What is crowdfunding for real estate? Everyone has heard about GoFundMe. Most of us understand that people go online to raise money for some cause or other, often a charitable or a worthy one. Some people also raise money for business ventures through platforms like GoFundMe, but you might ask, does that work for real estate projects?

Well, it does.

And while there would be no reason not to try launching a real estate development project on GoFundMe, it isn’t what most GoFundMe users would expect to find. Also, more importantly, you would still have to take care of all the other complicated aspects around real estate deals yourself.

There are crowdfunding sites that are designed for specific kinds of niches, like small business ventures, or creative projects such as movies, or charitable causes. and there are crowdfunding sites that specialize in real estate projects.

Management and clever bits

Real estate development projects involve a great deal of management, and all manner of other services including title search, zoning boards, architectural boards, architectural design, general contracting, and many legal services. All of these services incur fees that eat into the investors’ returns.

Real estate crowdfunding sites seek to create value for their investors by two broad strategies.

Firstly, by doing as many of the costly services in-house to ensure that fees charged to investors are kept low.

Secondly, by carefully vetting development projects and packaging and bundling these into different investment vehicles for their investors. In reality, real estate crowdfunding sites are very much in the real estate business and not just marketplaces where buyers and sellers of real estate can meet.

How they differ

Real estate crowdfunding is a vibrant and competitive sub-sector of the real estate industry.

There are various factors that distinguish real estate crowdfunding sites from each other. Some act as pure middlemen providing investors with access to developers while others act more like developers in their own right.

Another distinction is that some real estate crowdfunds loan investor funds to property owners as debt. The income stream is generated when the property owners repay their debt.

Other real estate crowdfunds use their investors’ funds to acquire equity in the real properties and the collection of rent on those properties provides the income to investors. If the fund has equity in the properties, the sale of the properties at the end of the anticipated holding period also provides capital appreciation to the benefit of investors.

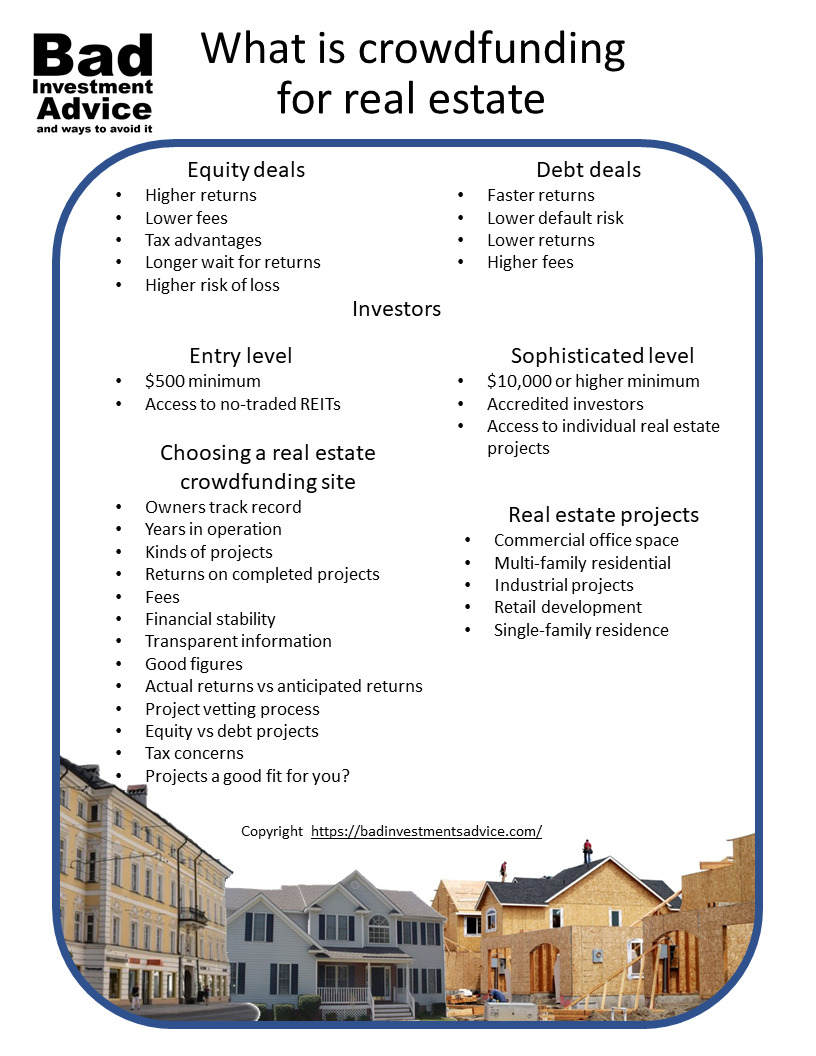

The real estate projects themselves can be commercial office buildings, retail developments, multi-family residential projects, industrial projects, even single-family homes, and different crowdfunding sites have strengths in different areas.

The main real estate crowdfunding sites tailor services for investors at different stages of their investing journey.

Entry-level

Note: This article contains affiliate links

Good examples in the US are:

Diversifyfund Growth REIT, minimum investment $500 and no requirements other than being a US resident.

Fundrise Core, minimum investment $1,000 within Core you can choose one of three strategies: i) Income, ii) Growth, iii) Balance of income and growth.

PeerStreet, accepts investors with a minimum account balance of $1,000

RealtyMogul, a minimum investment of $5,000 will allow you to invest in one of their two REITs provided other conditions are met.

More sophisticated investors

At the $500 to $5,000 level, most of these real estate crowdfunding providers give you access to their non-traded REITs. That means you will be participating in a diversified fund that will be invested in many different real estate projects. Sometimes you can choose whether you participate in the income part of the fund or the growth part of the fund or a blend of the two. That is for you to choose whether your objective is an income stream or a larger payout some time, usually three to five years into the future.

On US-based real estate crowdfunding sites, to be allowed to invest directly in individual real estate projects you normally have to go to the next level as an investor. In most cases, this will mean you need to qualify as an Accredited Investor.

The qualification criteria for being an Accredited Investor vary from state to state. It usually means a combination of

- Annual income in excess of $200,000, recent years, the current year and anticipated for the next year,

- Net worth in excess of $1 million – excluding your primary residence,

- Professional expertise that qualifies you as a sophisticated investor can reduce the above requirements

Essentially, if you qualify as an Accredited Investor that gives you direct access to investing in high-risk, unregulated, or less regulated investment products and vehicles. The law considers that you can accept the risks of these more dangerous investments without the protections afforded to us humbler folk,

Individual real estate projects

Of course, this is the fun part.

If you do meet the requirements and are able to find the necessary funds, you can get to tie your money up directly owning a piece of a commercial property. This is the exciting part of the game where you get to browse a catalog of developments with compelling stories and pictures of apartment blocks or condos with pools and palm trees.

While a good story with pretty pictures always makes a good read, what you should really be interested in is the numbers.

So what numbers would you expect to see with a real estate project on a crowdfunding site? You would expect to see convincing evidence of the project costs, the anticipated revenues in terms of rent, and an assessment of risks.

If a developer has already been identified then the costs of the project including contingencies may be known. Then you would also expect to see how the project costs benchmark against comparable projects, preferably for other properties close to the location of the project.

On the revenue side, you would expect to see evidence of the demand from prospective tenants. The rents expected to be charged should be benchmarked against other similar properties in the location. The revenue projections should be realistic and pass the sniff test from all angles. As an example, if the project is anticipating 100% occupancy within the first few months after it is move-in ready, what evidence is there that supports that claim.

Expect to see an assessment of the broader environment of the project. What other risks are there? What factors outside the control of the project could affect it? How resilient would the project be in a general economic downturn? The answers to these questions could lead you to do some of your own research.

This is all part of the due diligence process. You will want to see that the crowdfunding site has done precisely this sort of rigorous assessment. I would not be shy of asking them questions if the information they present seems incomplete, vague, or unsubstantiated.

A typical equity real estate crowdfunding project

We’ve already noted that an equity real estate crowdfunding project involves the crowdfunding site owning all or part of the property. With equity come some advantages and some risks.

Advantages of equity real estate projects

- There is the possibility of higher returns. In the same way that equity shareholders get paid after all other debts are paid, the largest part of the pie is left for them. Assuming that there is a large pie or any pie at all for that matter.

- There are possible tax advantages. As a part-owner you, as an investor may be able to write-off some or all of your share in renovation or capital improvement costs.

- Fees will usually be lower on equity deals.

Disadvantages of equity real estate projects

- The returns on equity deals tend to take longer to materialize. If the goal is to improve the property through capital improvements over the anticipated holding period and sell at the end of that period, then investors will receive the largest part of their returns at the end of the project.

- There will be a higher risk of loss and that loss can be total. In other words, the whole project could go belly up.

Note: This article contains affiliate links

Diversyfund is an example of a real estate crowdfunding platform that does a majority of equity deals. In fact, it is unique in that it acts as the developer for most of its projects.

A typical debt real estate crowdfunding project

In this arrangement, the crowdfunding site provides the funds to the developer in the form of a loan typically repaid in installments with interest. There are advantages and disadvantages to debt-funded projects.

Advantages of debt-funded real estate projects

- You will get paid sooner. As an investor in a debt-funded real estate project, you will likely start receiving repayments from the project much sooner than is the case with equity deals. These kinds of deals typically generate predictable income streams.

- The repayments should carry less risk. As a holder of the debt, you are paid before shareholders i.e. equity holders.

Disadvantages of debt-funded real estate projects

- There is less upside potential. Since the funding to the project is set up as a loan, the returns over the lifetime of the project are known and there is a ceiling on returns.

- The fees are likely to be higher. There will also be fees associated with setting up the loan. Those fees are going to eat into the returns of the project.

- There is default risk. So while the project may be set up with what might look like an ironclad loan arrangement there is always a risk that the project could fail especially if major construction or renovation works are not yet completed.

- Prepayment risk. In some cases, the debtor may choose to pay off the loan before it comes to term. As an investor, this will mean you will receive less income than anticipated. If this happens, investors would typically look to put their money in other projects sooner than otherwise anticipated.

Peerstreet is an example of a crowdfunding site that does only debt-funded real estate projects.

How to choose a real estate crowdfunding site

So, assuming that you have got as far as deciding that you would like to add real estate investments to your portfolio through a crowdfunding site, how do you choose a crowdfunding site? Here are some criteria I would suggest you consider.

The owners, what is their track record? You will want to see that the founders and owners are real people who have long successful track records in the real estate business.

Years in operation. How many years has the company been in operation? This is a comparatively new industry so many of these operations have only been around for a few years. But obviously the longer they have been around and the more consistent their track record the better sense you would have that this record is likely to continue into the immediate future.

Kinds of projects. What kinds of projects do they have on their books? Do they focus on any particular kind of property, are they focused in specific geographic regions. Do they do only or mainly debt deals or equity deals?

Completed projects. What is their track record of completed projects, what returns were achieved? If they publish information that groups previous projects according to their investment vehicles, that can give you a good sense of the risk profile of those investment vehicles. Fundrise is a good example of this.

Fees. How do their fees compare with other companies? When you get down to your final short-list you should compare the fees they charge.

Financial stability. Is the company financially stable and how do they compare with the competition. This is a hard question to answer because most of these companies are privately owned so there are no financial statements you can look up. The only figures you are likely to be sure of getting are the total value of assets under management, total sums invested with them, disbursements made to investors. One indication would be that they have a spread of projects at different stages on their anticipated timelines. As a general guide the larger they are the more resilient they are likely to be in an economic downturn.

Transparent information. How transparent are they about their projects – do they let you see inspection reports, zoning decisions, title documents. You may need to call them up and ask to see more project details to get a good handle on this. It is important though as going forward you want them to know that

Good figures. How compelling are the figures they present projecting project returns? Is every source figure reasonable and justified? You want to see compelling calculations that are neither vague nor superficial at one extreme nor trying to blind you with science at the other.

Actual returns vs anticipated returns. Do they publish project actual returns vs anticipated returns or do they just cherry-pick and share their best results?

Project vetting. How does the vetting process used by the site work? You want to be convinced by their due diligence process. One potentially meaningful statistic is the percentage of projects that make it through the vetting process.

Equity vs debt projects. Are you looking for equity projects and growth or debt projects and income or a blend of both?

Tax. Are there any tax advantages or is that not a consideration.

Project fit. Lastly, are you comfortable with and interested in the kinds of projects that the site has on its books?

After asking all these questions, if you are comfortable with what you see, then this is probably a good fit for you.

This article explains all the ways an individual investor can get involved in real estate investing.

This article provides more information on the history of real estate crowdfunding.

Questions and answers

Q. Is real estate crowdfunding a safe investment?

A. There are risks associated with all kinds of investments including real estate crowdfunding. Generally, the returns on real estate investments through crowdfunding are going to be higher than returns on bonds, in the order of 18 to 25 percent annualized returns on real estate equity projects. Occasionally some real estate projects will go south and if you are an investor in an equity deal the whole of your stake in that deal could be gone. For this reason, it will be good to diversify your real estate crowdfunding holidngs.

Q. Can you build wealth with real estate crowdfunding?

A. If you have a long time horizon, with the returns available, compounding returns then you can build wealth through real estate crowdfunding.

Q. How much should I invest in real estate crowdfunding?

A. Depending on your risk appetite and risk tolerance a typical range for a diversified portfolio would be to have between 5 and 15 percent of the total value in real estate.

Single-page summary

Here is a single-page PDF summary of real estate crowdfunding.

I hope you found this article interesting and useful. Do leave me a comment, a question, an opinion, or a suggestion and I will reply soonest. And if you are inclined to do me a favor, scroll down a bit and click on one of the social media buttons, and share it with your friends. They may just thank you for it.

Disclaimer: I am not a financial professional. All the information on this website and in this article is for information purposes only and should not be taken as personalized investment advice, good or bad. You should check with your financial advisor before making any investment decisions to ensure they are suitable for you.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you.

Hi, I live in another country, so Crowd Funding is quite new to me Andy. It sounds quite interesting, and I love the single page summary. It says it all. I suppose it’s like anything; there would be some risk involved.

Hi Yvonne

There are also real estate crowdfunding sites in Australia. crowdfundup.com domacom.com.au brickraise.com and venturecrowd.com.au are all real estate crowdfunding platforms operating in Australia. Also, it looks like you had legislation passed in 2018 giving permission for equity real estate projects through crowdfunding. From what I can tell account minimums to sign up with these sites as an investor start as low as $100 but for some the minimum is $5,000. As you say, like any investment there is some risk involved.

Thanks for the comment and best regards

Andy

Wow! What a wealth of information! My head is spinning. I like that there is a “low” entry barrier option as I am not a wealthy person. I never thought crowdfunding for real estate existed. Very Interesting!

Hi Brianna

Even if you were thinking of starting small with crowdfunding investing, I would opt for one of the larger companies. By that, I mean one with a large number of high value ongoing projects that are expected to mature over a spread of time in the coming years.

Thanks for the comment and best regards

Andy

I must admit I have never heard of crowdfunding investing. I also have to admit, I still don’t really get it enough to even think about investing in it. I don’t believe we have it here in Canada which may explain why I didn’t hear of it.

I must say I am interested in learning it so I will be reading your article again, perhaps a few more times.

This is a very detailed article of crowdfunding, job well done and I appreciate you sharing this investment opportunity with us Andy, you did pique my interest. Do you invest in crowdfunding yourself?

Hi Rick

Crowdfunding for real estate also exists in Canada. Nexuscrowd.com frontfundr.com are both real estate crowdfunding operations in Canada. It appears that directly investing in equity projects is only available for accredited investors in Canada, so that is quite similar to the situation in the USA. Though it is possible to invest in non-traded REITs through real estate crowdfunding sites in Canada like it is in the USA.

I have been looking at real estate crowdfunding for myself these past weeks, but I will be cautious. I think there is a possibility of a serious downturn in commercial office space so I would avoid those kinds of projects. However, I do think there will be some very attractive commercial multi-family projects because the pandemic experience seems to be fostering an acceleration of moves away from urban centers to suburban areas and beyond.

Thanks for your questions

Best regards

Andy

This article was so filled with so much information, my head is still reeling!

I did not realize that I can start with as much as $500. I have not known such a thing as crowdfunding existed in the investment world.

Thank you and best regards.

Hi,

I suppose you could say that crowdfunding is an online version of cooperative funding where a large number of small investors pool their funds together. Most people know about crowdfunding to raise money for needy causes or charity. Real estate crowdfunding is quite different in that the motives are completely profit-oriented. Like all investments there are risks but if you are looking to diversify your investments, crowdfunding could be an excellent way to add real estate to your portfolio.

Best regards

Andy

It is only in recent times that I have come across the term crowdfunding and it appears to not be that old. I see that in modern times the band Marillion managed to fund a tour through crowdfunding in 97′.

However, this type of funding can open up a whole new way to deceive and must be regulated in a way that this can’t happen. Quite a task I would have thought!

Has to be managed properly because what we are seeing online is an abundance of MLMs delving into Crowdfunding and in my opinion, not for the right reasons.

As we know crowdfunding is used for charities and its a known fact that only about 5-10 per cent actually goes to the charities cause which stopped me from giving money to charities.

It doesn’t take much for someone to scam a few £’s here and there.

The term crowdfunding just doesn’t sit right with me anyway.

I really enjoyed the article, thanks for sharing Andy.

Hi Mick

Crowdfunding for charitable and needy causes has all kinds of issues as you indicate and can be used by unscrupulous people to pull the wool over the eyes of donors for their own gain. Real estate crowdfunding is much more regulated in all countries.

It is also a burgeoning industry in the UK and so far mostly seems to be focused on residential projects. I am reading that in the UK any crowdfunding platform that offers investments is required to ensure that each individual investor is only allowed to invest up to 10 percent of their investible wealth in any one crowdfunding project. Investible wealth is calculated excluding your primary residence and cannot factor your pension or insurance. This is a little different than the approach adopted in the USA, Australia, and Canada which limits real estate crowdfunding to high net worth individuals. Property Partner and the House Crowd are examples of UK real estate crowdfunding platforms.

It is a pity that crowdfunding in general has garnered such a bad name from unscrupulous operators in other business areas because for real estate it is a serious and legitimate business.

Thanks for the comment

Best regards

Andy

Thanks for introducing me to the concept of crowdfunding for real estate. I was familiar with the term crowdfunding but was not aware that it could also apply to the field of real-estate.

I must be honest, it gave me hope. I think the main reason, is that I see it as an avenue to get involved in a property without the heavy investment upfront. Furthermore, it gives one the opportunity to diversify into commercial property, which I personally would not mind trying out.

Regarding the debt-funded projects, are there tax advantages, or is one subjected to pay taxes?

I am a South African citizen. Would you know of any decent crowd-funding sites for us?

Learned a lot from your article.

Thank You

Roopesh

Thanks for the comment. There are crowdfunding platforms operating in South Africa. Crowdprop, PropertyMogul, MaximumGroup, and RealtyAfrica are all real estate crowdfunding sites operating in South Africa. However, crowdfunding as an activity is not specifically regulated in South Africa. Other existing regulations may be in effect depending on whether donations are being raised for charitable purposes, or whether finance is being raised as loans as would be the case for debt-financed real estate projects. Other regulations would be in effect if the purpose was to raise funds as equity in a real estate project.

This suggests to me that if you were thinking of getting into this, I would be as thorough in my research as possible and only start with very small amounts.

To your question regarding taxes and loaning debt for real estate projects, there does not appear to be any specific tax advantage so your income from such a source would likely be taxed as income.

Thanks for your questions

Best regards

Andy

Hi Andy,

Wow what a great article on crowdfunding for real estate! This would have to be one of the most thorough articles on any topic I have read. Well done with that.

I know about crowdfunding but wasn’t all that aware of funding for real estate. I see you have posted in another answer some sites in Australia. I will definitely check those out. Worth having a look for sure.

Have you tried this yourself as yet?

Love your website too, very clean and clear. Look forward to your next article. Thanks again,

Kev

Hi Kevin

Thanks for the comment and positive feedback. Nearly all of my investing has been in stocks, ETFs and options. If I was at an earlier stage of building a portfolio and if my circumstances were different I would definitely be considering real estate crowdfunding. But everyone’s financial circumstances are different and we have to select investments that work for each of us. To my eyes the longer-term less liquid real estate crowdfunding projects look more attractive. I will keep a close eye on it though and I may change my mind and take a plunge.

All the best and thanks again for the positive feedback.

Best regards

Andy