Economic news headlines have been flashing Inflation Predictions 2021. When you think of everyday food and gas prices, there is an alarming story we are all witnessing as consumers.

However, the official story is – don’t worry, this is just a blip that will subside in a couple of years.

Then you look again and find the picture may not be so clear.

What have we all been experiencing

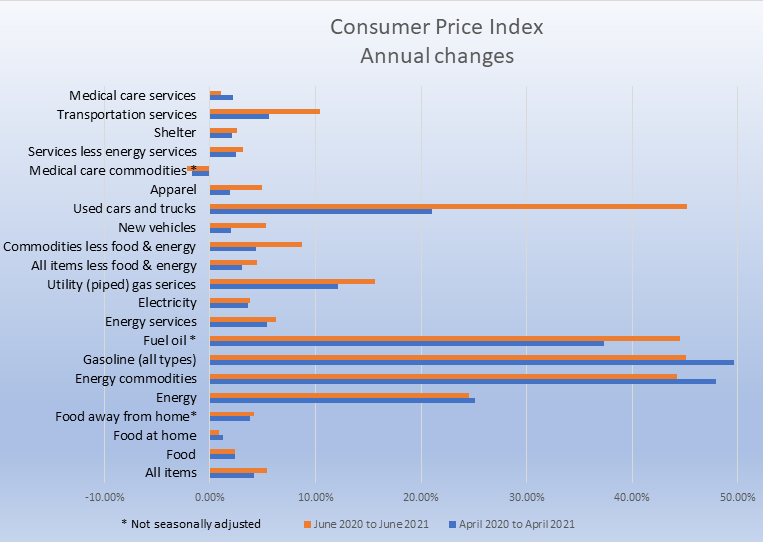

According to the US Bureau of Labor Statistics, 1)U.S. Bureau of Labor Statistics over the period from April 2020 to April 2021, the consumer price index, or the CPI rose by 4.2%.

That was bad enough. But the latest figures show the CPI has gone up by 5.4% from June 2020 to June 2021 mainly due to further increases in energy and used car prices.

Food prices

We all notice food price increases. Over the period April 2020 to April 2021,

- prices for food overall rose by 2.4%

- prices for food consumed at home rose by 1.2%

- prices for fruits and vegetables rose by 3.3%

- while prices for some kinds of foods rose by less than 1%

- prices for food consumed away from home rose by 3.8%

For the period June 2020 to June 2021, the overall food price increase was the same while there were minor differences within this category.

However, from January 2020 to April 2021 prices for food consumed at home rose by 4.8% and for food consumed away from home rose by 4.4%

Other items in the CPI basket made more dramatic moves.

Gas prices

We are so used to gas prices being on their own crazy ride, that we don’t necessarily make the link between gas prices and plain vanilla inflation. From April 2020 to April 2021, energy prices have been all over the place, but all are up.

- overall energy prices rose by 25.1%

- gas prices at the pump rose by 49.6%

- the price of natural gas rose by 12.1%

- the price of electricity rose by 3.6%

The year-on-year figures for June 2020 to June 2021 were slightly different mainly because of the price changes that already took place between April and June 2020.

Lumber

Though technically not part of the Consumer Price Index basket, after all, you tend not to see people wheeling carts around supermarkets with two-by-fours sticking out of the ends, lumber prices made the headlines. Again looking at the time window from April 2020 to April 2021, the prices of lumber rose by around 250%. According to the National Association of Homebuilders2)National Association of Homebuilders this added $24,000 to the price of a new home.

Real Estate

If we look at the trend in house prices, the US House Price Index rose by 12.6% from April 2020 to April 2021, 3)Federal Housing Finance Agency which is the highest 12-month increase since the index was started in 1975. Not only, but the previous record 12-month increase in this index was January 2020 to January 2021 increase of 10.9%.

This trend of accelerating increases has continued into May and June 2021. Historically, interest rates are low, there is a shortage of housing supply, and many buyers are flush with money saved during the COVID pandemic. All these factors are pushing house prices in the US higher at an increasing rate.

Used cars and trucks

One of the most dramatic increases has been seen in the prices of used cars and trucks over the three-month period of April, May, and June 2021. The net result is that the annual price increase for used cars and trucks from June 2020 to June 2021 cranked up to 45.2%. This was the largest 12-month increase for these items ever reported.

The rate of increase for new vehicles from June 2020 to June 2021 also climbed to 5.30%

Accelerating increases

I think when it comes down to it, none of us really pay much attention if inflation is going up annually by a steady percentage, especially when that steady percentage is low of say 2% or less. It is as if a gentle background increase gets emotionally baked into our economic expectations.

That steady background annual increase could equally well be 3% or even 4%. If that was the annual rate of increase and it stayed there for some years on end more or less constantly we would pay less attention.

But what it feels like we are all seeing is a sharper rate of increase. This increase is pretty much across the board while some elements of the consumer basket have increased by more and much more than others.

This may explain the emotional reaction many of us are having.

Other inflation measures

You may have heard or read that the Consumer Price Index isn’t the only measure of inflation experienced by consumers. Another measure often quoted is the Personal Consumption Expenditures Price Index or PCEPI published by the Bureau of Economic Analysis. In summary, the PCEPI is a broader index, in other words, it has more items in its basket. The CPI is used to adjust pension payments to veterans while the PCEPI is used to report the Gross Domestic Product or GDP.

There is a debate among economists as to how inflation should be measured and reported. Some favor an approach to the Consumer Price Index that reflects what is called a Cost of Goods Index, abbreviated to COGI. Others say that the basket of goods that make up the CPI should be rebalanced to reflect changing purchasing patterns. Cost of Living Index or COLI.

Without getting into the fine details, this is obviously an important question as governments will want to publish inflation figures that make them look good. Usually, this will mean publishing a figure that understates inflation or just paints a rosy picture.

One of the criticisms often leveled at the CPI is that the government frequently changes the way it is calculated and the composition of the basket.

So what’s the difference

We already said that the Consumer Price Index rose by 4.2% from April 2020 to April 2021. Over that same period the Personal Consumption Expenditures Price Index or the PCEPI rose by 3.6%4)Personal Consumption Expenditures Price Index Again, like the CPI, the PCEPI increase has been on an upward trend.

Both the CPI and the PCEPI have modified versions that exclude energy and food prices. With both of these other measures, the rates of increase are going up.

The official story looking ahead

OK, so that is the picture looking back at where inflation is and has been. Let’s summarize it in case anyone didn’t catch it.

By all the published statistics, inflation is rising. We are noticing this because inflation has been steadily low for a long time.

So where does inflation go from here?

We turn to the Federal Open Market Committee or FOMC of the Federal Reserve Banks for the official story. The FOMC basically said in its last public statement on 16 June 2021, that it will let inflation run and moderately above 2% a year, in fact at 3.4% in 2021 dropping to 2.1% in 2022 because it has been running at below 2% for some time now. What’s more, the Fed has not yet changed its position, even after the year on year CPI figures for June came out.

The Federal Reserve is saying that its long-term target for inflation remains at 2%. But because inflation has been running under that figure for some years, they can afford to let it run above the 2% benchmark for a while to enable the recovery from the economic impacts of COVID.

Other opinions

Many economists do not agree with the optimistic outlook of the Federal Reserve. Many think that inflation is likely to be worse.

Former Treasury Secretary, Larry Summers5)Could The Hot 2021 Inflation Rate Be The Next Big Lie? says we are fooling ourselves that inflation is going to come back down and that we should be looking ahead to times of economic overheating.

We also have evidence of our own eyes when we shop for everyday items. For example, apparel retailers have seen cotton prices increase by 34% and many are starting to use tactics such as bundling, resizing, or repackaging to disguise price increases to consumers.

Economist Steven Rattner,6)Too Many Smart People Are Being Too Dismissive of Inflation warns that too many government officials and other economists are too complacent about rising inflation. Commodities prices are up and that is a classic sign we are all heading for higher inflation.

Different scenarios

We can say that broadly speaking there are three, or perhaps four possible outcomes.

Firstly, if the Federal Reserve has got it right, we will see inflation go down in a matter of months and all will be hunky-dory again.

The second possible outcome is that other mainstream economists got it right, inflation will stay high but the financial systems and levers controlled by the Federal Reserve and by the Treasury will kick in and dampen the effects.

A third possible outcome is that more alarming inflation hits, the Federal Reserve adjusts interest rates and the Treasury adjusts the issuance of government debt but the markets don’t buy it. Wall Street takes a massive tumble and there is a domino effect that nobody knows how to stop.

I suppose you could say a fourth outcome is a mixture of the first three outcomes.

Hedges against inflation

How you deal with the probability or possibility of increasing inflation depends much on your perspective. There are certain asset classes that are classic hedges against inflation. These include gold, some other commodities, real estate, and Treasury Inflation-Protected Securities, or TIPS.

Some financial experts will also say that holding a diversified portfolio of stocks and bonds is a hedge against inflation. That is only going to be the case at certain stages of the economic cycle. Currently, stocks are at historically high values in relation to GDP and practically any other measure you care to think of. I think what that means is that economic pressures that will likely result in inflation are also prone to cause extended market downturns.

If you are looking to hedge with a basket of commodities then I would look for an Exchange-Traded Fund, or ETF that either gives you a broad range of commodities or a narrow range such as precious metals. Be aware though that commodities are volatile and we may already have seen much price inflation in commodities. So if you haven’t already taken this position, you may have missed at least some of the boat ride. This is probably the best online ETF database that will help you find suitable funds.

As we already noted real estate is another asset class that has seen big gains and the gains look set to continue. This article explains ways to invest in real estate.

Treasury Inflation-Protected Securities is another option. There are two simple ways to buy these. You can either buy them directly from the US Treasury TIPS can be bought for as little as $100 and you can choose between 5-year, 10-year, and 30-year maturities. If you prefer a more liquid way of holding TIPS there are ETFs that just invest in TIPS. This same online database of ETFs will lead you to suitable funds.

The classic inflation hedge – gold

The all-time classic hedge against inflation is gold.

If you think that inflation is going to significantly rise but the financial system will hold and will be able to manage it, then an easy approach to moving some of your portfolio into gold is to buy an ETF that tracks the gold price. The ETF with the symbol GLD achieves that.

However, if you are less than fully confident that the financial systems will be able to handle rising inflation, economic recession, and market crashes, holding physical gold could be right for you. There are a few ways to buy physical gold.

You can buy gold coins and either keep them in a safe place at home or in a bank vault.

Another approach that many are adopting, especially those who want to reap the benefits of pre-tax investing, is to buy physical gold through a self-directed IRA.

This article explains how self-directed IRAs work.

Affiliate Disclosure: This article contains affiliate links, if you purchase through a link on this site, I may receive a commission.

Questions and answers

Q. What will the CPI be for 2021?

A. The US Bureau of Labor Statistics expects the CPI to run at 3.4% for the 2021 calendar year.

Q. What is the projected inflation rate for 2022?

A. The CPI for 2022 is expected to drop back to around 2.1% according to the US Bureau of Labor Statistics.

Q. Will the stimulus cause inflation?

A. This is one of the most hotly debated economic issues today. Some argue that stimulus payments have a track record of having no impact on inflation. Others argue that the stimulus payments constitute trillions more dollars that will inevitably be chasing the same goods and services. I guess we will just have to wait and see what happens.

Single-page summary

Here is a single-page PDF summary of Inflation predictions 2021.

I hope you found this article interesting and useful. Do leave me a comment, a question, an opinion, or a suggestion and I will reply soonest. And if you are inclined to do me a favor, scroll down a bit and click on one of the social media buttons, and share it with your friends. They may just thank you for it.

You can also subscribe to email notifications. We will send you a short email when a new post is published.

Disclaimer: I am not a financial professional. All the information on this website and in this article is for information purposes only and should not be taken as personalized investment advice, good or bad. You should check with your financial advisor before making any investment decisions to ensure they are suitable for you.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you

Good day, I noted that you present the case for rising inflation and the case for inflation that will come under better control in 2022. You seem very careful not to say which one you think is more likely. Are inflation predictions something you need to be more cautious about than other economic or financial predictions? Thank you very much for sharing. Best wishes!

Hi and thanks for the comment and question. I wouldn’t necessarily say that inflation predictions are inherently less reliable than other economic predictions. One big difference is that governments certainly have a significant political interest in presenting inflation figures and predictions that put them in good standing for the next elections. I think what is particular about this time right now is that many eminent economists are lined up on either side of the argument. Usually, the experts more or less agree, and there are always going to be fringe opinions. Best regards, Andy

Thank you for this website, with all of the “gurus” flying around flaunting their Lamborghini’s, mansions, and expensive items people can fall into paying thousands for their course which don’t help at all and can make some people go broke just because they saw a Lamborghini and wanted to buy the course to be like their person with the lambo. And with people getting more and more into investing this is a great website to stay knowledgeable about bad advice.

Thanks, Mason

Hi and thanks for the comment. The phenomenon you are describing – flashy salesmen/women appearing with aggressive sales pitches is another of those classic signs that the market is reaching a topping phase and is set to crash. As you say many people are getting interested in investing for the first time, and pushy salespeople know that these first-time investors are easy targets, and flaunting wealth in front of them is one of the easiest ways to hook them in.

This article explains the market cycles and the rollercoaster of emotions that go along with boom-bust economics

.

Thanks again for the comment. Best regards, Andy

I don’t know, but almost everything gets more expensive as time goes by. Increasing food and gas prices are the most important. If you are into real estate, then the increased value of the property can actually be a good thing. I like that you include the idea of hedging, where you can use gold and real estate to hedge against inflation. In the end, it all depends on your personal outlook on it.

Hi and thanks for the comment. I agree that how we react depends to a great extent on our individual outlook. Of course, what will actually happen probably doesn’t care about our individual outlook. The markets will do what the markets will do. Best of luck and thanks again, Andy

this article is really helpful because of the awareness am getting now, things have really gone high food, gas, etc and the probability of price reduction is on the low side and this is an eye-opener because we all need to prepare for what is coming ahead of us. thanks for this eye-opener

Thanks for the comment. I am glad you found it useful.

Hello, Andy.

This is an excellent article! Due to the high rate of inflation in many areas, such as food prices, gas prices, and even real estate, where we are seeing higher prices in houses, now is the time to be more cautious when it comes to investment. Let’s only hope that the possibilities economists predict will be a game changer in the near future.

I need to pay attention to your upbuilding posts.

Hi Nsikan and thanks for the positive comments. I actually composed and posted the article with the available figures and a couple of days after posting, new even more alarming figures were published so I had to go back and update parts. The financial markets are very confusing places right now and inflation fears and inflation realities are some of the drivers of the current situation. Best regards, Andy

Well, it certainly sees like theyre piling the prices high now if thats the rate of inflation on bare essentials like food. Unfortunately I can see things getting a lot more expensive all round soon when the governments start pulling back in the money that the recent global Pandemic has cost them.

Hi and thanks for the comment. I agree, the issue really seems to be the impact of the unwinding of all the fiscal and economic measures governments have implemented to manage the pandemic. We might get a better handle on things in a year or so from now. We shall see. Best regards, Andy

This is a very good article on inflation. I realise that when we take just Consumer Price Index it is an index of only consumer goods, so this is not the complete impact in terms of impact on us. We need to consider asset price inflation in the respective cities we live in as well as others such as lumber if we are building a home. So your article clearly shows that CPI alone is not the full impact – gas prices, lumber, real estate prices can all have a large impact on people depending on where they live. Then there is stock prices too which have “inflated” arguably due to all the money printing.

What are your thoughts on Bitcoin or Ethereum as investments that are also a hedge against inflation?

Hi John and thanks for the comment. Yes, the CPI only gives part of the picture. There is also the Producer Price Index and just about every industry has its own inflation tracking index. As regards Bitcoin and Ethereum, I think it is worth keeping some exposure but I would expect a rough ride. I am not so sure these would be a hedge against inflation as the prices are still very sensitive to regulatory rumors and potentially restrictive actions of governments. But I think that if you buy in now at the slightly depressed prices from the recent April peaks, you will see some appreciation in prices over the next two or four years. So if that time frame works for you then I would agree that small positions would be worth it. Best regards, Andy

This is a very educational post on inflation and the predictions for inflation. I have certainly experienced the higher cost of food in my local supermarket. But to see the massive increase in petroleum and then lumber, is quite frightening, specially with the way it affects the house prices for new buyers.

I find it reassuring that you mention ETFs as a way to beat inflation, as I have several ETF funds spread across a basket of funds, and yes gold is also in my investment portfolio.

Hi, Line, and thanks for the comment. I agree that it is a good idea to have exposure to gold. The gold market may take a while to take off but I think it is inevitable that it will some time or other. Best regards, Andy

HI Andy. Thank you for another great post. Always learning something new from finance world when visiting your blog. Inflation predictions are not good, and just saving money on account make no sense now. Your advices and recommendations are very interesting, I will definitely look closer into possibilities of investing in gold.

Hi Cogito and thanks for the comment. Precious metals including gold have taken a hit in the markets in recent weeks. But I think the long-term case for a rise in the gold price is inevitable. Good luck and best regards, Andy

Inflation seems to be ahead. And we need to start taking action. I personally don’t like getting into gold. But there are still other options. I want to be careful too. There are bad options such as placing our hard earn cash into volatile segments that will quickly swipe out our money. I am glad I landed on your site. I need to learn as much as I can.

Hi Ann. I think the market is sending curious and seemingly conflicting signals right now. The major indexes are all gunning to new highs while the market breadth is thinning out in most sectors and industries. So it is really only a few very large-cap stocks that are carrying the headline indexes higher while most other stocks are on downtrends. On the other hand, US stocks are still the asset class with the highest velocity, i.e. above fixed interest, commodities, and currencies and within US stocks those that are showing the most strength are not the defensive stocks – but normally given all the other signals you would expect to see a flight into defensive stocks. I think this suggests that we are likely to see a market correction soon but the market will bounce right back with another V-shaped recovery. We shall see. Best regards, Andy