Whether you have ambitions of writing supercomputer code using artificial intelligence to find the holy grail of life-long investment success, or whether you want to get into short term stock trading, sooner or later you are going to have to learn how to do fundamental analysis on stocks.

What is fundamental analysis

Here follows a rather dry definition.

Fundamental analysis is that branch of investing that looks principally into the ratios derived from the financial statements of a company. It compares a company against similar companies in its industry and sector and takes into account the broader market and wider economic trends in inflation and GDP.

Fundamental analysis seeks to assess a company’s intrinsic value and how that compares with its market value. The goal is to determine whether the current stock price is under or overvalued and to find other indicators that suggest where the stock price will go. Fundamental analysis is one of the main branches of analysis in the financial arena, the others are technical analysis and quantitative analysis.

To learn more about technical analysis, check here.

To learn more about quantitative analysis, check here.

Here is an earlier article that gives a straightforward and simple guide to financial ratios.

An important point to note, and it is easy to get confused over this is that fundamental analysis is both a method of analysis in its own right and, it has come to mean a particular investment strategy or philosophy if you like that word in this context. Though personally when I see the word philosophy I think of stuffy 17th-century guys wearing wigs.

From a pure analysis perspective the definition a few paragraphs up is sufficient. But as regards an investment strategy if you are an investor who adheres to the school of fundamental analysis then:

- you will invest in a stock that you find to have higher intrinsic value than their current market price, you might even up the ante trading options to increase your potential upside gain,

- and if you are feeling bold you might short-sell stock whose intrinsic value you find to be lower than the current market price.

Hypotheses

There are several relevant theories here just to list and explain a few:

The efficient market hypothesis – states that the market is a big-thinking machine and prices adjust to reflect all the information everyone has about values and prices and what is going on in the economy, etc.

So if we do our fundamental analysis and find a stock whose price is currently undervalued by the market then if the efficient market hypothesis is correct, the market has blinders on and will eventually learn all it needs to know and the price will adjust over time to its true value.

The random walk hypothesis – says that stock prices move randomly from one day to the next. There may be long term trends that a stock price adjusts to driven by events such as dividends being raised or lowered or mergers or acquisitions. But from one day to the next, since all the information about companies is known to everyone in the market – or so the theory goes – any price changes follow a random path and in the short term cannot be predicted.

What to analyze

The simple answer to this question is pretty much anything that lends itself to analysis but obviously, that isn’t realistic. So starting from the company we could say let’s analyze: assets, liabilities, profit margins, returns on assets, returns on equity, earnings, dividends, competition, markets, the local economy, inflation and the global economy.

In reality, though most investors wouldn’t start with a company and decide to analyze it. You are much more likely to want to weed out the less promising prospects and focus only on likely targets for investment. So it makes more sense to start from the macro side. A logical approach would be.

Global economic situation – here we would be trying to answer a question whether it would make sense to invest in stock or would we be better of in fixed interest bonds or even cash. The questions here are:

- what has GDP growth been like,

- is inflation high, low, steady or volatile, and

- are interest rates high, low, steady or volatile

The global economic picture will tell us whether conditions are favorable for stocks altogether. Steady GDP growth, stable and low inflation, and interest rates, and other factors such as adequate supplies of and acceptably priced commodities and energy tend to favor up-trending stock prices.

If the general global economic situation points to favorable conditions for stocks, it will likely be more favorable for some economic sectors and some industries than for others. Politics may also play its part here. Political circumstances may for example favor public infrastructure projects, which could favor the construction industry or the telecom industry. Particular regions or states may also have policies that favor certain sectors or industries. Under those conditions, it is then a question of which companies would be best positioned to benefit.

Getting down to a small group of companies

There may be several avenues that our global economic analysis opens up, but for the moment let’s follow one imaginary lead. Let’s assume that we have identified conditions that are favorable for a distinct industry in a particular geographic area. At some point, our analysis will get down to a group of companies that could benefit.

We would then examine the financial statements of each company and look to benchmark each against the others for:

Operating parameters – return on assets, return on equity, gross profit margin, net profit margin

Solvency – leverage or debt to equity, debt to assets ratio

Liquidity – current ratio and quick ratio.

In this example, if it was a new opportunity, an industry in a specific area that was poised to get a boost in business and profitability we would be looking to see which companies would be in the best competitive position to win the business. This is a rather simplistic example but let’s say they would all be equally competitive and would all get an equal and fair shot at it.

We would look at the various indicators of valuation. These would include, price to sales, price to earnings, and price to book value, dividend yield, and dividend coverage.

One question leads to another

It is a process of asking question after question and whatever answers you get leads you to ask yet other questions. There is no real linear route of inquiry here but professional analysts would usually work off a checklist and any report the analysis generates would have to cover all those areas. A typical checklist would include:

- Company leadership and management

- Brands, intellectual properties

- The market for its goods and services

- Market position and competition

- Financials – all the above-described meat and potatoes ratios

- External factors – political, suppliers

- Environmental policies and practices

- Growth projections

Projecting growth

The last part of our journey is to estimate the growth of the company and determine whether that growth is reflected in its current  valuation. This is done by considering all the future cash flows, discounted to calculate a present value. There are several ways we can choose to do this.

valuation. This is done by considering all the future cash flows, discounted to calculate a present value. There are several ways we can choose to do this.

At one end, you can take the dividends to be received by investors, plus the proceeds that would accrue from a future sale of the company and discount all those amounts to a present value.

Another approach is to consider the present, i.e. discounted values of earnings. And finally, we could consider the discounted value of future cash flows.

The forward-looking growth expectation of a stock is represented by its Price to Earning Growth, or PEG ratio. Because growth expectations are looking forward a certain length of time they are only projections and there is still an amount of subjectivity is baked in.

Investing strategies

There is a range of different investment strategies that can use fundamental analysis. Here are just some of them:

Buy and hold – is an approach that is looking for long term gains and accepts holding on during market downturns. This is often combined with dollar-cost averaging which involves investing a regular fixed amount. It is an approach also discussed in other articles here.

Buy undervalued – this approach sticks with companies found to be undervalued as a result of fundamental analysis. The idea is that the market will eventually correct the errors of its ways and revalue these stocks giving investors the chance to cash in and buy into other under-valued stocks.

Contrarian – the contrarian investor can use fundamental analysis to seek stocks that are out of favor with other investors in the market.

Economic cycles – fundamental analysis can be used to determine certain kinds of companies with characteristics known to perform well in certain economic cycles.

Buy growth – fundamental analysis can reveal which stocks have high expected future growth rates.

Resources

If you are interested in finding out more about fundamental analysis, check here.

And here would be some reference materials I would recommend.

If you made it this far, then you must have found something of interest or value, and here comes the ask for a favor – do please share on Facebook or Twitter. The icons are right here if you scroll down a bit.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you!

This is a great and very informative post. I’m a technical FX trader so I’m not too well versed in fundamental trading. I definitely plan to become more fluent in stock trading, hopefully I’ll be able to transfer the skills easily

Hi Umar, as an FX trader you are a braver man than me. Maybe I’ve been too influenced by horror stories of lost life savings. Technical analysis is an area I am learning about. I am curious whether you have tried automated or algorithm trading of FX? Thanks for your comment and best regards, Andy

Hi Andy,

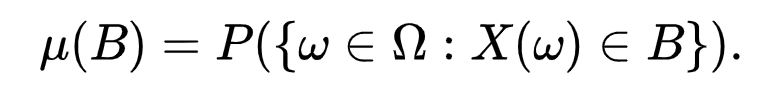

Very informative an in depth article. I am a telecommunication engineer so I love any post with equations 🙂 . I reckon this is golden information for anyone who are thinking of starting stock market investments.

I did some stock market investing few years back but did not really give a focused attention. Maybe it is time to start learning again. I have one question though. We are living in unprecedented times and no model will be able to predict what lies ahead I believe.

But are there any adjustments we can do to these fundamental analysis techniques if applying to current market conditions?

Hi Rajith, you are right these are unprecedented times and markets are moving dramatically and seemingly erratically. I tend to agree with accepted wisdom that the best insights into market movements come from combining fundamental analysis of intrinsic value with technical analysis of price movements driven ultimately by human behavior. Having said that you should never lose sight of the simple fact that the market moves because of the positions taken by large institutional investors who count for at least two thirds of market trades. We live in interesting times. Thanks for your comments and best regards, Andy

Yet another great glimpse into the world of the stock market.

Thanks for explaining some of the fundamentals in this what seems a complex industry, but it’s like everything new and once you get into it just a matter of time before you get to grips.

Had a discussion just the other week with a friend about this is/was the right time to invest. I said there is no point in humming and r’ing, just pick recognized companies and stick in some cash.

After all, the stock market is controlled by the mega-rich and I believe they manipulate what happens and you have to consider this current climate also.

Thanks for sharing a well-written article.

Thanks for the positive feedback. I agree with you that even though times are very turbulent on the markets at present, it is also quite likely that there will be bargains to be bought and if you are willing to accept the inevitable, that you will not be able to buy at the very bottom unless by a stroke of pure luck then this would be a good time to look for long term value. I agree with you as well that it is the mega-players who control the market – one very interesting factoid in comparison with the 1930s, back then roughly two thirds of exchange listed stocks were owned by individual retail investors. Now roughly two thirds or more of stocks are owned by institutions. One important key to knowing what is going on in the market is to know what the institutions are moving into and what they are moving out off. They may try to move by stealth but because of the volume of their trades they are not able to fully conceal what they are doing. Thanks again for your comments.

Hi Andy, this is great information. I particularly love the formulas you inserted and the links to your glossary, still the technical nature of the information may make more a smaller audience that finds benefit in this particular article. I will definitely be checking out more of your writing.

I used to buy stocks primarily based on fundamentals and I know they are important for long-term value of an investment. Right now I am more focused on technical analysis, a forex trader like the other commenter, but one of my long-term goals will be to use some of my earnings to buy stocks that I just hold for retirement, and those purchases will definitely be decided primarily on fundamentals. I’m sure I’ll have need to return to this article then.

By the way, don’t worry about my being in something more risky. I have a good supportive team and course that are teaching me all about risk management. This is something that can help mitigate the concerns.

Hi Bryce, Technical Analysis is also an area mostly new to me so I am still grappling with some aspects. Like you my stock picking strategy for many years was based on fundamental analysis. I had a system that worked well and managed to deliver gains that were on average a few percentage points above the S&P500. But the free stock screener I was using then started charging and I had to substitute with another that did not have the exact functionality of the earlier one. The profitability of the stock picks wasn’t working as well and that only became apparent after a time. Clearly there are pitfalls in all of this. I am glad to hear that you have a good support team. It would be easy to make costly missteps. I take your point that the material is highly technical in nature and then maybe not as readily accessible for all audiences. This is one of those subjects that could benefit from more visual explanation so that is something I need to work on. Thanks for your helpful comments, Best regards, Andy

At a time when I constantly see ads like: “No need for any knowledge, the system trades for you, you just invest…” reading your very knowledgeable article was such a refreshment! You are actually trying to teach people how to invest following their own research analysis, making an educated, informed decision, which I (and I’m sure others as well) highly appreciate. I know little about trading, but managed to lose serious money many years ago, leaning on someone else’s advice. Had I had a chance then to read at least this much you generously shared, I might have ended keeping or even increasing that money. Anyway, you kept my attention from the first to the very last letter and I think I learnt from it more than I managed to “pick up” on the topic through my whole life. Thanks for that!

Thank you very much for your positive feedback. I fully agree with you that it is infinitely more desirable to enter the world of investing and even saving from a better informed position than from one of dependence on someone else. Whether that would be someone else’s advice or even management of your funds. There are so many aspects of investing and actually just putting money aside in savings accounts that have to be tailored to your specific circumstances otherwise it is easy to lose out. As I have discovered from my own experience. Indeed much of the good advice that is shown here – on a site that is called Bad Investment Advice – is advice that I wish I had followed in my earlier and middle adult years. Thank you again for your encouraging comment. I wish you all success, with my very best wishes, Andy

I find your post highly informative. You are so knowledgeable in the area of stocks and shares. I am thinking about investing in stocks once the world’s situation is a bit better. You’ve helped me make an informed decision.

Really appreciate all this golden information through your article.

All the very best.

Thanks for your comment. I am glad you found this useful and interesting.

Best regards

Andy