What have the stock market returns for the last 30 years been and how has that changed over time. Can we expect that the current economic meltdown will change accepted wisdom and have us all fleeing into bonds, real estate, gold, or bitcoin?

Having said that, it never ceases to amaze me just how many people I know are nervous of the stock market and view it as a dangerous and risky place to invest. It’s doubly strange when these same folks are in it for the long haul. Especially as once your investment horizon exceeds 15 years, there is no period when stock market returns didn’t beat bonds and other mainstream investments,

But I guess when it comes down to it either some people are impervious to reason and blinded by an irrational fear of any downturn and paper loss of capital value or they are fully justified in maintaining a consistent, conservative risk-averse investing approach.

How the stock market has done over time

Here are the annual returns of the stock market from 1928 to 2019 as measured by the Standard and Poor’s 500 index, abbreviated to the S&P 500 represented by the blue line. 1)The historical data for the S&P 500 annual returns, the 10-Year US T-Bonds annual returns, and the annual US inflation rates were taken from this site. All calculations and charts here were made by Bad Investments Advice for this article.

As we can all see the annual returns are all over the chart. The highest annual return was over 52% in 1954, the lowest annual return was a loss of nearly 44% in 1931 while the average annual return was 11.57%. All these figures assume that any dividends received were reinvested in the stocks composing the index.

Since we are looking here at investing rather than day trading we need to consider performance over longer periods.

Here is what those returns look like when taken over successive preceding 30-year periods. As the data before 1928 is less reliable, the previous 30-year return line in our chart starts 30 years later i.e. in 1957. The blue line is still the annual returns of the S&P 500 while the steadier gray line shows the average return over the previous 30 years.

This paints a much more stable picture. But how did the stock market perform with respect to bonds for example? In the years leading up to during and after World War II, government bonds were a popular savings vehicle for private individuals, as I Iearned growing up.

This is how the returns of the Standard and Poor’s 500 index compared with the annual returns from 10-year US Treasury, or T-Bonds looks like.

The blue line still shows the S&P 500 annual returns while the orange line shows the 10-Year US T-Bonds annual returns.

We can see that the annual returns on the 10-year T-Bonds didn’t dip into negative territory quite as much as the S&P 500 index but it still moves up and down dramatically. On an annual basis, either of these investments would be a bit of a wild ride.

If an investor were choosing between the extremes of the stock market, as measured by the S&P 500 and government bonds using 10-Year US T-Bonds as a benchmark what would the long term performance of each look like.

Again the blue line is the S&P 500 annual returns while the gray line is the S&P 500 average return over the previous 30 years and the orange line is the 10-Year T-Bond average return over the previous 30 years.

We can see that over a 30-year investing horizon the stock market was still a more attractive place than government bonds, at least for the period over which we have reliable data.

Impact of time

Just for fun, if we were able to start the clock in 1928 and had $1,000 to invest, what would be the outcome if that had been invested in the stock market compared with 10-year US T-Bonds.

As you can see the stock market investment would result in around $5 million today whereas the government bonds would yield less than $100,000.

To be fair that’s almost like asking if you could have invested a single penny at the time of the birth of Christ, how bit a lump of gold would you own today. Unless you had a very generous and prescient great-grandfather, investing a single sum for a single individual over a 90-year period is, let’s say unlikely to happen.

So let’s consider some more realistic scenarios.

Real-life simulations – a lump sum.

Let’s take a look at how each of these investments would perform over a rolling 30-year window of time.

In the first case let’s imaging you had $10,000 to invest, maybe an inheritance from a relative or a generous gift to get you started. You could choose to invest either in the stock market or in government bonds.

We want to look at how that $10,000 would grow either in the stock market or in government bonds. We start the clock in 1928 so the first 30-year window is from 1928 to 1957 and so on. Our last 30-year window is from 1980 to 2019.

And to make the numbers a little more real, let’s assume that capital gains tax of 25% was applied to both cases. We will also carry forward any capital losses.

Here is what we’d see.

The blue bars of the $ sums we’d end up with if we invested in the stock market while the orange bars show the result of government bonds.

That looks to me like a fairly convincing case for the stock market.

The S&P 500 beats 10-year US T-bonds for every 30-year period we know about. The closest government bonds came to the stock market was in the 30-year period ending 2008 when the S&P returned $99,928 and the 10-year T-Bonds would have returned $75,005. At all other times, bonds returned roughly half of what stocks returned.

Real-life simulations – the steady investor.

Not all of us have generous relatives so let’s consider a case of a steady investor.

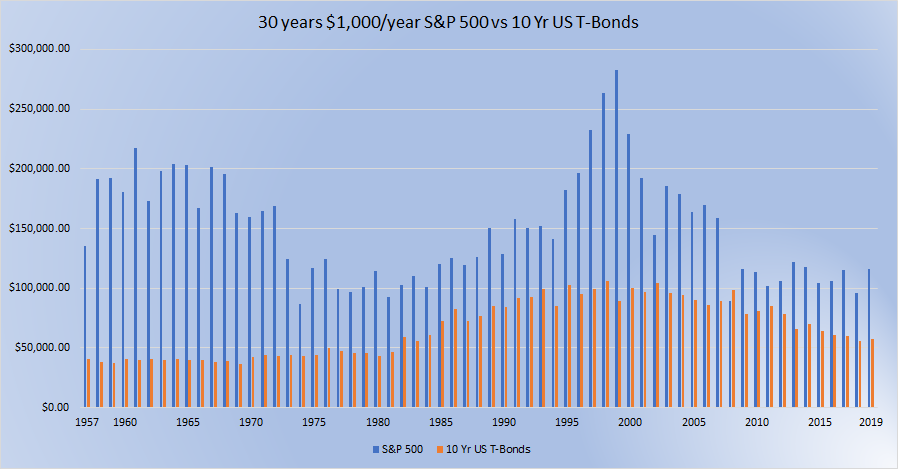

Here we are assuming that we have $1,000 a year to invest either in the stock market or in government bonds. Again to make the numbers more realistic we apply a 25% tax on capital gain and carry forward any capital losses. This is what we get.

The blue bars are the $ sums we would get from the stock market while the orange bars are the $ sum returns from government bonds.

Again we see that the closest they come was for the 30-year period ending in 2008. Over that period the S&P returned $89,433 and the 10-year US T-Bonds returned $98,100. So in this case investing in bonds would have beat the stock market.

But even then let’s imagine that our two investors or our single investor with two portfolios could hold on for one more year, the stock market portfolio would have bounced back and returned $115,714 while the bond portfolio would have lost ground and returned $78,045. The annual return on the 10-year US T-Bonds turned a negative 11.12% in 2009

What about inflation

Inflation is one of those certainties in life, much like death and taxes and about as popular.

Investment vehicles react differently to inflation, some are inflation prone while others are inflation resistant like gold is supposed to be a hedge against inflation but as we are only concerned with results, that isn’t the issue here. To learn more about inflation, check here.

This is what US inflation did over our time window in question.

Deflation in the 1930s following the 1929 stock market crash and into the early years of the great depression. High inflation during World War II and high inflation again coinciding with oil crises in the 1970s and early 80s.

Here is the impact of inflation on the annual returns of the stock market compared with the annual returns of 10-year US T-Bonds.

The orange line is the S&P 500 annual returns adjusted for inflation while the gray line is the 10-Year US T-Bonds annual returns adjusted for inflation. We see pretty much the same shapes as before but dampened somewhat and lower overall.

The next question would be what is the effect of inflation in the long-term, in our case 30-year returns. This is what that looks like

Here the orange line is the inflation-adjusted 30-year average annual return of the S&P 500 while the blue line is the inflation-adjusted 30-year average annual return for 10-Year US T-Bonds.

As you can see the inflation-adjusted bond returns, also called real returns were negative for many periods in the 1960s, 70s, and early 80s. Those would have been times when it was preferable to stuff dollar bills under a mattress rather than invest in government bonds.

Making the most of investing

If there were a few lessons I would draw from this, they would be

- invest for the long haul

- make regular contributions, that reduces your exposure to dramatic market swings

- the more you can spare early on the more it will grow over time

- maximize whatever employer-matching scheme you may have

- invest long-term in index-linked broad market funds, that mimic or replicate the S&P 500

- minimize your tax exposure by benefiting from Roth IRAs and other IRAs to the extent you can

- stay the course, hold tight, stick to your strategy, don’t bail when the market turns down.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you!

If you are ready to make the most important investment you can make, I’m talking about investing in your own financial education, then it’s time to check out the American Association of Individual Investors, the AAII. Membership of the AAII will provide you with access to regular reports, investing training courses, a stock screener, and other resources, all for a single annual membership fee.

Gi, I wish i had read your blog before I started investing in the stock market as a day trader. I think, if I had read your blog earlier, it would have saved me a lot of heart ache and money. I was trading options via an organization that indicated they had he key to success in options, After losing $6,000, I decided to get out and save what I had left. That experience led me to working in a different environment which we have a common interest. You have some great points for long term investing in the market than the quick in and out methods with options that so many people teach. One look at your blog may change their mind. Keep it up!!!

Dwayne Scheer

Hi Dwayne, like many people I have stumbled in and out of make money quick schemes invariably with the same disappointing and embarrassing loss. I guess the simple observation is that most of us are not psychologically equipped to achieve success in day trading however good the technical system used. At least we live to tell our tales. Thanks for the encouragement. Best regards, Andy

Thanks for sharing this info, I’ve been thinking about investing in the stock market for a long time, but I don’t really have any money to start. I feel like if you don’t put a lot of money into it, then you won’t see great returns either. For example, if I invest $100 and the stock goes up %5, then my return would only be $5. Then I would still have to pay taxes on that small profit as well.

Hi Joshua, as regards gains and taxes if you hold a position for more than 12 months you will only pay capital gains tax which is a lower rate than income tax. Also if you have only $100 or $200 to spare per month but a long time horizon I would look into an IRA that will allow you to invest in market indexed Exchange Traded Funds – ETFs. Much will depend on your employment status whether a traditional or Roth IRA works best for you. Even $100 per month is $1,200 per year. The example I gave of 30 years in the stock market putting in $1,000 a year and paying capital gains tax at 25% was overly pessimistic. If the $100 monthly contribution is after income tax and you are eligible for a Roth IRA then it grows tax free. As an example that $100 per month put into an S&P 500 indexed fund for the 30-year period from 1990 to 2019 if able to grow tax free would result in just under $198,000. Good luck with whatever you choose to do. Best regards, Andy

Hi Andy.

I read your article with great interest. I was previously interested in Forex Market and tried it out practically. But it wasn’t easy. In this article of yours, I gained a great deal of knowledge about the market. What are the most important factors you can analyze in the stock market? How much stock should we take in the beginning? I think it’s not fair to invest in the stock market these days. What do you think about it?

Thank you very much.

Darshana

Hi Darshana, stories of people trying Forex trading and losing large sums of money very quickly are common. As regards stocks the easiest way to start stock investing is to make small regular contributions into a broad index linked Exchange Traded Fund, ETF. You have to be ready that the value of the fund will go down as well as up but if you stay the course over the long term and that long term must typically be more than 15 years, you will gain. Thanks for your comment and best wishes, Andy

Hi Andy

Thank you for your explaining the share market, investment cycles for the past 30 years.

Giving us diagrams and real life data of how investing over the long term makes it easy to understand and visually see the concept of long term investment and wealth created compared to other types of investment.

I will definitely take up your, “making the most of investing” guide.

Regards, Bernardo

Hi Barnardo, thanks for your positive comment and feedback. I wish you all the best, Kind regards, Andy

I love the stock market! i started investing last year and didn’t even know what I was doing. I invested $3000 over some different stocks and ended up making $280 in about 4 months. Although it’s not huge money, it was free and easy. I would like to learn more on making lots of money and like the tips you mentioned. Thanks, I’ll be investing more now!

Hi Brandon, I’m glad you were able to make a profit last year. I tend to look at longer time horizons than 4 months but I know if the early years it’s difficult not to watch constantly to see if things are moving up or down. Good luck on your investing journey. Best regards, Andy

Hi Andy, I must congratulate you on a very well researched and well written article. Being a financial advisor for a number of years, previously, I know how crucial it is for readers to have a LOT of information available to make an informed decision.

You’ve spent a considerable amount of time on the detail of this article. Well done!

This is definitely a quality content article.

Hi Andre, thank you very much for your very positive feedback. Coming from a professional financial advisor that means a great deal to me. I’m sure you can appreciate that a subtitle for the article could be – Fun with Excel! – Thanks again for your encouraging remarks. Kind regards, Andy

I actually understood some of that; wish I’d had your blog to read 30 years ago!!

I find myself in the same boat. I would have three wishes though – I wish I had written it 30 years ago, I wish I would have read it 30 years ago and taken action on it 30 years ago. btw the subtitle of that piece could have been – Fun with Excel!