A ‘shoestring budget’ is all about making things work with just a little. It’s about stretching your dollars as far as they can go. Probably a term you’ve heard because it’s often used when people are trying to achieve something significant with minimal financial resources.

A ‘shoestring budget’ is all about making things work with just a little. It’s about stretching your dollars as far as they can go. Probably a term you’ve heard because it’s often used when people are trying to achieve something significant with minimal financial resources.

This money-saving strategy isn’t about depriving yourself—it’s about being smart with what you’ve got.

Investment Opportunities: Getting Started with Limited Finances

Starting small with investments can be both an approachable and rewarding experience. The common belief that substantial amounts of money are required to begin investing isn’t accurate. Today, even modest amounts can get you started in the investment game.

Exploring investment vehicles that align with a tight budget is crucial. Options like micro-investing platforms and fractional shares allow you to buy small portions of stocks, minimizing the financial barrier to entry. This way, you can invest what you can afford without waiting to amass large sums of money.

Financial literacy plays a pivotal role in making informed investment decisions. There are countless free resources online that cover the basics of investing. Delving into these can enhance your understanding and confidence, making it easier to navigate the investment landscape on a small budget.

Setting realistic goals and maintaining patience is vital. It’s essential to understand that investments typically grow over time rather than overnight. Clearly defining what you hope to achieve and sticking to your plan can help realize gains, albeit gradually.

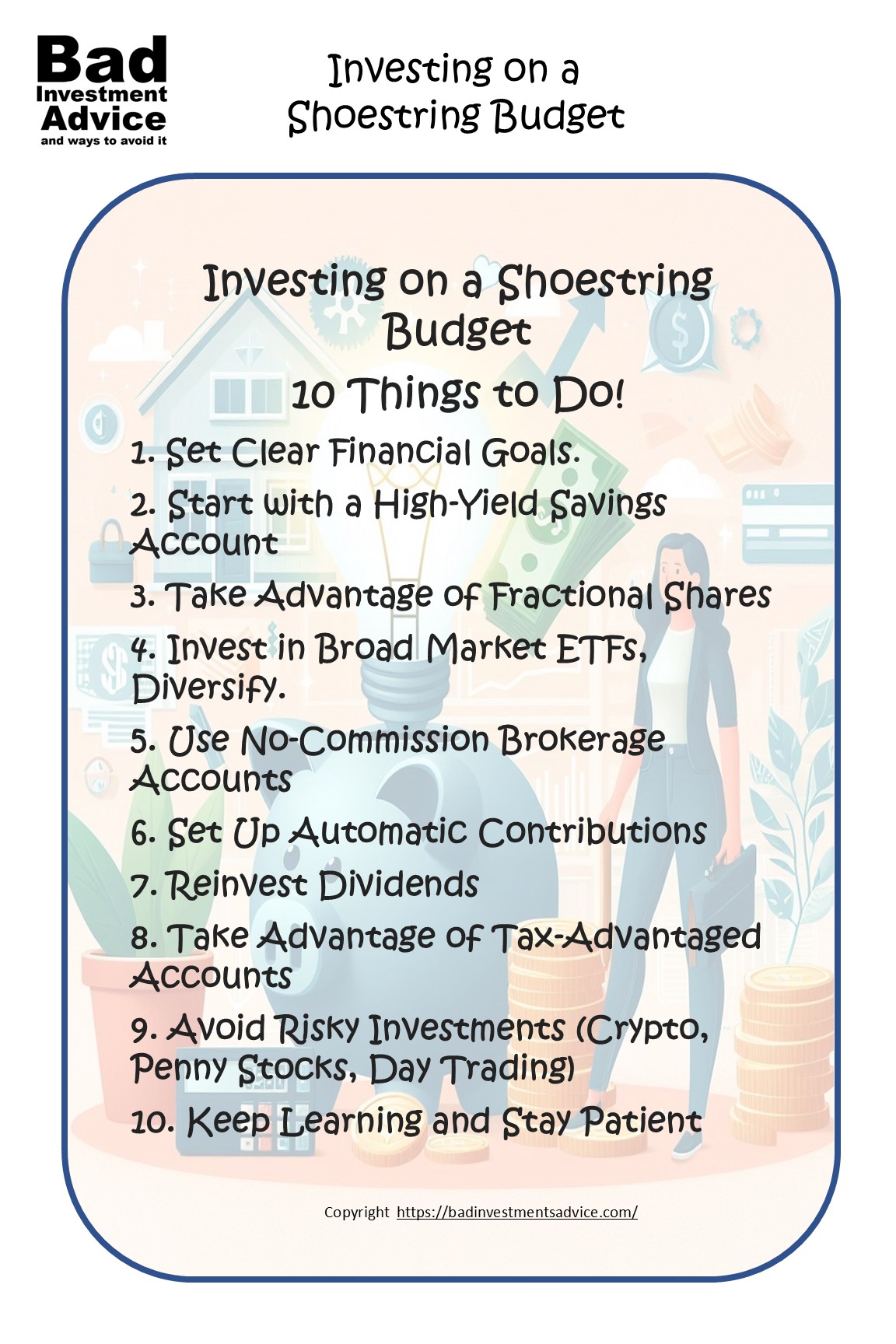

10 Things to do, starting to invest on a Shoestring

Here are ten things you should do investing small sums of money that will build wealth over time.

1. Set Clear Financial Goals

- Determine why you’re investing (e.g., retirement, wealth building, financial security).

- Define a realistic timeframe and risk tolerance.

2. Start with a High-Yield Savings Account

- Before investing, ensure you have an emergency fund (3-6 months of expenses).

- A high-yield savings account provides liquidity while earning some interest.

3. Take Advantage of Fractional Shares

- Many platforms (Robinhood, M1 Finance, Fidelity, etc.) allow you to invest in fractional shares of stocks or ETFs, meaning you don’t need to buy whole shares.

4. Invest in Broad Market ETFs

- ETFs (like Vanguard’s VOO or VTI) provide instant diversification and lower risk compared to individual stocks.

- Ideal for beginners with small capital.

5. Use No-Commission Brokerage Accounts

- Choose brokers that don’t charge fees on trades, such as Fidelity, Schwab, or Robinhood, to maximize returns.

6. Set Up Automatic Contributions

- Even if it’s just $10-$50 per month, automating your investments helps build discipline and long-term wealth.

7. Reinvest Dividends

- Choose dividend-paying ETFs or stocks and enable dividend reinvestment (DRIP) to compound your returns over time.

8. Take Advantage of Tax-Advantaged Accounts

- If possible, invest through a Roth IRA or 401(k) to benefit from tax-free or tax-deferred growth.

9. Avoid Risky Investments (Crypto, Penny Stocks, Day Trading)

- Stick to long-term investing in diversified assets rather than chasing quick gains in high-risk, speculative markets.

10. Keep Learning and Stay Patient

- Read books like “The Little Book of Common Sense Investing” (John Bogle) or “The Intelligent Investor” (Benjamin Graham).

- Stay consistent and patient—small investments compound significantly over time.

Diversify

It is always wise to diversify investments even with limited funds. Putting whatever small amount you have into various assets can spread risk and possibly improve returns. Another simple way to achieve diversification is to invest in index funds. You will find exchange traded funds, or ETFs that track market indices or will give you investments in a basket of stocks in a particular industry or sector. For an investor starting out very small, this is a much better approach that buying stocks of individual companies.

This diversified approach ensures you don’t put all your eggs in one basket, which is prudent financial strategy. Here is an article that goes into more detail about investing for beginners.

Living on a Shoestring Budget

Living on a shoestring budget means embracing new ways to save money and make ends meet. Sometimes it’s not easy, but it can teach you a lot about financial discipline. This lifestyle means thinking carefully about every purchase and decision. Plus, it builds character and can drive innovation. As Plato said – Necessity is the mother of invention.

Plenty of successful individuals started on a shoestring budget. Some of the most well-known entrepreneurs began their ventures with limited funds, then turned those small seeds into thriving enterprises. These success stories show what’s possible when you’re committed and resourceful.

To quote Paula Wagner, “Any good business person applies financial discipline to everything they do.”

Handling a restricted financial plan requires a particular mindset. It involves a balance between creativity and discipline. Finding inventive ways to cut costs or discovering hidden efficiencies can be pretty rewarding. The psychological aspect is unique—you learn resilience and adaptability, skills that stay with you for life.

Using a shoestring budget effectively demands some creativity. You need to find those hidden savings opportunities that others might overlook. Working with a shoestring budget trains you to prioritize, ensuring needs are met while wants are trimmed—at least, for now. It’s also about cultivating patience and appreciating what you have.

Launching a Business on Minimal Resources: Breaking the Myths

Starting a business might seem impossible without a hefty bank account, but that’s far from the truth. Many entrepreneurs have busted the myth that you need loads of cash to get going. What you actually need is a solid plan and a knack for making the most of what you have.

Before diving into business, research is crucial. Knowing your market inside and out helps you pinpoint where to put your limited resources. This approach minimizes risks and boosts your chances of success. Creating a lean business model focuses on essential aspects, cutting out unnecessary fluff that drains funds.

Tech tools are your best friends when resources are tight. Nowadays, you can manage many business tasks for little to no cost thanks to free software and online platforms. These tools help maximize efficiency and cut down on traditional overheads.

Connecting with local communities and finding mentors can provide invaluable support. Networking in your area can lead to collaborations that save costs, plus mentors offer guidance that steers you clear of costly mistakes. Community support often fills gaps that money can’t.

Success stories abound of tiny investments yielding big returns. There’s inspiration to be drawn from entrepreneurs who started in garages or kitchens with little more than a big idea and a small budget. This is proof enough that starting small doesn’t mean staying small.

Keep in mind that a shoestring budget isn’t just about scrimping and saving at every corner. It’s about making smart investments where they matter most. Whether it’s a few bucks to boost marketing or improving a product, spend wisely to get the biggest bang for your buck.

Financial Management: Strategies for Navigating a Tight Budget

Managing your finances well when every dollar counts can be a game-changer. First, it’s crucial to get clear on prioritizing expenses. Figure out which costs are non-negotiable and which ones can take a backseat. If it means eating out one less time a week to free up funds elsewhere, then that’s a choice worth making.

DIY can save you serious cash across various areas of your life. Whether it’s fixing a leaky faucet or cooking meals at home, doing it yourself helps keep costs down. It doesn’t mean cutting corners but finding ways to do things efficiently and effectively at a lower cost.

Budgeting apps and other financial tools fit perfectly into a shoestring budget strategy. Many tools come free and are excellent companions for tracking your spending, setting limits, and ensuring you stick to your financial goals. Find one that suits your style and habits.

Planning for the unexpected is a major part of financial management on a tight budget. Starting an emergency fund might feel challenging when resources are limited, but even small contributions add up over time. Knowing you’ve got a little cushion can offer peace of mind and financial stability.

Balancing quality and cost becomes essential, with a focus on value. Sometimes spending a little more initially saves money over the long haul, for instance, on a durable appliance or necessary expense that prevents costly problems down the line. Choose wisely and invest in things that provide long-term benefits.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you!

It has often been said that there is no better investment than your own financial education. One great way to accelerate your financial education and your investing success is with the American Association of Individual Investors, the AAII. When you join the AAII, you get access to reports, courses on investing, risk management, asset allocation, retirement planning, managing retirement finances, and other resources, all for a single annual membership fee.

Single-page summary

Here is a single-page summary of investing on a shoestring budget. You can download a PDF here.

I hope you found this article interesting and useful. Do leave me a comment, a question, an opinion, or a suggestion and I will reply soonest. And if you are inclined to do me a favor, scroll down a bit and click on one of the social media buttons, and share it with your friends. They may just thank you for it.

You can also subscribe to email notifications. We will send you a short email when a new post is published.

Disclaimer: I am not a financial professional. All the information on this website and in this article is for information purposes only and should not be taken as personalized investment advice, good or bad. You should check with your financial advisor before making any investment decisions to ensure they are suitable for you.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you

Investing on a shoestring budget is a smart approach to building wealth over time. I’ve personally found that fractional shares and ETFs make investing accessible even with minimal funds. It’s all about consistency—small, steady contributions add up. The emphasis on financial literacy in this article is key—understanding your options helps make informed decisions. Has anyone here tried micro-investing apps like Acorns or M1 Finance? Would love to hear your experiences!

Hi and thanks for the comment. I would also be curious to hear any experiences folks might have with micro-investing apps. For many years I was very disciplined and every month when my salary was paid I would transfer a set sum to my brokerage account. I find though the approach of shaving off a small sum from every debit or credit card transaction, rounding up say really intriguing. I guess it is an online equivalent of keeping a spare change jar on the mantlepiece and emptying the small change out of your pocket every day. I would be curious to know how much you could realistically accumulate over a month or a year without really trying. Thanks again for the question.

Hi Andy,

Thank you for sharing this article because investing on a shoestring budget is what I have been doing for the last 5 years.

Making the right sacrifices at the right time is important, especially when you are sacrificing things that are not too important at the moment.

Each month I invest a certain amount and in the beginning it wasn’t looking very good and there were times when I nearly quit. But, I kept going and things started to look up. I am not where I totally want to be yet, but I am in a good place and I know things will improve if I keep investing.

Thank you again for the reminder and keep up the great work.

All the best,

Tom

Hi Tom, thanks for reading and thanks for the comment. I am glad you found the article interesting. I wish you all the very best of luck.

Andy

Andy, this is an excellent guide for those looking to start investing with limited resources. You’ve done a great job breaking down the essentials—especially emphasizing financial literacy and patience. The practical steps, like using fractional shares, no-commission brokerage accounts, and automatic contributions, make investing feel much more accessible to beginners. I also appreciate the emphasis on tax-advantaged accounts and diversification, which are crucial strategies for long-term growth.

Beyond investing, your insights on financial discipline and launching a business on a shoestring budget are inspiring. It’s true—many successful entrepreneurs started with minimal funds but maximized their creativity and resourcefulness. The reminder that a shoestring budget isn’t about deprivation but smart financial decisions is a valuable perspective.

Overall, this is an empowering piece that proves anyone can start their financial journey, no matter how small. Great work making investing feel approachable and achievable!

Hi and thanks for the positive feedback.