Are savings bonds worth buying? My granddad certainly thought so.

Like many of his generation, his life was molded by powerful historic events, and that is an understatement.

I am often humbled by thoughts of what my grandparents lived through and experienced. Here are just some of what they saw:

Pomp and ceremony

They were both born when Queen Victoria was still on the throne. Not that they met her I’m sure. They probably never even got a glimpse except perhaps of the funeral procession.

That means they grew up infused with all that imperial pride and sense of place.

Not only on whatever rung of the social ladder they occupied or thought they occupied but also their place in the world of peoples.

And I know they viewed people from other countries with suspicion, fear, and disdain.

Seismic events

A few years ago my mother gave me the collection of love letters my grandparents had exchanged as fiancees when he was sent to Palestine as a soldier in World War I. There is something endearing and delightfully innocent about it all. I cringe though, reading his jingoistic comments about the strange and foreign peoples he encountered.

That also means they lived through the 1918 flu pandemic. The stock market crash of 1929 and the depression of the 1930s. I remember my mother telling me how when their father lost his job, to drive it home the first slice of bread they all ate at the meal table that evening had nothing on it. No butter, no jam. At least they still had food to eat.

He was a resourceful chap and found another job shortly after. Then there was World War II. They lived in London. He worked in a munitions’ arsenal so he wasn’t sent off to fight. My uncles were though. He, his wife and daughters lived through the blitz, growing vegetables in their back garden where he built an air-raid shelter.

The list of the inventions they both witnessed is impressive: Automobiles, aircraft, radio, television, atomic power, and the bomb. Man landing on the moon, the electronics and computing industry.

What they learned

What has all that got to do with savings bonds?

Of all those experiences that marked them the most, I am sure it was the great depression. I suppose that was also because my mother remembers it so vividly as she had her most impressionable childhood years through that period.

I remember her showing us photos of family members who had died of poison gas in World War I but no mention of the 1918 flu pandemic.

One of the lessons my granddad took to heart from the 1929 stock market crash and the great depression was:

Bonds = good!

Stocks = bad!

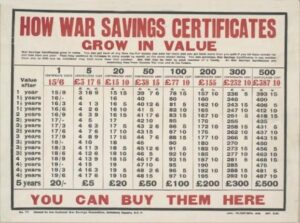

And not just any old bonds but high grade, guaranteed, protected and assured, belt and braces government bonds.

In his mind, the stock market was a place for gamblers. Newspapers of that time told stories of high-living market speculators ending it all with a bullet to the temple, hard-working people losing their savings, previously well-heeled families being turned out onto the streets.

He understood the value and need to build personal wealth but the only vehicles he used were government bonds and building society savings accounts. Building societies are common in the UK. Being a saver with a  building society puts you ahead in the line for a mortgage loan so you can see the attraction in a time when credit was much harder to come by for the common folk.

building society puts you ahead in the line for a mortgage loan so you can see the attraction in a time when credit was much harder to come by for the common folk.

Stocks vs Bonds

What may have been true during the great depression of the 1930s didn’t hold water in the decades that followed.

It is now clear with the wisdom of hindsight that my granddad’s quasi-religious shunning of stocks and promotion of bonds constitutes a piece of classic Bad Investment Advice. And he was a powerful figure when I was growing up. Following granddad’s advice was seen as a duty.

The Savings Certificate

This must have been 1976. With a small ceremony and flourish characteristic of my grandmother, then in her late 80s, she presented me with a savings certificate that had been left for me by my grandfather.

This was of course all out of an abundance of generosity and with the very best intentions. Thinking back, he must have bought savings certificates for all his grandchildren at about the same time in 1961.

These were 15-year certificates and I remember the certificate showed a face value of 5 pounds and the purchase value of 3 pounds 15 shillings which was the same as 3.75 pounds before decimalization which happened in 1971.

These were 15-year certificates and I remember the certificate showed a face value of 5 pounds and the purchase value of 3 pounds 15 shillings which was the same as 3.75 pounds before decimalization which happened in 1971.

You may not know this if you didn’t live through the 1970s. OPEC, the Organization of Petroleum Exporting Countries decided to squeeze the oil supply driving prices up. The US and all western European economies were completely dependent on oil. Prices shot up, there were shortages and lines at the gas pumps. Industries were put on shorter working weeks and there was a lot of belt-tightening. For more on the 1973 OPEC oil crisis check here.

One of the economic consequences was:

Rampant inflation.

This meant that the 5 pounds maturity value of the savings certificate was actually worth only 1 pound 8 shillings and 9 pence halfpenny or 1 pound 44 pence in decimal money because of the inflation in the intervening years.

Had the transaction taken place in 1961 it would be like my granddad swapped 3 pounds 75 pence for 1 pound 44 pence. Not a good trade.

This may all sound like ancient history here.

But this savings certificate was indicative of an ingrained pattern. Because of his experience of the great depression of the 1930s my  granddad had built all his savings with government bonds and interest-bearing savings account.

granddad had built all his savings with government bonds and interest-bearing savings account.

That was probably a good move in the 1940s and 1950s but when inflation kicked in he lost heavily.

The wisdom of hindsight

This experience with the savings certificate stuck in my memory and got me thinking about how my granddad had built his financial security over the years.

I remember as a teenager going to stay with my grandparents for a week during an Easter break. They still lived in the house in South London where my mother had grown up during World War II. He still had the air raid shelter long ago converted into a photography darkroom. He was an avid photographer and as was often the case back then, developing your own negatives and prints was common.

There was a comment my grandma made one day that stuck with me. He’d got up from the meal table and just left his plate behind. We were all expected to clean up after ourselves and my expression must have registered. She said to me

“Oh, let him. He’s worked hard all his life.”

And I’m sure he did.

And I’m sure he did.

I can’t piece together the story of his savings and how it had all come and gone. But of one thing I am sure. He would have lost heavily during the rampant inflation of the 1960s and ’70s.

Stuck as he was in government bonds and savings accounts and no stocks he would have missed the bull markets. And there were long periods when he was saving when returns on bonds did not keep pace with inflation.

But he stuck with his strategy and there is still much to admire in the lessons I learned from my grandfather – including discipline and consistency in investing. And after all, who knows what economic lessons we will be forced to learn from the economic turmoil that is still unfolding. For more on that thought check here.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you!

Hi Andy,

a very good read indeed, I love the dedication your grandad had towards trying to set himself, and his loved ones up for the future, even if he was unsuccesful in doing so, I feel this story has still taught yourself and the people reading this a valuable lesson. So, you could say he provided plenty of value with this story after all.

Thanks for a good read again, and all the best.

Thanks for the comment Robert. Of course a short article can hardly do justice to a life. He was an interesting character in many ways and quite a pillar of respectability and authority in his social circles. My mother always said I had inherited some of his traits – especially a hankering for tinkering with mechanical and electrical things. I’m sure he was an influence in more ways than I am aware of. Thanks again and best regards, Andy

I enjoyed reading your post. Your grandad certainly was a hardworking and caring man, and it’s obvious he loved his family very much However, his decision to invest in saving bonds was probably right for that time, even though it proved unsuccessful.

Hi Kathy, Indeed he was the central family figure that in many ways dominated my childhood memories even though I only saw him maybe a few times a year. When he passed away I was still a teenager and it left a hole in our extended family that was really never filled. Even though his investments may not all have turned out for the better he did manage to save to give him and our grandma a comfortable retirement. It was maybe more a question of missed opportunities. Thanks for the comment and best regards, Andy

Hi Andy,

Reading through your article, it is as if we were living through the years and the various historical events during those times. Guess the stock market was not that popular or sophisticated during those times and the fixed income instruments provided more attraction and safety. Might likewise be a case of investing within their level of risk aversion. What comes out of this, though, is that your investment strategy has to be attuned to the times and consistent with the risk profile you are willing to take in exchange for your target return.

Thank you for sharing and all the best.

I agree with you that our risk tolerance is shaped very much by our life experiences. My granddad’s conservative approach is also a factor of the times that remembered company failures leaving investors penniless in the previous century. Another significant factor was that investing in government securities was a patriotic duty during wartime. Thanks for the comment. Best regards, Andy

Andy, many just haven’t a clue just what it must have been like growing up through those years. Hard times for many!

Always a risky decision when it comes to investments and it doesn’t help matters when everything is controlled and dictated by the FED. A privately-owned bank that is beyond the law and was behind the great depression?

Your grandparents witnessed so many changes in their lifetime and the back-bone of society that we owe so much to.

Thank you for sharing your family experience.

Mick

Thanks for your kind comments Mick. As times go by I appreciate more and more the scope and breadth of his legacy. Even the photo I used in my about me page is a print he made from a photo he took and developed in his darkroom that had been the air raid shelter at the bottom of the garden. All the best, Andy

That’s pretty cool how your own history is part of this article and the history of how bonds came to be. Great article!

Thanks Duni. I realize after writing that piece just how much it all meant to me. It started out as an observation on a technical issue, but of course the family history aspect almost took over. Thanks for your positive feedback. Kind regards, Andy

This was fascinating, Andy (even to someone who knows less than nothing about investments) – and really well written, if you don’t mind my saying.

Thank you Sir! Your encouragement is most humbly received. It was only in writing this that I realized just how personal the story really was. A genuine experience of the potential therapeutic nature of writing. I still have a propensity for long complicated sentences where shorter ones will do. I think it comes down to more rigorous editing and trying not to click publish immediately after the first spell check and read through.