Which is the best trading platform for beginners? This review compares some of the most popular brokerage companies suitable for beginning traders and investors and suitable for more experienced and clients with other needs.

Side by side

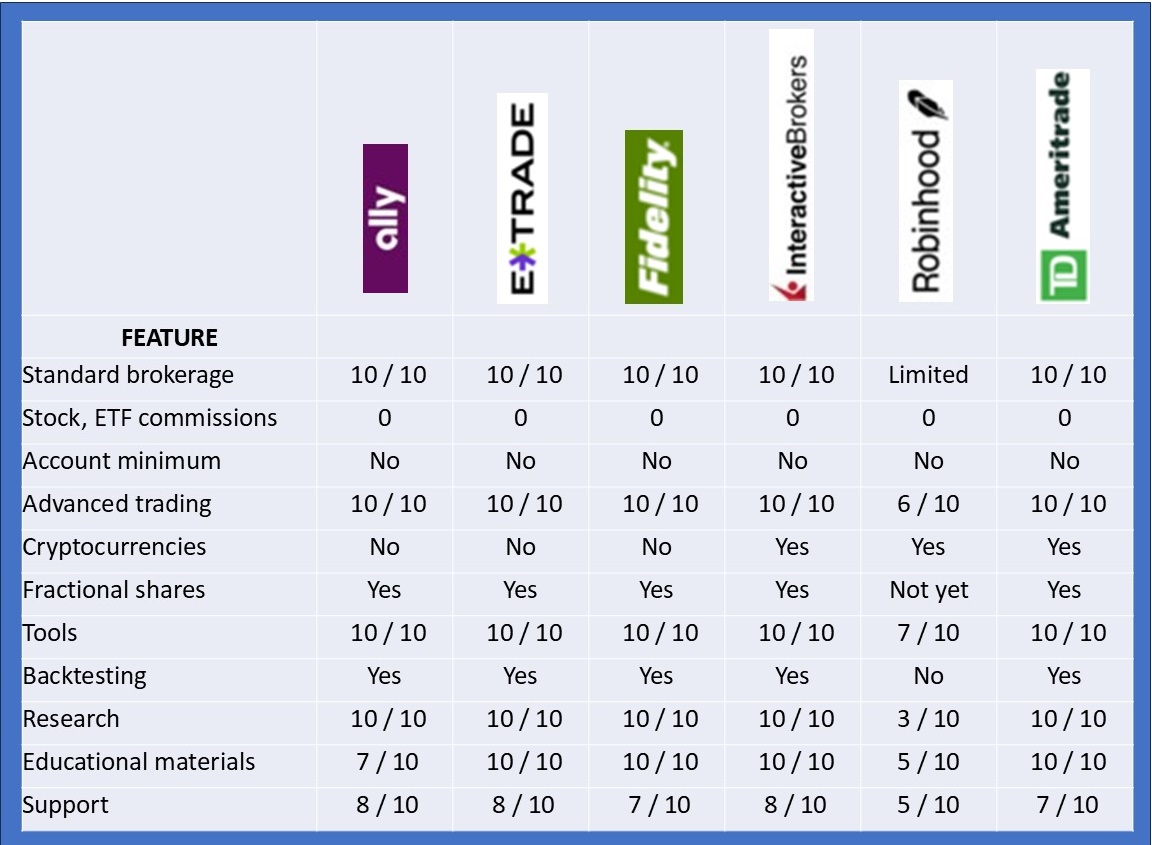

On the face of it from the above table, they all look pretty similar from a technical perspective. They each have their own distinct brand and much like car manufacturers, their brands seem to be aimed at attracting different kinds of customers.

Ally®

General Impressions – Personally I find the Ally® interface not so intuitive to navigate. It also has a somewhat strange mixture of service offerings, including auto loans and in some states home mortgages largely because of their history. When it comes down to it I don’t think you can be a brokerage company that is all things to all people. My feeling is that this rather unusual mix of service offerings distorts the focus of the company. Having said that there are many very satisfied Ally® customers.

The pros – Ally® has the lowest options commissions compared with all its competitors. If you do want all these service offerings through one brokerage provider, then Ally® could be a good choice.

The cons – No cryptocurrency trading. If you are going to rely on your broker for education materials then Ally® may not have the most comprehensive of offerings.

Ally® for beginners – Ally® does offer the service and features a beginning trader or investor needs. If you like the look of Ally® then go for it.

Ally® for other clients – If you live in one of the right US states and you want to get a mortgage, an auto loan, a checking account, debit card, and brokerage account all from one provider, then Ally® may be for you.

For a full review of Ally® for beginning traders or investors, check here.

E*Trade®

General Impressions – It is interesting to think back on my first impressions of E*Trade®. I opened a brokerage account with them back in 2002. I was so nervous about them going belly up that I thought once my account reached over $250,000 or whatever the FDIC coverage maximum was back then that I would open an account with a competitor to make sure I didn’t have all my eggs in one basket. In my defense, it was a fairly new venture back then and I was more used to putting my money in stodgy old retail banks. In retrospect my fears were unfounded. The platform of 2002 didn’t have anywhere near the bells and whistles E*Trade® has now.

In my mind E*Trade® still has that sleek high-tech high-performance brand feel to it.

The pros – The strong features of E*Trade® to my mind are many. The advanced trading platform Power-E*Trade® is excellent. The research tools are comprehensive and the educational materials are extensive easy to follow and well laid out.

The cons – The downside of E*Trade® is that you can’t trade cryptocurrencies. It seems frankly a little strange to me that they haven’t yet added these features when so many of their direct competitors have.

E*Trade® for beginners – from my own experience I can confirm E*Trade® is a good choice for a beginner investor or trader.

E*Trade® for other clients – because of the extensive features on the E*Trade® brokerage platform, it is also suitable for advanced traders and demanding investors.

For a full review of E*Trade® for beginning traders or investors, check here.

Fidelity®

General impressions – My impressions of Fidelity® are that as a brand they promote themselves to attract people who are looking for managed retirement investment products. I think this is also how the public perceives them as a financial service provider. The fact is though that Fidelity® also has a full suite of service provisions for investors and traders including a platform for advanced traders, Active Trader Pro®, excellent financial news and research, analytical tools, and educational resources.

The pros – In addition to its first-class trading and investing platform and supporting resources, Fidelity® allows trading in fractional shares. This means you can sweep dividends into stock positions and stay fully invested.

The cons – Fidelity® does not yet offer access to cryptocurrencies.

Fidelity® for beginners – A beginning trader or investor who likes the look of Fidelity® will find all the resources they need to start investing and trading,

Fidelity® for other clients – People shopping for retirement accounts, managed accounts or investment advice will also be well served at Fidelity®.

For a full review of Fidelity® for beginning traders or investors, check here.

Interactive Brokers®

General impressions – Interactive Brokers®, IBKR® for short is a platform aimed primarily at the advanced trader. By implication, the service offerings are less tuned to the needs of the beginner. To try to address this IBKR offers IBKR Pro® which has a monthly maintenance fee depending on account size and trading volume, and IBKR Lite® which has no account minimum, no commissions on US stock, and ETF trades and no maintenance or inactivity fees. The IBKR Pro® commissions schedule on other financial instruments, options, futures, mutual funds are tiered which results in the lowest most competitive commissions for high volume trades. IBKR Pro® also gives you access to a powerful API allowing you to build and run your own automatic trading routines.

The pros – IBKR® offers trading in cryptocurrencies and in fractional shares both of which are advantageous for many investment and trading strategies.

The cons – IBKR® has been slow to move its service to online browser and mobile platforms and at current writing still relies to some extent for advanced features on software that runs on your desktop. Some areas of the platforms aren’t intuitive to navigate.

Interactive Brokers® for beginners – IBKR® isn’t really aimed at the beginning trader or investor. But if you know you want to progress to advanced trading, this may be the right choice for you.

Interactive Brokers® for other clients – IBKR® is a good and favored choice for active and advanced traders.

For a full review of Interactive Brokers® for beginning traders or investors, check here.

Robinhood®

General impressions – Robinhood® is a new kid on the block of retail brokerage providers. Currently, they only offer trading in stocks, ETFs, options, and cryptocurrencies. This is somewhat limited. On the plus side, Robinhood® is very transparent in its business approach and its marketing. Its platform is also conceived for and optimized for mobile i.e. smartphone users. Its research and tools are seriously lacking – you don’t get any charts or screeners and I found its educational materials quirky.

The pros – Robinhood® works well on a smartphone.

The cons – It lacks many of the trading features of its competitors. It is also a small young enterprise competing with larger more capable and higher performance providers. The platform has also not performed well in the recent highly volatile markets and there are reports of transactions failing to execute.

Robinhood® for beginners – If you take a close look at Robinhood and still like it then fine.

Robinhood® for other clients – Robinhood® doesn’t really have any service offerings other than for the small scale investor and trader,

For a full review of Robinhood® for beginning traders or investors, check here.

TD Ameritrade®

General impressions – TD Ameritrade® is one of the major large brokerage platforms for retail investors and traders. Like all its main competitors it offers the retail investor no commissions on stock and ETF trades and no account minimums. You will have access to all other kinds of financial instruments including cryptocurrencies and be able to trade fractional shares. As a client, you will have access to a powerful array of research materials, analytical tools, and extensive educational resources. TD Ameritrade® also has some powerful strategy testing tools and an API interface allowing you to build and run automated trading systems.

To find our more about automated trading systems, check here.

The pros – TD Ameritrade® offers a powerful suite of service and a solid trading platform.

The cons – If there is any downside with TD Ameritrade® its that is was recently acquired by competitor Charles Schwab® and that casts a cloud of uncertainty over its future. In spite of the acquisition for the moment both companies continue to market themselves and operate separately. Schwab’s plan for integration has been delayed by the recent market turmoil due to the Coronavirus pandemic.

TD Ameritrade® for beginners – TD Ameritrade® services are very accessible for the beginner. The open question is what will be the impact of the acquisition by Schwab®.

TD Ameritrade® for other clients – TD Ameritrade® offers many retirement investment products, investment advice, and managed accounts suitable for clients looking for someone else to take care of investments for them.

For a full review of TD Ameritrade® for beginning traders or investors, check here.

I hope you found this comparison of retail brokers useful. Do leave me a comment, a question, an opinion or a suggestion and I will reply soonest. And if you are really inclined to do me a favor, scroll down a bit and click on one of the social media buttons and share it with your friends. They may just thank you for it.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you!

Are ready to get serious about investing in your own financial education? Then check out membership of the American Association of Individual Investors, the AAII.

The AAII is a nonprofit organization, dedicated to the financial education of its members. Your membership of the AAII will give you access to courses and resources on stock investing, financial planning, and how to manage your retirement finances.

I have always wondered if Etrade was any good. We used to use Global Tech/Wizetrade/lightwave/Mb trading and it was good for awhile. Then it sank into the abyss and we never went back into trading. Thank you. You have helped me make up my mind!

I’ve been with ETrade now for nearly 20 years and it has never let me down. I guess in the early days I was also worried that it would fizzle and disappear but it seems to have gone from strength to strength. Thanks for the comment and best regards, Andy

Hi Andy,

I dabble in some trading and am familiar with several of the platforms you write about. However, I am not as familiar with Ally. Looks like a good option and if I needed to, I would consider it.

Thank you for the breakdown for all of them. Very informative!

Hi Teresa, I have not tried Ally myself but I found many people with direct experience who like it a lot. Thanks for the positive feedback. Best regards, Andy

Great article Andy! Very informative as a comparison guide to the different trading platforms out there. I have been using Etrade for about 4 years and have been fairly happy with the overall platform and service. Keep up the good work!

Thanks Aaron. As I say I also like ETrade. I just wish they would add a couple of the main cryptocurrencies to their service. Thanks for the positive comment. Best regards, Andy

Hi Andy,

I never thought that so many trading platform actually exist. Thanks a lot for this informative article.

Hi Anestis, actually there are many more and some fairly big names too. I just got to a point where they all felt so similar that it didn’t make sense to review any further. I think a review could get much deeper into the specific analysis tools each of them have. But to do that kind of review you have to be a long time user who makes regular use of all or most of the tools on offer. I doubt you would even find such experience even among professional traders – who typically would only know one or two platforms in depth. Thanks for your comment. Best regards, Andy

Hi Andy, . This is a great article for people who are going into trading and would like a better idea to where to start or with whom to do trading with. I know some people who would find this article very useful and will forward them to it. Thank you

Hi Chantelle, thanks for the positive feedback. That would be great and I would love to hear any comment, suggestion or question they may have. Best regards, Andy

Hello Andy,

What a marvelous article. You give a summary of each company, General impression and if it is suitable for beginners. All in all, it is a reference for people to help them to choose the best.

In conclusion, I saved your site because it will be a reference when I decide to start a business with any of the companies

I wish you great success in your business

Rania

Hi Rania. Thanks for the positive comment. If you are considering using any one of them please check out the longer reviews – there are links in the article to each one. This would be particularly important if you want to use the educational resources on these platforms as I found those differ significantly in style and layout. And it seemed to me that they different ways these educational materials are presented would be very much an issue of personal taste. I return the compliment and wish you all the very best success. Kind regards, Andy

This is very good. I”m a novice in all of these but your explaining the distinct features of each platform has made this kind of trading easy to understand for someone like me.

The features, the pros and cons and it’s accessibility to newbies is very helpful to me.

I like that you gave a long enough list of companies to choose from. Which meant there was something for everyone.

Thank you.

Hi. If you are interested in learning more about any one of them, then just follow the link near the bottom of each piece, it will take you to a more detailed review of each one. Thanks for the comment. Best regards, Andy

This is very good. I”m a novice in all of these but your explaining the distinct features of each platform has made this kind of trading easy to understand for someone like me.

You gave me very helpful insights into the features, the pros and cons of engaging with each of these platforms and it’s accessibility to newbies is very helpful to me.

I like that you gave a long enough list of companies to choose from. Which meant there was something for everyone.

Thank you.

Hi. I think this is actually a very competitive field. Over recent years, for example, commissions on trades have dropped to zero. When I started with ETrade the commission on a trade of any regular stock was $9.95, that was the lowest rate around at the time and this was 20 years ago. If we are indeed heading into a period of declining stock prices and that extends over a number of years regular retail investors will get disappointed and leave the game and you could see the profits and viability of some of these service providers suffer. Much depends on where the markets go. Thanks for your positive comments. Best regards, Andy

Hi Andy, I am so pleased to have found another great article of yours. I am considering investing and learning more about cryptocurrencies and you seem to have a lot of experience in this field. Interactive Brokers could be a good place to start. Could you please help me with a few questions.

How many are out there, and what are they worth?

Why are they so popular?

Are they a good investment?

Are cryptocurrencies legal?

How can I protect myself?

Thank you for providing all this valuable information – you are doing a great job!

Hi Catherine

There are many cryptocurrencies – some of the most notable and well known are Bitcoin, Ethereum, Litecoin and Ripple. Every cryptocurrency has its own story and if you are considering investing or trading any of them, you should take the time to read up on their individual story. Most people trade cryptos trying to buy on a short term low and sell on a short term high rather than invest for a longer time. So that is really a process of technical analysis on their price movements, much in the same way that people trade Forex pairs where you are really trying to spot levels of support and resistance in price movements dictated by where other traders have placed buy or sell orders to either trade within those levels or to catch them when they are about to break out of their trading range. However, I think there is also a longer term story and case to be made. If you look at the story of Bitcoin for example it has shown substantial gains every 4 year period since it was issued. Having said that anyone who bought at close to its last peak of around $20,000 in late 2017 might have to wait a while to see the price go past that. Right now it is trading at around $9,500. What is interesting is that there are signs that institutions are steadily buying into Bitcoin and possibly other cryptos. That suggests it might be worth getting in if you are willing to hold for a few years. I will try and answer your questions:

Q How many are there and how much worth – A More than the four I mention and they are only every going to be worth whatever anyone is willing to pay for them – sorry a trite answer but it is the truth. True cryptos are intangible they are not attached to any physical thing.

Q Why so popular – A Many reasons. Because they have a bit of the Wild West about them. Part of the popularity is from the fact that “respectable” banks and many finance ministries don’t like them, and because they are based on a decentralized model of common recognition rather than centralized ownership – and centralized powers don’t tend to like that sort of thing. So they are people power, grass roots, street credible etc

Q Are they a good investment A- I think answered above

Q Are cryptos legal A- Yes in many countries and states. You will have to check locally whether you are allowed to have an account that trades or holds cryptos in the state where you live.

Q How can you protect yourself A Take an account with a reputable broker that will allow you to trade the cryptos you want to trade. I have an Etrade account for stocks so I had to open another account for cryptos and I opened one with Gemini. But if you are going to open an account with a broker anyway, then go for a broker that will allow you trade cryptos as well.

Thanks for the many questions and I hope the above helps

Kind regards

Andy

Hi, I have no knowledge whatsoever about trading, however, I have gained serious guidance and nuggets reading your post. The information you have provided is very valuable for me as a novice and I have bookmarked your site as a reference for my future endeavors in the space of trading. Have you thought of creating eBooks compiled from your posts – you might be pleasantly surprised at the positive response. Thank you.

Hi Ola, thanks for your comment. I am very glad that you found the information useful and please do come back and visit. I like the idea of eBooks very much. I probably am coming close to having enough material though I think the content would be a bit too disjointed which should give me pause anyway! I should give this topic a lot more thought.

Thanks and best regards

Andy