Is leverage trading risk-free? Simple answer – No.

Nothing in investing and trading is without risk. Leveraged trading just amplifies your potential gains and your potential losses.

So why use leverage for trading?

There are many possible answers to that question.

One answer is that you have a tried and tested system that maximizes the potential for gain while minimizing the potential for losses.

You have tested this system for a while. You have tested indicators that give you signals that tell you your system has a high chance to gain and at other times they tell you it is best to leave the market alone. So overall, you are confident that the amplified returns you will enjoy from leveraged trading will more than compensate for any amplified losses you may incur.

A more usual answer is because most people just think they are going to win.

Yes, there are lots of examples of traders who win big and have done so with leverage. But there are many more stories of people who have lost more than they bargained for.

What is leverage

Perhaps before we go any further we should consider what is leverage and how it is used.

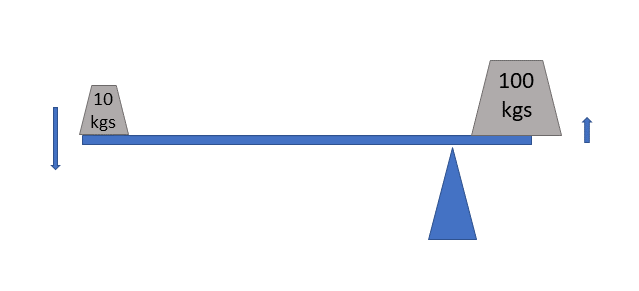

If you remember your high school science, a lever is something that you use to lift and move heavy weights.

Ancient man used levers to lift large stones and build monuments like Stonehenge and all the other Neolithic stone circles found over much of Northern Europe and the British Isles.

Leverage in finance achieves a similar result but with some meaningful differences. Financial leverage involves at least two parties to a transaction. And the transaction involves something that will or could happen in the future and shifts the pattern of risk and reward, rights and obligations between the two parties in certain ways depending on the contract governing the transaction.

That sounds rather confusing on the face of it. But leverage always involves one party to the transaction borrowing from the other or a third party. Effectively, one party gives up a right to some potential future benefit and charges the other party for that right.

Let’s simplify matters by considering a few examples.

Trading on margin

Trading on margin is one way to use leverage.

Let’s say you have a portfolio of stocks and exchange-traded funds or ETFs with a broker. If your broker allows you to use margin, your broker will tell you based on the holdings in your portfolio, how much margin you can use. Again a simple example will clarify what this means.

If your portfolio consisted of ten positions in domestic US equities totaling $50,000 in current market value and another ten positions in international equities totaling another $50,000 in current market value, your broker might say your account has a margin facility of $60,000. That would mean you could purchase other financial instruments through your broker up to the value of another $60,000.

Your broker will charge you, usually a little bit above the prevailing base interest rate on the total amount you are borrowing. The positions you have in your portfolio act as collateral for the loan your broker is effectively giving you.

Great! you think. Your positions went up on average 15% last year. So a year ago your portfolio started at $86,956 and increased over the year by $13,044. This next year you expect another 15% increase so the overall value increased by $15,000, why not add more positions?

Some math

So let’s do the math.

If we assume that your broker would charge you a margin rate of 7.5% and you did add positions worth $60,000 and it would increase in value by 15% like last year. You’d be up another $9,000 less $4,500 in margin fees so a net gain of $4,500.

So instead of just adding just $15,000, you would add $19,500 to your portfolio.

But if the market turns against you, things aren’t so rosy.

If the value of the positions you hold drops, then the margin facility on your account also drops. There are two ways to resolve this situation. You can either deposit more cash into your account, or you can liquidate some of your positions to add cash to your account.

If the drops in the value of your positions are comparatively small then the situation can be manageable. But if the market makes a significant correction and all your positions drop in value managing the situation is a lot more challenging.

In fact, in major market corrections, it often happens that people who are trading on margin get wiped out.

Short-selling

Short-selling always involves borrowing. After all, how can you sell something you don’t already own? The only way is if someone else lends it to you. You need an account with a broker that is approved for margin trades in order to be able to sell stocks short. However, strictly speaking, short-selling does not involve leverage because there is still a one-to-one relationship between the movement in the price of the asset and your gain or loss.

But since it is easy to get confused with these things, I thought it worth mentioning.

Trading Forex with leverage

Forex trading is almost always done with leverage using margin largely because traders are seeking to profit from comparatively small percentage moves in currency pairs. Brokers are willing to offer traders significant margins because the Forex markets are highly liquid so brokers know they will be able to unwind any positions that a trader has taken that are going against them, while the trader still has funds on their account.

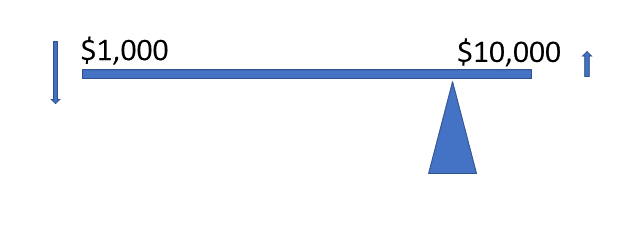

In Forex trading it is quite usual for traders to work with one hundred to one, or 100:1 leverage. In other words, a trader is able to take a position worth $100,000, which is in fact a standard lot size by only putting up $1,000.

The leverage in Forex trading cuts equally both ways. If you are working with 100:1 leverage then your gains and your losses are both amplified one hundred times.

Leveraged securities

There are many securities you can hold that are themselves leveraged. These include

- futures contracts

- options

- binary options

- leveraged Exchange-Traded Funds, or ETFs

Since leverage always involves borrowing, interest rates always have an effect on the cost of leverage. Let’s look at each of these, in turn, to see how leverage is applied.

Futures contracts

A futures contract is an agreement between two people to exchange some commodity or tradable asset at a future date at a fixed price.

Futures contracts are commonly available for such frequently traded commodities as oil, corn, rice, pork bellies, gold, or other precious metals but also for market indexes like the Dow Jones Industrial Average or the Standard and Poor’s 500 Index.

Futures contracts started between farmers and wholesale traders in agricultural produce as a way to iron out the risks of massive price fluctuations resulting from unpredictable weather and resultant feast or famine harvests. By agreeing on a fixed price for a fixed quantity of produce at a fixed date in the future, they would each give up a possibility of a windfall gain but guarantee a degree of predictable trade.

To make things easier, standard contracts were developed, and these contracts could change hands many times between farmers and wholesale buyers many times before delivery of the produce became due.

Fairly early on in this game speculators stepped in. They realized that they could trade futures contracts and close out their positions before the expiration date of the contract. In this way, speculators could trade futures and extract profits from the markets without having to cart wagonloads of rice or wheat around the countryside.

There is a lot more to modern-day futures contracts. But for our purposes here, the important point is that in order to enter a futures contract you only need to put up a small percentage of the total value of the contract. The commodity or asset that is contracted to be traded in the future is referred to as the underlying.

Leverage is achieved because a small percentage move in the price of the underlying will result in a larger percentage change in the value of the futures contract.

In fact, futures contracts are very highly leveraged and normally the preserve of professional and highly experienced, sophisticated traders and investors. For good reason. The potential for losses in futures trading are very considerable.

Options contracts

Options contracts are similar in many ways to futures contracts, in that they are for an exchange of a fixed quantity of either a commodity or financial security at a fixed price at a fixed future date.

The one important distinction between options and futures contracts is that futures contracts have to be settled, either by the exchange of goods or money equivalent at the expiration date, options contracts confer on one party the right but not the obligation to execute the exchange, while it confers the obligation but not the right on the other party.

In each case, the person who gains the right to execute one kind of future transaction has bought the option, while the person who takes on the obligation to take the other side of the future transaction has sold the option.

Options are traded on exchanges. The cost of the option is the premium and the buyer pays the premium plus a commission to the broker and the exchange. The person who sold the option receives the premium less commission to the broker and the exchange.

Again, all this makes more sense with a couple of examples.

Let’s say you buy a call option for 100 shares of the exchange-traded fund, SPY with a strike price of $460 and an expiration in January 2022. Today that call option will cost you around $1,300 plus commission.

Firstly, we should note that there are two kinds of options contracts. There are European-style options that can only be exercised on the expiration date and there are American-style options that can be executed any time up to the expiration date.

Back to our example.

Assuming we are dealing with American-style options, you’ve just bought the right but not the obligation to buy 100 SPY at $460 each on or before the end of the third week in January 2022. The person who takes the other side of the contract now has the obligation to sell you, 100 SPY, at $460 on or before the end of the third week in January 2022 if you decide to exercise the option. In return for taking on that obligation, the person on the other side receives the premium of $1,300.

Options, where the buyer acquires the right to buy, are called call options, while options, where the buyer acquires the right to sell, are called put options. This article explains options in more detail.

We can see how leverage works here.

Let’s say that SPY was sitting at $459 when you bought the January 2022 $460 strike call option. If the price of SPY increases by just one percent to $463.59 on the next day of trading then your call option that cost you $1,300 will now be worth $1,526 so a gain of 17%.

Let’s also consider what happens if the price of SPY drops by one percent the next trading day. Then SPY would cost $454.41 and your option would be worth $1,073 so a loss of 17%.

As we can see, for small changes in the underlying price over a short period of time the leverage cuts pretty much evenly both ways.

Options act very much like insurance. It is possible to use options to hedge your portfolio. By paying the premiums on a few options you can add insurance to your portfolio against a drop in value of your other holdings even while the whole market is dropping.

Options as insurance – an example

A simple example of hedging a portfolio would be as follows.

Let’s say you have a portfolio of positions totaling $100,000 in value that pretty much track the Standard and Poor’s 500 Index. And let’s say you are nervous that the market could drop by 10 percent over the next month.

If the SPY were at $460 now you think it could drop by as much as $46 to $414 over the next 30 days while the value of your portfolio would drop by $10,000 to $90,000. Let’s say you were willing to spend a little money and buy something that would gain in value by $10,000 under these circumstances.

If you buy put options with a strike price of $420 with two months to expiration they would cost roughly $470 each. If the price of SPY does drop to $414 in 30 days then the $420 strike put option with now 30 days to expiration would be worth $1,593 each.

So if you bought six of those call options, it would cost you $2,820, or 2.82% of your portfolio value. If the market drops as you expect, after 30 days those put options would be worth $9,558 or almost $10,000.

If you were confident that the market had indeed hit its low price with SPY at $414 then the logical thing to do would be to sell your six put options and use the $9,558 to buy positions in stocks or funds that you consider to have a strong chance of appreciating in value and are now available on the cheap.

There are many ways to hedge. That is just one example and probably not the best but it serves to illustrate how it can work.

Binary options

Binary options are a bit like regular options contracts except that the outcome condition is either met or not met and no underlying assets change hands. Binary options are available for major market indexes and commodities and a regulated quite differently in different countries.

Actually many countries don’t allow binary options trading at all because they are a bit like gambling and can really only be used for speculation.

When you buy a binary option you are taking a bet that the price of a certain commodity or stock index will be at or above a specific level at a specific date and time. If you sell a binary option you are taking the other side of that bet.

You are either right when the time comes in which case you receive your original stake back plus the difference to make it up to $100. If you are wrong you lose your original stake. Buyers and sellers of binary options fix the bid and ask prices in the market by placing orders and the exchange charges a commission fee, usually of $1.

Let’s consider a simple example.

Imagine that the price of Brent crude oil is currently $70 a barrel. If the market were more or less flat you would probably be able to buy a binary option that the price at noon tomorrow will be at or above $70 a barrel. The bid price might be $48 and the ask price might be $52. You place an order to buy at $50 in the hope that someone else will accept your bid.

If someone else does accept your bid, you pay $50 plus the $1 fee to the exchange. The other party pays $50 to cover the other half of the $100 and pays $1 to the exchange. When the time comes, if the price is at or above $70 barrel you are paid $100, and the other party losses their $50 stake. But if you are wrong the other party get’s the $100 and you lose your $50.

OK so let’s see how this works if the odds aren’t even.

Let’s imagine the same situation, the oil price is currently $70 a barrel and you think it will jump by at least $5 before noon tomorrow. You look at the bid and ask prices for a $75 a barrel binary option at noon tomorrow and see the bid price is $18 and the ask price is $82.

You place an order for $20. Someone else accepts your trade and has to put up $80. You each pay the $1 fee to the exchange.

Come noon tomorrow, if the price of oil has gone to $75 or more, you get $100. You have gained $80, less fees. The other party losses their $80. If you are wrong the other party gets your $20. In this case, if you win you’ve gained 400% on your $20.

Here we can see how leverage works with binary options and why they are like gambling. Trading binary options is a zero-sum game. The amount you gain is the same as the amount someone else losses and vice versa. The only link between binary options and the underlying is the price.

With binary options, there is no actual quantity of underlying asset or commodity that changes hands when the contracts reach expiration.

Leveraged Exchange-Traded Funds

Leveraged ETFs are funds that track an index and hold positions in derivatives such as futures and options to increase the return by a targeted factor. There are leveraged ETFs that track major indexes with different factors. The most common factors are 3x, 2x, and 1.5x.

Some of these funds have positive factors and some have negative factors.

Let’s say you buy a fund with a positive 3x factor on the Standard and Poor’s 500 Index, then if the S&P 500 goes up by 1% your fund should increase by 3%. And if the S&P 500 drops by 1% then your fund should drop by 3%.

The reverse is the case with funds that have negative factors. The funds with positive factors are often called bull funds and those with negative factors are called bear funds.

Because these leveraged funds are available as an exchange-traded fund they are available to any retail investor. This is a way for retail investors to gain access to leverage without having to be approved for margin trading by their broker.

Also, when you purchase a leveraged ETF your maximum loss is the sum you paid for the fund. So your losses are capped at the amount you paid.

This is a big difference with trading on margin, trading futures, short-selling stocks, or selling options where your losses can exceed the funds you have in your account.

A loud word of warning though.

Leveraged ETFs are best used to profit from short-term moves in market indexes when you are reasonably certain of the direction of the move. In fact, many leveraged ETFs only try to achieve the target multiple of the return on the underlying index for brief periods, sometimes even only for a single trading day. After that the fund effectively resets.

Also in practice, the funds don’t always achieve their targeted returns. They tend to come close but they often lose more on the downside than they gain on the upside. This means that during periods of volatility the leveraged ETFs can often end up with a negative overall return when the index actually achieved a positive overall return.

It is not advised to buy and hold these kinds of funds for an extended period of time as the financial derivatives held by these funds experience decay and become expensive when volatility increases. These funds have high expense ratios as they incur costs involved in frequent rebalancing, interest, and volatility premiums.

Bearing all that in mind, if you are interested in pursuing this further, here is a list of leveraged ETFs.

The long and the short

The long and the short of it is that leverage is a double-edged sword. If you do decide to use leverage, then do so carefully and responsibly and never kid yourself that it is risk-free.

Source material for this article. 1)https://etfdb.com/leveraged-etfs/7-mistakes-to-avoid-when-trading-leveraged-etfs/ 2)https://www.investopedia.com/stock-analysis/2012/are-triple-leveraged-etfs-a-good-idea-fas-faz-tyh-typ0430.aspx 3)https://www.investopedia.com/terms/f/futures.asp 4)https://www.binaryoptions.net/why-you-want-to-trade-0-100-binary-options/ 5)https://www.investopedia.com/articles/active-trading/061114/guide-trading-binary-options-us.asp

Questions and answers

Q. Does leverage reduce risk?

A. No. Leverage amplifies gains and amplifies losses. If a trade goes in your direction then you gain more. If a trade goes against you then you lose more. So leverage increases the risks to you. Using leverage will cost you money one way or another because it involves borrowing so if you use leverage indiscriminately, then you will lose more than you gain.

Q. What happens if you lose on leverage trading?

A. If you have a margin account with a broker and a trade goes against you, then your broker will ask you to add cash through a margin call. The broker also has the right to liquidate assets on your account to make up for losses on margined trades that have not gone your way.

Q. Is leverage good or bad in trading?

A. Leverage can be good for a trader or investor if used judiciously and strategically. If trades do not work out as you hoped then you can lose more than you otherwise would. If trades go really badly and you are over-leveraged then your account can be wiped out.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you!

It has often been said that there is no better investment than your own financial education. One great way to accelerate your financial education and your investing success is with the American Association of Individual Investors, the AAII. When you join the AAII, you get access to reports, courses on investing, risk management, asset allocation, retirement planning, managing retirement finances, and other resources, all for a single annual membership fee.

Single-page summary

Here is a single-page PDF summary of is leverage trading risk-free?

I hope you found this article interesting and useful. Do leave me a comment, a question, an opinion, or a suggestion and I will reply soonest. And if you are inclined to do me a favor, scroll down a bit and click on one of the social media buttons, and share it with your friends. They may just thank you for it.

You can also subscribe to email notifications. We will send you a short email when a new post is published.

Disclaimer: I am not a financial professional. All the information on this website and in this article is for information purposes only and should not be taken as personalized investment advice, good or bad. You should check with your financial advisor before making any investment decisions to ensure they are suitable for you.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you

References

| ↑1 | https://etfdb.com/leveraged-etfs/7-mistakes-to-avoid-when-trading-leveraged-etfs/ |

|---|---|

| ↑2 | https://www.investopedia.com/stock-analysis/2012/are-triple-leveraged-etfs-a-good-idea-fas-faz-tyh-typ0430.aspx |

| ↑3 | https://www.investopedia.com/terms/f/futures.asp |

| ↑4 | https://www.binaryoptions.net/why-you-want-to-trade-0-100-binary-options/ |

| ↑5 | https://www.investopedia.com/articles/active-trading/061114/guide-trading-binary-options-us.asp |

Thank you so much for this wonderful advice. I am going to bookmark this page. I have tried for so long to be able to understand just a tiny amount of trading on my own. My son is doing very well making his own trades and has tried to help me but I just end up getting confused. I will definitely be visiting your site again to gain a deeper understanding of this topic. We actually farm crops and my husband and I were just discussing the futures so this is actually very timely for me.

Thank you, again, for the deep dive!

Susan

Hi Susan and thanks for the comment. Of course futures contracts are managed quite differently by farmers and wholesalers especially where you make or take delivery. Though of course, you can also use futures to hedge against adverse price changes and then cash them out to use the cash to hedge your farming business. That is a whole other field and I would suggest that you research thoroughly before dabbling as futures use very high leverage. Good luck! and best regards, Andy

I am not the best when it comes to trading, mostly because I don’t understand how it all works, so rather than take risks myself, I leave the decision making to my financial advisor and broker, as he has time to keep a check on the markets and also the interest to do so.

However reading through your article, I learned a lot, and I loved how you explained how leverage worked, by using the scale, as this made the whole trading and leverage thing a lot more easy to understand.

Hi and thanks for your comment. I am glad you found the article interesting. Best regards, Andy

It’s a known fact that building a business means some kind of investment and of course a get-out plan if it doesn’t work. Trading on a budget is risky and the loss often means as mentioned on your website that borrowing becomes the only way out. Short selling is an example of borrowing from others to hit gold on investment which is risky but can work but it’s that risk that either makes someone successful or not. Great Read!

Hi and thanks for your comment. I am glad that you found the article interesting. Best regards, Andy

From my experience as a trader, with average level of expertise, I do not think any trading is risk free. It all depends on the trading plan, like you implied in this post. Maximizing the potential to make gain consistently is very okay, but most importantly avoiding high level of risk is necessary. In my opinion, little profits and lesser risks is preferable to high profits and high risks.

Hi and thanks for the comment. Best regards, Andy

This article was indeed very detailed and also well structured, I like how you wrote this, as a trader, I understand clearly and can relate to this article so well. Leverage trading isn’t bad at all, but it should be done only by experts in my opinion or by using a very strict stop Loss

Hi and thanks for the comment. I agree with you. Leveraged trading isn’t necessarily bad but it does need to be used carefully if at all. Best regards, Andy

Although I don’t know much about trading, I learned a lot about leverage trading from your post. Trading always seems to me to be a promising world where there are many opportunities to increase your capital. The margin facility is great where you get an additional value of the original amount of money which is available for trend and the short selling facility is something I’m looking for because the winning or losing ratio is considerable. I like the binary options although it’s more like gambling, if the bid price and sell price is almost even or something similar then the profit is less but there is a big difference in bid and sell price the chance of profit is loss is very high.

Hi and thanks for the comment. I have not tried binary options. But there is one thing I have found with investing and trading, it is best to choose a field and stick with it. I wish you the best of luck with your investing. Best regards, Andy

Very well put together article. I must admit though, I have zero understanding of trading. The extent of my knowledge would be to buy when it is low and sell when it is high! Do you trade at all? With the knowledge, you possess it seems like you could be successful with this!

Hi and thanks for the comment. I trade and invest. There are positions that I build in funds that I think have a good probability of increasing in value and I hold these positions for a long time.

I also make use of the stock replacement strategy explained in this article.

Good luck and best regards, Andy