Understanding the Landscape of Fake Investment Opportunities

Fraudulent investment schemes have been around for centuries, preying on the uninformed, the overly trusting, and those eager for high returns. These scams thrive because they exploit human psychology, particularly the desire to achieve financial success quickly and with minimal effort.

Scammers use deception, persuasive tactics, and fake credibility to lure unsuspecting investors. They often take advantage of economic downturns, technological advancements, and social trends to make their schemes appear legitimate. Investment frauds vary, from Ponzi schemes and pump-and-dump scams to fake cryptocurrencies and offshore investment frauds. While the nature of these scams may differ, they often share common characteristics, making it possible to identify them if you know what to look for.

The psychological appeal of “get-rich-quick” scams is powerful. Many people want to believe that they have found a shortcut to financial success. Scammers exploit this by creating an illusion of exclusivity, urgency, and legitimacy. Understanding these tactics is the first step in protecting yourself from falling victim to fraudulent investment opportunities.

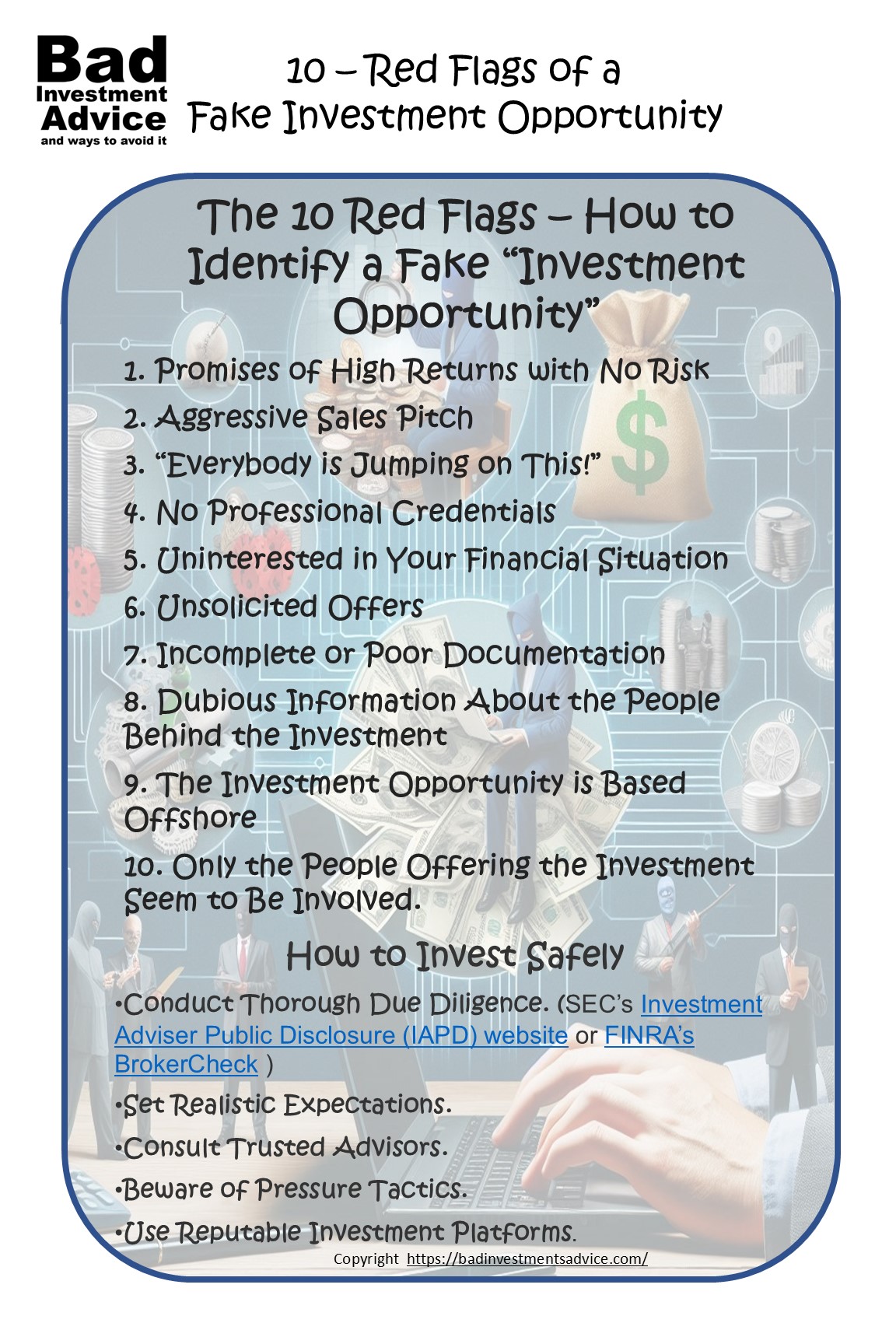

The 10 Red Flags of Fake Investment Opportunities

1. Promises of High Returns with No Risk

A fundamental rule of investing is that risk and return go hand in hand. If someone claims that an investment can deliver high returns without any risk, it is almost certainly a scam. Legitimate investments come with inherent risks, whether from market fluctuations, business performance, or external economic factors. Scammers will often downplay or entirely dismiss risks to lure in potential investors.

2. Aggressive Sales Pitch

Fraudsters frequently employ aggressive marketing tactics to create a sense of urgency. They may claim that an opportunity is time-sensitive or that only a few spots remain. This pressure discourages due diligence and critical thinking. A legitimate financial advisor or investment professional will never rush you into a decision or discourage you from conducting independent research.

3. “Everybody is Jumping on This!”

Scammers will often try to convince potential investors that their opportunity is already widely accepted. They may name-drop celebrities, influencers, or successful entrepreneurs who have supposedly invested. In many cases, these claims are entirely false, or the mentioned individuals have no knowledge of the scheme. Always verify such claims before making any commitments.

4. No Professional Credentials

Reputable investment professionals are required to have proper licensing and certification. Scammers either lack these credentials or provide fraudulent ones. Always verify the background of anyone offering an investment opportunity by checking with regulatory bodies such as the Financial Industry Regulatory Authority (FINRA). FINRA maintains a list of registered brokers, both individuals and firms. To look up registered investments of various kinds, the Securities and Exchange Commission (SEC) offers and online search.

5. Uninterested in Your Financial Situation

A legitimate financial professional will assess your financial goals, risk tolerance, and investment knowledge before making recommendations. If someone is pushing an investment without asking about your financial situation or goals, it is a red flag that they are more interested in getting your money than helping you make informed decisions. Here is an article that will help you understand your own risk tolerance.

6. Unsolicited Offers

If you receive an unexpected investment opportunity via email, social media, or phone, be cautious. Scammers often reach out to potential victims at random, hoping to lure them in. A genuine investment opportunity is rarely advertised through cold calls or mass emails. Be especially wary of individuals who attempt to befriend you online and quickly transition the conversation to investing.

7. Incomplete or Poor Documentation

Investment offers should always come with well-documented materials, such as a prospectus or detailed business plan. Fraudulent schemes often provide vague, incomplete, or even nonsensical documentation. If an investment document lacks transparency, is filled with generic language, or appears copied from other sources, treat it as a warning sign.

8. Dubious Information About the People Behind the Investment

Scammers often use fake identities or provide little information about the people behind the investment. A lack of verifiable details about the company’s leadership, office locations, or history is a significant red flag. A quick online search can reveal whether these individuals have been linked to past fraudulent activities.

9. The Investment Opportunity is Based Offshore

Many fraudulent schemes operate from offshore locations to avoid legal consequences. While not all offshore investments are scams, they often pose additional risks due to a lack of oversight and difficulty in recourse. If an investment requires sending money to a foreign account or is based in a country with loose financial regulations, exercise extreme caution.

10. Only the People Offering the Investment Seem to Be Involved

Legitimate investments typically involve reputable third parties, such as banks, law firms, and accountants. If an investment seems to operate in isolation, with no visible support from established institutions, it is likely a scam. The absence of reputable partners suggests a lack of credibility and regulatory oversight.

Spotting Unlicensed and Fake Professionals

To avoid falling victim to fraud, always verify the credentials of the person offering the investment. Here are steps you can take:

- Check Regulatory Bodies: Use resources such as the SEC’s Investment Adviser Public Disclosure (IAPD) website or FINRA’s BrokerCheck to verify if an individual is licensed.

- Investigate Their Background: Conduct a simple online search, looking for past complaints, lawsuits, or negative reviews.

- Confirm Affiliations: Fraudsters often claim to work for well-known firms. Call the firm directly to confirm the individual’s employment status.

Dealing with unlicensed agents exposes you to financial loss and legal difficulties. Many victims of investment fraud find it challenging to recover their money since the perpetrators often operate outside of regulatory jurisdictions.

Evaluating Pitches That Seem ‘Too Good To Be True’

Investment frauds rely on making their schemes appear extraordinarily lucrative. Here’s how to recognize exaggerated claims:

- Risk-Free Guarantees: There is no such thing as a risk-free investment. Even U.S. Treasury bonds, among the safest investments, carry inflation and interest rate risks.

- Excessive Profit Projections: If the projected returns are significantly higher than traditional investments, be skeptical.

- “Everyone is Buying It” Claims: Scammers use social proof to manipulate investors. Do not take such statements at face value—verify them independently.

Safe Investment Practices: Securing Your Financial Future

Protecting yourself from fraudulent investments requires diligence, skepticism, and informed decision-making. Here are steps to follow:

- Conduct Thorough Due Diligence: Research the investment opportunity, verify claims, and seek independent opinions.

- Set Realistic Expectations: High returns come with high risks. Avoid investments promising excessive returns with little downside.

- Consult Trusted Advisors: Seek guidance from a certified financial planner or investment advisor before making significant financial commitments.

- Beware of Pressure Tactics: Legitimate investment opportunities will not force you into rushed decisions.

- Use Reputable Investment Platforms: Stick to well-known brokerages and financial institutions for investing.

By following these principles, you can significantly reduce the risk of falling victim to fraudulent investment schemes and ensure a more secure financial future. Always remember: if an investment sounds too good to be true, it probably is.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you!

It has often been said that there is no better investment than your own financial education. One great way to accelerate your financial education and your investing success is with the American Association of Individual Investors, the AAII. When you join the AAII, you get access to reports, courses on investing, risk management, asset allocation, retirement planning, managing retirement finances, and other resources, all for a single annual membership fee.

Here is a single-page summary of the 10 red flags – how to spot a fake investment opportunity. You can download a pdf here.

I hope you found this article interesting and useful. Do leave me a comment, a question, an opinion, or a suggestion and I will reply soonest. And if you are inclined to do me a favor, scroll down a bit and click on one of the social media buttons, and share it with your friends. They may just thank you for it.

You can also subscribe to email notifications. We will send you a short email when a new post is published.

Disclaimer: I am not a financial professional. All the information on this website and in this article is for information purposes only and should not be taken as personalized investment advice, good or bad. You should check with your financial advisor before making any investment decisions to ensure they are suitable for you.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you

Fraudulent investment schemes have been a persistent issue, and this article does an excellent job of highlighting the common red flags. I’ve personally encountered aggressive sales pitches and unsolicited investment offers that seemed too good to be true. Fortunately, I took the time to research and avoided falling victim. In my opinion, financial education is the best defense against these scams. People should always verify credentials, be skeptical of “risk-free” guarantees, and consult professionals before making investment decisions. The more informed you are, the less likely you’ll be tricked by these deceptive tactics.

Hi and thanks for taking the time to read this and comment. I think you hit the nail on the head. Being informed, checking credentials, taking professional advice and conducting due diligence are the best ways to protect yourself. And always remember, scammers and fraudsters will be constantly creating new ways to dress up old scams.

This article is such a wake-up call! It’s surprisingly easy to get swept up in the hype of a “too-good-to-be-true” investment pitch, especially when it promises guaranteed returns. I really appreciate how you broke down each red flag in a way that’s simple to understand. Now I feel much more prepared to spot a scam from a mile away. The practical tips and real-world examples make it clear what to look out for and hopefully save others from losing money. Great piece!

Thanks for your comments. I think of all the red flags it may well be the sense of urgency that scammers use is often the most effective. After all, regular advertiser use the same tactic. The sad fact is it is easy for anyone to fall for a scam. We all have to remind ourselves of the red flags and stay vigilant.

Excellent piece, old chum! It’s too easy to think one will never fall for the oh-so-obvious slimy conman; we all can. i guess there’s something in the old maxim that if something seems to good to be true, it probably is.

That old maxim is very true indeed. The ability of scammers to invest new guises for the old tricks knows no bounds.