Understanding how to use stop-loss strategies is a must if you are ever going to take your approach to stock market investing out of the limited realm of “buy and hold”.

Simple definition: A stop-loss order is an order that will close your position when the market price hits a level that you set as the stop loss level.

Stop-loss – a simple example

It is easiest to understand a stop-loss order with a simple example.

Imagine you buy a 100 shares of XYZ Co stock at $10 a share. So your total purchase price for this position is $1,000. Let’s say you expect it to rise by as much as 50% over the next two years. Let’s also imagine that your total portfolio value is $10,000.

You know that both the market and individual stock prices can fall as well as rise but you want to limit your loss to 5%. The simple thing to do would be to put a stop-loss sell order on your XYZ Co stock for $9.50 and set similar stop-loss orders for all your other positions at 5% lower than their purchase price.

Why 5%, why not 5.5% or 3%? This is partly a question of your comfort level but also a practical one. You will find that if you set the stop loss too tight you will be taken out of positions too soon or you will only start investing in less volatile stocks to avoid being dumped out.

Alternatively, if you set the stop loss with too wide a margin, you will be upset at the losses and look back wishing you had exited certain positions sooner.

Most people should but many don’t

One thing about this subject is really strange. The more you learn about investing and trading in stocks, the more you come to realize that managing risk is one of the most important aspects if not the most important aspect of any successful investing strategy.

Something you are going to need to do to manage risk will be to limit your losses when either an individual stock or the overall market moves against you. The strange thing is that so many investors and traders know this and yet don’t use stop-loss orders.

This begs the question – why is that? If you ask professional fund managers and individual investors about this subject, large majority will agree on the need for stop-loss orders but many of those same people will admit that they don’t use them.

I think this reveals something fundamental about the psychology of the trader and the market professional.

Be all that as it may, let’s assume for our purposes that stop-loss orders are a good thing. They may reduce our overall stress levels and help with sleeping at night and we should get to know how to use them.

Straight percentage

The example above is an approach that many people use. They decide how much of a decline they would be willing to see, either in individual stock positions or in the overall portfolio and they set stop-loss orders accordingly. Those orders are set by calculating the required dollar stop value as a percentage of the price paid.

There are a few problems with this approach.

Firstly, it ignores technical factors that could be used to give a better sense of where the stock price could go. I will be more specific.

An example using a 5% stop loss

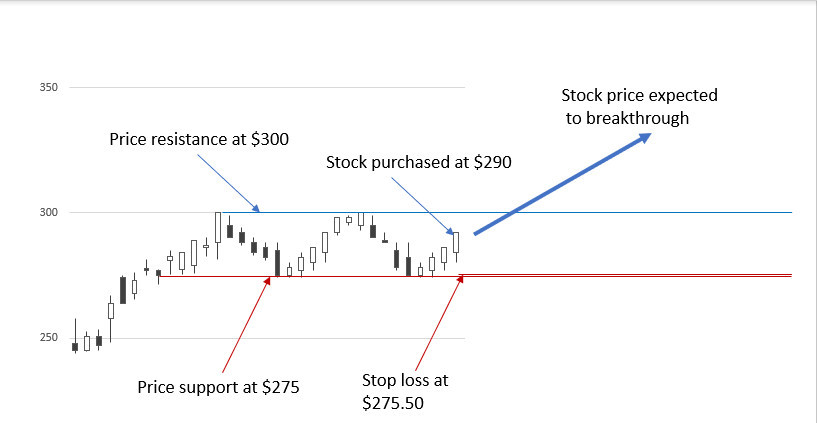

Let’s imagine that you have taken a position in a particular stock that has been trading within a certain range and has hit a level of price resistance several times and dropped to another level of support a few times as well. So the stock price is currently trading in a range between price support and price resistance. This is what that might look like.

In this case, the stock is trading between support at $275 and resistance at $300.

Other technical factors suggest to you that the selling pressure at the $300 resistance level has been exhausted so you expect the stock price break through the resistance and carry on upwards.

Let’s imagine you bought in at $290. If you were to apply a 5% stop loss approach you would set a stop-loss order at $275.50, i.e. 5% below $290. This is what that would look like.

In other words, you are hoping that something like the chart below will happen.

Let’s imagine that your expectations were basically correct. The market is such that this stock will eventually break out of its trading range, but you were just a bit early and the stock price bounces off the resistance level, then drops and tests the old level of support before heading back up and finally breaking through resistance. Because of the stop loss you set, your position could be stopped out at $275.50. Here is what would result.

Objections to this example

We could make an objection or two to the above example.

Firstly most experienced traders would only enter a position like this after the stock price had broken through the $300 resistance level in the first place.

They are unlikely to enter when the price is still moving within a range. However, prices moving within ranges isn’t always easy to see. Besides, you can often see different levels of support and resistance if you change your time horizon perspective.

The other objection is that few traders would have set a stop loss level just above a level of established support. On the other hand, in this instance, we assume that the trader applies stop-loss levels rigidly so the principle still applies.

Volatility – can take you out

Another potential issue with fixing stop-loss levels as a straight percentage of the purchase price of a stock is if the stock experiences a period of volatility. Volatility can occur even in light volume trading and can result in a stop-loss order being exercised.

Calculate – upside expectations, downside risk

A more solid approach to trading is to assess where you think the trade should take you if all goes to plan.

Use what you know about where the economy is going, what is going on in the broad market, and what is happening with the sector and the specific stock.

Then factor in what technical analysis tells you about how the stock price is behaving. All of this, taken together should tell you what you can expect for your stock if all goes to plan. This will be your expectation for the upside.

This same information should also tell you what will likely happen if things do not go as you plan. This will be your downside risk.

Success rates

We could take this analysis to another level. Let’s imagine that the trading approach you adopt succeeds on average 60% of the time and when successful yields a 50% average return on each trade,

I should point out that there are technical indicators that have been well studied and found to exhibit consistent success rates, so this isn’t complete fantasy.

If in a hypothetical case, the annual market return is 10%. Let’s say you wanted to beat the market by another 10% then you would be looking for a 20% annual return. In these circumstances, you could afford to lose 25% on your losing trades.

Rather than play with algebra, we can demonstrate this by imagining 10 trades each with $100 as a starting position and each lasting exactly one year. So our total portfolio at the start of the year was $1,000 and to return 20% would need to be $1,200 at the end of the year.

Six of those trades yielded a 50% gain so would return $150 each totaling $900.

Four of those trades would lose 25% so returning $75 each, totaling $300

$900 plus $300 equals the $1,200

You probably would not want to accept a 25% loss on your losing trades but the example above was for illustration purposes.

A more realistic simulation

Let’s look at a more realistic simulation if you are following a defined trading strategy with a known success rate.

For each trade, fundamentals, general market conditions, and technical factors would tell you the expected upside potential for the trade within a defined time horizon. Technical factors would also indicate where you should set a stop loss level and that would be your downside risk.

You would then annualize the expected upside return, and multiply that by the success rate. You then deduct the downside risk multiplied by 1 minus the success rate. That will give you a risk-adjusted annual rate of return for each trade. You then would decide whether it meets your criteria or not.

Stop loss and trailing stops

The most usual and better risk management approach to stop-loss is to use trailing stops.

As a stock price advances, rather than leave the initial stop-loss order in place, once the price has successfully entered a new territory is makes more sense to adjust the stop loss level upwards. This can be done automatically using trailing stop-orders.

Many online brokerage platforms will allow you to set a trailing stop-order at a percentage below the market price or at a set dollar value below the market price as the price advances.

There is evidence and some research that shows that setting trailing stop-loss orders, at 15% reduces downside losses during major bear markets and improves long-term performance both for standard buy and hold strategies1)Kaminski, Kathryn and Lo, Andrew W., When Do Stop-Loss Rules Stop Losses? (January 3, 2007). EFA 2007 Ljubljana Meetings Paper, Available at SSRN:https://ssrn.com/abstract=968338 and for momentum investing.2)Han, Yufeng and Zhou, Guofu and Zhu, Yingzi, Taming Momentum Crashes: A Simple Stop-Loss Strategy (September 24, 2016). Available at SSRN: https://ssrn.com/abstract=2407199

Testing trailing stops

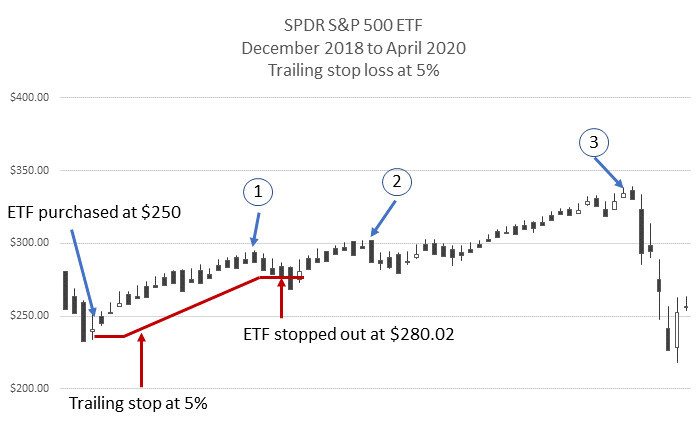

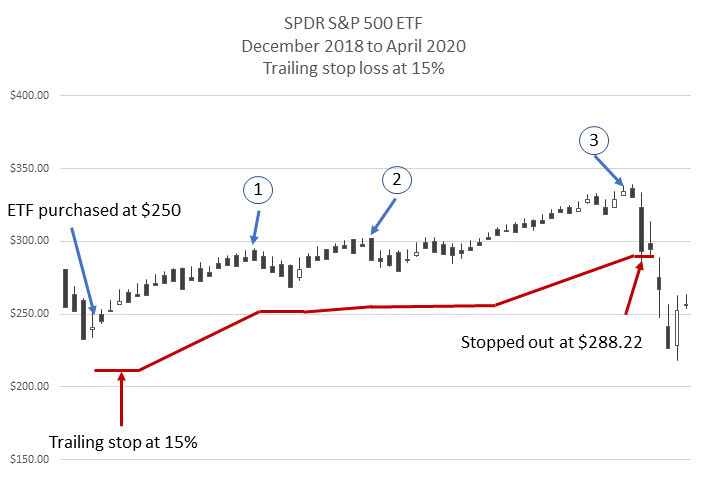

Let’s take a look at what would happen with a well-traded popular ETF is we set a trailing stop at different percentages for the same period.

Here is what the ETF from SPDR which tracks the Standard and Poor’s 500 index, symbol SPY, was doing between December 2018 and April 2020. Here we are looking at a weekly price chart.3)All historical stock price data was taken from Yahoo Finance. All charts were created by https://badinvestmentsadvice.com/

Let’s imagine that we bought in at $250 a share.

We will be setting our trailing stop at a fixed percentage below the price. There would be three price points where the price dropped and before a correction, we could be stopped out. These are shown here.

Let’s assume that we set our trailing stop at 5 percent. Here is what would have happened.

The first stop would have been set at 5 percent below $250, i.e. $237.50. We can see a 5 percent trailing stop would have taken us out of the position when the price hit $280.02 during the week ending 20 May 2019. Unless we got back in at some point we would have missed the bull rally that followed.

Now let’s look at what would have happened if we had set our trailing stop at 15 percent.

In this case, we would have been stopped out at $288.22 in the week ending 24 February 2020. That would have been a better place to close our position. We would miss the rest of the market plunge in March 2020 and stood a chance of getting back in after the market turned back in a positive direction.

Answers to some questions

Q. What is a good percentage for a trailing stop?

A. Evidence suggests that 15 percent is a good level to set a trailing stop both for a buy and hold strategy and for momentum investing.

Q. How do you do Trailing Stop Loss?

A. If you are using an online broker, setting a trailing stop loss is usually done by opening the position, starting a “sell” order, selecting trailing stop, and setting either a percentage or a dollar value. Your brokerage platform should allow you to preview the whole order before you execute it.

Q. What is the difference between a trailing stop loss and a trailing stop limit?

A. A trailing stop order will be executed at the market price once the stop-loss price has been reached. This is also sometimes called stop on quote. A trailing stop limit order will place a limit order once the market price had reached that level. The difference is that the limit order may not be executed as the market price may move away from the limit price. On the other hand, a trailing stop order will be executed at the market price which may result in a larger loss than anticipated because the market price may have moved.

Q. Do professional traders use stop losses?

A. Many professional traders use stop-loss orders and trailing loss orders. They may not use stop-loss orders if they have a hedge set up to yield a large enough profit if the market moves against their main position.

Q. What is the best stop-loss strategy?

A. Evidence suggests that the best stop loss strategy is to use a trailing stop limit set at 15% below the market price.

Stop loss and trailing stop orders are examples of a larger set of conditional orders. Traders who short sell stock or commodities will also need to consider using stop buy orders to close out their positions. To better understand short selling, check here.

To find out more about stop-loss orders, check here.

Here is a single-page PDF summary that explains stop loss and trailing stop orders.

I hope you found this article interesting and useful. Do leave me a comment, a question, an opinion or a suggestion and I will reply soonest. And if you are inclined to do me a favor, scroll down a bit and click on one of the social media buttons and share it with your friends. They may just thank you for it.

Disclaimer: I am not a financial professional. All the information on this website and in this article is for information purposes only and should not be taken as investment advice, good or bad.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you!

References

| ↑1 | Kaminski, Kathryn and Lo, Andrew W., When Do Stop-Loss Rules Stop Losses? (January 3, 2007). EFA 2007 Ljubljana Meetings Paper, Available at SSRN:https://ssrn.com/abstract=968338 |

|---|---|

| ↑2 | Han, Yufeng and Zhou, Guofu and Zhu, Yingzi, Taming Momentum Crashes: A Simple Stop-Loss Strategy (September 24, 2016). Available at SSRN: https://ssrn.com/abstract=2407199 |

| ↑3 | All historical stock price data was taken from Yahoo Finance. All charts were created by https://badinvestmentsadvice.com/ |

Very interesting explanation to the subject of protecting yourself against huge losses in the stock market.

Is there a signal that can be used for buying a stock, as well?

Hi and thanks for your comment. There are many indicators that can give buy signals. Most traders will use a few of these to confirm a trade idea. For pure technical signals, some are discussed in this article https://badinvestmentsadvice.com/how-to-do-technical-analysis-of-stocks-part-2/ I tend to look at a number of factors including a MACD cross and RSI coming up from below 30. This article https://badinvestmentsadvice.com/relative-strength-indicator-calculation/ shows how those signals performed for the same ETF examined here above as the market started to recover in late March 2020. My personal opinion though is that you should always assess how general market conditions are performing, and it is best to invest in the strongest stocks in the strongest performing sectors where there is evidence that institutional investors are buying.

Thanks again for the comment. Best regards, Andy

I wondered if I should be using a stop loss order and this article answered all my questions! Thank you!

Hi and thanks for your comment. I am glad that you found the information helpful. Best regards, Andy

I have a business coach nowadays. And if I would have known when I was trading back then, what I know now, I would have wanted a trade coach for sure. I don’t know if they exist, but if they do, I can recommend any individual who wants to trade to have one.

I very much had the impression that my stop loss orders were always hit. And then the stock would go back up 🙂

Hi Hannie, and thanks for the comment. I think that is a common experience and it has much to do with setting a stop loss too tightly, not using trailing stops and not adjusting stops according to market conditions. Thanks again and best regards, Andy

Awesome article. I’ve learned a lot. I wonder for a person like me who has no idea in trading whats-so-ever go about buying stocks or trading and if I were to start today would the “stop loss” strategy work for me or would I need some kind of middle man to help me?

LOL I don’t even know if I asked a right question that made any sense.

I was thinking about buying some stocks but I don’t know where to start and I’m not a risk taker either. Just trying to get some experience.

Hi and thanks for the comment. If you are looking for a simple way to build a diversified portfolio, the easiest way is to make regular monthly purchases of one or two major indexed ETFs. Most major online brokers will allow you to make purchases of fractional shares so you don’t have to buy a whole share. This means you can make regular purchases for $100 or $50 even. Here is a link that may help.

https://badinvestmentsadvice.com/stock-investing-101-pdf/

Do leave me another comment or any more questions and I would be pleased to answer.

Best regards

Andy

This is one of the most comprehensive articles on stop loss strategies I’ve found so far. When trading stocks or currencies, the most important thing is to understand the risk management. The lack of knowledge in this area is what causes many newbie traders to burn their trading accounts in a matter of days. Thanks for sharing this insightful and extremely helpful post. I’m still learning about trading and I don’t want to put any money in until I have a firm grasp of risk management.

Hi and thanks for the comment. I agree that risk management and therefore stop losses and trailing stops are very important parts of trading and investing. I think also the more active approach you adopt to trading and investing, the more important risk management becomes. If your approach is passive then buy and hold is more of an option. Thanks again for your comment. Best regards, Andy

Hi there,

Great post, it’s not often you get all the information you need from one article, so congrats on achieving that! Stop-loss and trailing stop orders have always been something on my list to learn but I always give up when I don’t find them easy to navigate. I’ve no excuses now though, so thanks for that!

I really need to start using them and getting into a routine of using them too.

Looking forward to seeing what you write next.

Sharon

Hi Sharon

Thanks for the comment. I am glad you found it informative. It is indeed very much worth it learning how to use stop loss and trailing stop orders.

Thanks again

Best regards

Andy

For a long time I have been thinking about investing in stocks, but I don’t know how to do it and which sites are trustworthy. I found this information very useful. So, stop loss strategies prevent any huge losses in cases the stock you invested in goes down?

I still need to learn so much before I start investing in stocks, this is such unknown territory for me, but I want to understand it better, in order to start invsting.

Hi

Yes, stop-loss sell orders will close a position if the market price drops to that level. Many long-term investors do not use stop-loss or trailing stop orders if they decide to ride out the market dips along with the market highs. If you adopt a passive approach to investing then it is reasonable not to use stop-loss orders. If you are an active trader though looking to enter and exit trades on a shorter time horizon, of say days, weeks or months, then it is essential to use stop-loss or trailing stop orders, or at least some other way of managing your downside risk.

Thanks for the comment

Best regards

Andy

I have just started doing research on stocks and investing because I plan on opening an alternate investment account to go along with my IRA account. This article described everything I needed to know about stop loss, and especially about the importance of managing risk. I saved this article for future reference, thank you!

Hi Joshua

Thanks for stopping by and thanks for your comment. I am glad you found it informative and useful.

Best regards

Andy