In this first of a sequence of articles comparing the main approaches to investing, we will be looking at what is the value investment strategy.

It is widely accepted that the main reference work on value investing is “The Intelligent Investor” by Benjamin Graham. published in the early 1970s after decades as an investment professional. Rather than try to rewrite the main points of the book, I will walk through it chapter by chapter and give some general impressions as well.

Anyone wanting to read this today is recommended to get hold of the updated version with the commentary by Jason Zweig. Graham’s text is a bit stuffy at times and the additional commentary draws parallels with later market periods and developments. While this version is about twice as long as the original, the additional commentary is well worth it.

The investor or the speculator

Graham pulls no punches about his disdain for speculation. He defines the criteria of investments as promising

- safety of principal and

- an adequate return

He defines speculation as any financial venture which does not meet these criteria. The text is addressed at two kinds of investors, the “defensive investor” and the “enterprising investor.”

I find it very interesting to note, in 1948 90 percent of the public regarded investing in stock as a gamble. The whole text is addressed to intelligent, cautious, investors and it is easy to conclude that Graham dismisses and can’t be bothered talking to anyone who subscribes to a different approach.

Graham says that stock trading has no safety of principal and no satisfactory return and is therefore just speculating. As he says though, Wall Street makes money off trading. Zweig sums it up:

- Investors make money for themselves

- Speculators and Traders make money for their brokers

for these reasons Wall Street hypes trading and downplays investing.

He also says that any attempt to time investments in anything other than the utmost mechanical way leads inevitably to speculation.

As a final concession to higher risk investing or trading, Graham accepts this can be tolerated as long as funds dedicated to speculation are kept entirely separate from the funds you dedicate to intelligent investment.

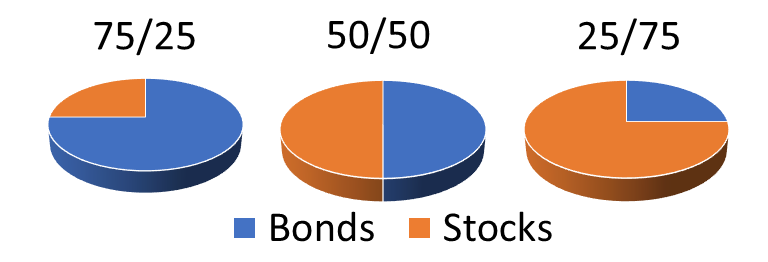

In the financial environment of the time Graham was writing, stock performance had been lackluster for long periods and bond investors had a safer time. One of the main questions he was considering was the optimal mix of bonds to stocks in a portfolio. He concluded it was somewhere on the spectrum between 25/75 and 75/25 both for defensive and enterprising investors.

He revisits the question of the best mix for a private investor’s portfolio between stocks and bonds a number of times throughout the book and comes to the conclusion over and over that a 50/50 split is the best.

Graham was trying to persuade the very conservative investing public that they should be taking a serious look at stocks, but of course only the solid, respectable, valuable kind, nothing that had any whiff of fly-by-night speculative business venture.

He noted how over the 20-year bull market from 1949 to 1969 the Dow Jones Industrial Average had multiplied 5 times and hence the underlying stocks’ valuations had also increased 5 times. On the other side, corporate returns had only increased 2-fold over the same period. Even though an investor following his methods would have seen 14 percent annualized returns, Graham clearly pointed to a likely correction in stock prices.

Graham’s advice is to expect average returns from a well-managed portfolio. Here are his main points:

- Use dollar-cost averaging to smooth out the ups and downs

- Don’t buy new, hot stocks

- Buy only “important” companies.

That was his introduction and the rest of the book is pretty much aimed at helping the cautious investor identify “important” companies.

He later underscores that an investor should expect to see the values of any individual stock positions increase by as much as 50 percent or decline by as much as 33 percent in a five-year period. If an investor does not have the emotional fortitude to handle that, then stay away from stocks and stick with bonds.

Where are we today

It is interesting to see how things have changed since Graham’s last edition.

In 1973 annual stock turnover on the US exchanges was around 20 percent, so investors as a whole were holding onto stocks for about 5 years.

In 2002 annual stock turnover was 105%.so in the aggregate stocks are held for 11 months, while many of the most actively traded stocks on the Nasdaq were only being held for 20 days or as few as 5 days.

One of the big changes since then has been computer-driven trading and online brokerages. That all looks totally normal to our eyes nowadays but what does all the money flowing into stocks mean for company valuations in relation to corporate earnings? In August 2020 the P/E of the stocks composing the Standard and Poor’s 500 index stands at around 30. That equated to an annual return of 3.33%.

That basic fact means the only meaningful way investors see returns from stocks above this tepid level of return is from appreciation in stock price. And the only way those stocks that are returning 3.33% annually can appreciate in price is through speculative fever.

Graham understood this fact too. As he said future stock prices are not predictable, only human behavior that drives stock prices can be predicted.

Formula for losses

Another phenomenon that Graham understood well, was the inevitable short-lived prospects of any simplistic, sure-fire way to get rich or beat the market. In Graham’s time, he had seen how simple beat-the-market formulas either fail immediately or result in diminishing returns that regress to average performance over time. He considered this to be one of the fundamental features of markets.

He gives two reasons for this.

Firstly – conditions change. A system that has been developed examining past price patterns is likely to fall apart at some point when unfamiliar conditions develop.

Secondly – as a system becomes known others adopt the approach and the possibilities for profit are slowly eroded.

Inflation

In Graham’s world, for the investor, who buys and holds a solid diversified portfolio of robust companies delivering average returns and a mix of bonds, inflation is an important consideration.

The basic limitation of fixed income securities, like bonds is that they are very sensitive to changing rates of inflation. If inflation increases, then the returns from bonds are worth less in their future value. However, stock valuations and dividends can increase if inflation increases.

In today’s investing and trading environment we have become accustomed to steady low inflation and lately very low interest rates. Personally, I find this worrying. The large volume of liquidity being injected into the developed economies by central banks since the economic collapse following the Coronavirus pandemic is likely to find its way into higher consumer prices and has certainly fueled the markets’ spectacular recovery. I think many of us could be caught off guard.

Zweig concludes this section by noting that a good way to hedge against inflation for a diversified portfolio of stocks and bonds is to add a portion of Real Estate Investment Trusts or REITs and if your tax situation is suitable Treasury Inflation-Protected Securities, or TIPS.

Similar sets of inflation and interest rate concerns affect the corporate world and hence corporate earnings and sooner or later stock valuations. Different industry sectors and different corporate financial structures have varying sensitivities to inflation and interest rates.

Graham notes that one of the big questions with inflation is whether productivity gains offset wage inflation. The pundits tell us in today’s world that big productivity gains are still to come from the inroads being made by Artificial Intelligence into human services. That can be good for shareholders but not so great if you happen to be one of the humans whose services are no longer required.

Know the market and its history

We now have about 200 years of stock market price history to see patterns of stock prices over time. There are three factors affecting stock prices.

- Real growth – in corporate earnings

- Inflationary growth – in prices

- Speculative growth – the public appetite for stocks

The main lesson Graham draws from looking at this history is a rule of opposites.

The more the general investing public expects superior long-term returns from the stock market, evidenced by large numbers of inexperienced investors piling into stocks, the more likely they are to be proved wrong in the short-term. Financial experts have a track record of fueling this enthusiasm.

History shows that the reverse is also true. It is exactly in periods when the general public is least enthusiastic about stocks that the best long-term results are to be had.

Portfolio Strategy

The generally accepted wisdom here is that risk and reward a correlated. The more risk an investor is willing to accept the higher reward can be expected.

Graham’s view is quite different. He believes that the rewards you can expect from your investments are directly related to the level of intelligent effort you put in and not the risk profile of your portfolio.

In the time of his last edition, 1972, his position was that bonds were attractive, stocks were set up for decline and he recommended investors should have a portfolio 50/50 split between bonds and stocks.

He also argues that this simple approach has the advantage that it is easy to follow. Since he also recommends periodic rebalancing that is made simpler by the straight 50/50 stocks/bonds split.

Tax

Since the cautious investor that Graham is talking to is going to have a significant percentage of the portfolio in bonds and will be looking at steady near average returns, optimizing the portfolio for tax purposes will make a lot of difference over the long-term.

Tax choices today are firstly whether to go with a Traditional IRA or Roth IRA. The difference being you can make pre-tax contributions to a Traditional IRA and then pay the tax due when you make withdrawals. Roth IRAs work the other way around. You make after-tax contributions but can make withdrawals tax-free.

The mix of taxable and tax-free bonds in a portfolio is relevant to your tax situation. A bond portfolio also has a choice of a range of treasury, municipal, high-grade corporate to low-grade corporate each of which offers a range of different durations, yields and default risks.

Selecting stocks

Graham advocates holding between ten and thirty stocks with the following characteristics:

- large market capitalization

- prominent within their industry sector (top 25% of companies)

- conservatively financed, i.e. low risk and debt to equity ratio (less than 1 for industrial companies and less than 2.33 for utilities and railroads)

- a long record of consistent dividend payments

- the price to earnings or P/E ratio should be lower than a maximum acceptable level.

Graham sets the maximum P/E at between 20 and 25. He recognized this would eliminate many if not all growth stocks, but in Graham’s view, there is no room in a defensive investor’s portfolio for growth stocks anyway, unless, they can be bought at a bargain price.

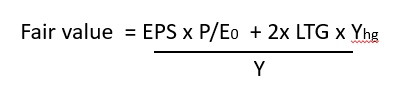

Calculating fair value

Graham provides a formula for calculating the fair value of a company.

Where:

EPS = Earnings per Share.

P/E0 = The Price to Earnings ratio of a zero growth company.

LTG = Long-term expected growth of the company over the next 7 to 10 years.

Yhg = The yield on a high-grade corporate bond.

Y = The yield on a current AAA corporate bond.

The catch here is how difficult it is to estimate the long-term growth rate of any company. Because of this uncertainty, Graham is very skeptical of growth stocks altogether and his advice is to stay away from them.

Periodic expert review

Graham makes the somewhat condescending recommendation that his defensive investor should get an annual expert review on the composition of his stock and bond portfolio, after all “he” – and clearly in Graham’s day, his defensive investor was invariably a “he” could hardly be expected to rely on his own paltry understanding of how to build and adjust a portfolio.

Of course, he should only use the most reputable advisors who would be satisfied with the commissions from any adjustments they recommend to make. Looking back we can laugh at his naive assertion that only the scallawag less reputable advisers would seek to profit from such an arrangement.

Dollar-cost averaging

This was one of his favorite ways to smooth out the risks of market ups and downs. The same holds true today. Indeed many mainstream brokerage houses and financial institutions will facilitate small regular contributions into a mixture of funds and financial instruments with low or no commissions or fees.

Personal circumstances

Graham considers how three people in very different stages of life and circumstances should approach investing. Unsurprisingly he comes to the conclusion that they should all adopt his 50/50 stock/bonds split portfolio.

He does give some consideration to something many of us who have a few decades of investing experience have observed either in our own actions or in friends or relatives. Your investment plan has to match you, your circumstances, your needs, and your proclivities.

If there is a mismatch then the chances are that things will unwind. Actually, the chances are they will unwind anyway. Not many of us have the discipline and consistency to stick with an investment plan for 30 years. But if you are going to rely on Graham’s approach, that is exactly what you will need.

Graham’s one nugget of advice to a young investor is to educate themselves so they can assess the true value of companies and invest in them for the long term.

Investing in what you know – the Peter Lynch way

After Graham has finished advising the defensive investor and admitted that an active and aggressive approach to investing can yield above average results, much of his advice lines up with the approach popularized by Peter Lynch. This can be summed up as:

Invest in what you know.

Picking up on Graham’s advice to the young investor to study how to assess the value of companies and their stock in specific industries, Zweig points out how the evidence shows that this approach can lead to substantial losses.

Investors will tend to get complacent about including in their portfolios, the stocks of companies that are close to home in some way. It is too easy with companies that are familiar to fail to apply the same rigor to the assessment of value as you do with unfamiliar ones. Zweig lists a number of studies to prove this point.

Home bias pitfalls.

If the complacency that can come with investing close to home can be avoided, then Graham’s advice holds good today as well as it did in his time.

The investor is encouraged to maintain the discipline of steady contributions into a balanced portfolio of funds and forget about trying to predict the future.

Advice for the enterprising investor

Graham obviously has a hard time giving meaningful advice to an enterprising or aggressive investor. He suggests starting in the same place as the defensive investor with the same mix of high-grade bonds and quality large-cap stocks.

Much of his instruction from there is about what kinds of investments to avoid. No surprise here, we are told to avoid low-grade bonds and preferred stocks except when you can pick them up at a significant discount when the market drops.

There are three possible strategies Graham suggests that the enterprising investor can take.

- Buy and hold large unpopular companies

- Purchase bargain issues

- Buy into “Special situations”

Large unpopular companies

This means buying those very large dividend-paying stocks whose price-earnings ratios are lower than the popular large companies and often have a bad rap with the financial media.

In fact, the approach known as Dogs of the Dow is an easy way to operate this strategy. If you just invest in a portfolio of the ten or twelve least popular but high dividend-paying stocks in the Dow Jones Industrial Average and rebalance every year then you will be implementing this strategy.

Purchase bargain issues

To buy bargain issues, on the other hand, the enterprising investor is going to have to do more research. The research should look for those stocks whose market capitalizations come close to either the discounted value of future earnings or the asset values i.e. the book value. The idea here is to buy companies that could be broken up and yield more when the assets are all sold off.

Traditionally these kinds of companies would be good takeover targets.

Buy into “Special Situations”

Graham notes a saying on Wall Street – “Don’t buy into a law-suit”, but this approach, which he considers the enterprising investor can take, does exactly that. He points to above-average returns investors achieved by purchasing convertible bonds of distressed railroad companies.

Other examples were Johnson and Johnson whose stock price took hits at various times because of high-profile bad news. The point that Graham makes is that the market often over-reacts. An enterprising investor who does their research can spot and exploit such opportunities provided they are willing to do something the crowd is not doing, wait patiently for results and accept losses if events don’t go in their favor.

Initial Public Offerings and rights issues

Graham and Zweig recount how periodically the market experiences periods of enthusiasm for Initial Public Offerings or IPOs, rights issues, and other means of drawing larger sums of money from the public into the capital markets. These will often last two the three years before the inevitable collapse.

At the start valuations are reasonable and the first investors are likely to make profits. As the enthusiasm builds to a frenzy lesser quality companies jump on the bandwagon. The end result is usually that the initial owners of the companies or the stocks succeed in diversifying their holdings while the public gets fleeced.

One of the most recent variants of this phenomenon has been ICO’s or Initial Coin Offerings. Some of these have been so wildly successful for the backers, they raised so much money they just walked away with the proceeds and didn’t bother to launch the promised product.

The quality of management

Graham gives a basic guide on how to gauge the quality of management of a company from the financial reports going back five or ten years:

- Read the CEO statements and look for consistency.

- Look at the level of executive pay and check how that compares with industry averages

- Look out for new issues of stock options to executives, get a measure of the “options overhang”

- Check whether managers are buying and/or selling the stock of the company.

- Look for extraordinary items, non-recurring expenses, “pro-forma” earning, all of these are signs of creative accounting.

One of the best pieces of advice is to read the financial reports from back to front. This is because what they do not want you to read will be buried in the footnotes and lengthy text at the end.

Practical stock-picking for the defensive investor

Graham offers some basic stock-picking approaches for the defensive investor, Zweig updated these but they should be reinterpreted for today’s environment.

1) Buy the same number of shares of each of the 30 Dow Jones Industrial Average stocks

2) Buy stocks according to these criteria:

- Large size, in today’s terms this would mean a market cap of $2 billion or more

- Strong financial condition, this would mean a good debt to equity ratio depending on the industry, and a current ratio of at least 2

- Positive earnings for the last 10 years

- Uninterrupted dividend payments for the last 20 years

- Earning growth of at least a third over the last 10 years

- Current P/E ratio should be no more than 15

- Price to book value should be less than 2.5

3) As Zweig says, the easy way for the defensive investor today is just to buy one or more low-cost broad market indexed funds. As a concession, the defensive investor who really does want to pick stocks would be permitted to take 10 percent only of their stock portfolio and pick stocks according to the seven criteria above.

Practical stock-picking advice for the enterprising investor

Again we read the warning, that the enterprising investor trying to beat the market is unlikely to succeed especially since the best professional analysts with all the research at their disposition are for the most part unable to do so.

The first piece of advice to the enterprising investor is to look for large unpopular but solid and undervalued companies in cyclical industries on the basis that today’s losers can become tomorrow’s winners. The enterprising investor would be advised to build a part of their portfolio with such stocks

The second category of stocks would be small-cap. Graham proposes that the enterprising investor can apply the same seven criteria that the defensive investor should use to select stocks, but can relax each of the measures and use their own discretion.

The method Graham proposes to sort through all the thousands of listed small-cap stocks is the monthly Standard and Poor’s Stock Guide. Today we can use any online stock screener to do the sorting.

Return on Invested Capital vs Earnings per Share

Since Graham’s day, largely because corporate accountants keep finding ways to move the goalposts, earnings per share no longer gives a reliable indication of how much a company is really earning. For the kind of analysis that Graham proposes it is more meaningful to look at the return on invested capital, or ROIC. This is defined as:

ROIC = Owner Earnings / Invested Capital

Owner earnings = (operating profit + depreciation + amortization of goodwill) – (Federial income tax + cost of stock options + capital manitenance expenditures + any income from irregular non-operating sources)

Invested capital = (total assets + past accounting charges that reduced invested capital) – cash.

It is almost as if there is an ongoing struggle between corporate accountants and security analysts. The more corporate accountants find ways to artificially distort earnings, the more analysts have to dig deeper Another popular measure of real earnings is earnings before interest, tax, depreciation, and amortization or EBITDA.

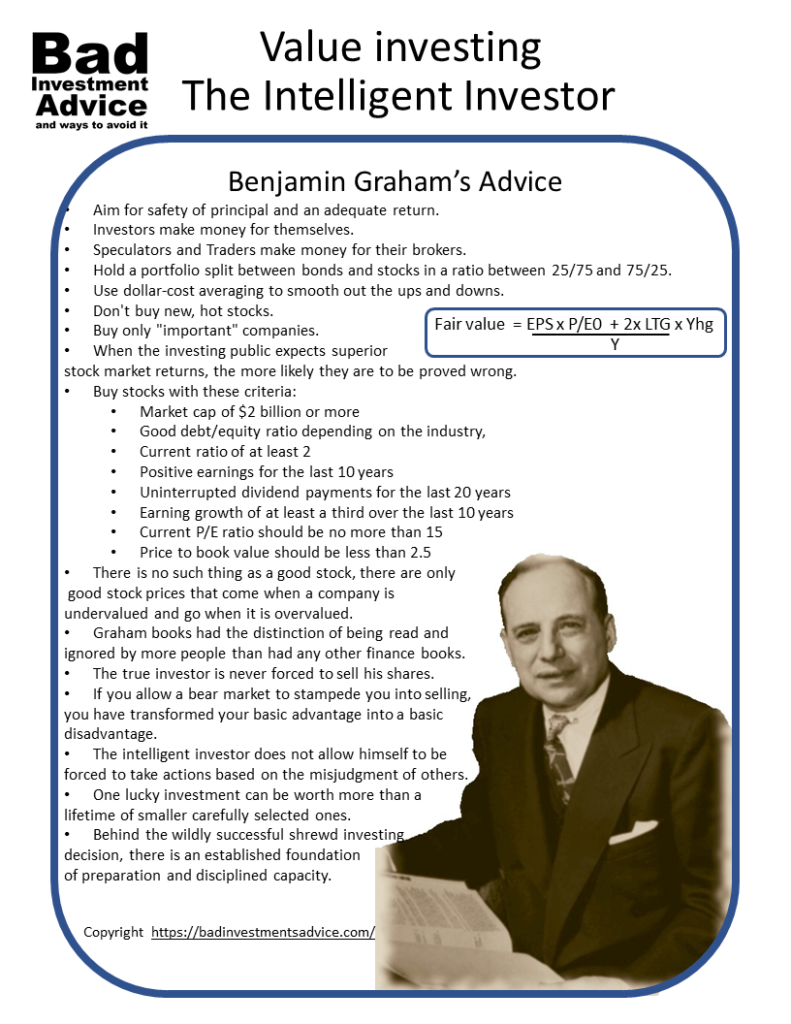

Summary wisdom

There are good and bad companies, but there is no such thing as a good stock, there are only good stock prices that come when a company is undervalued and go when it is overvalued.

Graham said that his own books had the distinction of being read and ignored by more people than had any other books in finance.

The true investor is never forced to sell his shares.

If you allow a bear market to stampede you into selling your shares, you have transformed your basic advantage into a basic disadvantage.

The intelligent investor does not allow himself to be forced to take actions based on the misjudgment of others.

One lucky investment can be worth more than a lifetime of smaller carefully selected ones.

Behind the wildly successful shrewd investing decision, there will usually be an established foundation of preparation and disciplined capacity.

My take

A question I have seen on personal finance chat sites and this like is whether Graham’s book, The Intelligent Investor is still valid or is it outdated.

I would say that like all valuable classic works of non-fiction, the foundation of this work is in well and thoroughly explained general principles. The specific examples given by Graham apply to his time. Many of the types of bonds and savings instruments are no longer available today. Even Zweig’s commentary and the parallel cases he offers are almost 20 years old now.

Is The Intelligent Investor ripe for a new update? Possibly yes. That would give us present-day examples of how to apply Graham’s principles. But the important objective of his book was to impart and instill the principles on which his investing approach is based.

Those principles have not changed.

This article explains more about Benjamin Graham and his books.

This post contains affiliate links.

You can buy your own copy of The Intelligent Investor, at BOOKS-A-MILLION here.

If, all things considered, Benjamin Graham’s approach to investing doesn’t float your boat, then check out a very different approach, what is generally referred to as growth investing.

Answers to Questions

Q. How do you value invest?

A. The easiest way to value invest is to buy indexed stock and bond funds, purchasing the same amounts through regular monthly payments.

Q. What are the main investment strategies?

A. Value investing, growth investing, income or dividend investing, socially responsible investing, momentum investing, sector investing are all different investing strategies.

Q. Which is better growth or value investing?

A. Evidence suggests it is easier to be successful at value investing. Growth investing promises higher than average returns but looking at the evidence is harder to achieve.

Q. What does the Intelligent Investor teach you?

A. The Intelligent Investor teaches the general investing principles which experience shows offer the most reliable chances of succeeding at investing over the long-term.

Q. Is The Intelligent Investor for beginners?

A. The Intelligent Investor is for beginning investors who are serious and willing to invest their time reading 500 plus pages. The text can feel a bit condescending at times but it is well worth the read.

Q. Is the intelligent investor outdated?

A. The investing principles explained in the intelligent investor are still valid. Many of the specific examples it uses are outdated.

Here is a single-page summary of The Intelligent Investor as a PDF download.

I hope you found this article interesting and useful. Do leave me a comment, a question, an opinion, or a suggestion and I will reply soonest. And if you are inclined to do me a favor, scroll down a bit and click on one of the social media buttons and share it with your friends. They may just thank you for it.

Disclaimer: I am not a financial professional. All the information on this website and in this article is for information purposes only and should not be taken as investment advice, good or bad.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you!

Graham really knew what he was saying when he discussed this topic and also told us about the predicted feature of stocks saying that it cannot be predicted and only human behavior that affects it can be. I will like to try to value invest myself because I think it is truly the best way to invest in stocks.

Hi and thanks for your comment. Indeed the unpredictability of stock prices was one of the cornerstones of Graham’s approach to investing. Best regards, Andy

Hello there! Thank you very much for sharing this wonderful article. I read through it and it is very detailed and well written. Graham seems like a very smart and straight forward person. He has indeed earned the name Intelligent Investor. Thank you for sharing the link on where to get Graham books, I too want to get first hand information on how to invest wisely and be like the intelligent investor. Thank you.

Thanks for your comment. Many people wonder whether this book is still relevant to investing today. My conclusion is that the principles that Graham teaches are indeed valid and relevant and the advantage of reading at least one good book on investing is that it should cover all areas needed to gain a holistic understanding. I wish you all the best of luck. Best regards, Andy

Hello there, thanks for sharing this extensive piece of information. I must say I really enjoyed going through your review as it contains valuable information people need to be aware of before starting to invest. I understand why the value investment strategy offers a practical way for the large majority of investors to be successful. Thank you again for sharing.

Hi and thanks for the comment. There is a good reason why Graham’s approach has stood the test of time and is still so well respected. Best regards, Andy

Many thanks for sharing with us an interesting and informative article. I have only basic ideas about investment or finance but looking at your article I understand that any investor must invest based on a clear and consistent policy based on an in-depth study of what works. I learned a lot from you here, including about inflation and portfolio strategy, which was unclear to me before. The summaries you have made of Benjamin Graham’s book will really help investors gain knowledge.

Hi and thanks for your comment. I am glad that the article helped clarify certain matters for you. Best regards, Andy

Reading through this article has been a lot of benefit to me, getting to know about Benjamin Graham and how he was able to devise different ways to develop investment strategies is very interesting and was surely helpful to traders to know what to do back in the days when he was writing Please can you tell me whether the ideas of Graham still be applied to investment today?

Hi and thanks for your comment and question. The investing principles Graham espoused apply equally well today as they did when he was writing back in the 60s and 70s. Today we have many different financial instruments that the retail investor can access at a very low cost. Commissions and fees for just straight trading are very low and often zero on many stocks and exchange-traded funds. But since all serious writers on investing have to deal with the psychology and emotions of traders and investors, these principles apply if anything more today. Best regards Andy

Nice article! Value investment strategy, this sounds interesting. Seeing that in the old days people thought investing was like a gamble, Graham did not really waste time with those people because his audience was intelligent people. He was of the opinion that there are good and bad companies but then there is no such thing as good stock.

Hi and thanks for the comment. Yes, that is very true that Graham made the observation that there is no such thing as a good stock. There would have been no doubt in his mind that there were and are many examples of bad stocks because there are bad companies and at some point, they will just go out of business dragging down their stock prices and any unwary investor holding their stock. In his mind, though a good stock would be a good stock that you buy when it is undervalued. If the stock becomes overvalued then it is no longer a good stock. thanks again and best regards, Andy

Hi,

From my online research value investing is an investment strategy that involves picking stocks that appear to be trading for less than their intrinsic or book value, Until you have a good feel for a firm’s competitive environment, its challenges and opportunities, and its strengths and weaknesses, you don’t really know enough to be investing in that business, you need to know the company is headed by a management team that will run the business competently, efficiently and honestly.

Thank you.

Aluko.

Hi Aluko and thanks for your comment. It sounds like you are an ardent student of Ben Graham already! I find it interesting how investors either fully adhere to Graham’s approach and focus on fundamentals and management or they are on the other side of the fence and focus on technical factors and chart patterns. I must admit I do a bit of both – ironically I am told that is the worse approach to adopt unless you are disciplined enough to completely separate the two. Thanks again for your insightful comment. Best regards, Andy

Thanks for shearing this review, first an investment strategy is a set of rules, behaviors or procedures, designed to guide an investor’s selection of an investment portfolio. Going through this review I have found good and profitable way to strategize before investing. I learned a lot from you here, including about inflation and portfolio strategy.

Hi and thanks for your comment. I agree that investing is all about using a system that has a proven chance of success and sticking with it through thick and thin. Best regards, Andy

Wow! Awesome write-up and take. I read “The Intelligent Investor” a little while ago and I took more away from your article lol. What’s your opinion on short-selling? I’m thinking about day trading and I see lots of people pushing it online. I know your not a financial expert but after reading this break-down I’m curious what your opinion is?

I look forward to more articles!!

Hi Adam and thanks for your positive comments. I don’t day trade myself as day trading pretty much means staring at the screen all day while the market is open. Also, intraday price movement is more volatile and trends less so profits tend to be smaller, less certain and slippage is more of a problem and that tends to erode your gains and amplify your losses. I myself have never tried short selling I prefer to work with put options. If you are going to short sell I would suggest that you do so only with a very good and robust brokerage platform. The big risk is price gaps between trading periods that make it difficult to execute trades at your stop-loss levels. Under such circumstances, you can find yourself exiting positions with higher losses than you anticipated. that problem can be even worse if your online broker is one of the newer ones – I think we have all read the horror stories. As I say, certainly for short and intermediate time periods of up to 6 months, options give you more leverage than short selling and can be used to limit losses. Thanks for the question and good luck. Best regards, Andy

The whole beauty of investment, I remember reading it somewhere is that it is your money working for you. In the light of this I think your article is a really interesting read and I’m glad that I came across it as I learnt a great deal from reading it. Thank you for sharing this enlightening and illuminating article.

Hi and thanks for stopping by and leaving this positive comment. Best regards, Andy

Hello there, thanks for sharing this wonderful information about the value investment strategy. I have been involved in many businesses over the years and so so many times I have been scammed and that’s why I have decided to make research about this one before getting involved with it. I really feel happy that the information you have here is trusted.

Thanks for the comment. Value investing is about the most trusted approach to stock investing. There is an ongoing debiate as to whether it is the most profitable. Though there is no doubt it is the safest approach a retail investor can adopt to building wealth over the long-term. I wish you the best of luck. Best regards, Andy