What is the best cryptocurrency investment? That’s a good question. George Gilder and a number of other of the digerati elite think cryptocurrencies and the blockchain technology on which they are based are poised to revolutionize the internet and the world of money.

And who is George Gilder? Only the technology pundit who loudly predicted the rise of the personal computers, the rise of the internet economy, and companies like Amazon, Google, and Facebook.

On the other hand, he also made predictions about various other technologies that did not come to fruition. And let’s put aside for the moment his other favorite topics such as supply-side trickle-down economics and intelligent design and instead focus on blockchain and cryptocurrencies.

What are cryptocurrencies?

Cryptocurrencies are a ledger of transactions coded into a blockchain which is a large computer algorithm that many computers all across the internet work on constantly.

What does that mean? Well, imagine a large chunk of computer code that is shared by many servers or nodes that constantly conduct self-replicating computations on the code. The data it contains lives a bit like a constantly self-feeding organic code creature in cyberspace.

In crypto-speak, what all those computers calculating and recalculating the blockchain are doing is called mining. Each cryptocurrency transaction is coded across the whole of the code. It is somewhat like DNA replicating itself. Another analogy would be how holographic images are recorded into each small particle of the material that holds the image.

Cryptocurrencies are also sometimes loosely called digital currencies but the important feature of cryptocurrencies is the use of blockchain technology to encrypt and protect the integrity of the information. Whereas a digital currency may use other means of encryption and protection.

So – for the logically minded – cryptocurrencies are a special case of digital currencies and frankly for the moment the only ones worth bothering with. But all that clever technical stuff can be left to the geeks. The questions for the investor and trader are whether they are worth investing in and how should you do it.

Bitcoin vs Ethereum

Bitcoin is the best-known cryptocurrency while Ethereum is a close second. If you are considering launching yourself into cryptocurrency investing or trading it is worth understanding some of the story, purpose, and features of each of these two main players. There are other cryptocurrencies that do different things but these are the two main ones to consider.

Where did Bitcoin come from and where is it going?

Bitcoin was launched in January 2009 when Satoshi Nakamoto announced in a white paper:

“the first release of Bitcoin, a new electronic cash system that uses a peer-to-peer network to prevent double-spending. It’s completely decentralized with no server or central authority.”

Mr. Nakamoto – the generally accepted theory is that it was a guy – then went on to explain how Bitcoin could only issue 21 million coins and this limitation was built into the algorithm, locked away deep in the blockchain. Another limitation was that Bitcoin is self-programmed that the last bitcoin would be mined in the year 2140.

Because of the way Bitcoin was set up, every four years or so the rate at which new Bitcoins are mined and created is halved.

The term “mining” is no mistake. The intention of Bitcoin is to replace the traditional function of gold as a store of value and a medium of exchange. I am referring here to the gold standard which has been used to peg a currency to the value of gold by various countries at different times in history. So like gold is mined out of the earth, Bitcoin is constantly mined into existence.

And in case you were wondering how big is the Bitcoin blockchain, in April 2020 it reached 280GB and continues to grow.

Nobody ever saw Mr. Nakamoto in person, he just sent emails and posted messages to the forum on the Bitcoin website. The last known message from him was an email to another blockchain pioneer Gavin Andresen in April 2011, and the elusive Satoshi Nakamoto has not been heard from since.

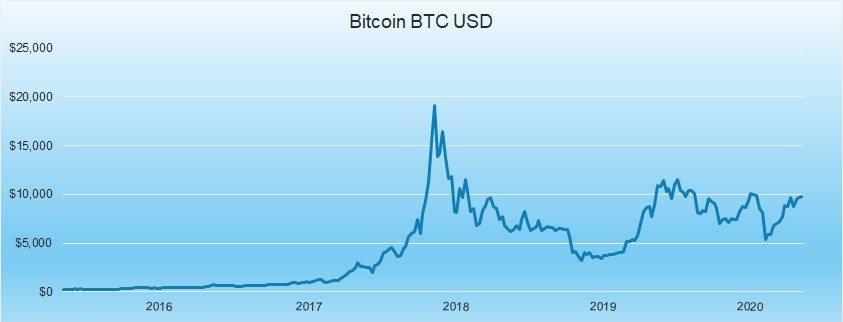

When Bitcoin was launched each coin cost factions of a US cent. In July 2010 it jumped to 8 cents. It traded in low volume in a range from about $50 to a few hundred for some years and then in early 2017, it took off.

The price hit a peak of just under $20,000 in early 2018, dropped to around $6,000 in early 2019, dropped, and climbed again into early 2020 until it took a dive again in February and March when all markets tumbled with Conoravirus fears. Right now in June 2020, it is testing the $10,000 level but frankly, it could go anywhere from here.

Blockchain technology

Bitcoin created and was the first to use blockchain technology. Bitcoin uses its blockchain to record transactions so that it functions as a medium of exchange replacing money, hence a cryptocurrency.

The clever part about blockchain technology is because it is decentralized across hundreds or thousands of nodes it is very difficult to hack or defraud. This makes it inherently secure and at the same time transparent. It is secure because nobody can hack all the nodes at the same time and it is transparent because everyone can see and has a record of what the transactions are.

This is what allows Bitcoin to behave as a medium of exchange without the need for a national bank to act as an issuing authority or other banks or entities like PayPal or Visa as trusted intermediaries for transactions.

Once created, the advantages of blockchain technology became apparent and other developers started to wonder what applications other than just money could use the innate secure, decentralized, and transparent features of blockchain.

And then came Ethereum.

What is Ethereum?

Ethereum is quite different from Bitcoin. The purpose of Ethereum is to provide a software platform for coding smart contracts using open source code. The smart contracts can be used to buy and sell products and services between two parties without the need for a third party middleman and can apply terms and conditions to the contracts, hence smart contracts. Ethereum is actually the software platform that, like Bitcoin runs on numerous computers all over the world also called nodes mining the code. The nodes are rewarded with Ether, the cryptocurrency for the Ethereum network, and the Ethereum network of computers is called the Ethereum Virtual Machine, or EVM.

Ethereum was created by Vitalik Buterin and Gavin Wood and launched in July 2015. Both of these founders are real people who appear physically in public and on videos on the internet.

There are a great deal more technicalities to Ethereum and what developers are doing using Ethereum. A number of large and powerful corporations have also signed up for an organization called the Enterprise Ethereum Alliance to develop decentralized applications, called dapps on Ethereum.

So, if Bitcoin becomes a new gold standard could Ethereum become the world’s new secure and trusted supercomputer?

Price Fluctuations

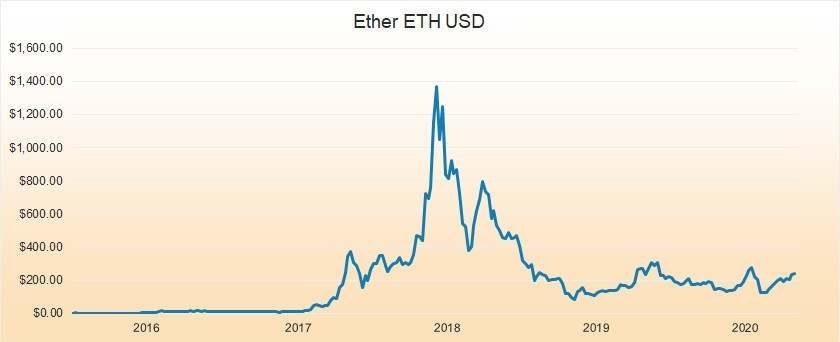

As these two charts show, both Bitcoin and Ether the Ethereum currency fluctuate massively in price to the US dollar, far more than the usual gyrations you see in stock prices. The symbol for Bitcoin is BTC and the symbol for Ether is ETH. 1)The data for the charts is from Yahoo Finance, the charts were created by badinvesmentsadvice.com

On a typical day to day basis, Bitcoin or BTC can vary between 5 and 10 percent in value. Ether was also very volatile when it hit its peak in late 2017 climbing as much as 60 percent in a week. In comparison, a stock may vary in market value by 1 or 2 percent in an active trading day.

How do you invest in cryptocurrencies?

There are a number of ways of investing in cryptocurrencies. You can:

Invest long-term

In other words, buy and hold and try not to get distracted by the massive daily price fluctuations. This may be an OK strategy if you are willing to hold for some years and hope for the best.

Trade short-term

This involves looking for patterns in price movements to predict where the price is heading much like many Forex or stock day traders. This approach makes use of technical analysis, discussed here.

Invest in an ICO

An ICO is an Initial Coin Offering. An ICO is a bit like an IPO, Initial Public Offering but without all the regulations and rules. Companies, or even loosely linked groups of people announce a plan to launch a new cryptocurrency or blockchain venture and invite the investing public to subscribe to a share of the outcome or to prepay for products or services. This is a specific sort of crowdsourcing.

Investing in ICO’s is probably the riskiest way of trying to invest in cryptocurrencies. Some ICOs have been so successful that the founders just made off with all the money they raised and never bothered to proceed with the proposed venture. Even if they do agree to go ahead there are no guarantees that the proposed venture will succeed or not be subject to some other fraud or debacle.

Invest in companies launching cryptocurrencies or working with blockchain

This could either be through investing in the stocks of the companies or through Exchange Traded Funds, ETFs aimed at this new industry. This might be attractive and it does carry a certain logic if you get bitten by the cryptocurrency bug and are convinced that decentralized currency and decentralized everything is going to dominate our futures.

On the other hand, the fact that there are now ETFs aimed at funneling investment dollars into blockchain and cryptocurrencies might be a sign you might already be late to the party. This also goes against the advice of many great masters of investment, as explained here. If there is any industry in today’s world that would qualify as a fad industry it would be cryptocurrencies and possibly blockchain.

Is it legal to invest in cryptocurrencies?

This was a problem for a while in many countries, then in February 2020 major cryptocurrencies including Bitcoin and Ether became legal in the US, UK, European Union, Japan, and most other developed countries.

However, it is still either illegal to buy most cryptocurrencies or banks are not allowed to handle then in Russia, China, India, Brazil, and other countries. If you are in doubt check in your country.

Where can you buy cryptocurrencies

There are cryptocurrency exchanges, such as Coinbank which trades nearly all cryptocurrencies and will transfer to and from fiat currencies. Fiat currencies are all the major currencies we are used to hearing about such as US dollar, Euros, Yen, etc.

If you are only interested in the main cryptocurrencies, many major brokerage firms now allow you to trade them. This table shows you which ones.

The risks involved in buying cryptocurrencies

There is a lot of debate and disagreement about many of the merits or otherwise of cryptocurrencies, but on one aspect everyone agrees. They are very risky.

Firstly they are risky in as far as the price fluctuates wildly and if you buy at one price you might have bought at a peak. You could be waiting for the price to climb back for a long time. Secondly, because of what they are cryptocurrencies have other risks.

Your title of ownership to cryptocurrency is coded into the blockchain and you access your currency through codes that have to be kept secure. Hackers are constantly trying to break in and steal cryptocurrencies. While that may be difficult once ownership is recorded in the blockchains the cryptocurrency exchanges where they are traded and exchanged for fiat currencies can be very vulnerable to attack.

There have been some highly publicized cases of cryptocurrency exchanges either being hacked and losing currencies or being fraudulent in themselves and the founders disappearing with the goods. Mt Gox is a famous case of a Bitcoin exchange that lost $450 million dollars worth of customers Bitcoins that it said were stolen and had to close up shop declaring bankruptcy in early 2014. For more on the Mt. Gox story, check here.

And if you did put some of your hard-earned money into an ICO hoping for the best, I suggest that you keep hoping but don’t hold your breath.

Storing cryptocurrencies

Because there is no bank holding your cryptocurrencies, there is also no insurance in the event of any loss. This means that if you make a mistake in a transaction there is nobody you can go to for help. Also, if someone does hack into your coins they are gone and that’s it.

Storing cryptocurrency on an exchange can be very risky as noted before, they are under constant hack attack.

You also have the option to store your cryptocurrencies in what is called a cold wallet. That is code that you keep offline, on a memory stick for example. But to make that safe there are all kinds of precautions you have to take securing your passwords, your means of identification which could mean a smartphone and all the verification steps you have to go through to authenticate yourself to access your cryptocurrencies. Effectively you have to become your own bank.

Once you have built a fortress around your codes and passwords and email account and phone number, what then if something happens to you and a family member has to access your cryptocurrencies if you are incapacitated for whatever reason.

Grim stuff I know but there have been cases of people disappearing or passing away and their closest family members were unable to get at their Bitcoins for example. So this is something to consider.

Are cryptocurrencies a bad or a good investment?

This has to be the 64,000 Bitcoin question. I would just say there are a number of things to consider.

It does seem that some big institutions, corporations, and wealthy individuals are building positions in major cryptocurrencies like Bitcoin.

When stocks have tottered into bear markets, there has sometimes been a rush into Bitcoin.

Whatever the fortunes of Bitcoin and Ethereum may be, blockchain is an exciting technology with many applications wherever data needs to be handled securely and used by many people all over the world and where transparency and trust are key.

So whether the suggestion to buy cryptocurrencies is good or bad investment advice, to be honest, you have to judge for yourself.

Disclaimer: I am not a financial professional. All the information on this website and in this article is for information purposes only and should not be taken as investment advice, good or bad

I hope you found this brief introduction to cryptocurrencies interesting and useful. Do leave me a comment, a question, an opinion or a suggestion and I will reply soonest. And if you are really inclined to do me a favor, scroll down a bit and click on one of the social media buttons and share it with your friends. They may just thank you for it.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you!

References

| ↑1 | The data for the charts is from Yahoo Finance, the charts were created by badinvesmentsadvice.com |

|---|

Thanks for a great post. Crypto currencies have confused me for some time. After reading what crypto currencies are in your post this has helped me get a grip of what they are.

Hi Russ and thanks for the comment. I am glad you found it interesting and clarifying. Best regards, Andy

Hi Andy,

What a great post! I have heard a lot about cryptocurrencies but did not understand them that well myself. I appreciate your in-depth explanations and being able to understand how they work.

Well wishes,

Sonia

Hi Sonia

I am very glad that you found it interesting and informative. I think this will be a very interesting space to watch over the next years.

Best regards

Andy

Hi Andy. Thank you for your informative article. I have heard of Bitcoin and Ethereum long time ago but don’t really quite get it what it is. I thought they are the same kind. After read your article, then I realise there are different.

Yesterday I have come across a platform which you can join for free with a list of services provided and something to do with blockchain. I wasn’t quite understanding what it is and how it works.

And today I saw your article and about the blockchain technology, I guess that could be the ICO which I have learnt from your article today.

Somehow the universal has direct me to your article to help me clear some of my confusion! Thank you for your sharing.

Hi Janet

I should clarify that Bitcoin and Ethereum are both cryptocurrencies. I must admit it took me years to get my head around these things and if you are used to the idea of parting with money for tangible products or at least the promise of future tangible products then cryptocurrencies don’t fit that bill. The cynical view would be that cryptocurrencies are evidence of the greater fool theory. If you are willing to take the plunge and part with money to buy a cryptocurrency you are doing so on the hope that at some future time there will be greater fools than you willing to part with even more money to buy them off you. One of the principle catches in this argument though is that the money itself is just a representation of value and that representation is subject to the trust we all place in it, and inflation rates and fiscal and monetary policies.

I’m glad you found the article interesting and I hope useful.

Best regards

Andy

Hi Andy,

It’s a very interesting concept but the decentralisation both a pro and a con because you can remain anonymous forever but it really becomes free estate for smart hackers.

I’ve had heard about it but brushed it off because there are way too much risk involved and probably why it’s a rich man’s game

Thanks for taking the time to break down the concept of cryptocurrency!

Cheers,

SAM

Hi Sam

Yes indeed cryptocurrencies are very risky indeed and the more I look into them the more I uncover new risks lurking in every dark corner.

Thanks for your comment

Best regards

Andy

Hi Andy,

An interesting post as I have no clue about cryptocurrencies. The only thing I knew about them was that I kept getting emailed on LinkedIn by people who came across as blatant scammers. So, I blocked these people and I didn’t think anymore of cryptocurrency.

Reading your article, I am still none the wiser whether it is a good or bad thing. You have stated that we need to judge for ourselves. I am definitely going to do that by staying away from cryptocurrencies.

Thank you for sharing and keep up the great work.

All the best,

Tom

Hi Tom

I am glad you found it interesting. Aside from cryptocurrencies there are other applications of blockchain technology that are less prone to scammers and financial risk. I heard there is a group working on developing blockchain technology to record the exact source of agricultural produce from farm to table in a completely secure way.

I agree with you though – the currencies part is like taking a big gamble.

Thanks for your comment

Best regards

Andy

Hi Andy,

Your review is very informative and well-written. I heard in the past about BitCoin and I know there were many scams involved around it. After reading this review, I can say I have a clearer idea of the crypto currencies.

There is a huge risk with investing in crypto currencies, but if well researched could be an excellent way to make money.

Thank you,

Yoana

Hi Yoana

Yes and I know a few people who had their fingers burned in one of those scams. In many respects it is typical of a new industry, unregulated and much like the wild west. It is possible to make money though if you are careful and get the timing right.

Thanks for the comment

Best regards

Abdt

I never knew Bitcoin was invented in 2009, I thought it started in late 2016. Maybe It’s because I’ve heard about it but haven’t done full research until I came upon this great article. Thank you for this information I will keep it in reference when I might consider looking into buying cryptocurrency.

Hi Joshua

Yes, Bitcoin has been around for some time. I do know some fortunate individuals who jumped in early long before it had its meteoric rise in 2017. As the chart shows though you would need extremely fortunate timing to have got out with the maximum winnings. I see many opinions expressed online that it is either going up again or coming down again. So I guess it is a question of – take your pick and hope for the best!

Thanks for the comment

Best regards

Andy

Great information. We were just trying to figure out what all this meant. Thank you for explaining this in a way that makes sense.

Hi Christy

Thanks for the positive feedback. I am glad you found the article informative.

Best regards

Andy

Hi Andy,

This is a very useful article because it talks about something that all people should read it. The reason that it is about cryptocurrencies that are created few years ago and it is still confused for many marketers. I really used Bitcoin two years ago but I left it because many people warned me that it is risky.

I learned new things about them when I read your article. It makes everything clear after it was ambiguous.

Wishing you great success

Rania

Hi Rania

Cryptocurrencies are indeed very interesting and developing quite rapidly. It took me a while to get my head around many aspects of what they are and how they work and I am still learning. I agree there are big risks involved and I think I will watch from a somewhat safe distance without too much exposure. I am very glad you found it interesting and useful.

Kind regards

Andy

Lots of speculation about cryptocurrencies and their phenomenon in our world is very palpable. I found it interesting after reading a book on Bitcoin that Satoshi Nakamoto, in his emails, was extremely irate with the financial system after it crashed in 2007 and Bitcoin was designed as an alternative, more transparent form of currency. I bought into that idea after reading about it but now that our whole world is changing due to the corona virus, I feel like it could be a useful tool against humanity by forcing us into a cashless society…

just my current thoughts and feelings….

thanks for sharing such a relevant piece of info

I also recently read George Gilder’s Life after Google and he talks a lot about Satoshi Nakamoto. I think there may be a tendency to read a bit to much into the things Nakomoto said/wrote. Yes there is a movement to push cryptocurrencies and blockchain technology is already changing many things and solving big problems but I wouldn’t write of nation-states just yet. We will see what happens. Interesting times ahead, thanks for the comment and best regards, Andy

That was fascinating, even if some of it did go way over my head. Did George Gilder’s foresight enable him to make the same kind of fortunes as Mark Zuckerberg or Jeff Bezos? If not – is he worth listening to!? 🙂

Good question. He has made a name for himself predicting other things and has some sort of a track record. But to be honest his record has probably better served to get him bookings on cryptocurrency and blockchain futurology type panels. I don’t know what kind of speaker fees he commands. I am sure they are more than enough to pay for hotel bills and a few meals and maybe payments towards a condo in Florida but I doubt they get into the astronomical heights of the Zuckerbergs of the world. Having said that I do think Mr. Gilder has successfully invested in a number of leading-edge companies and probably made serious money – and likely more than speaker fees. Anyway, next time I am sharing a G & T with him and other digerati at a blockchain party on the other side of the galaxy – I’ll ask and post the answer here. Thanks for the question. Best regards, Andy