Blockchain is basically like a digital ledger that’s shared across a network. Imagine a record book that everyone can see, but no single person controls. That’s blockchain – a system that keeps data in blocks, secured and linked together, forming a lengthy, secure chain.

At its core, blockchain works as a secure, reliable store of information because it is maintained on a decentralized network. You know how normally a bank keeps track of all your transactions? Well, with blockchain, everyone who is part of the network has their own copy of that record, and they all work together to confirm any new additions to it. This makes it very hard for anyone to cheat or hack the system.

What’s the buzz all about then? Blockchain has huge potential in transforming how we do things online. It’s being used to secure cryptocurrencies like Bitcoin, but it doesn’t stop there. The technology is revolutionizing industries like supply chain and healthcare by making systems faster, cheaper, and safer.

So what’s the main job of blockchain technology? At its essence, it aims to build a world where transactions can be made without needing a middleman, cutting out extra costs and inefficiencies. Imagine solving complex problems like identity verification or cross-border payments with just a few clicks and with high security.

Take the example of Bitcoin. It’s perhaps the most famous use of blockchain. Bitcoin transactions are recorded on the blockchain, making it possible to buy and sell securely without needing to go through a bank. It’s an open ledger that anyone can access, yet it remains secure and trusted by the community.

Breaking Down the Complex: Making Blockchain Understandable

Getting a grip on blockchain might seem like cracking a tough nut, but leveraging some simple analogies can help. Think of blockchain like a Google Doc shared among many people. Any changes made are visible to everyone, and no single person can alter the document without others noticing. That shared, open quality is what enhances trust within blockchain systems.

Trust vs Trustless

You will often hear blockchains referred to as trustless. The term is used to contrast blockchain systems with traditional systems such as banking, insurance or stock, bond or commodity markets that rely on a trusted middleman as a go-between for buyers and sellers. Traditional systems are often also regulated by a central authority.

These traditional systems can only work if the middleman is trusted by the other two parties wishing to transact, In contrast, blockchain systems can be trusted by buyers and sellers because they trust in the security and transparency of the blockchain and need neither a middleman nor a central regulating authority.

Permissioned vs Permissionless.

One of the consequences of blockchains that operate without a central regulating authority is that anyone who can access the network can access and use the blockchain. This is a typical characteristic of public blockchains like the large majority of cryptocurrencies and is referred to as permissionless blockchains. In contrast, other non-public blockchains often require users to be approved and are referred to as permissioned blockchains.

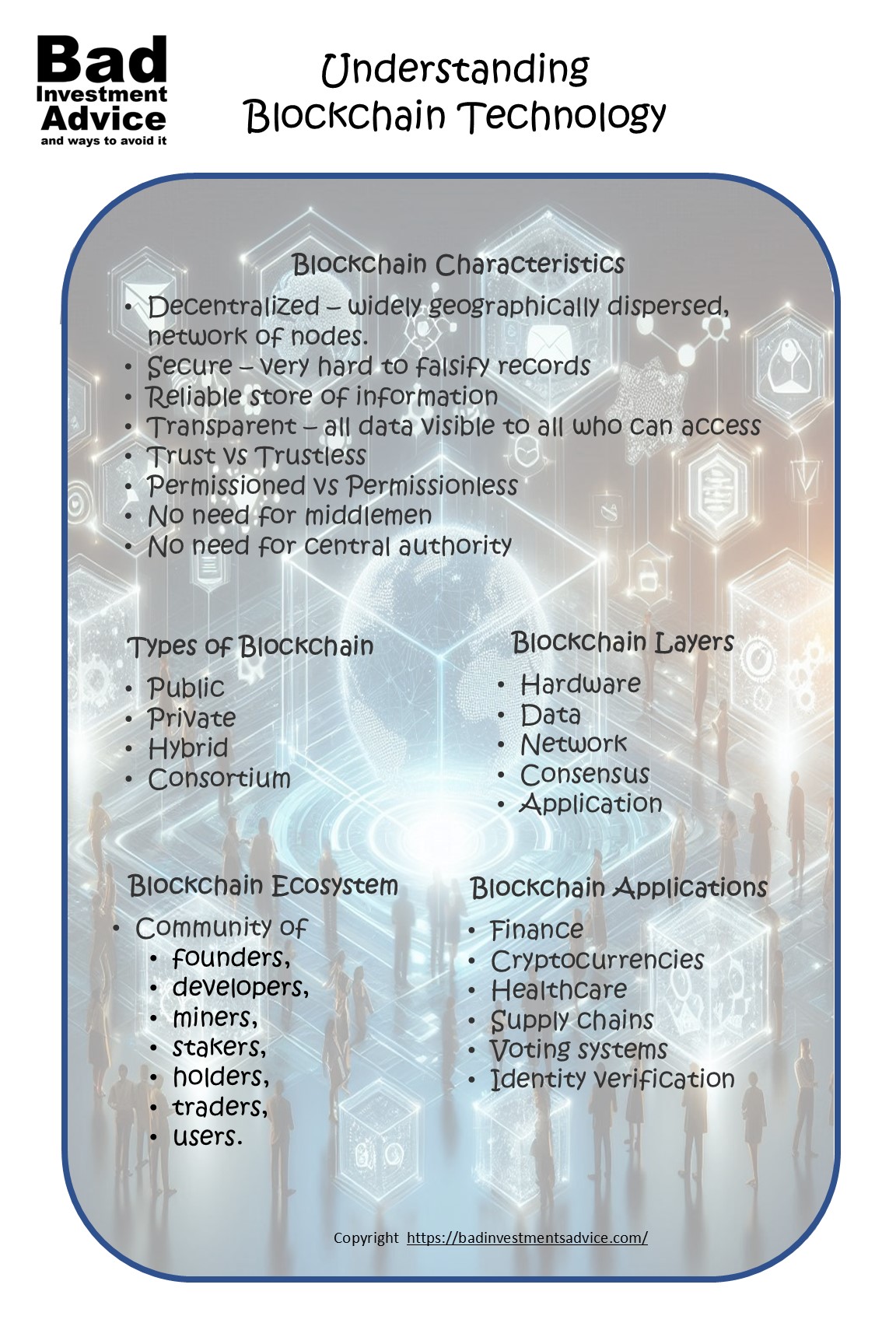

Blockchain Ecosystems.

Another term you might hear banded about is a blockchain ecosystem. A blockchain ecosystem is a term that encompasses the community of individuals and entities who contribute to maintaining, updating or modifying and using a particular blockchain, and its vision, philosophy, principles, rules and regulations. These individuals and entities include: founders, developers, miners, stakers, holders, traders and users.

Understanding blockchain’s foundation rests on decentralized networks, where control isn’t locked in the hands of a few powerful players. By distributing data across a large number of nodes, which are preferably widely geographically dispersed, blockchain enhances security and reliability. When everyone in the network shares the responsibility for maintaining and updating the ledger, tampering becomes near impossible, promising greater security and transparency.

The technical jargon can often make blockchain feel out of reach, but simplifying the terms helps. Smart contracts, for instance, are just programs stored on the blockchain that automatically execute actions when certain conditions are met. They’re like vending machines for legal contracts – insert conditions, and outcomes are delivered automatically when terms are satisfied.

Many people think blockchain is the same as Bitcoin or just about cryptocurrencies, but that’s not the full picture. While Bitcoin is a popular application of blockchain, this technology can be the backbone for various other systems like supply chains, digital identity, and even voting systems, highlighting its diverse applications beyond just cryptocurrency. Here is another article about investing in cryptocurrencies.

Transformation of opaque data into something comprehensible can dissolve common myths about blockchain. Just because something is complex doesn’t mean it’s incomprehensible. Approach blockchain step-by-step, and it slowly becomes a versatile tool that many industries will rely on in the coming years.

Diverse Landscapes: Types and Layers of Blockchain

Blockchain technology isn’t a one-size-fits-all. It comes in different forms, each serving unique purposes.

Four types:

- Public blockchains are open to everyone. Anyone can join and conduct transactions, making systems like Bitcoin and Ethereum decentralized and transparent.

- Private blockchains are where only certain participants can make changes. These are typically used by businesses that want the benefits of blockchain but need to control who can access the data, keeping it secure within the organization.

- Hybrid blockchains, provide the best of both worlds. These combine features of public and private blockchains, allowing specific data to be public while keeping sensitive information secure, providing versatility for businesses in sectors like finance that need both public accessibility and internal security.

- Consortium blockchains have multiple organizations managing it, rather than just one. This type is common in sectors needing collective decisions, like banking, where transparency among institutions is crucial but public exposure is not necessary.

Five Layers:

- Hardware

- Data

- Network

- Consensus

- Application

Each type of blockchain operates within a multi-layered architecture. The five layers – hardware, data, network, consensus, and application – come together to form the backbone of any blockchain system. Each layer plays a critical role, requiring seamless operation to ensure the system is efficient and robust.

Different industries leverage these various blockchain types and layers as they need. Supply chain industries might use hybrid blockchains to track goods while financial institutions could favor consortium blockchains to maintain privacy but allow regulatory transparency.

Understanding these types and architectures helps businesses and developers select an optimal blockchain solution, navigating the landscape with confidence and innovation.

Pros and Cons: Weighing the Blockchain’s Impact

Blockchain’s biggest draw is its promise of transparency and security. With its decentralized nature, it builds trust among users by reducing the potential for fraud or errors. Every transaction is recorded permanently and verifiably, and once data is added, it can’t be changed without the network’s consensus.

But blockchain isn’t without its hiccups. The technology can be energy-hungry, particularly in systems like Bitcoin’s proof-of-work model. This raises concerns about its environmental footprint. Also, scalability can be an issue. As every transaction must be verified by many nodes, this can slow down the network and drive up costs, especially during high traffic periods.

Looking at the societal angle, blockchain can open doors to financial inclusion for unbanked populations by providing alternatives to traditional banking, creating opportunities for economic growth and stability. This technology offers new avenues for transparency and accountability in social systems and governments.

Despite these advantages, blockchain applications are still evolving, and regulatory hurdles pose significant challenges. Compliance with various national and international regulations can complicate implementation and limit its adoption in some sectors. There’s also the matter of new types of fraud and cyber threats emerging, targeting blockchain systems.

The debate about whether blockchain is a net positive isn’t clear-cut. Consideration of real-world case studies reveals both success stories and failures, illustrating that while it’s a promising technology, its impact depends greatly on how responsibly and innovatively it is deployed. Within these complexities lie opportunities, urging industries and individuals to weigh benefits against challenges thoughtfully.

The Future of Blockchain: Opportunities and Challenges Ahead

Blockchain is poised to redefine major sectors across the globe. In finance, for instance, it’s all about making transactions faster and more secure, potentially changing the very nature of banking and money management. But the implications go beyond just financial systems.

Healthcare is another arena ripe for blockchain innovation. By securing patient records and ensuring privacy, blockchain can streamline data management while maintaining trust. Meanwhile, supply chains can benefit from increased transparency and reduced fraud, which boosts efficiency and accountability.

Despite the vast potential, challenges do exist. Adoption barriers like regulatory frameworks and skepticism about privacy and security need addressing. Industries must be prepared to navigate these themes efficiently as they develop blockchain systems.

Looking ahead, blockchain’s true opportunity might lie in sectors that demand transparency and accountability. If developers strike a balance between innovation and regulation, it could trigger broader adoption and acceptance.

Over the next decade, blockchain is expected to grow and mature, integrating more into everyday processes across industries. Businesses, developers, and regulators must collaborate to unleash its full potential while mitigating risks, ensuring that blockchain technology leads us to a more efficient and transparent future.

Here is another detailed article that explains the history and technology of blockchains.

Here is a single page summary of blockchain technology. You can download a pdf here.

I hope you found this article interesting and useful. Do leave me a comment, a question, an opinion, or a suggestion and I will reply soonest. And if you are inclined to do me a favor, scroll down a bit and click on one of the social media buttons, and share it with your friends. They may just thank you for it.

You can also subscribe to email notifications. We will send you a short email when a new post is published.

Disclaimer: I am not a financial professional. All the information on this website and in this article is for information purposes only and should not be taken as personalized investment advice, good or bad. You should check with your financial advisor before making any investment decisions to ensure they are suitable for you.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you

This article does a great job of breaking down the complexities of blockchain into easily digestible concepts. The comparison to a Google Doc really helped clarify the decentralized and transparent nature of the technology. One question I have is about the scalability challenges—how do newer blockchain technologies aim to overcome the speed and energy consumption issues, especially in high-traffic networks? Would love to hear more about innovations in this area!

Hi and thanks for the question. The issue of high energy consumption is one that applies to the Bitcoin network, because it used a proof-of-work method to validate new blocks being added to the chain but doesn’t apply anywhere near as much to more recent blockchain networks because they implemented a number of approaches to scaling while avoiding the pitfalls of using up ever more computing power and hence energy. Though your question is simple the answer is a bit complicated and could get very technical. One simple method is to adopt poof-of-stake rather than proof-of-work. In proof-of-stake validators put up tokens as collateral, as long as the network of validating nodes is truly decentralized and not controlled by any one entity.. Another approach is to move some transactions to a second layer. One technique that has grown in popularity is to split new blocks into smaller chunks and task different nodes with validating different chunks of the new block. This is called sharding. Other approaches involve increasing the block size and reducing the time to validate a new block.

Great article! I appreciate how you broke down the complexities of blockchain technology into easily digestible analogies, like comparing it to a shared Google Doc. The distinctions between trustless systems and traditional intermediaries, as well as permissioned versus permissionless blockchains, were particularly enlightening. It’s fascinating to see how blockchain’s decentralized nature is transforming various industries beyond just cryptocurrencies. Looking forward to more insightful content like this!

Thanks for taking the trouble to send this positive feedback. I’m glad to hear you found it interesting.