Are you trying to work out how much money to retire and live well? Or maybe you have already retired early. In which case how much money did you retire on for an early retirement?

Here are some simple numbers.

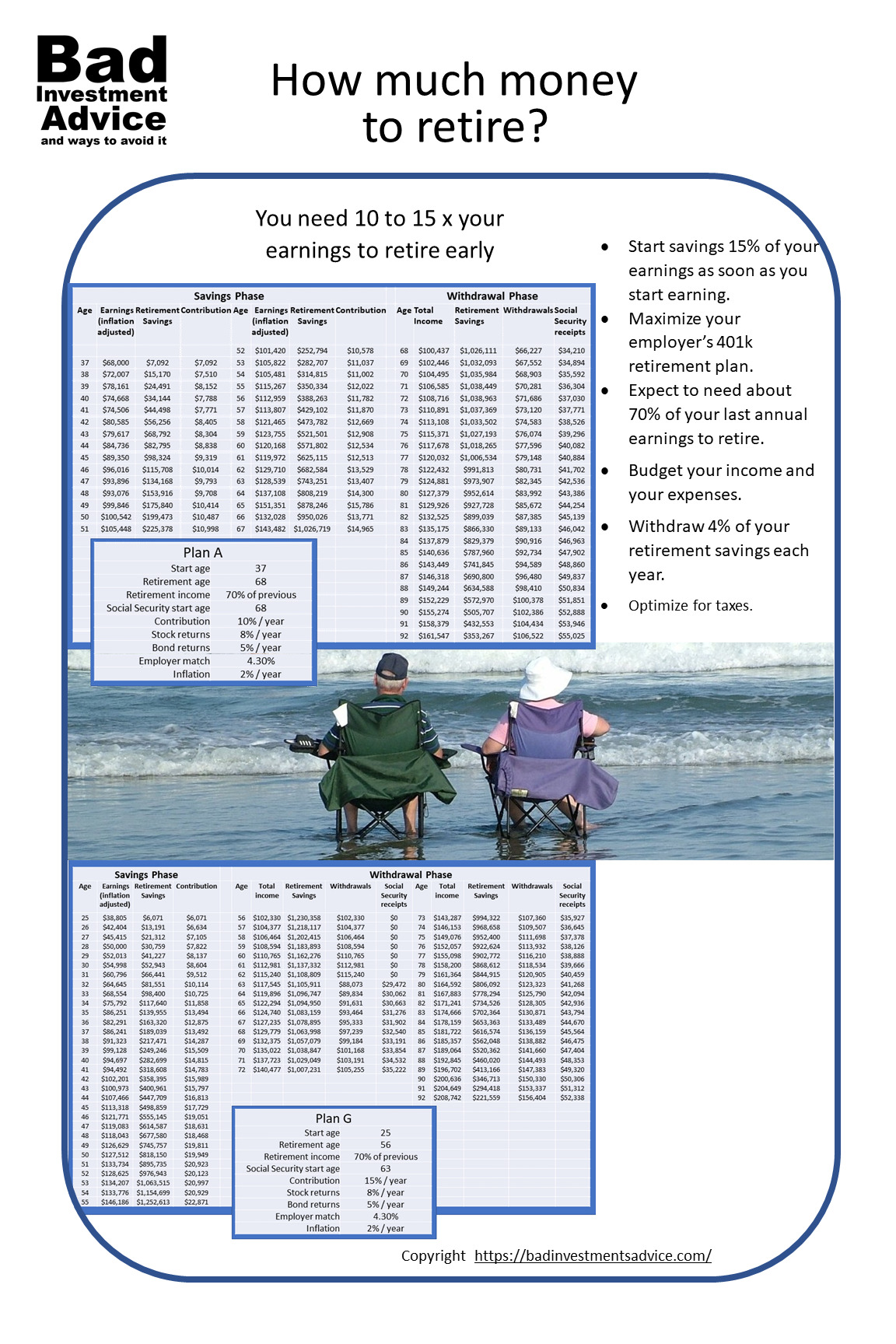

- To retire early you need a sum of about 10 to 15 times your last annual earnings.

- Every year save at least 10% of what you earn.

- Expect to need about 70% of your last annual earnings to retire.

Retirement and early retirement are preoccupations of many people throughout their working lives. Just thinking of my own experience, barely a week goes by without my thoughts and hopes drifting in the direction of early retirement.

There are a few simple common-sense calculations that will help you get a handle on this question.

And of course, there will be no end of bad investment advice that can set you on a bad path or just regular life events can easily derail your plans.

One piece of good advice though is to start saving for retirement as soon as you start earning.

If you can do that, you will be ahead of the crowd. If you start saving early and do it consistently then you will not experience any dramatic reduction in your standard of living when you retire and you will likely have the option to retire early.

Most people need less in retirement

As we said most people will need in retirement around 70% of their earnings in the last year of employment.

A number of assumptions are baked into this general rule-of-thumb that will not apply to everyone, particularly if you are retiring early.

The main assumptions are that your responsibilities in retirement will be to yourself and your spouse and that you no longer have dependent children to support or send to college.

Another assumption is that you will not incur all the costs involved in showing up for a regular job. These would include the costs of commuting. Also, when you work you tend to spend more money on food away from the home, or clothes for work for example. You will also no longer be plowing earnings into your retirement savings.

Some people will want the same as they had when they were earning. Some will want even more so they can live it up. And some people will decide to live more simply and frugally in retirement.

Social Security

The payments you receive from social security will vary depending on your history of lifetime earnings and contributions.

In the US in 2021 the maximum you can receive from Social Security is $3,248 per month or $38,976 per year. The average payment received from Social Security is $1,543 per month or $18,516 per year. 1)Social Security Education and Lifetime Earnings https://www.ssa.gov/policy/docs/research-summaries/education-earnings.html

For the moment we will assume that you have no other source of income in retirement other than Social Security and your retirement savings.

A 30-year plan

Over a lifetime of employment, most of us work for somewhere between 30 and 40 years. In today’s world of portfolio careers, it is actually quite rare though to start planning for retirement right at the start of a 40-year working career. Though as we already said, that would be ideal.

The chances are if you are at the early stages of your career you have other more immediate concerns like career advancement and starting a family.

So, to give ourselves some wiggle room, it makes sense to consider a 30-year plan as a base case.

If I were to take a stab at building a plan here would be some generally accepted assumptions to construct a plan.

- We will need an income from retirement savings of 70% of our earnings before retirement. As we already said.

- We will start investing at age 37, retire at 67 and imagine that we need funds for 25 years after age 67 until age 92.

- We will receive an average of $18,516 per year from Social Security. 2)How much money will you get from social security https://money.usnews.com/money/retirement/social-security/articles/how-much-you-will-get-from-social-security

- We will assume that the investments are made in 401k plans or IRAs.

- We will make contributions in pre-tax dollars and gains made by the plan will not be taxed.

- We will pay taxes on our withdrawals from the plan when we get to that point.

- We will assume that the fund is invested aggressively in the first 20 years, 100% in stock funds.

- During the last 10 years of building our savings, we will transition from 100% stocks to 60/40 stocks/bonds by year 30.

- We will start withdrawing from the fund in year 31 to top up our Social Security receipts to reach 70% of our previous year’s earnings.

- Over the 25-year withdrawal period, we will transition the fund from a 60/40 stock/bond mix to a 100% bond fund.

A lifetime of earnings.

This is the logical place to start putting a plan together. 3)Income Percentile by Age Calculator for the US https://dqydj.com/income-percentile-by-age-calculator/

On average, employees experience their most significant increases in earnings between the age when they first enter the labor market and age 35. Then from age 35 to 55, they see sometimes gradual increases and sometimes declines.

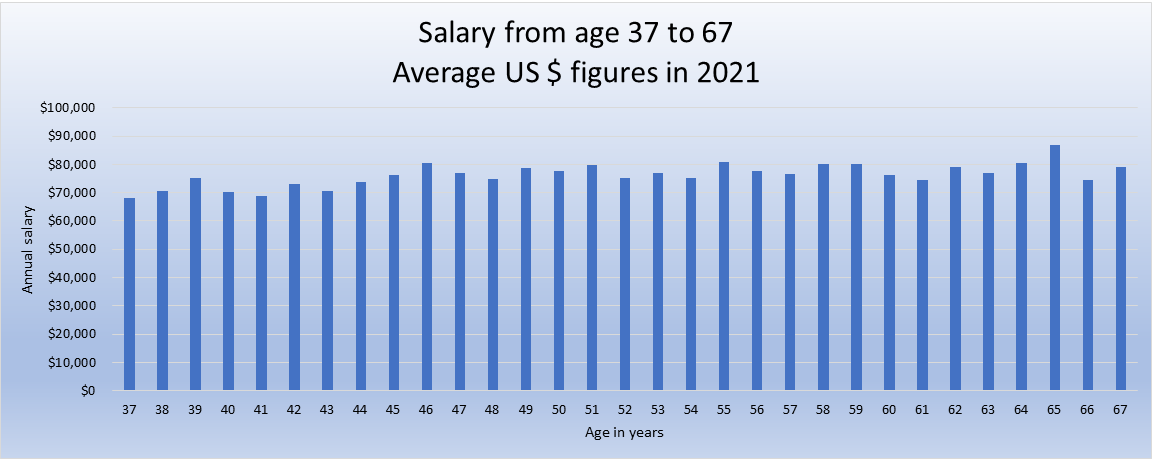

According to the US Bureau of Labor Statistics, this is the pattern of earnings an average employee can expect from age 37 to age 67. First as a table.

And then in graphic form.

Source US Bureau of Labor Statistics

The above is an average situation. There are very significant variations for where you live, the highest level of education you reached, and the industry where you work.

Nevertheless, for the moment it makes sense to continue using average figures. Also, because our target is to ensure a level of income in retirement that is related to the level of earnings while employed.

Apart from that, it makes the most sense to work out what an average Joe or Jane can achieve and how they can get there.

Adjusting for inflation.

These figures are what individuals at the ages shown would earn in today’s dollars.

So, someone in the US who is 37 today earns on average $68,000. And while someone who is 67 today earns on average $79,290, a thirty-seven-year-old can expect to earn on average the inflation-adjusted equivalent of $79,290 when they reach the age of sixty-seven.

This is important when we are working out how much money we’re going to need in retirement. Anyone who is 67 today can tell you that thirty years ago the average 37-year-old was earning a lot less than $68,000 a year.

The best way to do this is to adjust our annual earnings for inflation. It does mean that we will be dealing with larger sums in the future, but these are more likely to resemble the actual dollar sums we will need.

We should also assume that the sum we receive from Social Security will continue to benefit from Cost of Living Adjustments or COLA. So, we will also inflate Social Security receipts by the same rate of inflation.

Currently, the target rate for annual inflation is 2%. In recent years the Federal Reserve Bank has more or less achieved this rate on average.

Rates of return for stock funds and bond funds

Working with these average salary figures, we will assume that most of the time throughout this 30-year plan you will be employed, and your employer has a 401k savings plan.

If you don’t have an employer 401k plan, we will assume that you set up an Individual Retirement Account, or IRA so you can also make pre-tax contributions.

401k plans usually give you a limited range of funds to choose from but from those funds, it should be possible to select funds that invest in stocks or funds that invest in bonds and some that mix both.

Currently, 401k plan annual returns range between 5 and 8%. We can expect that a fund that is heavily invested in stocks would earn close to 8% a year while a fund that is heavily invested in bonds will earn 5% a year. 4)Average 401k return: What you can expect https://smartasset.com/retirement/average-401k-return5)What is a good annual return for a mutual fund https://www.thebalance.com/good-annual-mutual-fund-return-4767418

Adjusting for downside risk

We’ve talked about the average returns of retirement funds. Averages are great over time as they will tend to smooth out the ups and downs. And over a long-term plan, you want to get the best returns compounded so it makes sense to invest in funds that have a consistent track record of performing well.

But what happens if the stock market crashes just before you are about to retire. If you are heavily invested in stocks at that time your retirement nest egg can also take a beating. Most of us would be seriously upset if that were to happen.

The general rule of thumb is that returns on stock funds are more volatile while returns on bond funds are more stable. To deal with that possibility of a major market downturn just before our plan matures, most financial advisors will tell you to move your money from the higher-performing and more volatile funds into the more conservative less volatile funds progressively leading up to the date of retirement.

The approach we adopt here is to start the plan by investing 100% into the higher-performing stock funds. Then ten years before our retirement date, we gradually move our money over from 100% stocks and 0% bonds to 60% stocks and 40% bonds.

The reason we don’t go to 100% bonds at the retirement date is that we will still be looking to our savings to pay out for another 25 years so there is still room for long-term growth.

However, since we do want our savings to be more conservatively managed in retirement, over the 25-year period of withdrawals it does make sense to gradually transition to 0% stocks and 100% bonds. So we make those adjustments to the plan over time.

Our 30-year plan returns.

We shouldn’t forget that most employers offer to match your 401k plan contributions by a certain percentage. The average employer match today is 4.3% of your salary.

We should also note that the Internal Revenue Service sets limits on the pre-tax contributions you can make to a 401K plan or an IRA. Today, in 2021 people under 50 can contribute up to $19,500 and people over 50 can contribute $26,000 a year.

Considering the figures we are looking at, we are far below the point where we come close to the ceiling on pre-tax contributions.

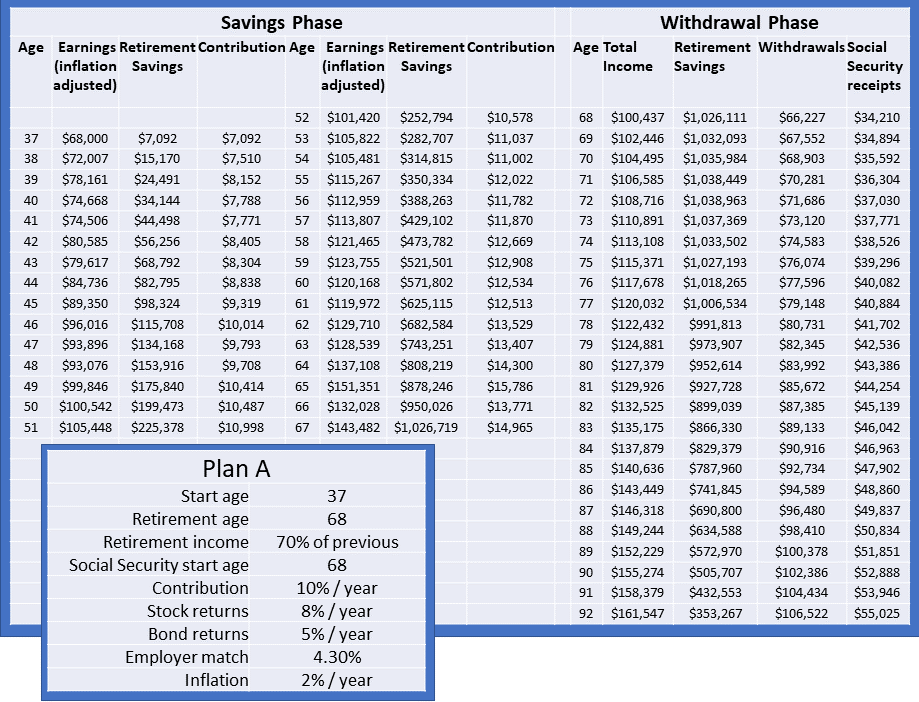

If we work with all the above assumptions, this is what our earnings, contributions, and total fund value would look like during the first 30-year period and then our Social Security receipts, withdrawals, and total fund value during the last 25 years of our plan. This is our Plan A.

Source: All calculations and charts Bad Investment Advice.

Right off the bat, we can see that plan A works.

At age 68 we would be withdrawing $66,227 from our plan, we would receive $34,209 from Social Security, assuming it hasn’t gone bankrupt by then. So, combined we would have $100,437 which is 70% of the $143,482 that we would have earned the previous year.

We can also see that our plan would still be worth $353,267 when we reach the grand old age of 92.

What if things don’t work out

So what happens when real life gets in the way? There are any number of things that can happen to disrupt our plan. Here are just some obvious ones.

- You are out of work for some period of time

- Your employer goes bankrupt or otherwise robs your pension plan

- Your funds underperform

- You have unexpected costs or liabilities, such as medical or legal bills

- You get reckless and start raiding your retirement account.

- You move to another country.

- Inflation goes berserk and you need a wheelbarrow full of dollars to buy a loaf of bread

The inevitable fact is that life will tend to get in the way. Things are going to happen that either means you will have less money than you thought, or you will need more than you thought.

This is why most financial advisors recommend reviewing your plan, at least once a year and make adjustments if your circumstances have changed.

Emergency fund

Another piece of good advice is to establish an emergency fund. The general guidance is that you should have enough money to last you through about six months if you were to suddenly lose your source of income.

If you work in a less reliable industry where layoffs are more frequent and it can take longer to find employment again, then you may need to increase how long you would need your emergency funds to last.

The point is that if you do establish an emergency fund, you will be in a much better position to keep paying your bills, rent or mortgage, etc. and weather whatever financial storm you encounter without having to sell your house or put all your furniture on eBay.

A worse case

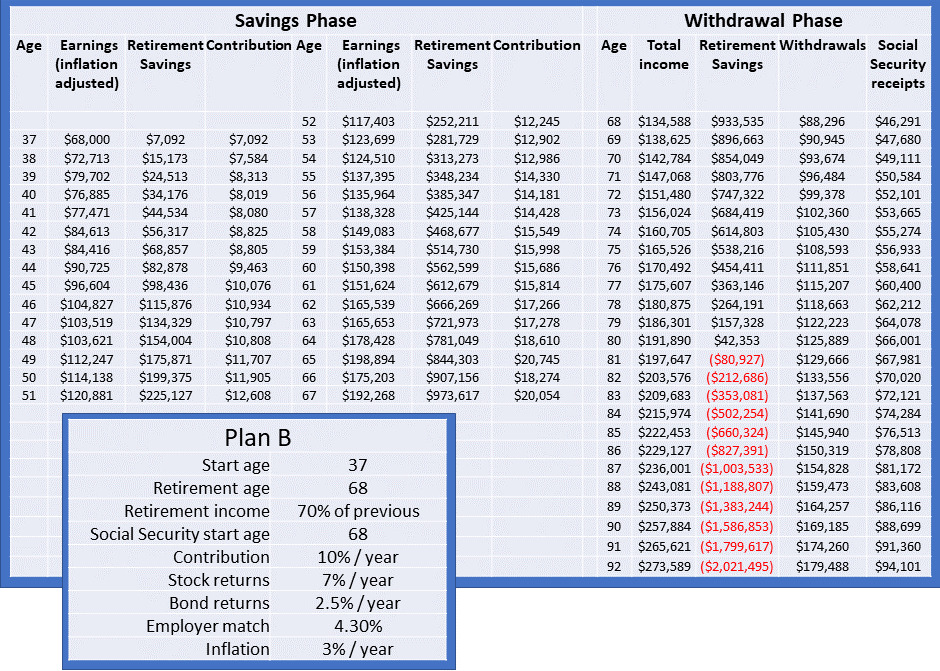

Still, with our 30-year plan, let’s see what it would look like if

- Our stock funds only delivered an average of 7%

- Our bond funds only delivered an average of 2.5%

- Inflation averages 3%

This is what that would look like and let’s call this Plan B.

Source: All calculations and charts Bad Investment Advice.

If we still wanted 70% of our last year’s earnings in retirement, then our fund would run out of money when we reach 81 years old.

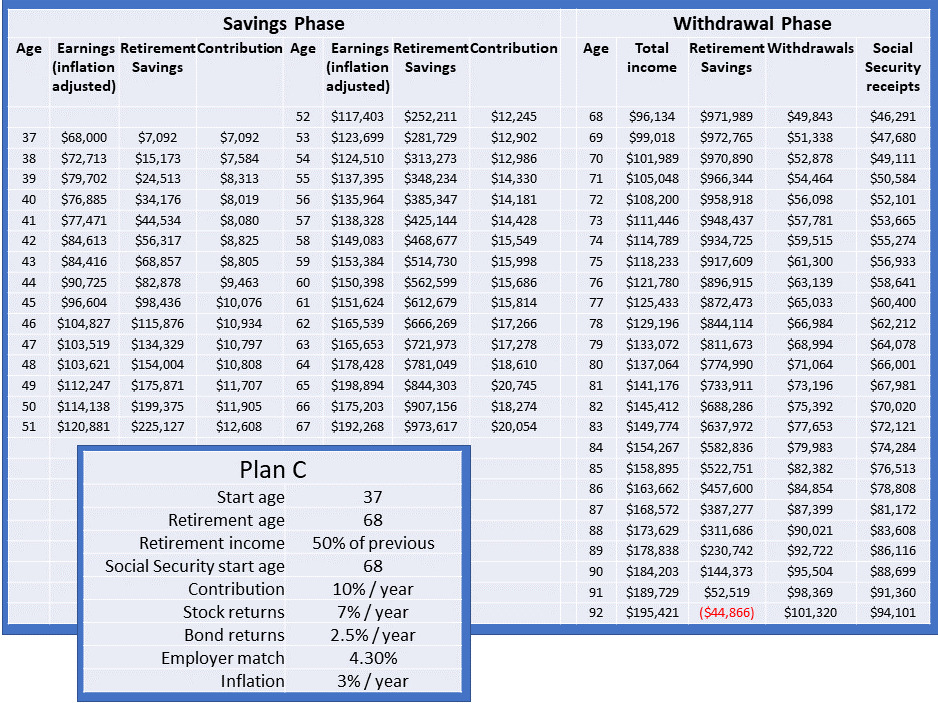

We can sort of fix that if we drop our ambitions for a comfortable retirement and opt to retire with 50% of our earnings in our last year of employment. This is what the plan would look like then and we can call this Plan C.

Source: All calculations and charts Bad Investment Advice.

So this way instead of running out of money at age 81 we could make it last until we reach age 92.

Mind you the prospect of a 50% pay cut isn’t particularly attractive for anyone. So, the chances are we would have seen this coming and done something to ease the situation like find some way to continue working or find another source of income.

A better case

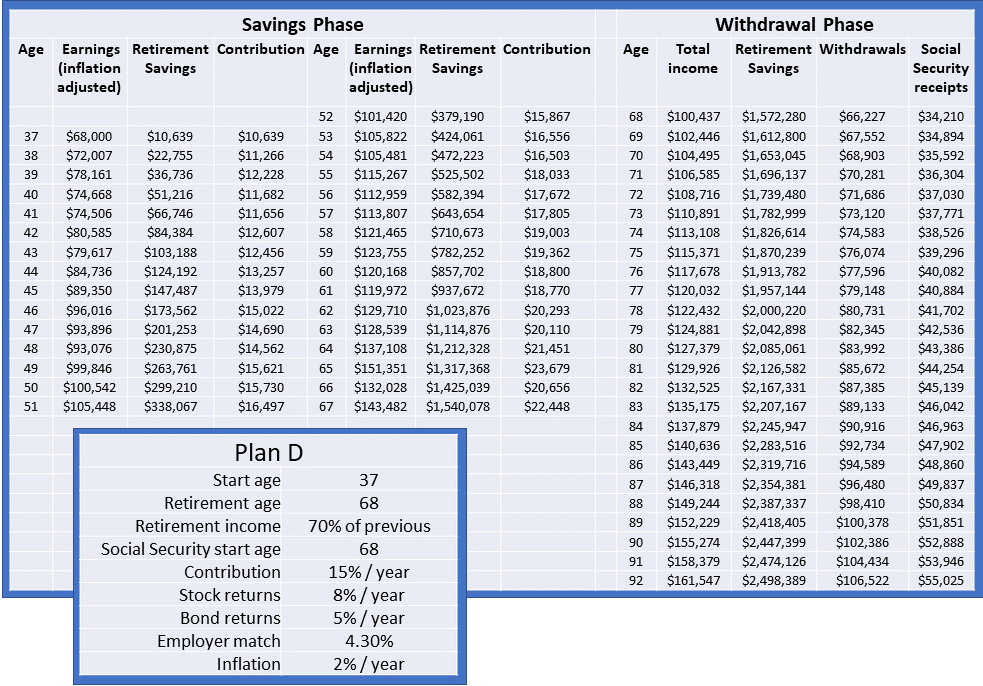

Let’s take a look at how the plan would perform if we were able to set aside 15% of our pre-tax earnings into a retirement savings plan. Still, with inflation running at 2% and the return on a stock fund at 8%, and a more conservative bond fund at 5%, this can be our Plan D and it looks like this.

Source: All calculations and charts Bad Investment Advice.

Clearly, this is a much more attractive situation. Firstly, we should note that the annual contributions into the retirement fund are still below the ceiling of $19,500. So we can still count on being able to make pre-tax contributions.

After 30 years, by the time you reach the age of 67, you would have $1,540,078 in retirement savings. If we just withdraw monies to achieve 70% of your last year’s earnings when you reach the age of 92 your fund would be worth $2,498.389.

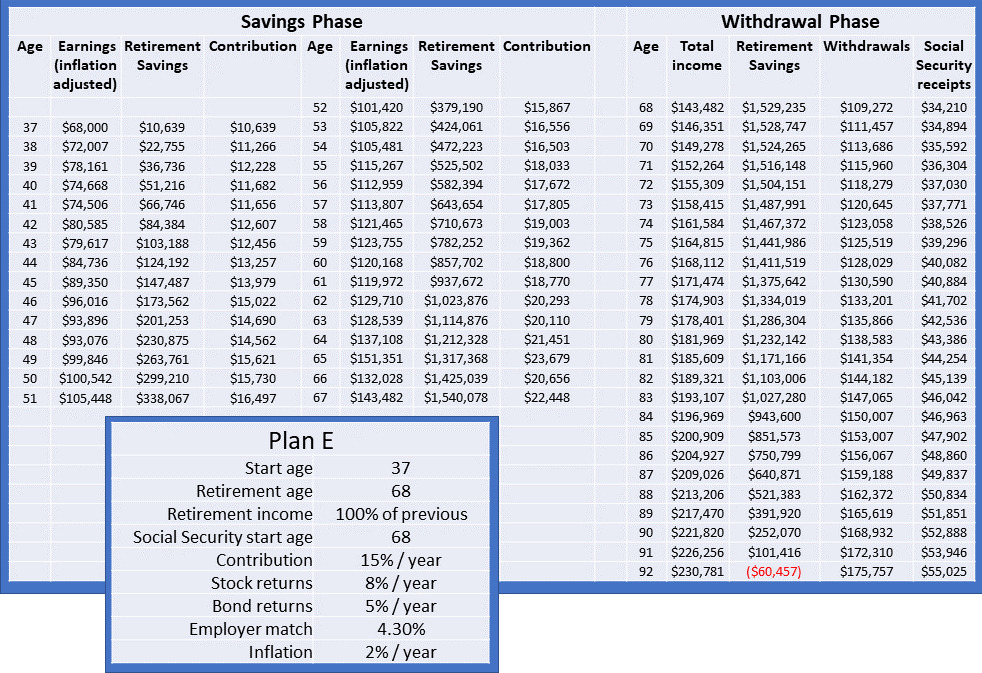

Let’s see what would happen if we withdraw funds to have 100% of our last year’s earnings. This will be Plan E.

Source: All calculations and charts Bad Investment Advice.

That is pretty much spot on. We only run out of funds in the last year at age 92. So a minor adjustment would take care of that.

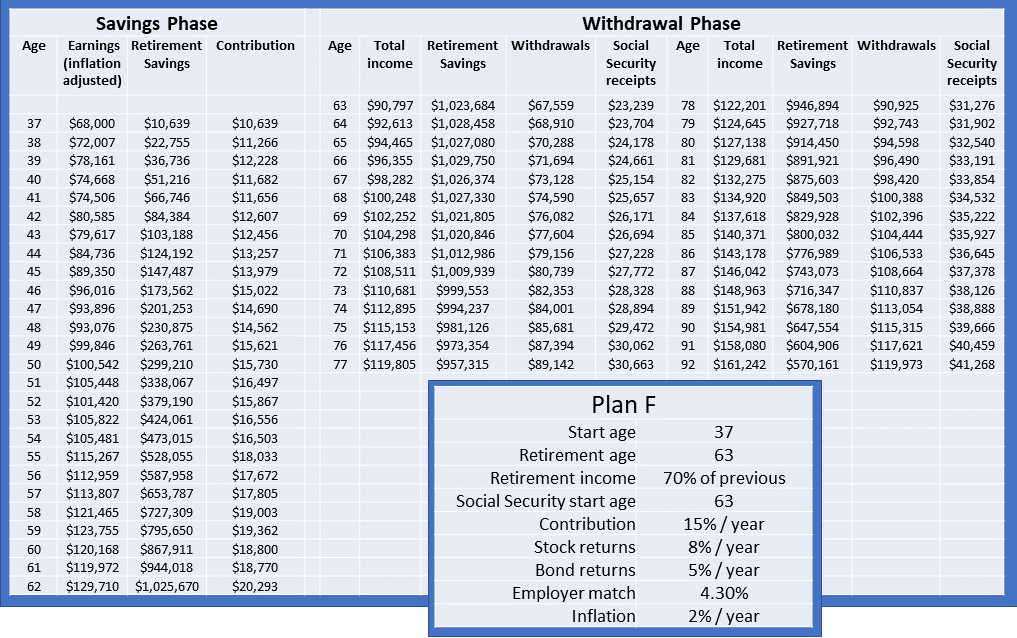

Logically the bigger pot of money should give us more possibilities. What about if we to see if we could retire, say 5 years earlier but stick with the 70% of our last year’s earnings before we retire.

Let’s assume we opt to receive Social Security payments at age 63 then we have to factor an approximately 25% reduction on the payments we would have received at age 67. All of these figures we are still adjusting for inflation of course. 6)Should you take Social Security at 62? https://www.fidelity.com/viewpoints/retirement/social-security-at-62

Since we will be ending the plan 5 years earlier, we should also start the process of moving from 100% stock funds to a 60/40 stock/bonds mix 5 years earlier.

This is what all that would look like and this is Plan F.

Source: All calculations and charts Bad Investment Advice.

As we can see this works very well. The plan still has $570,161 when you reach the age of 92. So we could afford to be more generous with ourselves or pay a little less into the plan.

But let’s remember, retiring at 62 is quite common. With this plan, we were able to retire at age 62 by only starting to save at age 37, ie. 25 years earlier, and saving 15% of our pre-tax earnings.

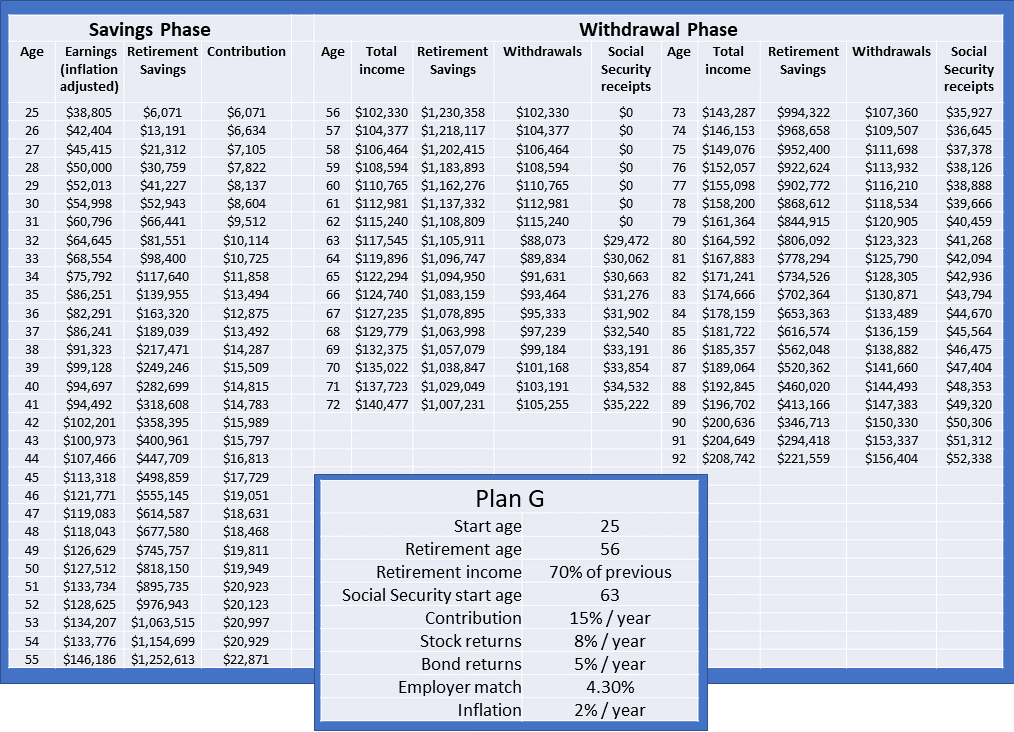

An early retirement plan

What would a plan look like if we started much earlier at age 25 and wanted to retire at age 55? That should be doable.

We would not be able to rely on Social Security. It would also mean we would be saving during the earlier years when our earnings are likely to be lower and distractions would be many. This is our Plan G.

Source: All calculations and charts Bad Investment Advice.

As we can see that works.

Our contributions are comfortably below the limit for pre-tax contributions.

Our retirement savings should have reached $1,252,613 when we reach the age of 55. In our first year of retirement, we withdraw a full $102,330 to reach 70% of our last year’s earnings. As long as we keep a cool head our plan should carry us through to the age of 63 when we start receiving Social Security.

So why are we told to save more?

You could well be wondering why financial advisors tell us to save at least 15 to 20% of our annual earnings right from when we start earning. Why do they do that?

I think the simple answer is that most people simply don’t start saving for retirement early. So most of us are playing some kind of catchup.

How much did you retire on for an early retirement?

As we said the general rule of thumb is that you need between 10 and 15 times your annual earnings to be able to retire early.

Our calculations show that if you save 15% of your earnings and invest in stock funds you should have amassed roughly 8.6 times your earnings after 30 years. If you are OK retiring on 70% of your previous year’s earnings, then you can do it.

If you are able to set aside 10% of your annual earnings, for 30 years, at average earnings levels you would still be under the ceiling for pre-tax contributions. After 30 years your retirement savings would be around 11.4 times your last year’s earnings.

Fun early retirement stories

As I said earlier, some people are ready to live very cheaply to retire early and get off the rat race.

Here’s an example of a couple in their early 40s with two children.

They stopped working, sold everything, traveled the world working remotely 1 day a week. They say they are still saving for full retirement and will be able to stop working 1 day a week at age 55.

Another fun story is about someone who developed the F.T.I which stands for

F%#$ (expletive) This Index.

It is your age in years multiplied by your net worth divided by your annual expenses. The author says once your FTI reaches over 1000 you can say your last goodbyes to your boss. In his case, he said his sweet farewells at age 41 with an FTI of over 1400.

If there is something in common between most people who retire early and are willing to tell the tale, is that they have a very firm grip on their expenses. They plan and project their investment revenues and expenses and often seek to optimize their taxes.

Many who do retire early and are able to make it work for them come to the conclusion that all the hype about needing millions of dollars in savings to be able to retire is a myth. 7)How much did you retire on for an early retirement https://www.quora.com/How-much-did-you-retire-on-for-an-early-retirement

Some early retirees tell you that you have to own the place you live in and have paid off the mortgage. Other early retirees live perfectly comfortably only in rented accommodation.

But I think it is fair to say that early retirement is more a euphemism for living individually. Often early retirees work part-time or have various side hustles that complement their income.

It is noticeable how many very early retirees are fiercely individual. There seem to be more diverse and individual ways to retire early and live differently than the classic route to retirement after 30 or 40 years of working.

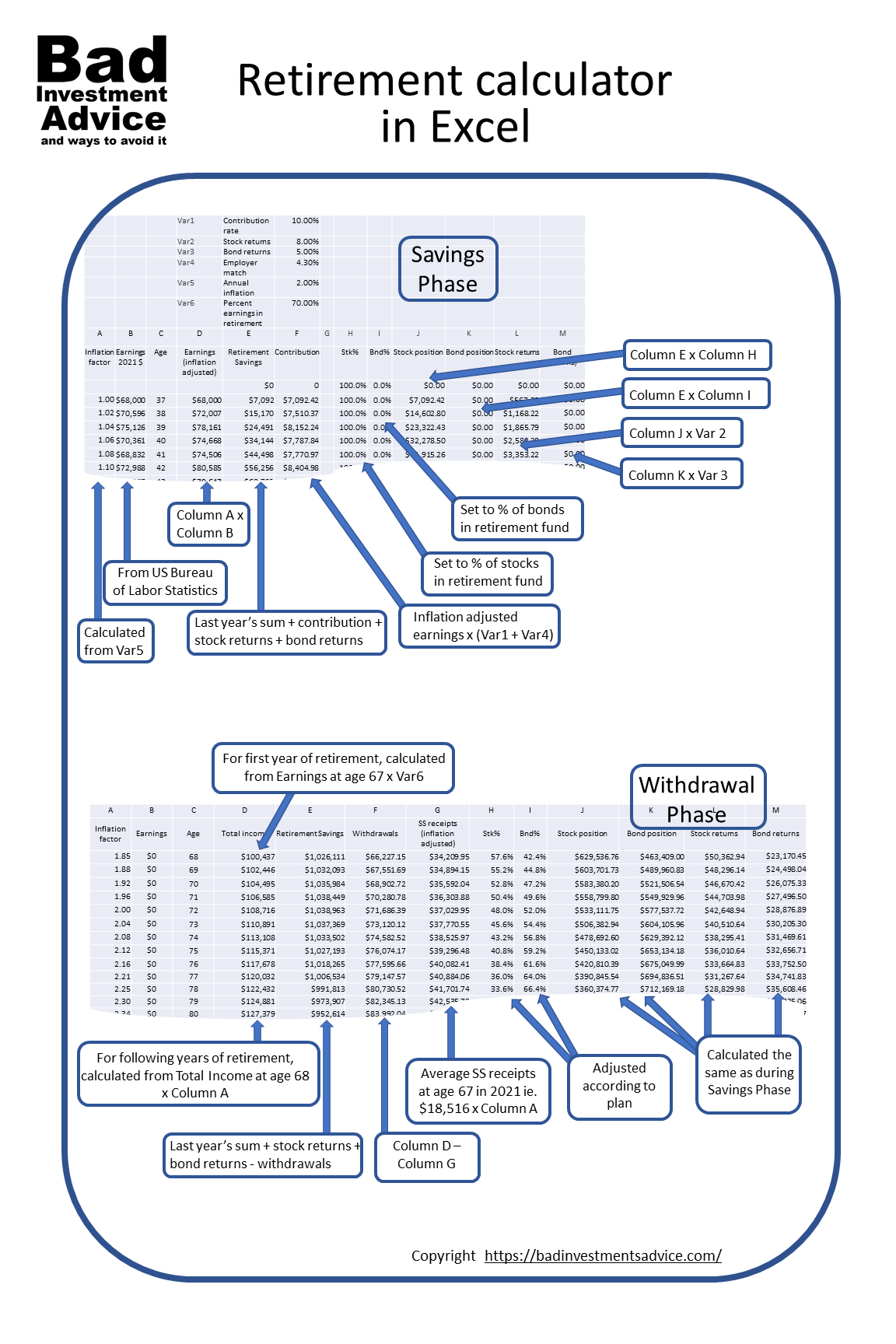

For the calculations we made here we built spreadsheets in Excel. Here is a PDF you can download that explains how the retirement calculator is created in Excel.

Because I tend to build these spreadsheets from scratch I like to spread out each step into a different column, that way it is easier to spot and correct mistakes.

If you want to see the effects of playing with your numbers, this article walks you through some of the best online free retirement calculators.

This article will help you do some more of your own research into retirement planning.

Q. What is the 4% rule?

A. The 4% rule is a whole portfolio approach to funding retirement. It means you can withdraw up to 4% of the total value of your retirement savings each year.

Q. What is the average age when people retire?

A. Most of us plan to retire either at 65 or 67. But the actual retirement age in the US today is in fact at 61.

Q. Is $800,000 enough to retire on?

A. Using the 4% rule, if you have $800,000 saved you can withdraw $32,000 a year. If that is enough for you to live off, then you can retire.

Here is a single-page PDF summary of how much money to retire.

Affiliate Disclosure: This article contains affiliate links, if you purchase through a link on this site, I may receive a commission.

Investing for your retirement is important. Many would say that investing in your own financial education is equally important. If you are ready to get serious about your own financial education, then check out membership of the American Association of Individual Investors, the AAII.

The AAII is a nonprofit organization, dedicated to the financial education of its members. Your membership of the AAII will give you access to courses and resources on stock investing, financial planning, and how to manage your retirement finances.

I hope you found this article interesting and useful. Do leave me a comment, a question, an opinion, or a suggestion and I will reply soonest. And if you are inclined to do me a favor, scroll down a bit and click on one of the social media buttons, and share it with your friends. They may just thank you for it.

Disclaimer: I am not a financial professional. All the information on this website and in this article is for information purposes only and should not be taken as personalized investment advice, good or bad. You should check with your financial advisor before making any investment decisions to ensure they are suitable for you.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you!

References

| ↑1 | Social Security Education and Lifetime Earnings https://www.ssa.gov/policy/docs/research-summaries/education-earnings.html |

|---|---|

| ↑2 | How much money will you get from social security https://money.usnews.com/money/retirement/social-security/articles/how-much-you-will-get-from-social-security |

| ↑3 | Income Percentile by Age Calculator for the US https://dqydj.com/income-percentile-by-age-calculator/ |

| ↑4 | Average 401k return: What you can expect https://smartasset.com/retirement/average-401k-return |

| ↑5 | What is a good annual return for a mutual fund https://www.thebalance.com/good-annual-mutual-fund-return-4767418 |

| ↑6 | Should you take Social Security at 62? https://www.fidelity.com/viewpoints/retirement/social-security-at-62 |

| ↑7 | How much did you retire on for an early retirement https://www.quora.com/How-much-did-you-retire-on-for-an-early-retirement |

Hi,

Thanks for the detailed post! I do really wish I’d started saving for retirement a lot earlier as well. Its a bit dishearting to think about all those compounding returns that will never happen now!

One element of chasing retirement that I’ve found very satisfying recently is looking at what I need to be happy – and I’ve found (and now just quit my job because of it), that what I really want is time. Not stuff that I have to pay for, but time to be outside, with friends and family just being. It’s amazing how much more I’ve been able to put in my retirement pot since I had this realization – and also how much less my retirement is going to cost me. Win-win in my book!

Do you have any advice for retiring early? I’m switching direction at the moment and my retirement plan is something that seriously needs some focus.

Thanks again!

Hi Lisa

Thanks for the feedback. Something worth considering is that retirement and all that conjures up really belongs to an era where people worked their whole lives in one job for one employer and then after some grand party from one day went from full employment to full retirement. Think the movie About Schmidt.

In today’s world of portfolio careers it probably makes more sense to pursue a number of activities at the same time some of which earn income.

Sorry I am not expressing this very well. In other words if you are not in a fixed full time career job, it probably doesn’t make sense to think of “retirement” as a goal per se.

To retire early – that would really depend how much capital you have now how much you are and can earn, how much you can set aside and what additional work you would be prepared to put in.

Thanks again for the comment

Best

Andy

I’m 35 and I do set a couple hundred euros aside every month into some investment funds created by my bank. I’ve been thinking about starting investing in stocks but I’ve honestly haven’t had the time as I’m working full time on a day job and on my business all the evenings. Once I get my business going and can quit my job I’m definitely going to start investing more. I just hope that day comes before it’s too late…

Hi, it sounds like investment funds created by your bank are probably the best bet if you are short on time. One of the popular myths about stock investing is that its about studying companies and finding under valued gems and investing in them early before everyone else does. One fact most fund managers don’t want you to know is that a good 70 % of them under-perform a fund that just mechanically tracks the S&P index. I’m also stuck in a job that sucks my time and mental space.

Best

Andy

I occasionally read many Americans live paycheck to pay check and no savings for retirement. America is a flourishing country with a fully functional economy. It is hard to imagine many people live without thinking of the future.

I have got not so good financial advice from money managers. Now I manage my portfolio which seems to offer better investment returns.

Another thing is diversification of assets. One can purchase land which may appreciate. I see many people doing that in India. Buy houses and get them tenanted. These are excellent sources of investment.

Thank you for giving great advice on finances. I love index funds. They really have done well. The return may not look glamorous but it is a time tested and a wise investment.

Saving money anytime you earn should be part of early education to instill people’s minds how important saving is for life.

Hi and thank you for your comment. It is indeed very strange that many American’s did not learn the value of regular saving. I agree with you that indexed funds are an excellent and solid way to invest for future growth. I also agree that sound financial education should be a standard part of the curriculum. Thank you for your comment. Best regards, Andy

Hi Andy,

I am also the victim of bad investing advice, or as you say getting scammed! Early in life I never had the money left over to save anything. I had low paying jobs that barely paid the rent and put food on the table. Then, it seems when you get a better job, you need to use any money that you have saved, as a downpayment on a house.

When I did finally start putting money into mutual funds, the market tanked, and I did the same as others did, got out near the bottom, just to look years later and see the market returned to the former levels…Oh, if I had just waited!

Investing is not easy, and returns of 8% interest on savings can’t be found today, so the only place is back in stocks. Today’s markets take a strong stomach with the ups and downs day-to-day.

I have 20% in gold using the IAU and GDX, and I am glad I do, they are doing quite well lately. Do you think they will continue to do well? Personally, I do because of the recent government spending due to covid 19, inflation is going to come back once the reality of this debt starts to affect the US dollar. Any advice?

Hi Chas and thanks for sharing your experience and the comments. I agree with you that gold is likely to continue rising at least in the near and intermediate-term. At some point, though the shine will be gone, but that may be a while yet. I am also perplexed at how things will shake out because of all the liquidity and debt the Fed and US government and other governments are throwing at their economies. It isn’t clear to me though that there will be any inflationary pressures for a while yet. Yes, all that extra money will have to go somewhere but actually the reduction in economic activity is having a deflationary impact on prices. As for advice, I would suggest to avoid being over-exposed to one asset class. 20 percent is a lot to have riding on one position. If you are looking for something that will consistently out-perform the S&P 500, then take a look at the iShares ETF symbol MTUM. It is a momentum strategy ETF. It can underperform the market on downturns for a short while, but that is more than made up by the extent to which it out-performs on the upside. As long as your time horizon is more than a few years, you should be fine. I have to add a disclaimer though – this is for information purposes only, not personalized financial advice. Good luck and do come back, Kind regards, Andy

Hello there! this is an amazing review you have got here. I am sure these quality informations in this post will be of great help to anyone who come across it. I totally agree with everything you have said here. Indeed, Its not a bad idea to start planing for the retirement before it comes; its a good head start.

Hi Joy. Thanks for the comment and the endorsement. Best regards, Andy

I found these details very interesting because I am now recently retired. Even more interesting because up to retirement I was employed as a pension scheme administrator who also managed the group life insurance department. I like your quantifying of how much, exactly we should be saving, and in which instruments. With all the possible shifts in the value of money, I think inflation is the hardest to deal with. Sometimes it is just regular increases and in other cases if might be due to changes in government policies or natural disasters. In addition to all you suggested, I always advise that recently retired persons take on easy to handle occupations to supplement income and to keep their brains active. Thanks for a good article

Hi and thanks for the comment. I really appreciate your wise input given your professional experience. Perhaps projecting inflation at a steady 2% is somewhat optimistic. When playing with the model I found that inflation has a seriously detrimental effect. This is probably why making contributions at only 10% is also overly optimistic and would not do well if inflation picks up. This is another reason why the advice is to save 15 to 20% as you earn. I fully agree that taking a small or part-time job in retirement is good both from the income perspective and to stay active. Thanks again and best regards, Andy

Enjoyed reading your post, I have never put much thought into retirement before. But now I have just turn 40 and the years go by so fast, I am starting to think of it more.

I am glad that I started a pension 10 years ago now,but have not given it much thought since then. But as you mention things can go wrong such as stock market crashes or unexpected costs.

I will bookmark this site for reference because you have highlighted everything that could go wrong and what to do should the worst happen.

Very useful and helpful article

Hi Jenny and thanks for the comment. I am glad that you found the article useful. Best of luck, Andy

There’s some very interesting facts and figures here.

Anybody, whatever their age or point in their working life would do well to print this info off and pin it somewhere where they can see it every single day, several times a day. One day we’re in our twenties with zero responsibilities and the before we know it we’re in our 50’s having done very little prep for retirement. It’s scary how quickly the time goes. I’m in that situation now.

The days of final salary pension schemes are well and truly over and people now are having to make more provisions for themselves, especially now that State Retirement Ages are starting to be moved to the right all over the World. The age we can qualify for a State Pension now in the UK is 68 – raised from 65 for Men and 60 for Women a few years ago.

Of course, earning a residual income which pays forever for work done early on is a great way to have a very lucrative – and if you’re quick enough – a very early retirement!

Cheers

Rich 🙂

Hi Rich and thanks for the comment. So true. It is all too easy to find ourselves in such situations and then think back – if only! As you say with the exercise of some forethought, creativity, and hard work there are other ways to secure income streams in later years. Best regards, Andy

I’m so glad you are covering this subject. As a certified personal financial coach, I see too many couples nearing retirement that haven’t put away the necessary funds to live comfortably. I see retirees working at Walmart because they didn’t get enough money put away and now realize Social Security isn’t enough. Young adults and couples just starting out need to learn this early in order to be prepared.

Hi and thanks for your comment. I particularly appreciate the endorsement from a certified professional. Many of us seem to be prone to making these myopic decisions with our personal finances. The personal savings rates in the US were on a steady decline from 1980 to around the year 2005 and have only been creeping up over the last 15 years. That lack of personal finances has a way of coming home to roost as you say. Best regards, Andy