Could Fidelity offer the best trading platform for beginners? This is a review of Fidelity’s services the pros and cons and what it does for the beginning trader.

- Name: Fidelity

- Services provided: Full integrated suite of financial services.

- Price/Fees: zero commissions on trades

- Website: https://www.fidelity.com

- Main features: One-stop shop for all financial services for individual investors and small businesses.

- My rating: 4.5 out of 5

Fidelity at a glance for the beginning trader

- Standard brokerage: Yes

- Cryptocurrencies: No

- Fractional shares: Yes

- Research tools: 10 / 10

- Tutorial resources: 10 / 10

- Support: 7 / 10

Fidelity – who is it for?

Fidelity accounts and services are aimed at a variety of customers with different needs: They even have a neat little tool that asks you a few questions to determine what kind of account you should open

- Investing and trading accounts

- Cash management accounts

- Educational savings accounts

- Retirement accounts

- Small business retirement accounts

- Wealth managed accounts

- Charitable accounts

Individual Investors and Traders

Fidelity’s brokerage account allows you to trade:

- stocks, domestic and international

- ETFs – including select Fidelity ETFs and others from industry leaders

- mutual funds

- bonds

- options

Online trading of US stocks, ETF, and options are available at zero commissions.

Fidelity also allows trading in fractional shares allowing you to keep all cash invested and to build a diversified portfolio even if the total sum invested in comparatively low.

Active Trader Pro

Active Trader Pro

Active Trader Pro is Fidelity’s advanced trading platform. You can customize your Active Trader Pro dashboard to show you what you want to track. This gives you access to real-time prices, you can set alerts and define entry and exit strategies.

Fidelity gives you tips and access to educational videos on how to use the platform, generate ideas and strategies, and track performance.

Cash management

Fidelity’s cash management accounts will give you FDIC insurance, checking, and ATM services. It provides a way to manage your cash in all the usual ways and to save.

Traders and investors can also open and link brokerage and cash management accounts to get the benefits of both in one place. Businesses – can also open brokerage and cash management accounts.

Individual retirement accounts

Fidelity has an extensive range of individual retirement accounts and plans.

- Rollover IRA – allows you to roll over 401ks from previous employers into a Fidelity Rollover IRA. You get to keep the tax advantages and you can use Fidelity advisory services.

- Traditional IRA – you can make tax-deductible contributions and pay tax-deferred on withdrawals.

- Roth IRA – contributions are made after-tax but withdrawals are tax-free provided certain criteria are met.

- Roth IRA for minors – this is for minors with earned income, like child actors or under-age entrepreneurs. They follow the same principles as regular Roth IRAs – contributions are after-tax, withdrawals can be tax-free as long as certain conditions are met.

- Inherited IRA – this kind of online account is only open to individuals. There are minimum distributions that must be met but this allows you to consolidate inherited Traditional IRAs, SIMPLE IRAs, SEPT IRAs or workplace retirement plans into an Inherited IRA with Fidelity.

- Inherited Roth IRA – like the Fidelity inherited IRA a Fidelity Inherited Roth IRA can work for Roth IRAs you inherit, as long as certain conditions are met.

Retirement solutions for individuals and small businesses

These Fidelity products are available for self-employed and/or small businesses.

- SEP IRA – Fidelity’s Simplified Employees Pension Plans are for self-employed individuals and small businesses to get tax-deferred savings for retirement with no account minimums or fees.

- Self-employed 401k – allows self-employed individuals and individual owner businesses and partnerships without employees to make tax-deferred savings for retirement.

- SIMPLE IRA – for businesses with fewer than 100 employees these accounts offer pretax contributions and tax-deferred withdrawals.

- 401k plans – for small businesses with fewer than 100 employees. These offer the usual advantages of 401k plans: pretax contributions and tax-deferred withdrawals, employer matching. Contributions can be flexible depending on the business annual results.

- Investment-Only – retirement accounts for small businesses, also called a Fidelity Non-Prototype Account. This is a brokerage account allowing small businesses with existing retirement plans to undertake additional investments for employee retirement purposes.

Fidelity managed funds

Fidelity is well-known for its managed funds. Each fund pursues a specific strategy clearly captured in the name of the fund. These funds cover major market indices, variations on large-cap, medium cap and small-cap, growth and value, international markets, emerging markets, real estate, US and municipal bonds, long-term, intermediate-term and short term Treasury bonds, international bonds and US sustainability designed to provide exposure to companies with higher environmental social and governance performance than peers in their sector.

Professional advice and wealth management

Under the heading of Wealth management, Fidelity offers a Robo-adviser solution, professional adviser services and investment in Fidelity’s managed funds.

- Fidelity Go – this is a Robo-adviser solution that will manage a portfolio of funds customized to your personal needs. Fidelity charges a 0.35 percent monthly management fee, but charges no commissions or other fees for this service. There is no account minimum for Fidelity Go, but $25,000 in your Fidelity Go account will get you personalized planning and advice.

- Portfolio Advisory Services Account – $50,000 gets you professional investment advice customized for your need and preferences from Fidelity.

- Separately Managed Accounts – $100,000 to $350,000 gives you access to diversified portfolios composed of either stocks, bonds, ETFs, personalized for you with advice from Fidelity.

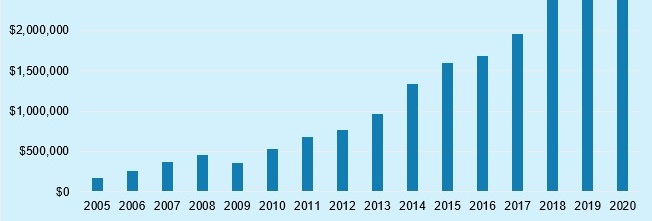

- Wealth management – starts with Fidelity with an investment minimum of $250,000. Fidelity will manage your investments according to your needs and preferences and charge an annual fee from 0.50 to 1.5 percent.

- Private wealth management – a minimum of $2 million gets you a professional team of investment managers at Fidelity with annual fees from 0.50 to 1.05 percent.

None of the above is going to be of interest to a beginning trader of investor but I suppose it can’t hurt to know that you are somehow rubbing shoulders with some big players.

Planning and advice

Fidelity has some simple easy to use educational and guidance materials consisting of short instructions, graphics, calculators, and short videos on many aspects of personal finance.

- Financial basics – monthly budgeting expenses and savings, paying down debt, controlling credit, paying off student loans

- Building savings – planning for the future, annual financial health checks, building a safety net, setting objectives and creating an investment strategy

- Saving for retirement – starting early, choosing IRA plans, building a diversified investment strategy

- Tax strategy – tax-efficient investing, charitable giving, low-cost money management, cash management, 401k, IRA or Roth IRAs.

- Digital investing and advice – guides to how to use Fidelity Go Robo-adviser for retirement, building wealth, and large purchases.

- Retirement planning – saving for retirement, preparing for retirement, managing money in retirement

- Life events – leads you through examples of dealing with life’s transitions whether planned or unplanned from a financial perspective.

News and research

This is where all Fidelity’s resources for following financial news and researching financial instruments are to be found. The areas covered are:

- News – the latest news from leading publishers consolidated by Fidelity into one place

- Watch list – create your own watch lists of stocks, etc

- Quote – for stocks, options chains, daily prices for Fidelity funds, daily prices for annuities

- Alerts – set your own alerts for price movements

- Mutual funds – search and compare mutual funds

- Stocks – research stocks, stock screeners, expert strategies, research firms, research firm scorecards, search reports

- Preferred securities

- ETFs

- Closed-end funds

- Bonds, fixed income and CDs – research, tools, recommendations, and tutorials

- ETFs – search, compare and expert opinion and commentary and related tutorials

- Options – scans, screens, expert analysis, trading ideas,

- Markets and sectors – analysis of the performance of different markets and industry sectors

- IPOs – a calendar of upcoming IPOs with possibilities for Fidelity customers to subscribe

- Annuities – deferred fixed and deferred variable

Fidelity learning center

Fidelity’ Learning Center has an extensive range of educational materials including videos, articles, webinars, and courses going into greater depth than the planning and advice center. The learning center materials cover:

- Investment products

- Mutual funds

- ETFs, ETPs

- Fixed income and bonds

- Options

- Options strategy guides

- Stocks

- Trading and investing

- Technical analysis

- Fundamental analysis

- Markets and sectors

- Trading

- Technical indicator guide

- Tools and demos

- Personal finance

- Retirement planning

- College planning

- Charitable giving

- Family financial safety

Fidelity also offers live events, on-demand webinars, and strategy coaching sessions.

Fidelity – the pros – for the beginner

Fidelity does have an extensive range of easy to use tutorial materials including courses suitable for a beginning trader of investor.

To compete with other brokers Fidelity also provides zero-commission trades on plain vanilla stock trades.

Another plus for Fidelity is they allow you to trade fractional shares, so you can build a diversified portfolio and stay fully invested starting with a comparatively low investment sum of a few thousand dollars.

Fidelity – the cons – for the beginner

Fidelity does not yet provide access to trading crypto-currencies.

Fidelity is a large financial services provider that has been around for more than 70 years. So it’s not surprising to see a number of complaints against the company. Most complaints seem to relate to poor customer service and disputes over what may or may not have been promised over the phone and technical issues setting up accounts. Many of Fidelity’s competitors seem to experience similar customer complaints. To learn about complaints against Fidelity check here.

Fidelity – how does it rank?

I’d say 4.5 out of 5 for Fidelity. I’ve held Fidelity funds for over 20 years now and I wasn’t aware of all their other services tools and available resources until I was doing research for this piece. I’m not sure whether that was my fault or their failing. To see how Fidelity compares with its main competitors, check here.

My recommendation

If you are a beginning investor or trader looking for a brokerage account, I would say you couldn’t go wrong with Fidelity.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you!

Are ready to get serious about investing in your own financial education? Then check out membership of the American Association of Individual Investors, the AAII.

The AAII is a nonprofit organization, dedicated to the financial education of its members. Your membership of the AAII will give you access to courses and resources on stock investing, financial planning, and how to manage your retirement finances.

Thank for this amazing review on Fidelity. The good thing about Fidelity is that it create an opportunity for Beginners to learn trading very fast and I really like the aspect that says that “to compete with other brokers Fidelity also provides zero commission trades on plain vanilla stock trades”. I am not too sure if it operates from here in Germany but I will have to google it out. Thanks for the Post.

Thanks for your comments. Fidelity is indeed available in Germany fidelity.de and it looks as if it has similar product and service offerings as are available in the US. Though it looks like it makes a big distinction between private investors and institutional investors. Viel Gluck! Bestens Andy

Hi Andy. Thank you for this recommendation. I’ll give Fidelity a try and I have two main reasons to do so: First of all I respect your site and I have seen previous recommendations have been good too. And second, I like that trades involve zero commissions. That’s not easy to find.

Thanks for this review.

Hi Paolo and thanks for your comment. Zero commissions on stock trades is common among the major competitors. The fees of options trading are where you still get small differences. It is also important to check how stable and responsive is the platform during periods of market volatility. Good luck.and thanks again, Andy

I have just decided to go into the world of trading so it is just normal for me to say that I am just hearing about this platform called Fidelity. From your research however, I see that f I can make the best use of it, it can be the perfect place for me to make so much more by taking the expert advice and checking out the news they offer too. I think the price for using this is actually very worth it and I should register.

Thanks Riley. Fidelity is a serious and stable company. I think it is likely there will be some consolidation in the brokerage industry and on balance I think Fidelity will be well placed to remain competitive. Thanks for your comment and best luck to you. Regards Andy

Thanks for the informative post. They seem to be well covered in terms of what a person can invest in, which is important. It’s also good to hear that they have a good training programme, as for a beginner starting out, it can be a minefield.

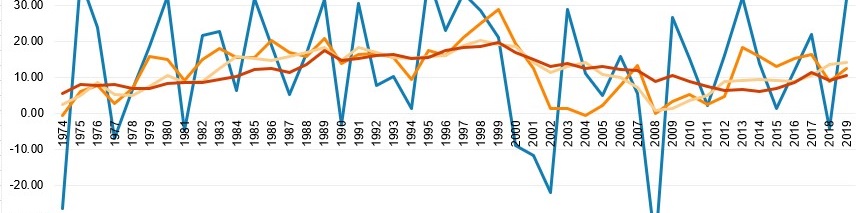

Indeed it is a minefield. It is also noteworthy how commissions have fallen over the years to zero because of intense competition. There are now so many large players in this business I’m not so sure they can all survive. Fidelity is one of the longest standing, has a solid reputation and a long track record of good performance of its own managed funds. Also the fact that it is privately held makes it less prone to takeover. I think this one will be around for a while still. Thanks for engaging.

With the lock down every day here due to the effect of covid 19 pandemic on the world, trading online is one major way to stay in form and on top. your review of fidelity is explicit and well researched. i think i would like to give it a try. and also if you permit, i would like to share this article with some of my friends

The stock markets are still quite volatile these days. I not sure anyone really know where they will settle if they ever do. This website is in the public domain so please do share with friends. Thanks for your comments.

Hey,

This is a very informative and insightful article. I am very much a beginner in the world of trading and I must admit it is a very scary world for me. You obviously know what you’re doing and what you’re talking about.

If Fidelity is the best platform for beginners, then following your thorough review I may give this a try. I will let you know if I do and I will give my own review on it too. I will follow your lead.

Thank you for sharing and keep up the amazing work on your site.

All the best,

Tom

Fidelity probably is a good place and has some important competitive advantages over others – access to crypto currencies and fractional shares is a big plus in my book. Also being a large financially stable provider with a robust platform and reputation has to mean something. Thanks for the comments and best luck! Andy

Hey Andy,

thanks for your detailed overview of Fidelity. There is such an abundance of brokers out there that it can be really exhausting to do the research and comparisons on ones own. Therefore, a site like yours is really helpful

Since the current crisis seems to give a lot of opportunities for investments, I’m really interested in carefully trying my hand in it. I will definitely check out Fidelity.

Cheers, Frederik

Thanks Frederik. If you had cash to spare a few weeks ago there seemed to be many opportunities in the markets. Now I’m not so sure we know where this will all end up – if there is such a thing. The established wisdom is – always stay in the market. SO good luck and thanks again, Andy

Thank you for this wonderful post. Fidelity looks obvious choice for a novice like me. Is there anything that I must be worried about before starting?

Thanks for the comment. Fidelity is a very solid company with a full range of products and support. If you are thinking of starting to manage your own investments but aren’t sure where to start, on their site head for Planning and Advice and look under Life Events. That will help you set objectives and build a plan depending on what is going on in your life. If you are looking for specific technical information then the Learning Center under News and Research is a good place to go. There are also links to sign up for weekly classes for beginners. Good luck.