So you are looking around at investments, Forex trading, you think maybe you want to become the next Warren Buffet, albeit on a more modest scale perhaps. You are fishing, not phishing, around on the internet looking for the best advice you can find on how to invest money in the stock market.

Well, how about checking out what the masters of the market have to say.

Do the lessons change?

One of the first people to ask this question was a fund manager, author, and a regular contributor to the financial press, John Train who asked the most famous and successful investors around to describe their investment strategies.

I guess he thought that the lessons did change with circumstances as he felt the need to revise and reissue his book. He added new sections and interviewed yet other investment gurus who had emerged in intervening years, riding waves of success on new techniques or with new financial instruments.

Let’s remember that the period when John Train was doing his research, the 1970’s 80’s and 90’s saw significant infrastructural changes in the finance world including deregulation and electronic markets.

Mr. Train wrote a sequence of three books. The Money Masters published in 1980, The New Money Masters, 1994 and Money Masters of Our Time issued in 2000. My observation would be that the lessons or their application may have to change to suit circumstances but the principles behind those lessons remain unchanged.

A question of style

Now here’s the catch. There isn’t one simple list of investing rules specific enough to be practical, in other words, that you could use to go and build a portfolio or trade stocks, that would work for everyone.

Each investor will have their own goals, investment horizon, risk tolerance, and time available, and discipline or lack thereof to apply to the task.

We could say that at one extreme there is the long-term conservative risk-averse investor looking to steadily build a nest egg over a 30-year period, regularly and diligently squirreling away spare savings every month. At the other end of the scale, we can imagine an ambitious trader looking to trade short time horizons, willing to enter risky situations, and willing to learn how to use complex options strategies.

While the same investing principles may apply to both, it is unlikely the same set of lessons and rules is going to work well for each of them.

Different strategies

The investment masters follow several principle approaches to stock market investing, maybe each adding their own flavor.

Long term growth investing – build a portfolio of stocks that are set to grow. Periodically review each stock in the portfolio and as soon as its growth starts to slow or when it looks like it has reached its peak, liquidate that position and look for another growth stock.

Long-term value investing – this approach involves analyzing companies looking for those whose market price is below their intrinsic value. Build your portfolio with these value stocks and eventually, the market will come to its senses and the prices will rise. Monitor the price of each stock and as they approach the true value of the stock, sell and enter a position in other value stocks.

Neglected industries – this approach looks to build a portfolio of stocks in neglected industries and the intrinsic value exceeds the market value. It is a variant of value investing but industry-specific.

Contrarian investing – Bad news is often an excellent trigger to buy a stock. Even better if the bad news turns out to be false. The market tends to over-react to bad news. The reverse also holds true. The market will over-react to good news sending prices to excessive highs. Contrarian investing just tries to do whatever everyone else is not doing.

Outsource – find an investment expert and pay them to invest for you.

Note to self

Is this all? What about day trading, what about moving between asset classes that show the most promise. What about the sector, industry considerations adapted to market conditions. What about investing according to market cycles, in other words moving into different assets depending on whether the market is going up, going down, or sideways. It is also strange that there is no mention of income investing. These are all good questions.

Long-term Growth Investing

There are various issues with growth stocks that will make them riskier while they also offer the potential for more reward. Pity there is no such word as “rewardier”.

Growth stocks tend to have a higher price to earnings or P/E ratios than the rest of the market, you need to determine whether that premium is an over or underestimation of where the price should be.

OK, so this is tricky and involves some judgment. One technique is to project earnings growth into the future as compared with the current market P/E and make the assumption that at some point maybe five years out the P/E of a growth stock will converge to the P/E of the market. You set up a table of future earnings over that five-year period and then plug in a discount rate that will reduce those earnings to match the current market price. I tend to do these kinds of calculations by trial and error even though there are clever ways with fancy formulas.

Let’s say you calculate that you need to discount the future earnings by 12 percent to match the P/E of the current price, then 12 percent is the equivalent rate of return. You would have to be able to buy other stocks at a P/E of 8.3 to match that return. The P/E of the Standard and Poor’s 500 is around 15 or equivalent to a 6.67 percent return so that particular growth stock looks like a bargain, to put it mildly, all else being equal.

Another issue with growth stocks, as has been observed by many including the investment gurus interviewed in Money Masters of Our Time, is that they tend to tank when the market turns from bull to bear.

If you are going to adopt a growth investment strategy, then know the downside risks, monitor your stocks, and the market to get out before you hit the peak. You also need to control your emotions so you don’t panic and sell at the bottom either.

Long-term Value Investing

This is the domain of conservative institutions and for many good solid reasons. Institutions, in particular banks, have the resources to objectively and dispassionately analyze company financial’s in-depth. This is where they can get an edge on the private investor in their ability to uncover pockets of under-priced intrinsic value. If you are running a pension fund or mutual funds it is also reassuring to your investors to be able to report that you take the most meticulous care of their funds and only place them in high-value quality assets.

Trend Reversal Investing

This is an approach taken by some big names in investing. It involves looking at what is going on around you for major changes in industries, consumer products, infrastructure. Then working out which companies stand to gain from the change and hope you can get in before everyone else does.

Do Something Different

Many of the famous name successful investors made their reputations by doing something different from those who went before. What they did differently changed each time of course.

Short-term Active Investing

Contrary to popular conception, rapid turnover, short time horizon trading is the style of only a few investment masters. It is a very difficult approach to maintain successfully year after year. Also despite what financial advisers with high-pressure sales pitches for their subscription services want you to believe, it is a difficult approach for the private retail investor to pursue successfully and consistently.

The style and approach adopted by the short-term active investor contrasts starkly with the long-term approach, as explained below:

Short-term Active vs Long-term Investor

- Enter and exit trades rapidly vs Hold for the long-term

- Get in early vs Follow long-term trends

- Sell on signs of price drop vs Hold on during short-term corrections

- Sell when the price rises vs Hold as long as the company is solid

- Constantly seek new plays vs Stay with familiar value holdings

- Trade whatever works vs Buy only intrinsic value

- Pursue many areas vs Invest only in well-studied areas

- Stay flexible vs Stay disciplined

- Time trades carefully vs Buy over time

Stock analysts vs Market analysts

If I would point out one sobering observation of this study, it is that good stock analysts tend to be poor market analysts and good market analysts tend to be poor stock analysts. Oh, dear!

Does that mean if I want to become a stock whiz I should forget trying to acquire the skills to read and trade on the market and vice versa? It is a good question and one on which the experts do not agree. So, sorry but the jury is out on that one.

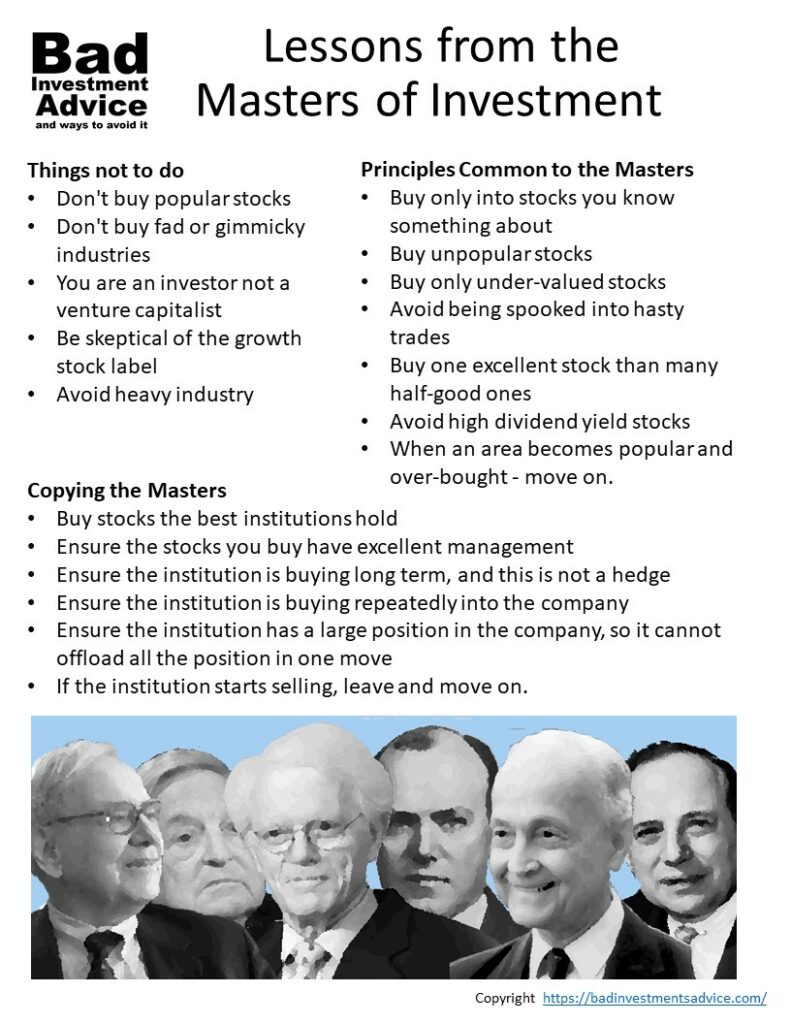

Principles Common to the Masters

- Buy only into stocks you know something about

- Buy unpopular stocks

- Buy only under-valued stocks

- Avoid being spooked into hasty trades

- Rather buy one excellent stock than a load of half-good ones

- Avoid high dividend yield stocks – good companies should be investing profits in more growth

- Be ready to move on when an area the rest of the market previously ignored becomes popular and broadly over-bought.

Copying the Masters

This is where the reporting requirements imposed on institutions can play into the hands of private investors. If you want to copy what a value fund is doing just build a portfolio from the stocks held in their published reports. Because timing is less of an issue with these kinds of assets getting the information a few months late shouldn’t hurt too much. We hope.

If you are going to adopt this approach, there are a few simple procedures to follow

- Ensure that the companies you are buying have excellent management

- Make sure that the institution is buying in for the long term, and that this is not part of some hedging strategy

- Make sure that the institution is buying repeatedly into the company

- Make sure the institution has a large position in the company, so it cannot offload all the position in one move

- If the institution starts selling, leave, and move on.

It is a good approach to adopt, but like all investment strategies, there are risks. Don’t forget that the institutional reporting requirements can mean that you will only see when a big institution is selling a position months after they start making those trades.

Things not to do

This is a list of things the investment master does not do, and we shouldn’t either.

- Don’t buy popular stocks

- Don’t buy fad or gimmicky industries

- As an investor you are not a venture capitalist – don’t try to be one

- Don’t believe that a growth stock really is a growth stock unless you can confirm it still has growth potential. Often stocks with a “growth” label are yesterday’s stars

- Avoid heavy industry unless you are sure of the right conditions

Buy Stocks vs Buy Funds

There are good reasons for buying funds rather than buying individual stocks. If you are starting small you can achieve diversification only by buying into a fund. But that does depend on the type of fund. Some funds are formed just to get on a bandwagon fad of some specific new industry or emerging market region. They may do well one year and poorly the next.

One way a small scale private investor can ensure mediocre results is to shop for the best performing funds and then switch to another best performing fund next year. That will guarantee you buy high and sell low and you will lose in the long run.

In the long run

I’m not going to quote John Maynard Keynes. The sad observation is that most portfolios like most fund managers underperform the market in the long run. The surest way to avoid that fate is to follow the advice and example of the masters.

To learn more about one of the all-time icons of investing, Benjamin Graham, check here.

This article contains affiliate links.

You can purchase a copy of Money Masters of our Time at Books-A-Million.

How to invest money in the stock market pdf download

How to invest money in the stock market pdf download

I hope you have enjoyed this excursion into the advice of the investment masters. Do leave me a comment, a question, an opinion or a suggestion and I will reply soonest. And if you are inclined to do me a favor, scroll down a bit and click on one of the social media buttons and share it with your friends. They may just thank you for it.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you!

Hi Andy,

This was a really useful and thoroughly researched post!

I consider my partner and myself as long term dividend stock investors.

Thanks for the handy summary at the end of your article. We’ll have a closer look at it in deciding which investments where going to make!

Kind regards,

Catherine

Hi Catherine and thanks for the comment. I added a downloadable single page PDF summary just a short while ago. I am glad you enjoyed the article. Kind regards, Andy

Great read. I never really thought about getting into investing in the stock market because of how risky it can be, but there are some great pointers here on what should be done if I were to get into a field like this.

I’ll keep this page bookmarked to refer to it later if I get interested in a field like this again.

Thank you for sharing!

-Joseph

Hi Joseph and thank you for the comment. The value of all assets is eroded by inflation unless they appreciate in value by more than the rate of inflation. Currently inflation may be low and with the economic downturn we are all going to experience inflationary pressures will be lower still. However, for years now real rates of return on savings accounts have been negative. So while stocks may be risky, in many respects just sitting on a pile of cash is a guaranteed way to lose money. Thanks again for your positive feedback and please do come back. Kind regards, Andy

Great tips!

I will be following your blog from now on. I am exploring the stock investment realm myself and documenting what I learn as I go.

Bye for now!

Hi Sonia

Thanks for your comment. I am glad you found it interesting and useful. I can’t take any credit for the substance of the tips – I am just repeating what 20th century icons of investment have said. I agree though it does make for interesting reading. I’ve bookmarked your site too and will return to follow up. Kind regards, Andy

I’ve been looking for a while for content that makes it easier for me to understand what to do and what not to do. I’m just a beginner and I’m trying to learn more about the area, but the internet is giving me a gazillion different opinions and I don’t know who’s right!

Thanks for the comment. That is indeed a dilemma. There are indeed a lot of divergence options being expressed. One important filter to apply would be whether the person expressing the opinion is trying to sell you something or not. Sadly many of the best seller books high up on Amazon when you look for stock market investing are written and vigorously promoted by authors whose main source of income seems to be running subscription investment advice services. The books are very often thinly veiled promotional material and often vastly over-hyped by what can only be fake reviews and ratings. I suggest that you check out the previous article here, in particular Money Masters of Our Time

https://badinvestmentsadvice.com/best-investment-analysis-books-and-some/#masters

Or if you prefer, scroll back up to a review of the Intelligent Investor by Benjamin Graham.

I hope this helps. Best regards, Andy

Thank you for explaining in a way that easy to understand.

Hi. Thanks for the comment. I am glad that you found the article easy to understand. Best regards, Andy

Hi Andy,

Thanks so much for the post. The information is definitely what I’m looking for. I’m going to download the pdf. And also check our those books because I prefer to read and learn instead of buying into the many scheme out there.

V/r

Hi and thanks for your comment. There are indeed many subscriptions schemes out there. Some may be valuable some are going to be questionable. What is common is that you will see more promotion of the winning advice and tips given and less of the losing advice. There is also honesty though. Broadly speaking there are two approaches – a passive approach of buying the market and an active approach of trying to select stocks. The honest truth is that it is difficult to achieve superior results through an active approach. Our best defense is information and investing discipline. Kind regards, Andy

Dear Andy,

Good post to share. I tried both funds and stock many years ago. What your post suggested is very helpful.

Hi Daisy

Thanks for your comment. Over many years of investing I have stuck with stocks. Only recently have I taken a position in a bond fund. Good luck and I am glad you found the article useful and interesting. Kind regards, Andy

Hi Andy,

Thanks again for over delivering in your post. You definitely have some great knowledge. I recently hired some help with investing in mutual funds. I think you said funds under deliver in your post. Did I read that correctly?

Thanks

Hi Greg

Thanks for the comment. No I would not say that funds under-deliver. There are many excellent funds which do provide superior performance. The issues are whether they will do that consistently every year and whether the costs of the fund outweigh the incremental performance they should be delivering over and above what a broad market index fund provides. Also the article is relaying what investment experts have said based on their experiences over many years. Professional financial advisers are equipped to give you advice that is tailored to your specific needs and circumstances. So you should have confidence that you are getting advice that is right for you.

I hope this clarifies.

Kind regards

Andy

What a very informative post about the stock market. I have to be honest, I do not know to much about stocks. I have always been to worried about the risks involved, but I have to say you make it sound pretty good.

I love all the helpful information you have here. Great job.

Maybe I will have to reconsider now that I know so much more.

Thanks for leaving this comment. There are of course risks in all kinds of investments. It is a particularly volatile time in the markets now and I would counsel anyone who is considering investing in stocks for the first time to be extra cautious. Not only does nobody really know whether the market is going up or down right now but nobody really knows by how much. So while gains are possible there are still probably many in the market right now who will hope to recuperate loses they sustained in late March. But it is definitely a good idea to keep informing yourself until you do feel you have the confidence and understanding to invested in a way that works for you. Best regards, Andy.

Hi Andy,

Thanks for your post. I have always been a bit confused regarding investing in the stock market, specially as an expat. Thankfully I came across a book called “Millionaire Expat: How To Build Wealth Living Overseas …”, which talks about investing in ETFs in the long term, so my partner and I are doing that. But I always try to keep educating myself more regarding stocks, so this post has been really helpful.

Hi Fernanda

That sounds like a very interesting read – thanks I will check that out. I moved between countries a number of times. I hope you don’t fall into traps I did ending up with little bits in different countries and incurring high exchange costs. I talk about my experiences here.

https://badinvestmentsadvice.com/what-is-tax-deferred-savings/

It is always good to inform yourself on this subject. So I hope you find the books in my list useful and engaging.

Kind regards

Andy

Hi Andy,

Thanks for this advice. As these days it hard to trust who to believe who not to because everything looks shiny on the surface.

You’ve provided us with a detailed advice. Much appreciated.

Many Thanks

Habib

Hi Habib

Indeed you are right. There is a great deal of hype on this subject – including many of the books on stock investing which have mysteriously found their way to the top of the best seller lists in Amazon which are just hard-sell vehicles for stock tip subscription services. That is one advantage of looking for investment advice from 10 or 20 years ago – the author is much less likely to be trying to sell you something. And as long as the lessons are still applicable – which they seem clearly to be – so much the better.

Kind regards

Andy

Great article. I have invested in the past, but have made some mistakes along the way. This time around I will look into this post for reference followed by research, so I will have a more broader mindset when it comes to investing.

Hi Joshua, I have also made many mistakes investing. Interestingly it has always been when I have strayed from the system I was trying to follow. That in itself is a very valuable lesson. Thanks for your positive comment. Good luck and kind regards, Andy

What is contrarian marketing?

Well there is already a clear definition of a contrarian investor and investment strategy. It really does involve doing what others are not doing and in many senses is just another way of saying to buy unpopular stocks. I don’t think I have heard the idea of contrarian marketing. But I could speculate that my site is one approach to contrarian marketing. I realized when I was looking at the stock investing niche that there were already many professionally run sites offering good solid investing advice, so I wondered what if I were to offer bad investment advice, labeling it as such so it was clear. Not that the advice offered by the great icons of investing in this article is anything like bad advice – quite the contrary. Maybe I should have made that clearer.

I suppose another definition of contrarian marketing could be to try not to sell something in the hope that people will be so fed up with hard-sell everywhere else they go that they will come to you for relief and then buy from you.

Or did I miss the point?

Very interesting and helpful information! I especially like the final sections, learning from the Masters.

Thanks for the comment and I am glad you found it interesting. Kind regards, Andy

Hello Andy,

This is an interesting and informative essay that deals with everything about stock market. A few years ago, I worked for one-year purchasing and selling shares of some companies in my country. But I found myself sitting in front of the laptop following the increase and decrease of the stock market. Finally, I decided to quit after I made some money because it is risky.

After reading your article, you make me very enthusiastic to go back. Moreover, I liked all your tips about the stock market

Have a great day,

Rania

Hi Rania

I think it is easy to get drawn into the idea that investing in stocks is tricky and takes a great deal of time and energy and constant attention. As the masters of investment so clearly say, that should not be and that is not the most productive and profitable approach. It is always best to have a system that is based on sound principles that is hopefully simple and straightforward to follow in a systematic way. I do think there are gems of wisdom to be learned from these iconic master of investment. It is just a question of whether we have the discipline and emotional fortitude to apply them and stick with them.

Thanks for taking the time to comment.

I wish you all success

Kind regards

Andy

Thank you for sharing this information in such a clear manner. I never considered what the difference between a stock and market analyst is, so I’ve learned something new today.

I definitely agree with the bad investment advice – some of this is cliche, but it’s astounding how many people simply jump ship if a stock goes in the red or if a friend tells them it’s good. Research is certainly key, otherwise the stock market is no more reliable than gambling.

Yes it is a very important distinction between stock research and research of the stock market. Much of the advice of the masters may sound like cliche but it is surprising how few of us take it seriously and follow it. It is easier to get sucked into ideas of hot stock stories and then as you say that becomes just more like casino gambling. Albeit without the flashing lights and ringing bells. Thanks for the comment. Best regards, Andy

You have a very good advice on stock though am currently not an investor in stocks, its very helpful and details.

I have one question though who is a venture capitalist?

Best wishes

Hi James. A venture capitalist is someone who invests in small start up usually privately owned businesses and usually provides additional assistance to bring a new company to success. It is a very risky area and venture capitalists expect that a high proportion of the ventures they invest in will not be successful and they will incur a total loss. This means that the few that do make it have to make it very big to compensate for all the other losses. There are also venture capital funds you can invest in as a private or retail investor. They are also often very risky. Thanks for the question and I hope this helps. Kind regards, Andy

Hi Andy,

I had been trying to learn more about my options in the stock market and which avenues would be the best for me. I was “green” when I started my research but now am getting a better grasp!

The tips and things to avoid are helpful as we look for a company to invest in.

For a beginner investor should I start with a low risk tong term investment or devote more time in finding short term higher value investments?

Hi Justin

thank you for the comment. If you really are beginning with investing and want to invest in stocks the simplest approach is to start with an Electronically Traded Fund, ETF that models a broad market index link the S&P500. SPY is such a fund. You will need an account with a broker and the best there would be to take an account with any of the large online brokers. A number of them have been reviewed here. I have an account with E*Trade for example. Many of these online brokers require no minimum balance and will charge zero commissions on stock trades so the barriers to entry and costs are low.

Here is an article that compares many of the main brokers.

I am not an affiliate of any of these by the way.

I hope this helps.

Best regards

Andy

There are some great points in your article. Have always been skeptical when it comes to the stock market but this post gives me much more confidence. Thank you

Thanks for your positive feedback. I am glad you found the article useful. Kind regards, Andy

Hi Andy,

I love how thorough your post is. It is not only informative but also educative as well, especially for people who are so new to stock markets or tradings but eager to learn about it more.

So, yesterday, my husband’s foster father advised us to start investing money for our daughter’s college fund. So, he contacted ETrade and managed to open an account. But then we have no clue of what to do next.

I have bookmarked your site for future reference.

Thanks a lot!

Ferra

Hi Ferra

For college savings I would look into 529 plans. I looked around on E*Trade and I couldn’t find that they offer 529 plans. As regards what to do now rather than try to build a stock portfolio in your case I would check out the E*Trade Core Portfolios. They can be started with a minimum balance of $500. These allow you to find a suitable fund to build savings for your daughter. The advantage is that E*Trade will lead you through a process to establish your goals and match a fund with your needs. They will manage the fund and you can make regular contributions. If Core Portfolios doesn’t work for you, in general if you are not sure what to do I would call E&Trade customer service and they will help you out.

Good luck

Andy

This is a great article. I agree with you about not buying short term stocks. I still don’t understand why I shouldn’t buy popular stocks, can you please explain this a little further for me?

Hi Catherine, the point that the masters of investment make on popular stocks is that the popularity drives the price up so by their very nature they have a tendency to be overpriced. Buying a popular stock is not like putting down money on a favorite horse to win a race. Because effectively popular stocks tend to be overpriced and therefore the profit potential can be handicapped. However, that isn’t to say that a popular stock doesn’t have fundamentals that indicate it is otherwise a good buy. It is a many faceted issue but a general rule that the research supports. I hope this clarifies. Best regards, Andy

Investing is something that has been on my todo list for the past decade but it just seems that I never have the time to educate myself. I know it’s a matter of prioritizing, but there’s always something that seems more urgent. I do put a little bit aside every month into some low risk investment products my bank offers because I know they are better than letting money sit on my account as the interest rates are minimal these days. I know this won’t result in fortunes but I guess it’s better than nothing. I also have two apartments I’m shortening the mortgage every month so I consider them as investing. Fortunately, my father has taken a keen interest in investing on his retirement and keeps educating me about the subject. He made some nice profit with the COVID vaccination companies simply by following news and their twitter feeds from all things.

Regular contributions into low risk investments over the long-term is actually one of the best ways to save and invest largely because you are more likely to stick with it and less likely to raid your nest egg. And building ownership in real estate has proved to be a solid investment over most economic periods. The COVID situation has indeed shifted the market in interesting ways. The industry sectors of biotech and healthcare are leading the bull market which followed the late March decline and look set to continue to rise. So if your father got in early on that rise, well done. Thanks for the comment and best regards, Andy

Very neat! It must have taken an enormous amount of research. I wonder what advice the heads of the top investment banks would be prepared to share? Might be interesting to compare.

Thanks for the comment. Many of the investment icons whose experience and advice is distilled into the lessons presented here worked at investment banks at least for some of their professional careers. One issue with the investment banks is the need to separate the trading and fund management area from the mergers and acquisitions and IPO intermediary area. So the question what would top investment banks say, you’d want to know whether you are hearing from the M&A and IPO wing, which is going to do all it can to market any new offering to ensure full subscription and reduce their own risk of being left holding unsold shares which could then drop in value, or whether you are hearing from the wing that trades on its own account and manages funds. Either way, these are the big boys and gals so you will always have to ask yourself whether what you are hearing is really for the benefit of the small investor, or to preserve the profitability of a small privileged club. Sorry to get all conspiratorial but it is always something to bear in mind. Thanks for the positive comment and interesting question. Best regards, Andy

Thanks Andy, for your post. There’s a lot to digest here.

My husband and I have tried various techniques over our lifetime, and just when things were finally rebounding after the last couple of market crashes, COVID hit. Needless to say, our investments are in the tank.

Whether or not we can recover enough to retire on, I don’t know. It’s so disappointing.

Sometimes I wish I put all our money under the mattress, LOL.

Thanks again,

Suzanne

Hi Suzanne

Many of us have had similar experiences. However, the bottom of a bear market is the worse possible place to sell out. With all the monetary easing that the Fed is doing, I think we will see more money sloshing around and probably big price movements.

Thanks for the comment

Best regards

Andy