Checking our retirement plans is something many of us do from time to time. There are many online calculators on the internet that can help you develop a plan or adjust an existing plan. This comparison, looks for an answer to the question, which are the best retirement planning calculators?

What exactly are you calculating anyway?

On the surface, this may seem to be a trivial question but there are many different calculations that you need to do at different times to plan retirement.

- Calculating how much to save – when you start out your plan

- Calculating the impact of changed circumstances – either unanticipated expenses or an unexpected windfall or you have changed your life plan where, when, and how you want to retire.

- Calculating how much you should be withdrawing – a question you will ask when you start pulling funds out of your nest egg.

The more comprehensive retirement calculators allow you to do all the above while some simple calculators perform just one function or one basic calculation using a few variables that you provide.

The best retirement calculators at a glance

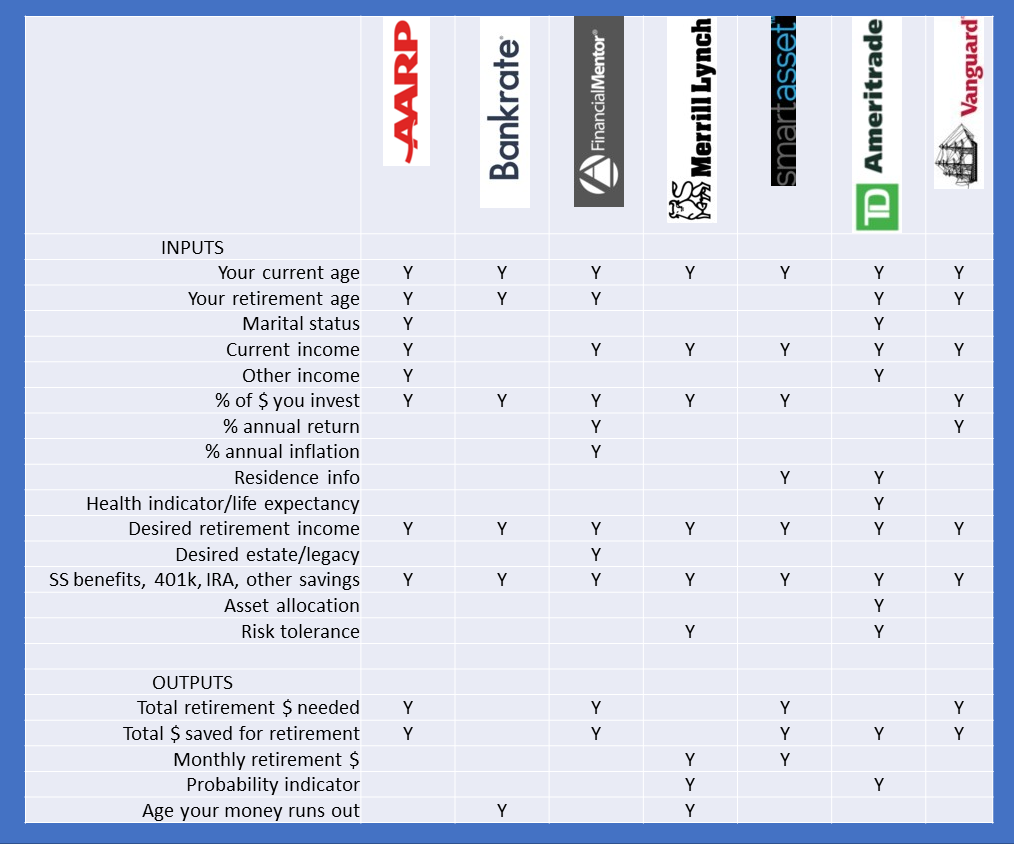

Functionality – the variables you can change

There are many retirement planning calculators online, this table compares the functionality of these calculators. Each of the inputs is a variable that you can change, either by typing in a number of moving a slider on a scale.

OK – it’s a complicated table. Some might say needlessly complicated. But it does give a clear idea of all the personal and financial information you can enter. Also, as you look down the list and it’s easy to think – oh yes, that is something that could change the outcome.

And if you are someone like me who prefers to work things out from scratch in Excel, this article walks you through some basic calculations of how much money you need to retire.

Here is what I found about each of these in turn.

AARP

Maybe I shouldn’t have been surprised but I was positively impressed by the extensive functionality of the AARP retirement planning calculator. The website itself is a little clunky, very slow to load and the calculator doesn’t feel as slick and interactive as many of the others.

But as you can see from the table, it captures the most granular personal information about you and your spouse. It is also positive that you can factor in existing employer plans, IRAs, and any other savings you may have.

On the output side, the AARP calculator just gives you two figures, how much you need and how much you’ve saved. It also shows a bar chart of the relevant $ sums each year. You can’t easily adjust any of the variables, you have to go back to the beginning and input different figures.

Overall a capable calculator but somewhat awkward to use.

Bankrate

Of all the calculators that made it to this finalist list, the Bankrate retirement calculator has the least functionality. I’m including it because this calculator is comparatively easy to use as all the variables are shown on one page and it is easy to make adjustments and see the effect on the results.

However, the only result this calculator shows is which year your retirement money will run out – which in itself could be a bit of a depressing thought. Of all of these, this is probably not the best.

Financial Mentor

Financial Mentor actually has five – yes FIVE retirement calculators:

The Ultimate Retirement Calculator – reviewed here and above

Retirement Withdrawal Calculator – calculate the impact of adjusting the amounts you withdraw from the funds you have.

Simple Retirement Calculator – you input:

- current $ savings,

- $ you want when you retire,

- $ monthly additions and

- % annual return on investments.

- It shows you

- the total number of months you will need to save.

- It shows you

Retirement Investment Calculator – you input

- $ savings goal

- $ current balance

- % annual return on investments

- Number of years available to save

- It shows you

- Current savings future value in $

- Total savings gap in $

- Monthly deposit required in $

- It shows you

Millionaire Calculator – you input

- Initial $ investment

- Regular $ contribution

- Annual % return on investments

- Average % inflation

- It shows you

- Number of years to reach $1 million

- The purchasing power of $1 million in today’s $ at that future date

- It shows you

With the Ultimate Retirement Calculator, Financial Mentor has really tried to pull out all the stops. Where it is strongest is in your ability to add expected windfalls, inheritances, and such. It is also very good for factoring in existing employer plans, existing IRAs, and other investments.

If anything I’d say that the features on this are maybe a little overdone. It would be easy to make a mistake trying to use this calculator. It’s a bit like trying to drive a Ferrari – so I am told. High performance but easy to crash if you don’t know what you are doing.

Generally, though Financial Mentor has obviously fallen over backward to provide you all the tools you could likely need as it is easy to select the right calculator for what you want to simulate. So this is a good place to go if you want to try out different scenarios or if your financial circumstances have many complex elements.

Merrill Lynch

As you can see from the comparison table, the Merrill Lynch calculator does not have all the functionality of the others, however, its one good feature is its interactivity. After a few pages of putting in the main variables, it takes you to a page that shows what you will need, how much you will have and any gap. Sliders allow you to change variables on the fly and see the impact on the outcomes. It is very fast and responsive.

Smart Asset

The Smart Asset retirement calculator has some strong features. It allows you to input comprehensive data on any employer plans, IRAs, annuities, and other savings.

In the end, when you do the final calculation it allows you to adjust the age you retire with a slider and see the impact on the $ sum you are able to accumulate. You can also adjust all the other variables with sliders. Smart Asset also tells you how much they recommend you save to achieve the goals you set.

Overall the Smart Asset calculator is powerful and feature-rich but a little slow. It has to pause to think with each adjustment before showing a result. And I’m not sure I fully understood how to use the interface, as discussed later on.

TD Ameritrade

As you can see from the table showing all the features, the TD Ameritrade calculator has a wide range of input variables. The calculator itself requires you to input a few at a time before advancing to the next page to input more variables. But at least when you are done it shows you a page of results and gives you sliders to adjust:

- Retirement age and life expectancy

- Annual retirement living expenses

- Extra annual savings

- Portfolio risk

Of all the calculators I found this to strike the best balance between user-friendliness and features. Overall I thought an excellent calculator.

Vanguard

Vanguard is another very slick intuitive and responsive retirement planning calculator. It was the only one I found that links to the government Social Security site and allows you to estimate your future Social Security Benefits and add that into your calculation.

If you have a relatively straightforward case of regular employment with an employer’s sponsored retirement plan and you will be eligible for social security benefits, I would recommend the Vanguard retirement calculator.

Other calculators

Here are some others I checked out and reasons why I am not including them.

Betterment – I found this just a bit too simple.

Dave Ramsey – The calculator itself is OK. I am not including it as the site tells you the average annual return on the Standard & Poor’s index was 12% which is not entirely untrue but…

Actually, the average return since 1926 has been 12.68% but you can only reap that return if you don’t pay any tax on your investments. In 2019 once the annual capital gain on your investments exceeds $39.376 you will pay 15% capital gains tax which would make the theoretical 12.68% return closer to 10.78%.

In 2019 if the annual capital gain on your investments exceeds $244,425 you will pay 25% capital gains tax which would make the theoretical 12.68% return closer to 9.51%.

If you are able to arrange all your portfolio gains to be tax-free, then you can make your calculations accordingly.

Edward Jones – I found the interface tricky. Some sliders are set on a logarithmic scale so it isn’t easy to input exact figures and you can’t enter existing savings.

E*Trade – only allows three variables: age you start, the age you plan to retire, and the annual rate of return. It assumes you invest $6,000 annually up to age 49 and then $7,000 from 50 on. It will tell you the total size of your nest egg on retirement. It’s just too simple to be much use.

Fidelity – I tried. You have to register an account first. Then to use the calculator they oblige you to read and sign disclosures. I gave up.

Nerdwallet – This one actually was OK but just not as granular as some others and not able to simulate employer-sponsored plans.

Prudential – lets you input all your personal variables but then asks you to register to get the result. Since there are others who are less demanding, I didn’t bother.

Quicken – This is really a 401k plan calculator. But there are no explanations on how to set the variables. I tried with the case simulation below and got ridiculous results. So again I don’t understand or they are not explaining it well enough.

Case simulation

Now we come to the fun part. Let’s see how these calculators perform with a typical case.

Single person, 36 years of age, annual income $85,000, growing at 2% per year, already saved $50,000, eligible for social security and intending to retire at 67 and wants to have 100% of current income i.e maintain the same standard of living. Is currently saving $1,000 per month into an employer-sponsored retirement plan and the employer matches at 50%. This means $18,000 per year is going into the retirement plan which equates to 21% of the person’s salary. If social security benefits are started at 67 then this person will receive $2,732 per month. Some calculators suggest a life expectancy of 91 so retirement payments are needed for 27 years.

AARP – results said that the person needs $1,270,041 to retire, but will have managed to save $2,312,832 and also displays a bar chart which shows how the retirement fund accumulates up to age 67 and then is drawn down and continues to grow.

Bankrate – results said that the plan provides $2,451,532 and retirement savings would run out at age 94.

Financial Mentor – says $1,749,115 is needed at retirement and the plan would provide $2,107,550 and says there would be a surplus of $358,435.

Merrill Lynch – says the plan needs to provide $3,574,286 at retirement to deliver $85,000 a year or $7,083 a month in today’s $. It says that in a poor market the plan would deliver $6,798 monthly and last to age 90 whereas in an average market it would deliver $8,427 a month and last until age 93.

Smart Asset – says $3,178,878 is needed at retirement and that the plan would provide a total of $5,326,459 at retirement giving an annual income of $237,940 which would include $52,225 social security benefits. Smart Asset recommends a lower rate of contributions towards the plan.

If the other calculators are anything to go by I must be making a mistake. I’ve tried this multiple times and I keep getting the same result. There are a few elements I noticed that could be the cause of this.

The result is highly sensitive to the average rate of return on investment. If I crank this down to around 4% it does suggest that the plan is closer to being on target.

Also, it is easy to confuse the expenses in retirement with income in retirement. For example, some calculators ask you to select whether your lifestyle in retirement should be the same, more frugal, or more extravagant than when you were working. And notes that you would typically need around 85% of your income to maintain the same lifestyle. Whereas it would be easy to think that to maintain the same lifestyle you would need 100% of your income in retirement.

TD Ameritrade – says the plan will last 27 years and has an 82% chance of success which is says is above the confidence zone. It also says that annual expenses in retirement will be $59,957.

Vanguard – says a monthly income of $7,083 is needed and the plan would provide $6,899 a month. So it is quite close.

Other helpful resources

This article will help you asking yourself important questions you’ll need to answer to work out how much you might need to retire.

Or some of these other sources.

What it all boils down to

It’s always going to be a case of different horses for different courses, so there is no simple answer. It is somewhat comforting that most of the calculators gave similar results for the same case. The differences were either due to different assumptions about rates of return, how much you actually need when you retire to maintain the same lifestyle, and my ineptitude at entering the details.

I would have the most confidence in the results provided by Merrill Lynch, TD Ameritrade, and Vanguard. I am clearly doing something wrong with Smart Asset. I guess I’m just not smart enough.

For the case simulated here, I would say Vanguard was the easiest and most intuitive interface.

My recommendation

Depending on your case – check out the simple calculators from Financial Mentor first to see if there is one that does all you need. If not then try either Vanguard, TD Ameritrade, or Merrill Lynch next. If they don’t give you the functions you need to enter all your details then try the Financial Mentor ultimate retirement calculator.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you!

Hi Andy,

I just started my first IRA last month. I admit that I didn’t really know much when I decided to take this action.

Your post just helped me understand what questions I need to ask next time I sit down with my investment coach.

Thanks

Hi Greg, thanks for the comment. I am pleased that you found the article useful. If you are starting out on saving for retirement and have many years to go it could be useful to play with one of the simple investment calculators reviewed to make sure you are on a good track. The earlier you start the better off you will be at the end of the road. All the best to you, kind regards, Andy

Hi thank you so much for such a wonderful, thorough article. I had been looking for a good retirement calculator so your advice and recommendations will be incredibly useful. I have retirement funds spread over 4 different providers due to moving jobs, so I’m hoping to look into the benefits or pitfalls of transferring them to one pot. I am ideally looking to calculate how much I now need to be contributing, so I’ll take a look at your recommendations. I look forward to checking out the rest of your website, maybe for some advice.

Hi Sara, I also have a very complicated situation because of moving jobs though I also moved countries a number of times. I have four little retirement pots from many years ago but with the added complication that two are in Euros, one in Pounds and one other in Dollars and I will most likely retiring in the US. I’m glad you found the article useful and thanks for your encouraging comments. Kind regards, Andy

Hi Andy, a very good explanation on retirement calculators, I have tried the ‘Financial Mentor ultimate calculator’ and it is really easy to use, it also gave me a good overview of how my retirement fund is going to look like 😉

It is a shame that most people leave their financial planning to their pension fund, it is seldom that will be enough.

Thank you for sharing and making it easier to understand.

Hi Cornelia, I think a lot of people find when they come closer to retirement that there are many elements that need to be factored. People change employers and careers more than used to be the case so we inevitably end up with a number of financial elements composing the puzzle. This is where a tool like the ultimate retirement calculator comes into its own. Clearly Financial Mentor did their research on this issue. Thanks for your comments and kind regards, Andy

Andy, this was a very thorough and impressive comparison of all the financial retirement calculators. I admit this is not something I have looked into much. It will certainly help if I try to find one to put my own particular numbers into. I like the amount of detail you put into this article. Thanks for posting!

I have been following Dave Ramsey for years and I wish you would have done more with his calculator. I don’t think he is being misleading but rather putting something out for his particular audience, who if they follow his principles are putting most of their retirement funds into Roth investment vehicles, whether a 401K or IRA, where the taxes have been pre-paid and therefore, any gains are not taxable. He recommends those the most after any employer-sponsored plans with a match have been maxed out. You could probably still include his calculator with a caveat that it assumes mostly pre-taxed contributions.

Other than that one quibble, I loved this. Great job!

Hi Bryce, thanks very much for this. I did go and have another look and I agree I was a little too hasty to dismiss the Dave Ramsey calculator. I’ve made an edit in the post to reflect this. The restrictions on Roth IRAs mean that any contributions you make for yourself after having maxed out an employer 401k, could only be up to $500 a month and that would be if your household income is below a certain level. This may apply to many people but not all. Personally I have been caught out before by tax deferred investments as they only work if you spend all your life within the same tax jurisdiction.

I appreciate your comment and I agree with you.

Thanks for pointing this out

Kind regards

Andy

Hi Andy,

Interesting article for sure. I didn’t realize there was such a choice of calculators.

My question is if any of these are useful calculations outside the USA? If you’re required to input social security numbers or tax form numbers, it would limit my use in Canada.

Thanks again,

Suzanne

Hi Suzanne, That would be the Ultimate Retirement Calculator from Financial Mentor

https://financialmentor.com/calculator/best-retirement-calculator

It lets you enter all that information yourself and is not specifically designed for US based users. That does put the onus on the user though to know what their social security benefits will be and whether it will adjust to cost of living. The Ultimate Calculator allows you to input those variables and many others besides. I hope this helps. Thanks for the comment and best regards, Andy

This is a very helpful article. I have recently read You Can Retire Sooner Than You Think. Thank you for sharing Andy.

Hi Wilbert, thanks for checking this out and thanks for the comment. I haven’t read the book you mention but I just checked out the promo video on Amazon. That is very interesting and reminds me of comments friends of mine who have already retired have said to me as they have had similar experiences. It is all too easy to get lost in the numbers around finance and forget the happiness angle which begs the question – if you aren’t doing this for your own happiness then why are you doing it at all! He did say in the video – it doesn’t matter if you are in your 20s, 30s, 40s or 50s – well, I guess I missed that boat. Oh well, maybe we could say 60 is the new 30? or whatever. Thanks again and I hope at least one or two of those retirement calculators was useful for you. Best regards, Andy