Have you been looking for recommended debt relief programs? Well, you’ve come to the right place. Seeking debt relief assistance is not something anyone does lightly but sometimes it is unavoidable.

If you’ve already decided you need to contact a debt relief program, here is a table that should help. Click on any of the logos to go to their website.

This article contains affiliate links

- Debt provider: Curadebt

- Minimum debt (unsecured): $10,000

- Unsecured debt: Yes

- Secured debt: Limited

- Tax debt: Yes

- Year established: 2000

- Free consultation: Yes, with a certified debt specialist

- Fees as % of debt enrolled: 20% average

- Key features: Assistance with back taxes

- Ratings: Trustpilot

- Accreditations: AFCC, IAPDA

- US States excluded: CT,ID,KS,LA,ME,MT,NH, NV,OR,SC,TN,UT,VT, WV, WY.

- Debt provider: National Debt Relief

- Minimum debt (unsecured): $7,500

- Unsecured debt: Yes

- Secured debt: No

- Tax debt: No

- Year established: 2008

- Free consultation: Yes, with a certified debt specialist

- Fees as % of debt enrolled: 15 to 25%

- Key features: Student & business debt

- Ratings: BBB, Trustpilot

- Accreditations: AFCC, IAPDA

- US States excluded: CT,GA,KS,ME,NH,OR, SC,VT,WV

- Debt provider: Freedom

- Minimum debt (unsecured): $7,500

- Unsecured debt: Yes

- Secured debt: No

- Tax debt: No

- Year established: 2002

- Free consultation: Yes, with a certified debt specialist

- Fees as % of debt enrolled: 15 to 25%

- Key features: Online dashboard

- Ratings: Trustpilot

- Accreditations: AFCC, IAPDA

- US States excluded: 75% of the US is covered

- Debt provider: Accredited Debt Relief

- Minimum debt (unsecured): $7,500

- Unsecured debt: Yes

- Secured debt: No

- Tax debt: No

- Year established: 2011

- Free consultation: Yes, with a certified debt specialist

- Fees as % of debt enrolled: 14 to 25%

- Key features: Online enrolment and service

- Ratings: BBB, Trustpilot

- Accreditations: AFCC, IAPDA

- US States excluded: CO,CT,DE,GA,HI,IL, KS,ME,NH,ND,OR, RI,SC,VT,WA,WI

- Debt provider: ClearOne Advantage

- Minimum debt (unsecured): $10,000

- Unsecured debt: Yes

- Secured debt: No

- Tax debt: No

- Year established: 2007

- Free consultation: Yes, with a financial expert

- Fees as % of debt enrolled: 20 to 25%

- Key features: Extra educational resources

- Ratings: BBB, Trustpilot

- Accreditations: AFCC, IAPDA, USOBA

- US States excluded: CO,CT,DE,GA,HI,ID,IL, KS,ME,MN,MS,MT,NV,NH, NJ,ND,OH,OR,RI,SC,SD, TN,UT,VT,WA,WV,WI,WY

Some things to know

Most of us, as adult human beings, are reluctant to swallow our pride and accept that we need help with managing our money. It is good to be aware that some of the measures we may need to take to better manage debt can result in a lower credit rating. So we are right to be cautious.

However, and this is an important fact to be aware of, most debt relief programs offer confidential debt counseling by a certified debt consultation professional at no cost. These can be private and confidential conversations between you and the counselor. Nobody else needs to know about that conversation. Neither your employer, nor friends, or neighbors and not even family members if you so decide.

The sad fact is that most people who encounter problems paying off debt don’t reach out for help until the situation has deteriorated and become critical. This is likely to put you under additional stress and render the choices you have to make more rather than less troublesome.

Approaches to eliminating debt

There are many approaches to managing and eliminating your debt and everybody’s situation is unique. It is easy to get lost in a maze of terminology. I will not drag this out, but here are some straightforward definitions that should help. As you will see some of these overlap.

Do it yourself

This can be as simple as tracking your outgoing expenses. Write down every single expenditure, no matter how small. categorize everything that is essential, like rent or mortgage, regular bills, food. Then in another category the non-essential expenditures like dining out, entertainment, or impulse purchases.

The next steps are rather obvious. Can you curtail or eliminate the non-essential expenditures? This is where you run the numbers and plan a way forward to see if you can pay off your debt and how long it will take.

Contact your creditors

Do it yourself can also mean that you contact your creditors and seek to negotiate different payment terms that will work better for you. This could be to delay payment for a while, reduce the rate of interest being charged, extend the period over which repayment is due.

If you are experiencing serious trouble making payments, due to difficult circumstances such as medical emergencies, changed work situation,s or whatever reason, contacting your creditors before you get behind is one of the first things you should do.

Debt negotiation

Debt negotiation is where you or a debt relief agency working on your behalf negotiates more preferable terms for you to pay off debt. It could involve forgiving you some or all of the debt. Often a debt repair agency will be better placed to negotiate preferable terms for you.

Debt collection agent

These are companies that take on the task of collecting debt on behalf of others. In the US there are federal rules they have to abide by but they will often resort to aggressive and scare tactics to get you to pay up. As many of us know from experience, it can be intimidating being hounded by debt collection agents.

Debt settlement

Debt settlement is where either the loan is settled in accordance with the terms of the loan or new terms are negotiated.

Debt forgiving

Debt forgiving involves reducing all or some of the principal sum of a loan. It is a term that is often used in the context of sovereign debt when a countries loans are forgiven by lenders often involving the World Bank or the International Monetary Fund.

Debt management

Debt management is a general term that means managing debts. It can be any combination of measures to pay off or eliminate debt.

Debt relief program or service

Debt relief programs or services are agencies that assist you and intervene on your behalf to negotiate preferable terms with your creditors to your benefit. This often includes debt consolidation.

Debt consolidation

Debt consolidation involves paying off retiring or forgiving some loans and setting up a new loan to pay off the newly negotiated terms, if any, with the original creditors. Debt consolidation arrangements are usually what a debt relief program or service provider will do for you. You can also make your own debt consolidation arrangements if you know your way or are willing to try to navigate your way around these things.

Debt servicing

Debt servicing just means paying down debt in accordance with the terms of the loan.

Declaring bankruptcy

Declaring bankruptcy either under chapter 7 or chapter 13 is something you have to do in federal court and will involve attorney fees. In the US new laws came into effect in 2005 giving greater protections under chapter 13 making it more attractive than chapter 7. If you have a job with a steady income you may be eligible for chapter 13 and your creditors will likely not be able to repossess certain assets or foreclose on your home.

Chapter 7 will normally involve the liquidation of all your non-exempt assets. The exempt assets will be just the essentials that you need like your home, car, essential furnishings, and things you need for work.

Bankruptcy will have long term effects on your credit rating and will stay on your records for 10 years. It will make it more difficult to get a mortgage on a home, buy a car, or even to get a job.

Secured and unsecured loans.

A secured loan is a loan that attaches a lien to an asset. Real estate mortgages and car loans are examples of secured loans. Personal loans, credit card debt and student loans are examples of unsecured loans.

Secured loans will usually carry lower rates of interest than unsecured loans.

It will usually be easier to negotiate new terms on an unsecured loan than on a secured loan because there is a greater risk of default on an unsecured loan. On a secured loan the creditor just has to repossess the asset, e.g. foreclose on your house or tow your car away.

What debt relief programs do

A debt relief service or program will usually negotiate better terms with your creditors for you. They will often also consolidate your debt into one loan and set up a plan whereby you stop paying your creditors but make regular payments to the debt relief agent instead and they make payments to your creditors.

What they all offer

Researching all the main debt relief providers you see some very clear common threads. User-friendly and professional excellent customer service is one of the cornerstones of success in this business. So if their customer service doesn’t sparkle, hang up the phone and look for another.

If you are looking into using a debt relief program, you need to look for many positive testimonials from satisfied customers. As important as positive testimonials will be records of how they handled and resolved customer complaints.

All the major debt relief providers have customer track records of relieving debt for as low as 20 percent of what was owed. All the good ones also offer some kind of money-back guarantee. A typical repayment plan set up by a debt relief provider will take you between two and four years to pay off.

The other criteria to check is how long a debt relief provider has been in business. In order to gather a meaningful body of satisfied customer testimonials, you should be looking for a provider who has been in business for at least five years and better for ten years.

What they don’t all offer

Where one debt relief provider distinguishes itself above others is either handling debts or loans that the others don’t or negotiating better terms and providing even better customer service than the others.

Since each individual debt situation is unique it is actually not that straightforward comparing the rates terms and conditions one provider is able to negotiate with your creditors versus another. You will need to commit to using a particular provider and enter a contract with them before they can start negotiating with your creditors.

Red flags

When you are shopping around for a debt relief program there are some red flags to watch for. Look out for anything in their promotional material that looks like an unrealistic promise. Here are some obvious red flags, avoid any provider who says

- They guarantee to eliminate your debt or settle it all for a small fraction of its outstanding value

- Tries to charge you fees before they settle your debt

- Says they can stop or prevent lawsuits from your creditors

- Tells you to halt all communication with your creditors, without explaining what can happen if you do

- Tell you that all creditors will settle terms with them

Federal Trade Commission Consumer Information

Questions and answers

Q. Do debt relief programs provide value for money?

A. Do your research. A debt relief provider may be able to negotiate better terms with your creditors than you can. Run the numbers. Make sure you benefit as much as they do from that whatever plan they propose to you.

Q. How long does it take to get out of debt using a debt relief provider?

A. It typically takes between two and four years to pay off a debt relief plan after one has been set up.

Q. Will using a debt relief program damage your credit rating?

A. A debt relief program will usually involve them setting up a loan that consolidates your other debts. This will only work if your creditors accept less favorable repayment terms. Once they do that it will impact your credit rating. You will be able to restore your credit rating much more easily after you have paid off a debt relief program than you would if you had declared bankruptcy.

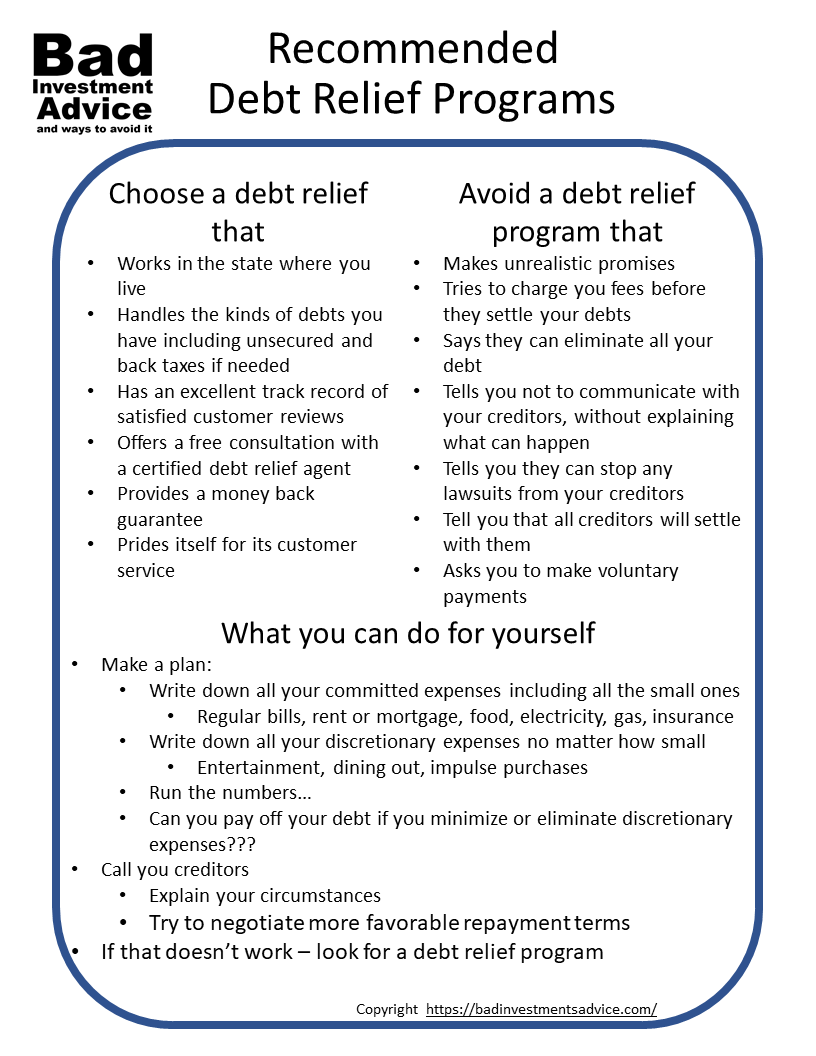

Single-page summary

Here is a single-page PDF summary of recommended debt relief programs.

I hope you found this article interesting and useful. Do leave me a comment, a question, an opinion, or a suggestion and I will reply soonest. And if you are inclined to do me a favor, scroll down a bit and click on one of the social media buttons, and share it with your friends. They may just thank you for it.

Disclaimer: I am not a financial professional. All the information on this website and in this article is for information purposes only and should not be taken as investment advice, good or bad.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you

Thanks for sharing this post, Andy.

I have actually done it myself. I did exactly what you said in the paragraph where you talk about how to do it yourself. I tracked all my income and expenses and created a debt relief program. It’s amazing how much money I was spending on things that I don’t even need. $2 each day on stupid things does not seem like much money but it accumulates very fast. When these expenses are controlled, they can be funneled into a debt relief account and thus, help you to pay it off quickly. $2 here, $3 there times 100 days, and boom, you have $500 less debt.

However, I was not aware that there are these debt relief programs out there. This is valuable information worth bookmarking. Thanks again for sharing and keep up the good work with your site.

Hi Ivan

Doing and executing a plan yourself should always be the first thing someone does and I commend you for doing that and making it work for you. The article is very US-centric and actually, while there are federal rules, programs and services have to be licensed on a state by state basis so it is quite a patchwork situation. In the UK it looks as if programs are approved by the government so that if probably a better regulated and more predictable situation.

Thanks for bookmarking – but between you and me I sincerely hope that you never actually need to refer to it!

Best regards

Andy

This is the best piece of advice I have seen offered in dealing with debt. The only way to deal with debt is like Andy says, take care of it your self or it will get worse. There are way too many people going into debt and the problem is only getting worse. And like you say, Andy, for most they wait too long to take the proper action to deal with it in a timely manner and then it’s too far gone. It’s so good to see someone offering help in this area. Thank you Andy and keep up the good work.

Hi Rick and thanks for your very positive comments. I think we have to recognize that human nature is deeply involved and many of us don’t make the best decisions or do what is rationally best for us certainly not all the time and possibly not most of the time. We all need to strike a balance in managing our credit and sometimes we have to flex our muscles a bit as it were to test our comfort levels. It is always going to be best to self-correct and not let things go too far. Thanks again and best regards, Andy

Your article is based on the American situation, I guess, so some of the information ‘goes above my head’. Like the tables you have in the beginning. But I particularly like your paragraph with red flags. That is very practical and useful advice for anybody.

When I was young I cared too little about money. In the Netherlands you were allowed to have a negative bank balance if you had a regular job. I was a teacher at that time. Yet I never saw my bank balance at the end of the month being negative as a debt.

Not too smart, I know 🙂

I am happy to say I don’t have debts at the moment. No car loan, not even a mortgage. Are there a lot of people in debt where you live?

Hi Hannie, yes the article is very US-centric but other than some basic principles, providers of debt relief services have to be licensed to operate in each state so you end up with this patchwork situation and slightly different rules, etc depending on where you live. So over here once someone needs a consolidation loan and/or debt services the situation is fragmented and highly individualized.

I get the sense that things are more standardized and regulated in Europe. When I was living in the Netherlands I didn’t have a regular job, I was running my own one-man operation business so I was a lot more careful about keeping my bank balance in the black. As you say a negative bank balance usually means you are paying interest so you have debt.

In the US some areas of household debt have remained somewhat stable since the financial crisis of 2008 2009 up until 2019. Actually, in 2020 the coronavirus resulted in a lot of households reducing their credit card debt because of the lockdowns and reduced retail therapy opportunities. US households are holding, on average the following: $145,000 overall average debt. Obviously, it is more complex than that since not everyone has a mortgage or student loan, etc. But the mean figures by household are

$215,000 mortgage, revolving credit card debt $6,271, Home equity loans $49,929 car loan $17,553, unsecured personal loans $5,538

(Data source: Federal Reserve Bank of New York)

It looks as if there has been a large increase in the number of US households using debt relief services to consolidate loans and manage their payments. US consumer sentiment in terms of how they gauge their ability to manage debt payments has been worsening. Coronavirus has had a big impact and the effects are still making their way through the systems.

Best regards

Andy

One thing I’ve found is that having that well stocked emergency fund removes a lot of the worries that other people presumably have. We don’t have to worry about how to pay the bills or buy food etc if for whatever reason I stop getting paid, and it means we can remain calmer and not as stressed about the situation, financially at least.

Excellent point! Of course, when someone is deep in debt and struggling to get out they will likely have exhausted any emergency fund a while ago. But I agree, building an emergency fund is a must. Much will depend on your circumstances if you have a job with tenure then suddenly losing your job will have a lower likelihood than if you work in a sector where you could be fired at a moment’s notice. If you live in a country that has government-provided healthcare then you are less likely to suffer massive financial loss due to some medical emergency unlike most of us living in the US.

This article deals with steps to take before you start investing including building an emergency fund.

Thanks for your comment and best regards, Andy

Hi there,

Great post outlining some of the good debt relief programs out there. I’ve been looking into this topic as I have a whopping $100,000 in student loan debtr racked up and don’t work in the public/service sector so I don’t qualify for any forgivenesses as far as I know. I’ll definitely be looking into these, especially the FTC programs. Thanks again!

Hi Dev, US News rated National Debt Relief as the best for student loans. – I am not affiliated with them btw – They are one that is also licensed in more US states than most others. But of course, there are no one-size-fits-all approaches here. Whatever solution your go for has to be tailored to your circumstances. Best of luck with this. Kind regards, Andy

Hi Andy,

This is such an important and informative article. I could really do with help with debt to be honest. Since lockdown started, I have run into a bit of debt (nothing serious), but I could do with a bit of advice and your article really has helped. When I watch the news in the UK there are so many small and bigger business people who are so stressed out with the debts they are in because lockdown has closed their businesses.

I actually know a few people who are in debt with their businesses so I am going to share your article with them. I hope it can help them and give them a direction for getting out of their debt. I have said I would help them if they need to pay for things, even though I am in a bit of debt.

Thank you for sharing and keep up the amazing work.

All the best,

Tom

Hi Tom

It would be an understatement to say that the coronavirus has impacted many lives and plans in negative ways. This article is very much focused on the situation in the US. From a few online searches, it looks as if the situation in the UK is more standardized and regulated, but that could be a mirage. You have the Financial Conduct Authority, the Advertising Standards Authority and there seem to be many cases of debt relief and credit services being put out of business for some misdeed or other. And it also looks as if many outfits are trying to capitalize on the distress people are experiencing because of the economic impact of the pandemic. It does look as you have many small companies that serve on a commission basis as front offices for larger financial debt relief institutions. There is nothing necessarily wrong with that. But as in all things, I would say buyer beware.

I would suggest to start looking on an actual UK government site that explains debt relief options.

Good luck and all the best

Andy