit organization, dedicated to the financial education of its members. Your membership of the AAII will give you access to courses and resources on stock investing, financial planning, and how to manage your retirement finances.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you!

I’ve always wanted to try my hand at stocks and shares but I just never felt comfortable with it… I guess the bottom line is you need to know what you are doing and to do that, you need to study the subject to understand it. Your website could definitely help in that regard.

Thank your for your comment. I agree with you that it is advisable to inform yourself how to trade in and invest in stocks. But as you do your confidence will build. Whereas years ago fees and commissions were prohibitively high many excellent brokers offer accounts and trades with zero commissions. It is possible to start investing with very small amounts and steadily gain experience and confidence. You will find many articles on this website that walk you through different aspects of investing in stocks. Thank you again for your comments and good luck. Kind regards, Andy.

Hi Andy,

👏🏼👏🏽👏🏾👏🏽👏🏻👏

In this two part series of lessons that I have read in less than 20 minutes, I have learnt what I could not learn in more than 20 weeks, from two Coaches!

In Part 2, you have included many more techniques that I had not heard of, but you explained them in great detail and with incredible know-how!

I like the way you have connected the two articles. I was able to toggle between the two.

Please check my comment about the link in Part 1. Here in Part 2, you start off with, “If you missed the first part it’s right here.” And the sentence is linked.

Fantastic work!

Hi Teboho, I thought it would be interesting to look at how all the different technical analysis tools handled the same period for the same price chart to see whether they generated similar signals for market entry and market exit. I think it is clear there is some overlap but not universally in all cases. I think this was also a very interesting period since the fund has seen very volatile price activity over the last months. We live in interesting time. Thank you again for your very helpful comments. As you may noticed I fixed the errors you spotted. I wish you all success, Kind regards, Andy

Hello, this is very detailed content you have here. I really appreciate the detail and clear explanations, I read the first part and I found it logical and well presented, I have saved these page so as to come back for future reference, Thanks for sharing such amazing detailed information with us all.

Thank you for taking the time to leave this comment. I am pleased that you found it informative. Please come back and check other related articles. Best regards, Andy

Thank you for sharing this technical analysis. I’m still a beginner, so I try to learn hard. I believe that stock trading is not a gambling and depends a lot of your trend reading skill (although luck may also play a part). How many parts do you plan to release the technical analysis knowledge? I’ll be looking forward to read all of them. Thanks

I agree with you that stock trading is not gambling as long as you trade and invest using a rational system based on sound principles. I will be publishing further articles that delve deeper into the specific of technical analysis. I will be looking at how the various assistive analytical tools such as MACD, RSI, Bollinger Bands and ADX provided different or similar signals for certain recent price movements. I suppose you could say this would be sort of selective backtesting. Thank you for your comments and please check back soon. Also you may find the other articles on fundamental analysis and quantitative analysis of interest. Have a great day, kind regards, Andy

Good analysis of stocks to help prospective investors’ understanding of the complexities around this type of investment. Stock investment to me over the years has remained a puzzle. The language is better understood by the experts in the business, so I think. Now I have insights to an extent. However, when it comes to trading, wouldn’t you suggest I engage the services of an expert?

Hi Debbie, Thanks for your positive feedback. In earlier days effectively before online trading when commissions and fees were high it was only feasible to trade individual stocks if you had a reasonable sum of money and you were ready to accept the risk of significant losses. These days many online brokerage firms will give you an account with no minimum and allow you to trade stocks and ETFs with no commissions. So the risks are much lower, While I agree it is desirable to take expert advice or better learn from experts there is no real reason why you should let an expert do it for you if you have the desire and are willing to put in the effort to learn. Even if you only start with a few hundred dollars and build from there. I think it is really a question of learning enough to understand the basics and you own motivations and emotions and using a system whose risks and rewards match your needs and tolerance. Having said that the markets right now are very volatile and times like these have historically drawn in new investors who often get in too late and will lose substantially. Check out this article

https://badinvestmentsadvice.com/how-to-begin-investing-in-stocks-steps-to-take-before-you-invest/

which might give you more insight and a few others on this site. Let me know your thoughts. Thanks and good luck, kind regards, Andy.

I know that finding a good article does not come by so easily so i must commend your effort in creating such a beautiful website and writing an article to help others with useful information like this.Technical analysis can help spot demand (support) and supply (resistance) levels as well as breakouts. Simply waiting for a breakout above resistance or buying near support levels can improve returns. It is also important to know a stock’s price history.Elliot wave explained a secret of stocks in his theory when he said ” the wave patterns of stock price movements display fractal patterns, following Fibonacci ratios at each level of analysis much like the structures of ferns, leaves, sea shells and snowflakes”this refers to human behavior and natural rhythmic cycles….

Many thanks Wilson for your compliments. I am glad you found it interesting and useful.If you are looking for an understanding of other aspects of investing, check out the other articles here about fundamental analysis and quantitative analysis. I will also be adding more articles on related subjects. Thanks and best regards, Andy

The second part is more advanced the terminology is brokers languages. A broker is that individual with a license who will be following your stocks. The broker decision will be base on market trends. So the first part allowed you to make an educated decision when it comes to your investment, but part two prepared you to tackle the markets, and also understand how GDP will affect the markets. So great continuation to part 2.

Thanks for your comments. Of course this subject doesn’t stop here. There will be more articles comparing how the various analytical tools behave around similar market conditions to get a handle on what tools to read for which kinds of signal. Thanks again. Best regards, Andy

Awesome buddy, this sounds like Forex too. I tried Forex years back and they have almost the same tools too analyse the market. I’ve always wanted to try stocks and shares but I just never felt comfortable with it. I guess it is time for me to learn this way of growing wealthy as well. Just let me finish the website I am working on and then after that I will focus my mind to learn this things.

Hi Juma, indeed many would say that whereas forex is pretty much a zero sum game, whereas when you trade and invest in stocks you are buying and selling something of intrinsic value with a much larger potential for delivering an income stream in terms of dividends and capital appreciation than is the case with currencies. Having said that of course when market prices are far out of bounds with respect to a company’s earnings the relationship of share ownership to income delivered is all but lost. But yes you are correct. The tools of technical analysis apply equally to stocks as to forex since it is patterns of human behavior that are being examined and revealed. Kind regards, Andy

Hi Andy

It is good to read about all the different mathematical techniques that can be used to determine of it is good to buy or sell stocks. They problem is that models tend not to be good predictors, as what happened in the past cannot be used to predict the future. I am a great believer in using all the data at hand to make predictions to know when to sell shares but that does not guarantee success. If they did then a lot of mathematicians would be rich, it is too unpredictable.

In all the types you have discussed, which one is the most reliable one for success?

Thanks

Antonio

Hi Antonio, actually I think you will find that there have been a few mathematicians who have got rich. Or at least there was a famous fund manager who used almost exclusively mathematical techniques – Benjamin Graham who was also Warren Buffet’s mentor. Yes you are right it is advisable to study as many angles as you can on stock positions to know when to enter or exit a trade. And as you say none of that is any guarantee of success as there is always risk involved. And another point is that some factors are inevitably going to be more important than others. In today’s world where the big boys, and girls are putting their money is going to be one of the if not the biggest price driver. Of all of the analytical tools I find ADX to be the least useful. What I am looking for is indicators of whether a stock is overbought or oversold. I find MACD and the Stochastic oscillator gives a good indication of that. I find the Bollinger Bands give a good sense of whether to stay in a position that I already hold or get out. And you always have to have an eye on volume being traded. So I don’t think there is a simple answer to your question as there are too many factors and looking for indicators when to enter a trade and when to exit a trade are different because the market has moved in the interim. I’d be interest to know your opinion on this. Thanks for your comment and thanks for the question. Kind regards, Andy

I’m soon going to be investing in the stock market and it can be risky if you don’t know what you’re doing I’ll be going over this website again before investing because the information on this site is really good the charts and graphs are very well put together and no writing mistakes makes everything clear.

Hi Joe and thank you for your positive feedback on the site. Do check out other articles and if you have any comments questions or suggestions then please leave them and I will respond. Yes stocks are risky but there are risky ways to trade and invest in stocks and less risky ways and there are downright careless ways guaranteed to lose you money. So it is certainly advisable to know what you are doing. I wish you all the very best. Kind regards, Andy

Hi Andy, investment and financial knowledge is even more important in this fast and rapid changing world. It really help reading through your list of shares investment terms. When i was first started in shares investing, it was not easy to understand the technical terms and reading the shares diagrams. I had read through many investments books. In order to improve my investment knowledge. And i learned the hard way that having the knowledge and not knowing how to use it. Is not going to help either. It was not easy to understand the investment terms because it is so complicated. Until i read through what you had shared, it is so easy to understand. It really helps a lot. Really save up lots of money signing up for workshops that does not even work.

Thanks,

David Koh

Hi David and thank you for your positive comments. I agree there is much to learn in this field and it is easy to lead yourself astray down a wrong path and lose money and confidence and give up. For that reason even with a good deal of knowledge and study the best place to start for many people could be regular contributions into a market indexed fund and allow that to build over time. Then divert a small portion of the regular contributions to investment vehicles with a higher risk reward profile. But it will always be necessary to use a solid system and stick with it in a disciplined way. I wouldn’t spend money on workshops either. Good luck to you and thank you for your comments. Kind regards, Andy