Cryptocurrencies have emerged as a revolutionary financial instrument, turning the traditional understanding of money as paper notes and coins issued by a central authority on its head. At its core, cryptocurrency is a form of digital currency that uses cryptography, encoding blocks of data onto a decentralized distributed network. The blocks are combined into a chain and you will often hear the term blockchain technology.

The purpose is to create a secure record of financial transactions, and verified asset transfers on a decentralized network that no one entity controls. Any issue of new currency units is predetermined and programed into the blockchain when the cryptocurrency is first launched. Understanding these basics is crucial for anyone looking to enter this space.

How Cryptocurrencies Started

The first attempt to create a digital currency was Digicash in the late 1980s and early 1990s. It didn’t use blockchain technology and required banks to adopt it – which they didn’t so it failed. Then came Bitcoin which addressed many of the issues of Digicash improving the encryption and using a decentralized blockchain hosted on a distributed network of independent nodes.

As important as the innovative technology behind Bitcoin, was its launch timing. It was launched in January 2009, shortly after the financial crash triggered by the sub-prime mortgage failures. Many private individuals felt betrayed by government bailouts of large financial institutions, who were felt to be complicit in creating the financial meltdown, while individuals who lost their homes had to fend for themselves.

That set the stage for a large enough pioneer community of innovative thinkers, looking for an alternative to government controlled money systems, to buy into Bitcoin’s concept of “A peer-to-peer electronic cash system” which was the title of the Bitcoin whitepaper.

All serious cryptocurrencies publish a whitepaper before launching, explaining their purpose, the technology and the tokenomics. It’s the closest thing in the crypto world to a prospectus issued before a new public offering of stock. There are no rules dictating what a whitepaper has to cover but there are best practices.

It might sound a bit abstract, but understanding what Bitcoin was trying to do, fulfilling the functions of money, i.e. a store of value, a medium of exchange and a unit of accounting, in a secure, reliable manner without a central controlling authority will help you understand the differences, merits and weak points of other cryptocurrencies.

Cryptocurrency units are usually referred to as tokens. Tokenomics means the economic model of a cryptocurrency, basically how the total supply of tokens is divided between different stakeholders, for what purposes and over what timeframe. Tokenomics includes factors like supply, distribution, and utility within its specific ecosystem. A grasp on tokenomics helps investors determine the potential value and growth prospects of a cryptocurrency.

A crypto ecosystem is a term that means the broad community of founders, developers, users, investors, traders, lenders, and node operators associated with that cryptocurrency.

Here is another article that helps analyze the health or otherwise of a crypto. It also explains tokenomics in more detail.

Crypto’s Today

Crypto’s Today

Among the many thousands of cryptocurrencies, blue-chip cryptos like Bitcoin and Ether are the most recognized and established, providing a relatively safer investment. The other major coins, which also have some utility are called altcoins. By utility we mean for example providing platforms for lending, or derivatives or some other function that users value. Another category of cryptos is stablecoins whose value is linked to a fiat currency, usually the US dollar. Coins that have no utility are often referred to as meme coins or by even more derogatory terms.

Meme coins are coins supported by a community of enthusiastic holders on social media and as the name suggests are linked to a specific meme. Another notable group of coins is Artificial Intelligence related coins and AI-meme coins. AI-coins are linked to a specific AI development group, technology or AI-agent. AI-coins first appeared in late 2024 and have exploded in the months since.

Some well-known altcoins (and their symbols) are Solana (SOL), Ripple (XRP), Cardana (ADA), Avalanche (AVAX), and Near Protocol (NEAR). Tether (USDT) and USDC are examples of stablecoins.

Some of the favorite meme-coins are DOGE, BONK, PONKE and some of the major AI-coins are, Virtuals Protocol (VIRTUAL), AI16Z, and AI Rig Complex (ARC).

All of these cryptocurrencies differ in terms of technical structure, tokenomics, the team behind them, community, meme value, utility or lack there of, and the extent of decentralization of the network. In a certain sense you could say those are the fundamentals whereas the patterns of price over time of cryptocurrencies are the technicals.

This is where your consideration of timeframe is important. The general rule is that if you are investing in cryptocurrencies over a long-term, then fundamentals are more important. If you intend to trade cryptocurrencies in the short-term then you are more likely to be concerned with the technicals of price.

As regards price movements, if you watch the prices of Bitcoin, Ether, Solana, other altcoins and some meme coins, you will probably notice if Bitcoin goes up 1%, Ether might rise 1 or 2%, Solana probably 3 to 5 %, some other altcoins and meme coins will go up 5 to 10%. The same will happen if prices drop. The price of stablecoins should hold to their fiat currency peg during the ups and downs of other cryptos. All cryptos are volatile, Bitcoin and Ether are the least volatile while meme coins in general are the most volatile.

Regulation of cryptocurrencies is an evolving arena, impacting everything from investor protection to market stability. Keeping a tab on regulatory changes is vital as they can substantially affect market dynamics and even the legitimacy of certain cryptos.

The US has just entered a new era with the change of administration in 2025. A number of legal cases in the US against crypto companies have been dropped. The new administration has announced it is going to introduce legislation on stablecoins and has announced other crypto-related initiatives. Staying informed will not only protect your investment but also offer strategic advantage in navigating this ever-changing market.

Navigating Crypto Exchanges: CEX vs DEX

When it comes to trading or holding cryptocurrencies, choosing the right type of exchange for your purposes is crucial. Centralized Exchanges (CEX) and Decentralized Exchanges (DEX) operate differently, each with unique advantages and drawbacks.

On CEX platforms, like Binance or Coinbase, the exchange becomes a third party between buyers and sellers managing transactions and holding your private keys. This means the exchange is responsible for securing and managing your funds, offering ease for beginners but also posing risks if the exchange is compromised.

In contrast, DEX platforms allow users to trade directly from their wallets. This peer-to-peer method of operating means individuals retain full control of private keys, providing increased security and privacy. However, this requires users to be more tech-savvy and diligent in managing their security.

Picking the right exchange hinges on personal needs: consider factors like user-friendliness, supported cryptocurrencies, transaction fees, and the level of security you require. New investors might find centralized options more user-friendly, while seasoned traders may prefer the autonomy of decentralized platforms.

In practice centralized exchanges were for a long time the easiest way to convert between fiat currencies and cryptos even for investors who hold their crypto in their own wallets. A comparatively recent innovation is that many popular wallets allow you to directly buy cryptocurrencies from fiat currencies through third-party intermediaries using features in the wallets themselves.

Connecting Your Wallet – Should You?

If you do go as far as holding your cryptocurrencies in a wallet that you and only you control, the way you will interact with the broader crypto ecosystem is to connect your wallet to a website of a crypto company offering a service that you need. It is essential that you only connect your wallet to a site that you know you should trust. This is where you have to do your research.

Most cryptocurrencies and crypto projects will have their own communities on social media sites such as Telegram and Discord. If hackers are trying to set up fake sites to mimic the real sites you are trying to connect to, there will usually be some discussion of that on the official social media sites.

Also reputable large crypto ecosystem information sites such as Coingecko and Coinmarketcap will list the real URLs of the crypto entities. Be very careful about following links to connect your wallet, especially any links sent to you through a social media site. This is where many scammers operate.

If you do have your own wallet, one piece of advice you will hear over and over is never to share your private keys with anyone. Anyone who has your private keys can empty your wallet and your cryptocurrencies will be gone forever. Also if you lose your keys and the computer or smartphone where you have your wallet stops working, you will not be able to load your wallet onto another device and you’ve lost access to your cryptos.

Safeguarding your investments with robust passwords and security measures is a must. But gaining total control of your cryptos in your own wallet means not only that you have security but also you have the responsibility to keep them safe and working. If you lose or give away your private keys then you have nobody to turn to. Nobody is going to bail you out.

Trading Tactics vs Investment Strategies

You have to decide whether you are going to trade cryptocurrencies in the short term or invest for the long haul. Short-term trading, capitalizes on price fluctuations within a day or two or even within minutes. It’s intensive and demands constant attention to market trends, making it a thrilling yet nerve-wracking endeavor.

In contrast, long-term investing focuses on buying and holding assets like Bitcoin or Ether for years, banking on their gradual appreciation. This strategy requires patience and a belief in the technology’s future success, providing a less stressful but still compelling approach to cryptocurrencies.

Leveraged trading offers the potential for outsized returns, but it amplifies both gains and losses, introducing significant risk. In the volatile world of cryptocurrencies, where prices can swing wildly, understanding your own risk tolerance is critical. Leveraging modest amounts or using it sparingly can mitigate potential pitfalls.

The 4-Year Bitcoin Cycle

The Bitcoin 4-year market cycle offers valuable insight into crypto market patterns, centered around Bitcoin halvings. The Bitcoin halving happens approximately every 4-years and it means the rate at which new Bitcoin is awarded to Bitcoin miners is cut in half. This pre-programmed reduction in new Bitcoin supply has historically influenced market dynamics, essentially because it means Bitcoin has become more scarce.

The 4-year cycle has given investors a potential map to navigate the unpredictable crypto seas. Some believe that today the halving phenomenon itself has less of an influence on price since so many halvings have already happened. The newly Bitcoin minted Bitcoin represents an ever decreasing proportion of the total supply. But like many market phenomena, the 4-year Bitcoin cycle is baked into the psychology of the market.

Here is an important point to consider when investing in Bitcoin. A daily price chart for Bitcoin from September 2014 to March 2025 looks like this.

Source: Yahoo Finance and Bad Investments Advice

If you were worried about buying Bitcoin at a high point, then seeing the price take a nose dive, from the historical data, how long would you have to wait for the price to recover and stay above your purchase price?

The first big price peak was on 16 December 2017 when the price hit $19,497 and then dropped. If you had bought at that point you would have to wait until 17 December 2020 for the price to recover and proceed upwards from there. There was another period from 18 September 2022 to 14 January 2023 when it dipped in and out of that price territory but the price marched on upwards from then on.

The second big price peak was 8 November 2021 when the price hit $67,673 before tanking. The price recovered on 27 October 2024 and marched on upwards from there. Since then the price has not dropped below that level of $67,673, at least not yet.

The point being, other than the dodgy period from September 2022 to January 2023 where unsteady hands could have been shaken out, if you buy Bitcoin and hold for at least four years the historical data suggest you will always come out on top.

Jargon and Crypto Terms

There is a whole range of technical terms you will discover as you get into the crypto world. One that comes from stock trading and is particularly prevalent is pump and dump.

Pump and dump schemes are notorious in crypto markets—artificially inflating a coin’s price before selling off en-masse, leaving unaware investors with losses. Another term which is closely related to pump and dump is a rug pull. A rug pull is when the founders or insiders hold a large portion of the total supply. This typically happens on a coin launch and is often seen with dubious meme coins. A coin is launched, the public comes in and buys, driving up the price. Once the price is high enough the insiders dump their holdings tanking the price.

Vigilance and thorough research into any coin are essential to avoid getting caught. Scout for community reputation, usage cases, and developer history before investing.

Interconnections: Cryptocurrency and the Broader Market

Cryptocurrencies, once residing on the fringes of the financial world, are now inextricably linked with the broader economy. This interconnection affects not only how cryptos are perceived but also their price movements.

The influence flows both ways. Notably, economic policies, interest rates, and inflation figures shape investor sentiment in crypto markets, much like in traditional markets. A ripple in the larger economic waters can cause waves in crypto.

Cryptocurrencies can sometimes decouple from stock markets, offering an alternative investment avenue. This decoupling makes them attractive during periods of economic malaise, providing diversification for traditional portfolios.

Despite this, the path is not devoid of uncertainty. The high volatility of cryptocurrencies, combined with the lack of historical data like traditional stocks, means significant swings based on market perception and speculation.

Stay informed about global economic trends and how they might affect crypto prices. Understanding the relationships between financial markets can improve decision-making, mitigating risks and enhancing strategic planning for investments.

Guarding Against Sector Risks

In the dynamic world of cryptocurrency, security breaches and scams are prevalent threats to investors. Familiarizing yourself with these risks is vital to protecting your investments.

Hacks remain a constant threat, where attackers exploit vulnerabilities to access funds. Using reputable exchanges and wallets with high-end security measures will significantly reduce the chances of loss.

Scams in the crypto industry often manifest as enticing investment opportunities or fraudulent websites convincing users to connect their wallets. Keep a keen eye on domain authenticity and never share personal keys with any platform.

Pump and dump schemes, while more common in lesser-known coins, pose significant risks. Conduct thorough research into any cryptocurrency, ensuring it has legitimate usage and community support before committing funds.

Regulations also play a key role in shaping the crypto landscape. Awareness and adherence to changing legal frameworks can safeguard your investment while enticing institutional investors, potentially stabilizing the market.

Developing a risk management plan is crucial. This means diversifying your portfolio, setting stop-loss limits, and with cryptocurrencies, only investing what you are willing to lose. Keeping abreast of market and regulatory developments can provide an edge in making informed decisions.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you!

It has often been said that there is no better investment than your own financial education. One great way to accelerate your financial education and your investing success is with the American Association of Individual Investors, the AAII. When you join the AAII, you get access to reports, courses on investing, risk management, asset allocation, retirement planning, managing retirement finances, and other resources, all for a single annual membership fee.

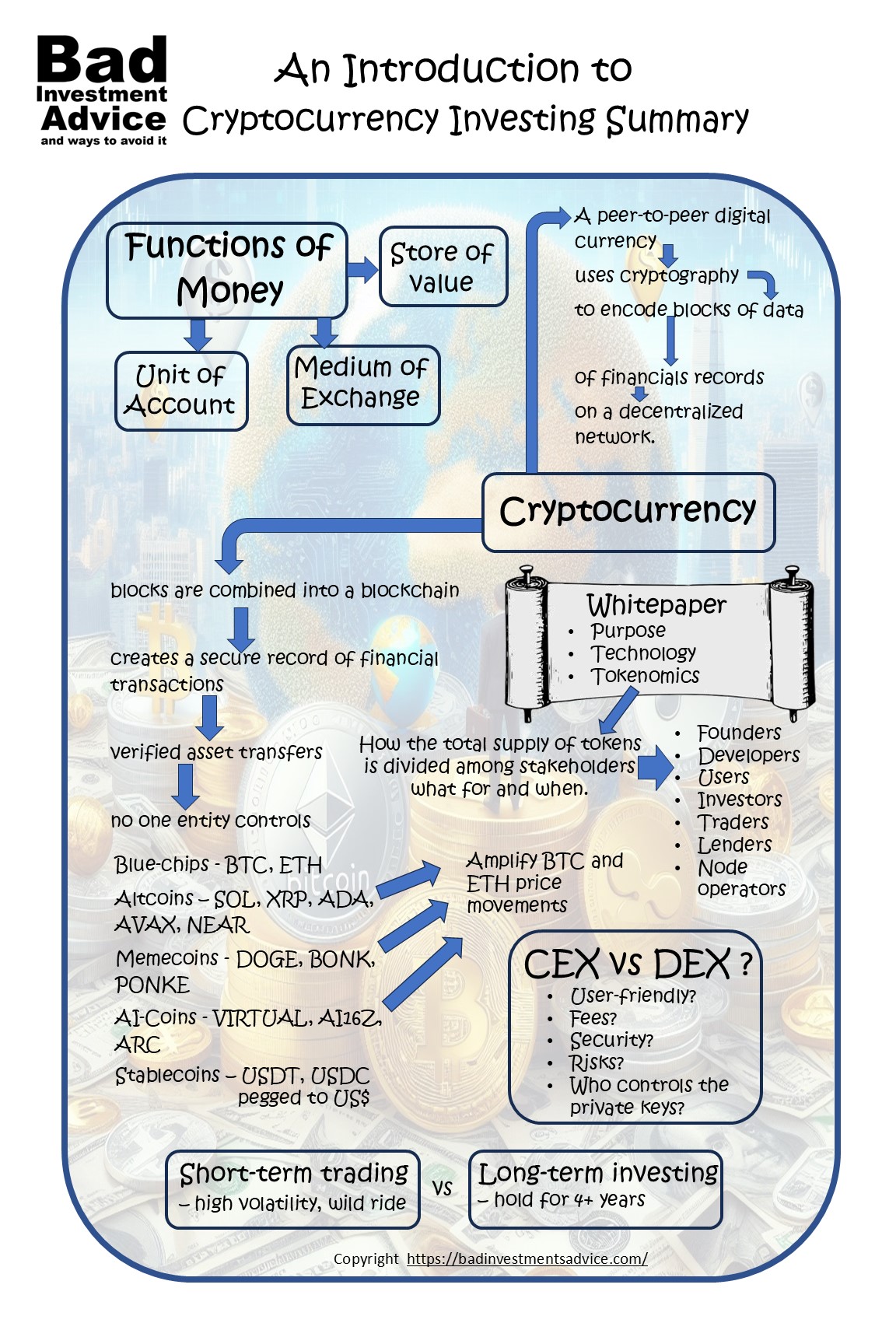

Single-page Summary

Here is a single-page summary of An Introduction to Cryptocurrency Investing. You can download a pdf here.

I hope you found this article interesting and useful. Do leave me a comment, a question, an opinion, or a suggestion and I will reply soonest. And if you are inclined to do me a favor, scroll down a bit and click on one of the social media buttons, and share it with your friends. They may just thank you for it.

You can also subscribe to email notifications. We will send you a short email when a new post is published.

Disclaimer: I am not a financial professional. All the information on this website and in this article is for information purposes only and should not be taken as personalized investment advice, good or bad. You should check with your financial advisor before making any investment decisions to ensure they are suitable for you.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you.

Hello Andy!

This was a great introduction to cryptocurrency! You did a fantastic job breaking down the basics in a way that’s easy to understand, especially for those who might feel overwhelmed by all the technical jargon. I really appreciate how you covered both the benefits and potential risks, giving a well-rounded perspective.

As crypto continues to evolve, do you think it will become a mainstream financial tool, or will it remain more of a niche investment? I’d love to hear your thoughts on where the industry is headed.

Angela M 🙂

Hi Angela and thanks for the comment. Cryptocurrencies have already acquired a reputation for being an alternative investment that is not correlated with either the stock market or the bond market. However, it would be easy of argue that this reputation is maybe no longer justified. Certainly in recent months crypto has followed the market up and down more closely than in previous years. There could be a number of reasons for this. One likely contributor is the kind of investor and trader attracted to Bitcoin and Ether ETFs. These ETFs gave an easy route to traditional investors and traders to take positions in Bitcoin and Ether. Those investors are more likely to buy and sell like they do other high risk stocks, options and futures. The same is likely to be happening with people to buy and sell cryptocurrencies directly either through a CEX or DEX. In other words more short term traders who a prone to follow general market sentiment. The counter theory is that cryptocurrencies are inherently less inflationary because in more cases their supply is limited, whereas governments who control fiat currencies can print their way out of debt. There are more complexities to this argument. One element is that the more money is printed, that money finds its way very quickly into hard i.e. scarce assets. Since we are entering a period of massive global monetary expansion this is likely to mean that the prices of gold and crypto blue-chips i.e. Bitcoin and Ether, will rise. We will see what happens. Thanks again for the very interesting question. Best regards Andy