Could Ally offer the best trading platform for beginners? This is a review of Ally’s services, the pros, and cons from the perspective of the beginning trader or investor.

- Name: Ally

- Services provided: Financial services provider.

- Price/Fees: zero/low, no account minimum

- Website: https://www.ally.com/

- Main features: One-stop shop for retail financial services for individual investors.

- My rating: 4 out of 5

Ally at a glance – for the beginning trader

- Standard brokerage: Yes

- Cryptocurrencies: No

- Fractional shares: Yes on dividend reinvest

- Research tools: 10 / 10

- Tutorial resources: 7 / 10

- Support: 8 / 10

Ally, who is it for?

Ally is one of the older retail financial service providers. It was founded in 1919 by General Motors as a bank for financial automobile loans. It still has that part of the business but has expanded its range to cover many other areas:

- Retail banking – regular checking, savings accounts, ATM debit cards

- Savings and Retirement accounts – CDs and IRAs

- Automobile financing – of loans and leases.

- Mortgage loans – only available in some US States, all the usual fixed and variable, and refinance options.

- Brokerage accounts – for traders and investors.

- Managed investment accounts – have Ally do it for you.

Brokerage commissions/fees

With no account minimum, Ally’s brokerage account offers zero-commission trades on stocks priced at over $2 per share, certain ETFs and options while a per contract fee of $0.50 applies to options. They charge a commission of $4.95 on shares whose price is between $0.01 and $2, a fee of $1 per bond, and a fee of $9.95 on mutual fund trades.

Brokerage platform

Ally’s trading platform gives you access to trade:

- Stocks

- ETFs

- Options

- Bonds

- Mutual funds

- Forex

With a brokerage account, you can opt to have dividends of shares whose price is above $4 reinvested automatically.

Ally provides fractional shares to enable this feature. You can opt for this to apply to your whole portfolio or just to select shares. All shares whose price is at least $4 and are exchange or NASDAQ traded are eligible. Some ADRs are also eligible.

The Ally brokerage gives you access to a comprehensive desktop platform and a mobile app that allows you to monitor your account and trade on the go.

Brokerage tools, research, and resources

Ally’s trading tools include,

- Charts – eight kinds of customizable and interactive charts including candlestick, mountain, bar, and line can be used to analyze the performance of stocks, ETFs, and market indices.

- Customizable watchlists – for individual or groups of stock

- Profit and loss calculator – to analyze the potential outcomes before placing a trade

- Probability calculator – a tool that uses implied volatility to determine probable outcomes

- Research and news – on any stock, Company quotes, news, market statistics, price highs and lows, dividend dates, and peer comparisons.

- ETF screener – research ETFs by category, name, price range, or expert rating. Research and analyze price performance.

- Options chains – a display of available options chains

- Mobile app – for monitoring and trading on the go

- Customizable screeners – for stocks, ETFs, mutual funds and backtesting stocks

Retirement accounts and Certificates of Deposit – CDs

Ally offers retirement accounts in the form of IRAs linked to CDs. Ally offers three kinds of IRAs:

- Traditional IRA – make pretax contributions, pay taxes when you withdraw upon retirement.

- Roth IRA – eligible for tax-free growth and withdrawals. Maximum income restrictions do apply.

- SEP IRA – for small business owners, provides tax-deferred growth.

These IRAs can be linked to three kinds of CDs:

- IRA High-Yield CD – 3 months to a 5-year term,

- IRA Raise Your Rate CD – 2 or 4-year term

- IRA Online Savings – offers a fixed interest rate, currently 1.5 percent.

Managed portfolios

Ally offers managed portfolios with a minimum of only $100 and very low fees. There are no annual fees and no setup fees. An Ally adviser, as in a person, will help you chose your plan. There are four plans to chose from and with some, you can adjust the level of risk you accept.

- Income – maintains a conservative, risk-averse approach

- Core – domestic and international diversified fix-income assets – the risk profile can be adjusted between conservative to aggressive.

- Tax optimized – this plan allows after-tax contributions and can give tax advantages when you start to withdraw.

- Socially responsible – invests only in companies with good track records in energy efficiency and environmentally sustainable practices.

Once you select your plan Ally maintains 30 percent of your balance in cash, earning interest. Your account is managed daily by smart software which takes care of any necessary rebalancing. There are no annual fees.

Retail banking, auto, and home loans

Probably partly because of its history, Ally offers many of the financial services that a private individual would typically need.

Ally has checking and savings accounts with ATM debit cards.

Individuals and businesses can obtain vehicle financing through Ally including flexible loans or leases and with vehicle protection plans covering service and repairs.

Ally can provide 30-year fixed, 15-year fixed, and adjustable-rate mortgages. Mortgages are only available in some US States. The Ally website includes an affordability calculator allowing you to calculate the price of the house you can afford as a function of your income, credit rating, and monthly expenses. They also have a monthly payments calculator which will show you your monthly payment options calculated from the home price, your credit rating, and depending on whether you chose 15 or 30-year fixed term.

Ally educational materials

Ally’s educational materials cover all the retail finance areas that their services provide. These educational materials include articles, videos, courses, and live events. As for the subject matter, their materials cover:

- Life events – career, college, family, retirement, travel, and wedding

- Money – budgeting, credit, estate planning, saving and taxes

- Banking – financing home purchase and improvements and car

- Investing – stocks, bonds, ETFs, and options.

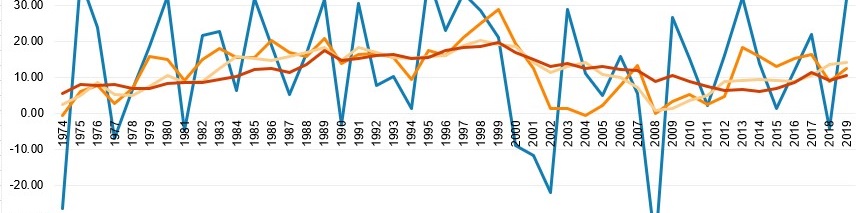

The educational is not really aimed at the beginning trader or investor. It is more suited for planning personal finance and general life events. All important stuff, but not really the focus that a beginning trader is going to be looking for. Also, one of the overwhelming messages of Ally’s investment advice promotes fixed interest instruments. At a time when interest rates are at all-time historic lows, this isn’t really an attractive or even particularly useful song to be singing – My opinion.

Ally – the pros – for the beginner

For the beginning trader and investor Ally does provide a robust platform and like its main competitors offers zero-commission trading, very low account minimums, and currently the lowest per contract charge of $0.50 for options.

Ally – the cons – for the beginner

Ally doesn’t rate highly on the Better Business Bureau, but that seems to be because it didn’t handle well the few complaints it received. The lack of cryptocurrency trading is also a disadvantage for many traders.

Ally – how does it rank?

I’d say 4 out of 5. Ally has a lot of fans even though it doesn’t seem to me like a great place for beginning traders. I guess I don’t find the educational materials exciting enough. However, Ally does give you the lowest rates on options trading out there. To see how Ally compares with its main competitors, check here.

My recommendation

If you are a beginning investor or trader looking for a brokerage account and you like the look of Ally, then I’d say go for it.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you!

The interesting feature is the probability calculator which I think would be useful for me. Separating emotion and logic is one of the hardest things especially when the market has been volatile like recently. It would be good to find out what indicators it offers as well. Not having crypto does not bother me. Is this available in the UK?

I agree with your point – separating emotion and logic. In some senses the more rigid and systematic your approach is to investing and trading the less likely you are to allow emotion to interfere in your decisions. This is why I think quantitative methods have an upper hand over qualitative methods especially during periods of high market volatility. Unfortunately, you can only open an Ally with Ally if you have a US address and social security number. But I am sure there are many solid brokerage providers in the UK, it being such a centre for financial services. Thanks for your comments. Best regards, Andy

i like this site better than any i’ve reviewed. it’s really well thought out and the articles seem well researched and honest. i do some day trading at home and find much of what you comment on to be true. keep this going, i think this topic is underserved, and everyone should get educated and involved in this aspect of life.

yay, great stuff!

Thank you for your positive and encouraging comments. I agree generally people should learn about money, finance and investing. Unfortunately it can be a very dry topic so people are easily turned off. Thanks again and we will do our best to keep it up! Best regards, Andy

Hey Andy,

Thank you for this very informative and in depth review. I did not know about ally. I tried forex and option trading with some other brokers and none of that went well. But all the benefits of Ally seems to be really nice. Does your rating of Ally applicable for a starter as well?

Hi Rajith,

My rating for Ally is specifically for people wanting to start trading and investing stocks and possibly options. There are a number of people who rate Ally highest of all for a starting investor. It is a solid company and the platform seems very stable and performs well under stress. Also the low cost of options trades is worth noting if you decide to go in that direction. Good luck and thanks for the comment. Best regards, Andy

This is one of the best investment advice site that I have come across. I used the affordability calculator of ally and it looks accurate. Will explore more as the benefits look promising. Thank you for this wonderful article

Thank you for your very positive feedback. Looking into all the features and services Ally offers I also formed the opinion that they are a very solid company. Thanks again and best regards, Andy

Hey,

I am very new to trading and I have been looking at a lot of different platforms. Your review of Ally is very comprehensive and informative. It’s very easy to absorb as a beginner on trading platforms.

It doesn’t seem as pricey as other platforms and the low account minimum is definitely an attraction for me.

The fact that you give it a 4 out of 5 is also an attraction and could be the pull I need to try this out.

If I do eventually try this out then I will let you know and give you my review of the platform.

Thanks for sharing and keep up the amazing work on your site.

All the best,

Tom

Hi Tom,

The world of brokerage accounts was not really open to all until recent years when zero commission trades have now become common. I recall the commissions I paid on my first stock trades in the 1980’s were the equivalent of around $50 per trade. It was a very expensive game back then. If you are considering an online broker today, Ally would be a solid and good choice.

Thanks for your encouraging comments

Best regards

Andy

I am definitely a beginner trader. I have dabbled into it a bit without much success. Appreciate the review of Ally as a platform for beginners. Seems to have a lot of bells and whistles. I will look into it further. Cheers

Success with stock trades can be elusive when the market is either going sideways or downwards as it has been recently. I adopt a quantitative long-term approach seeking undervalued stocks with long-term growth momentum. I only see the positive results over the long-term but it does work. Thanks for the comment and good luck! Best regards, Andy