At the start of any investment journey, if you were sitting down with a financial adviser they will lead you through a series of questions to understand your risk tolerance. But, let’s say you’re doing it yourself, then you could do worse than go looking for the best risk tolerance questionnaire available.

From risk management to risk profile

Risk management is a big subject and can seem a little esoteric at times. Large organizations employ teams of people just monitoring and managing risks. In the field of personal investing, things are somewhat simpler though just as important for the person doing the investing.

If you have encountered risk management in an organizational or business setting you will know it starts by identifying risks across all sorts of different internal and external areas and mapping them out in terms of the likelihood of occurrence and severity of impact. Then looking at internal organizational controls and mitigation measures. A couple of examples would be the risk of bankruptcy of a critical supplier or the risk of accounting fraud.

Fortunately, developing a risk profile for personal investing is less complicated than managing risks in an organization or a business. However, both share the common feature that the process of internal dialog on the subject of risks is equally if not more important than any conclusions or report that may be produced.

The main purpose of a questionnaire about risk is to have a conversation with yourself and your financial adviser, if you have one, to build a risk profile that will help guide you in the choice of suitable investments.

Terminology

One of the primary challenges of using a sequence of questions to build a risk profile for personal investing is the need for a commonly accepted vocabulary. We need to agree on the meaning of terms such as “conservative investment strategy” or at the other end “aggressive investment strategy”.

There is inevitably going to be a learning process. As the individual gains an understanding of what these terms mean and how they apply to his or her investment plan. Even a short way down the road there may be a need to reassess and possibly adjust the plan if the fit wasn’t optimal at the outset.

Risk tolerance in personal investing

Risk tolerance is just one part of the picture making up your overall risk profile. Risk tolerance is how much risk you feel comfortable with before you get to the point where you could no longer sleep at night.

But let’s remember, the higher the risk the higher the reward. So If you only accepted risks that you were completely comfortable with you would limit the rewards you can achieve. For this reason, a financial adviser will usually seek to include investments in your portfolio whose risks come up to your risk tolerance limit.

While risk tolerance is how much risk you are willing to put up with, risk appetite is the other side of the same coin and means how much risk you would want to take on. If I could use a gambling analogy, you won’t find many people who go for a day at the races and then are only willing to risk a bet on the favorite for any race.

OK, that was an unfortunate analogy and I am not saying that investing is or should be like gambling.

Risk capacity is your capacity to manage risk given all the other parameters of your investments and what you need from them. To get into all those other parameters we should run through the question areas that need to be covered.

What is your investment time horizon?

This is the time horizon for building capital so is it 1, 3, 5, 10, or 15 years or longer?.

The period over which you want to receive withdrawals?

This will start once you have built capital and will continue typically for several years. In the case of retirement, it would run to the end of your lifetime and your partner’s lifetime. In the case of saving for college or the down payment on a house, it would be for a set number of years or a lump sum at a point in time.

What is your primary investing objective?

Some answers to this question would include:

- To preserve capital

- To build capital

- To provide a stable income

- To speculate

- To provide a legacy

Annual income expectations

You should then be asking yourself how you expect your income to change over your investment time horizon and through the withdrawal period. Possible answers could be: no change, gradual increase or decrease over time, large increase or decrease over time.

Anticipated major expenditures

In the case of building capital over a long time for retirement, you also need to consider if there are any large foreseen expenditures in the pipeline, such as paying for college.

Socially and environmentally responsible investing.

This is another important area of questioning. Many people will want to have some or all of their portfolios invested in socially and environmentally responsible companies or may wish to exclude investments in certain kinds of companies or industries.

Loss aversion

Now we come to the tricky bit. You will need to get a handle on how you deal with downside risk. This might seem obvious but getting this part right is key to the whole process.

If your aversion to loss is over-estimated then this will put you into investments that are too conservative and will likely only deliver low gains that may even struggle to keep pace with inflation.

If on the other hand your aversion to loss is under-estimated and you enter investments that are too risky for you, your portfolio will likely experience sharper downturns now and then which could prompt you to lose faith with the plan and jump ship.

Either over-estimating or under-estimating your loss aversion can result in you abandoning the plan halfway through, either over frustration at low returns or anxiety over occasional setbacks in portfolio value.

Asking the same question from multiple angles

The answers to most of the previous questions are going to be hard numbers or clear objectives. When it comes to assessing risk aversion and risk appetite because these are sensitive issues that touch on fears, psychology plays an important part.

How questions are framed will steer you, as the respondent in one direction or another. An obvious example of essentially the same question framed in opposite ways would be:

Question 1. Do you not accept the possibility of a loss in the value of your investments, while that means the probability of lower gain?

Question 2. Do you accept the possibility of a loss in the value of your investments, while that means the probability of higher gain?

Since we have a natural tendency to agree with whatever position the questioner is coming from the responses to question 1 will be skewed towards not accepting the possibility of loss while the responses to question 2 will be skewed towards accepting the possibility of loss.

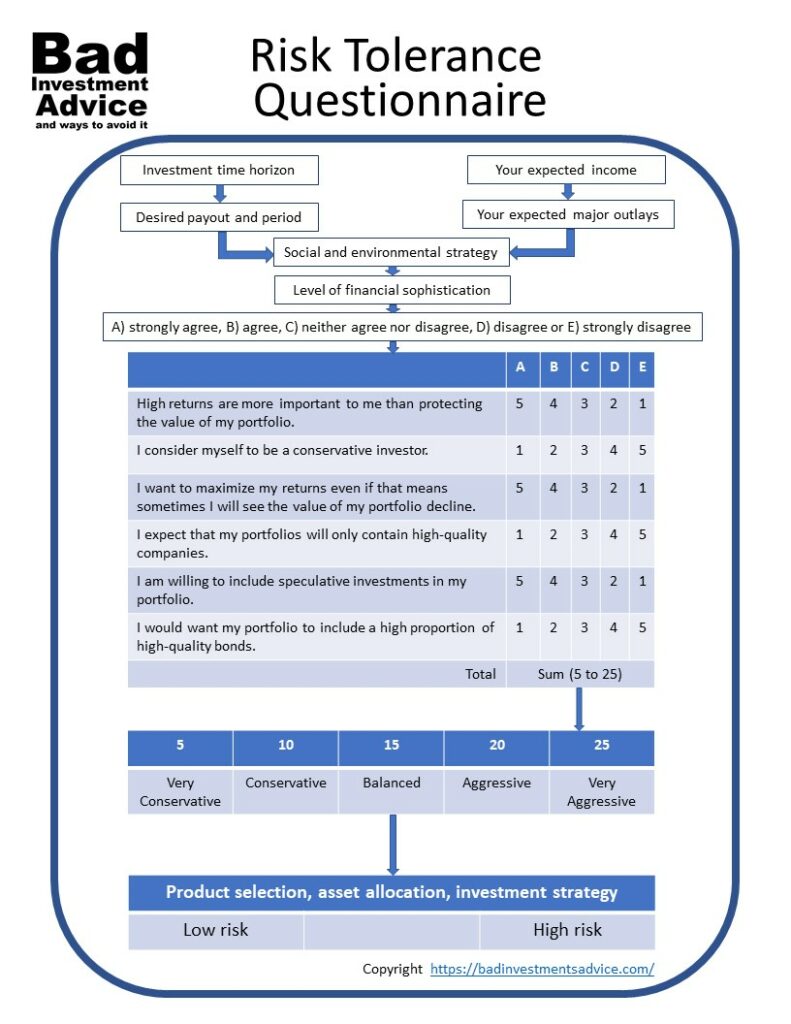

A good approach is to ask the same question from multiple angles ensuring that you have a good mix of positive slant and negative slant. Even then the order in which such questions are asked can skew results. Following best practices in the formation of questionnaires, using a Likert scale approach, a questionnaire could look like this.

Instructions. Indicate whether you:

i) strongly agree, ii) agree, iii) neither agree nor disagree, iv) disagree, or v) strongly disagree with the following statement.

- High returns are more important to me than protecting the value of my portfolio.

- I consider myself to be a conservative investor.

- I want to maximize my returns even if that means sometimes I will see the value of my portfolio decline.

- I expect that my portfolios will only contain high-quality companies.

- I am willing to include speculative investments in my portfolio.

- I would want my portfolio to include a high proportion of high-quality bonds.

The responses would then be averaged out to put you somewhere along the spectrum between very conservative at one end and very aggressive at the other end. For more on the Likert scale, check here.

Financial sophistication

This is another important area to consider especially if you are going the self-managed route. Would you be comfortable adding an options’ strategy for example to a stock portfolio to either hedge downside risks or to extract extra income

Flexibility and risk capacity

Flexibility is necessary for any long term financial plan. Circumstances are going to change. A professional financial adviser will check in with their clients at regular intervals. Investors doing it themselves will need to build in their own periodic reassessments and make course changes as needed. The capacity to adjust your portfolio to changing needs and circumstances is also an aspect of risk management.

Portfolio risk strategy

Once all the analysis is done your risk profile will determine a mix of assets for the phase during which you are building capital and another mix of assets during the payout phase.

If the period over which you are building capital is long then you will start with a greater proportion of higher risk and reward assets than during the payout phase. But also during the payout phase part of your expenditures could be highly discretionary and other parts would be essential. You would want the essential expenditures to be covered by stable income sources while discretionary spending could be funded through more speculative income sources.

Pulling it together

In researching this article I set about looking for the best risk tolerance questionnaire. In the end, I decided to make one.

Here it is as a single-page PDF risk tolerance questionnaire.

I hope you found this article interesting and useful. Do leave me a comment, a question, an opinion, or a suggestion and I will reply soonest. And if you are inclined to do me a favor, scroll down a bit and click on one of the social media buttons, and share it with your friends. They may just thank you for it.

Disclaimer: I am not a financial professional. All the information on this website and in this article is for information purposes only and should not be taken as investment advice, good or bad.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you!

Are ready to get serious about investing in your own financial education? Then check out membership of the American Association of Individual Investors, the AAII.

The AAII is a nonprofit organization, dedicated to the financial education of its members. Your membership of the AAII will give you access to courses and resources on stock investing, financial planning, and how to manage your retirement finances.

Thank you so much for this informative guide. It was really easy to follow and I found it very useful. I will apply the tips that you shared.

Hi Ladia, Thanks for the comment. I am glad you found it interesting and useful. Do drop by again and I would be pleased to receive any other comments, suggestions, or questions. I will respond soonest. Best regards, Andy

What an amazing advice on investment and how to tolerate risks. I found your post highly educational and all investors should read this before making an investment in any business.

Best wishes

Hi Rani

Thanks much for the positive feedback. I am glad you found it educational and useful. Best regards, Andy

Thank you so much for this highly informative article, Andy! I am currently thinking about entering the investment arena (I have never invested anything before), but I definitely think that I need to utilize the services of a financial advisor. I’ve heard so many horror stories about people investing in certain brands, only to lose their money, and then some. However, I know that by buying stock in a bigger corporation, such as an Amazon, Apple, or Walmart, there are many more opportunities to garner a profit. I definitely want to educate myself more on the stock market and how the entire process works, but it definitely seems like a great idea. Great read! God bless you!

Hi C.N.

You are right there are many pitfalls and an inexperienced investor is well advised to seek assistance from a professional financial advisor. There are many signs that the market will be in for a bumpy ride at least until next year because the recession is far from over. So in this environment, it would still be possible to see a setback in the form of reduction of value of your investments even if you do invest in large reputable companies. Thank you for the comment and I wish you the best of luck. Best regards, Andy

Hi Andy what an amazing article be excellent way to break down risks. I took a lot from your article so thank you very much for some great info.

Hi Russ

Thanks for the positive comments. I am glad that you took a lot from the article. Best regards, Andy

“If you don’t risk, you will not learn.”

This sentence comes from my father’s speech that reminds me of now.

After I thoroughly read your article, I think that I will have a good way to break down risks.

All the best

Thank you for your comment. I will remember your father’s wisdom. Thank you for sharing. I am glad you found the article interesting and useful. Best regards, Andy

I found that those questionnaire that are out there too high level. They don’t really capture your risk appetiser but it is something for sure, they can give you an idea. I like that you put one together. Nice format. However, you really test your risk when you are in the investment, when you see that you are in drawdown and things are going in the wrong direction. Here is when you really see how you handle risk. From that experience you can make better choices. Very good article. Thank you for sharing.

Thanks for your comment. I agree. There is only so much a questionnaire can accomplish for someone new to investing. They are only going to get an idea of how they really do react in a down market when confronted by one. That’s why this has to be an iterative process giving people the opportunity to reassess as they gain experience. Thanks again for your comment.Best regards, Andy

Amazing contents on your website as well as this post is super beneficial for all the investors out there. There is a fool proof method before making an investment. You seem to be very knowledgeable in this area of business. Please keep these lovely posts coming in.

All the best

Thank you very much for your positive feedback. This is greatly appreciated. I hope that the subsequent material will be as interesting and useful as the existing material.

Best regards

Andy

Hi Andy

Very informative and useful as always. I totally agree with your opinion which said:

But let’s remember, the higher the risk the higher the reward. So If you only accepted risks that you were completely comfortable with you would limit the rewards you can achieve.

I found this article very useful and at the same time very interesting. You really attract the attention of the reader with your charming style.

I really liked all the tips especially the ones you mentioned in: Asking the same question from multiple angles. I totally agree!

Have a great day

Rania

Hi Rania

Thanks for your very positive feedback. The composition of questionnaires is indeed a very complex task. It is a prime example of Schrodinger’s theory, that the process of examining something affects the outcome. I’m glad you found the article interesting.

Kind regards

Andy