Someone starting out in investing sooner or later is going to ask themselves, what is quantitative investment analysis, and do I need to get my head around it?

Or – can I just leave it to a clever computer program that will manage my investments?

Or – can I just leave it to a clever computer program that will manage my investments?

Or – can I just take advice from investing experts who do analysis for me?

And if there is such a thing as quantitative investment analysis is there such a thing as qualitative investment analysis?

The answers to these questions are:

Yes but only enough to get by,

Yes but only enough to get by,

Yes if you want to go that route,

Yes but you might have to pay for it, and

Yes, there is such a thing as qualitative investment analysis and it’s pretty much at the opposite end of the investing landscape.

First of let’s have some straightforward definitions.

The quest for more alpha

Everyone engaged in stock analysis is looking for sources of alpha. Alpha is a measure of excess returns on a stock over and above the returns of the market. The greater the alpha of the stocks you pick, the more you will beat the market. A simple way to remember it – it’s like the alpha person, leading the pack.

Approaches to analysis

In the investing world today there are different approaches to analysis:

Fundamental analysis – looks into the ratios derived from the financial statements of a company to determine whether it is under or overvalued and to find other indicators that suggest where the stock price could go. To learn more about fundamental analysis check here.

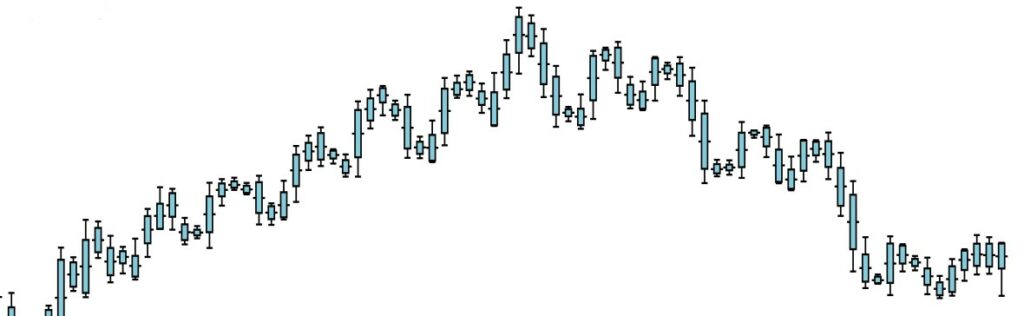

Technical analysis – studies past and current price data looking for patterns and clues to future price movement. The intention is to reduce or eliminate emotions such as greed, fear, or the effects of hype from trading decisions. To learn more about technical analysis check here.

Qualitative analysis – looks at qualitative aspects of a company that cannot easily be expressed as numbers. Such things as leadership, employee morale, customer loyalty, or market opinion revealed through market surveys or focus groups. Qualitative analysis looks for competitive strengths and weaknesses.

Quantitative analysis – uses mathematical and statistical techniques to examine long-term historical patterns in stock prices.

Quantitative analysis the how

The process involves starting with a hypothesis, examining a data set, and seeking to develop a model that explains past price movements, testing that model over and over, and applying the model to predict future price movements. This approach can also be used to study bond and ETF prices.

Quantitative analysis is used by fund managers and professionals and many funds define the quantitative analysis strategy they use to make investment and trading decisions.

Some would say that one of the dangers with quantitative analysis is that it works until it doesn’t. Essentially something changes in the market and then the model no longer works.

In case, you were wondering, a term you will come across in this area – a “quant” is a person who is expert at quantitative analysis.

There is a lot of clever stuff to quantitative analysis. This is just scratching the surface.

Backtesting – uses, and pitfalls

One of the main techniques used in quantitative analysis is backtesting.

Backtesting is the process of taking a database of historical, usually, stock price data, and then testing whatever theory or hypothesis the analyst is investigating using the historical data.

Let’s take a simple example.

Say your hypothesis is that stocks with the lowest price to earnings, i.e. P/E ratios beat the rest of the market over time. To turn this starting hypothesis into something we can test it would be easier to make this more concrete, like:

Hypothesis: US exchange-listed stocks with P/E ratios in the lowest 10th percentile, will be in the top 10th percentile for returns over any 10-year period.

Now that is a model that we can test against historical data of all US exchange-listed stocks. Our database will have all stocks on the market and closing prices either weekly, monthly or yearly going back as far as we have reliable information. In practice that will be to the late 1920s.

We set up a program to start at a particular point in time, sort all the stocks by P/E ratio, and take the lowest ten percent. Our program then projects the returns of those stocks over the next ten-year period and compares that with the returns of all the other stocks in the market. We could choose to set our program to return a result of either “yes” or “no” whether our low P/E stocks landed in the high returning stocks. Alternatively, we could decide to have our program return a score of the return of the low P/E stocks compared with the return of the other stocks, which is probably the more useful approach.

Then our program would start at the next increment of time and perform the same calculation over the ten-year period from that point onwards. Assuming we decided we wanted a relative score of the returns and not just a yes/no result, we’ll end up with a series of relative 10-year returns of our low P/E stocks vs the rest of the market for each starting date.

Those figures will exhibit a spread between high and low figures. The extent of the spread will be an indication of the risk of achieving the returns should this hypothesis be used to build a stock portfolio.

In practice, we would most likely want to adjust our hypothesis and run further backtests. In this example, we would probably want to adjust the percentile of low P/E stocks to say the lowest 5 percent in increments of one percent. Another important question with this hypothesis would be whether and how frequently we would rebalance the portfolio. And should that rebalancing exercise involve equalizing the value of each stock holding or should it involve reselecting the lowest tenth percentile of stocks? We might also want to adjust the time period from between 5 and 15 years or more in increments of one year which would typically result in lower variability and hence lower risk of achieving the desired returns.

One of the issues you have to watch for, and this was a frequent criticism of backtesting in general, is that historical stock data sometimes excludes stocks that didn’t last the course. Either the company went bankrupt or fell upon hard times and was not able to maintain its listing, or it was taken over or merged with another company. We could create a similar problem if our programming approach doesn’t capture those stocks that fell by the wayside.

So you have to be sure that your data set includes stocks of all those companies that didn’t make it and that the program is able to cater for those cases.

This was one pitfall that some early proponents of backtesting fell into. This is particularly a problem if you start with current data and then work backward in time. Generally, if you are using backtesting you have to be careful that your methods are not benefiting from what is effectively the wisdom of hindsight.

Larger data set

s There is no reason why quantitative analysis, seeking to predict future stock prices should just confine itself to stock data. In addition to all the historical economic data available covering industries and markets we have growing data sets from the Internet on consumer activity but also themes issues and trending stories. All of these data sets can become grist for the quantitative analyst’s mill.

Models of quantitative analysis

Let’s look at some common models of quantitative analysis as they are used by fund managers. Funds are obliged to explain their investment strategy and then stick with that strategy. This is supposed to give investors some kind of assurance that the fund managers don’t make an investment or trading decisions on a whim.

Factor investing models – involves particular factors that are inherent in particular asset classes. The factors indicate how an asset exhibits a risk-return pattern that outperforms the overall market. An example of a factor is how small-cap stocks as a group outperform large-cap stocks.

Event investing models – look for price patterns that historically happen before or after different types of events. These would typically be corporate events such as a merger, acquisition, or spin-off. There are hedge funds that base their investing approach on arbitrage opportunities arising around corporate events.

Systematic global macro strategies – study markets across countries, looking in sectors and industries seeking to create asset allocation across regions, countries, sectors, and industries that have historically favorable fundamental performance. Again there are hedge funds that adopt this approach to building portfolios designed to profit from predictions that the fund managers make about global events. Such global events could relate to politics, interest rates, international trade, or exchange rates.

Risk parity – seeks to allocate funds across asset classes based on how each asset class tends to behave under different circumstances. The idea is that as circumstances change some asset classes will lose, others will gain and the winners will offset the losers. Essentially this approach builds a portfolio on the basis of risk allocation rather than capital allocation.

Statistical arbitrage – looks for price mismatches between correlated securities. The approach is supposed to reduce exposure to market risk as it involves taking a long and a short position at the same time. It can involve a lot of options and other derivatives and active trading as positions are sometimes held for only fractions of a second.

Managed futures – This investing approach follows a set of rules and seeks to profit from price momentum once the system generates a signal that an asset price is moving either up or down. There are methods that deal with just one asset and others that exploit signals generated from the price movements of one or more assets to predict price movements in other assets.

Smart beta – is an approach used to systematically manage passive investments such as ETFs, and mutual funds. The reference to beta simply means that this method is based largely on the relationship between the price movements of assets in a portfolio respective to the broad market. Smart just means they are very clever about it.

Risk Premia – targets a specific factor and then seeks gains by taking long and short positions. Unlike Smart Beta, Risk Premia returns are less dependent on market returns. However, because they involve derivatives and higher transaction costs they have to work harder to achieve desired results.

Quantitative value – is an approach that examines in great detail a company’s balance sheet and the profit and loss statement and feeds the figures into a complex model which generates an overall score. This score then ranks the stocks. This approach requires a long time horizon to achieve good results.

AI and Big Data – these are modern buzz words applied to finance. It is basically cutting edge approaches to use machine learning to delve into large financial data sets. When it comes down to it though its really just clever ways of looking for new sources of alpha.

Potential problems with quantitative analysis

There are a number of pitfalls with quantitative investment approaches. Firstly many investors, myself included are reluctant to let their investments be run by what is effectively a “black box”. There are also a number of infamous cases of very large funds using quantitative techniques and automated trading to disastrous effect.

One of the best known is Long-Term Capital Management which took the global markets down with it because the models used to drive its automated trading hadn’t considered that in 1998 the Russian Federation would default on its sovereign debt. The Fund was deeply involved in so many markets causing a domino effect that was only halted by the intervention of the Federal Reserve and other institutions.

This is a prime example of the main danger with quantitative investing particularly when the strategy adopted makes extensive use of financial derivatives. It is generally accepted that derivatives are a way of transacting risk. That might seem like a cool thing to do, however, the effect is that the overall level of risk in the market is increased. So when things unravel they tend to do so in dramatic ways.

In the end

Quantitative investment analysis is here to stay and growing and becoming cleverer. Thinking back to our starting investor wondering whether to get their head around this subject – I would say watch this space.

If I were to offer a wild analogy plucked out of thin air it would be this.

In the early days of the world wide web and after the first commercially accepted web browser, Netscape’s Navigator opened up the web to a visual experience, if you wanted to build websites it was more or less an obligation to learn to code HTML. But today there are tools with intuitive graphic user interfaces you can use to build a website. For all, I know someone may be pioneering website creation tools that respond to voice commands.

While it may be necessary in today’s environment to be able to write computer code to test quantitative investment hypotheses, one day you might just be able to ask Alexa.

To learn more about quantitative analysis check here. Or if you have experiences or opinions on qualitative analysis or investing in general that you would like to share or ask a question, please leave a comment. I will get back to you soonest.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you!

Getting your finances and your investments in order is important. Many would say it is more important to invest in your own financial education. This could be a good time to check out the American Association of Individual Investors, the AAII.

When you join the AAII, you get access to reports, courses on investing, risk management, asset allocation, retirement planning, managing retirement finances, and other resources, all for a single annual membership fee.

Please excuse me if this comment was duplicated; it appears I hadn’t submitted it.

This post was informative and, having lived through the consequences of my own financial mistakes, provided thoughts on a starting point to invest in the future and is appreciated.

Your sections are clear and, because of this, it led me to look over the rest of the site.

Seeing that you actively engage in people’s comments, acknowledge your own financial lessons past, tells me you are an individual seeking to lend assistance to others in avoiding potential pitfalls.

Have saved this website for future reference.

Kind regards, MH

Hi MH, I am very glad that you found it interesting and potentially useful and thank you for your encouraging comments. It is indeed a humbling experience to make investment mistakes and the larger the mistakes the more powerful and lingering those feelings of regret can stay with us.I can only wish that I had the good sense to consistently follow my own advice right from my early days of saving and investing. There are alluring bright shiny objects and unscrupulous predators at every corner. I wish you all the best and do please come back and check from time to time for more material. Very best regards, Andy

Thanks Andy for this exhaustive article on what quantitative investment analysis is. I’ve encountered a lot of terms that are used quite frequently by our fund managers as they report on the performance of our benefits scheme. I’m glad that I’ve been able to take them in from a different perspective and at a more relaxed pace through reading your article.

One approach that is all too common in our part of the world is the systematic global macro strategies which are determined majorly by the political election year. The months leading up to and after elections in the East African Region are characterized by low volumes of trade as investors pull out before, watch the market and only return after any forecast electoral violence has ended or not lasted as long as anticipated. Thankfully, our fund managers have learnt to mitigate the associated risks.

We are Blessed.

Mark

Hi Mark, that is a classic macro strategy that you describe and I am sure well adapted to the regional environment. Just out of curiosity I looked up currency exchange controls for Kenya and note that they seem to adopt a similar approach as applies in the US. Clearly the issue here is capital flow. Tanzania seems to be tighter. Anyway, I am sure that a local, national or regional fund needs to be well invested in the local economy, so pulling vast sums out before a national election is going to be disruptive and incur its own costs. Though as you say, preferable to the alternative of running the risk of greater losses if there is extensive political turmoil. Thank you very much for sharing this interesting insight and example. With my very best wishes, Andy

In all of my years investing in stocks, it is only now that I read about the addition of quantitative and qualitative analysis. Previously, it was only the two, which are fundamental and technical analysis. And we thought that they are enough and we depended on them too much. Today, I’d like to commend the blogger for these new insights on investing and I myself must adapt these as well.

Like you said, there are potential problems with quantitative analysis in stock investing. I’d like to ask, what about qualitative which is most of the time is vague?

Hi Gomer and thank you for your comments and question. Qualitative analysis techniques are really more often used in areas other than investing where the observed phenomena are less expressible as simple numbers and where subjectivity is involved. Having said that many large investment funds establish their reputations on seeking out and holding “quality” investments. But there are really a number of ways of understanding what a “quality” investment is. The traditionalists, which include some famous names in investing seek quality in corporate leadership, unassailable brand identity, customer loyalty, workforce morale. Judging and ranking such attributes inevitably requires subjective judgement on the part of the analyst. Others might say that the only thing that determines a “quality” investment is whether it will appreciate in value more than the market and deliver a greater return than the market – i.e it has a high alpha. You might say that is more akin to a value based investment approach but the two are closely related. I recently attended a presentation by the manager of my pension fund and it was interesting just how much he was obliged to insist in responding to questions from members, on how the fund only takes positions in quality investments. I think there are two aspects here. Firstly, there is good evidence that quality investments perform better over the long run, and secondly investors and particularly conservative investors are going to be more attracted to funds that say they only hold quality investments. So in a sense it becomes its own self-reinforcing argument.

This is a very interesting angle and topic and thank you again for your engagement and question. Kind regards, Andy

I certainly learned more about Quantitative Investement Analysis from this article. I an see that this approach can be beneficial for anyone engaged in Stock Analysis to analyse the long term patterns. But as you point out the risks of this model can be a pitfall. So comparing it to Big Al and Alexa would you say it i less risk with Big Al and Alexa?

Hi Hilde and thank you for you comment. I was imagining a future when we could literally dream up an investment hypothesis and ask Alexa to check it out. Then behind the scenes Alexa would enlist the services of a bank of supercomputers and backtest our clever idea against all the historical stock price data since 1930 to today and out would pop the answer in a silky smooth voice of course. I suppose this would be more akin to Deep Thought – the super computer in Douglas Adam’s Hitchhiker’s Guide to the Galaxy that was constructed to work out the answer to the ultimate question of the meaning of life and everything. I sincerely doubt we are there yet mind you I haven’t tried. Kind regards, Andy

Hello there thanks for this review. It was helpful and as well educative. I must say these are amazing strategies that every trader needs to apply. I have been into forex trading for a while now and I really find it difficult to do analysis on stocks and it really affects me when trading. I think your article has really broadened my knowledge on the various analysis

Thanks for your comment. I think that all of these techniques and approaches of analysis have something to offer. And I agree with what you are implying here that while technical analysis is a valid approach for a short term trader and is I presume the most applicable way to trade forex, applying just that approach only to stocks will not produce great results. You have to have an understanding of the fundamentals. Thanks again. Best regards, Andy

I just got into investing and have been trying to learn as much as possible. There is some great information in this post and it has shown me there is a lot to learn. Will bookmark this so I can take in more.

Thanks for your comment Greg. Congratulations on getting started. It is a big subject to say the least. Maybe I should have started with a piece on Fundamental Analysis and then another on Technical Analysis before launching into the esoteric realms of Quantitative Analysis. Anyway, more to come. Thanks and I hope you find other articles here useful. Best regards, Andy

Thank you for this informative article. I have dipped around in stocks and investing in the past, but I did not have complete knowledge of it as a whole. After reading this article I might want to learn some more so I can get much clearer understanding.

Thank you for your comment Joshua. I am glad that you found it interesting. I will be posting many more articles, many of which should be more directly relevant to individual investors that this particular one. I nevertheless felt it is an interesting topic even though the subject can involve complex mathematics and statistics. I wish you all the best, Kind regards, Andy

Thanks for the explanation! It reminds me of the algorithm trading class I had in college. I will show your article to my friends still working in the area. Thanks!

Hi Richard and thanks for your comment. I’m jealous that you had an algorithm trading class at college! I did an engineering degree and then a masters in business administration and never had any classes on algo trading. Mind you that was many years ago and I think you did computer science if I’m not mistaken so that makes sense. Thank you for your positive feedback. Best regards, Andy