Micro-investing has become a buzzword in the financial world, acting as a bridge between traditional investing and the modern, tech-savvy landscape. Unlike conventional investing, micro-investing opens doors for individuals who might be starting from scratch or those who don’t have thousands to spare. The beauty of micro-investing lies in its simplicity and accessibility, making it a perfect entry point for anyone looking to dip their toes into the world of investments without heavy financial commitments.

Micro-investing has become a buzzword in the financial world, acting as a bridge between traditional investing and the modern, tech-savvy landscape. Unlike conventional investing, micro-investing opens doors for individuals who might be starting from scratch or those who don’t have thousands to spare. The beauty of micro-investing lies in its simplicity and accessibility, making it a perfect entry point for anyone looking to dip their toes into the world of investments without heavy financial commitments.

This dynamic approach to investing lets people start small—really small. Imagine being able to invest with just a bit of spare change. Yup, that’s the magic. Micro-investing builds on the idea that little by little can go a long way. It’s a gradual buildup, a journey that starts with small steps, which are crucial, especially for beginners.

Many people feel daunted by the complexities of the stock market or the thought of picking individual stocks. Micro-investing wipes out all this fear, offering platforms that manage the hard parts for you. Through features like automation, smart portfolios, and fractional shares, these platforms make it possible to invest without needing a finance degree. Instead, you get to learn by doing, seeing how markets behave over time with minimal risk.

Thanks to the rise of mobile-first apps, access to micro-investing has never been more straightforward. With just a smartphone and a few minutes, anyone can set up an account, explore investments, and start growing wealth. It’s about empowering individuals to take charge of their financial future, even if they start small. It’s a kind of empowerment that’s reshaping how people view saving and investing.

The strategies behind micro-investing aren’t just about making money. They’re about building new habits and changing financial behaviors. Investing regularly, even in tiny amounts, fosters a mindset of saving and financial responsibility. As this practice becomes routine, it’s not just about accumulating wealth but about adopting a new way of thinking about money. This shift can pave the road to long-term financial stability.

The Benefits of Micro-Investing: Transforming Small Dollars into Big Gains

Low-barriers to entry: Micro-investing platforms are changing the investment game by making it super easy for anyone to start investing. One of the most significant benefits is the low barrier to entry. You don’t need to wait until you’ve saved thousands; in many cases, you can start with just a buck. This shift is crucial for those who’ve felt shut out of traditional investment avenues and can now jump in with confidence.

Automated round-ups, recurring deposits: The convenience of automated features is another huge perk. With options like round-ups that invest your spare change, or setting up recurring deposits, growing an investment portfolio happens almost effortlessly. It turns investing into a background task that quietly accumulates wealth over time, without requiring constant attention.

Fractional shares, ETFs: Another major advantage is access to fractional shares and diverse investment offerings, such as ETFs. These platforms let you spread your investment across varied markets, which is a key strategy to managing risk. Diversification isn’t just a buzzword—it’s a smart move that reduces the impact of market volatility on your portfolio.

Accessibility: The accessibility of micro-investing apps is worth highlighting too. Built with a mobile-first approach, these platforms are user-friendly, allowing you to monitor and manage your investments on the go. Whether you’re grabbing coffee or sitting at home, your portfolio is right there in your pocket, easy to check and adjust whenever necessary.

Ideal for beginners, minimal risk: For beginners, micro-investing serves as a practical learning tool. It offers an opportunity to learn the ropes and understand investment strategies with minimal risk. Making small, manageable investments helps build confidence and deepen understanding without the fear of losing big.

The power of compounding: Consistency and the power of compounding play a big role in micro-investing’s appeal. Small, regular contributions might not seem impressive at first glance, but over time, the magic of compounding can turn them into a significant nest egg. It’s a long game, where patience and regularity can lead to surprising growth.

Managed portfolios, robo-advisors: Lastly, the platforms often take the guesswork out of investing by offering managed portfolios and robo-advisors. You don’t have to stress about picking the right stocks. Instead, you can lean on expert strategies that streamline investment processes, allowing you to sit back and watch your investments mature.

Choosing the Right Micro-Investing Platform: Analyzing Your Options

Choosing the right micro-investing platform is like picking a partner for your financial journey. It might sound a bit dramatic, but it’s true. With so many options out there, it’s crucial to find one that aligns with your goals and style.

First things first, check out the fees. Even though they might seem small at first, those little bits add up, cutting into your returns over time. Look for platforms with transparent fee structures or, even better, those offering commission-free trades.

Then, think about what kind of investment options you want. Some platforms offer a wide variety of stocks, others stick with ETFs. Platforms like Acorns or Stash let you invest spare change and work great if you’re looking for something simple and automated.

Consider the user experience too. If you’re constantly on the move, a mobile-friendly app can be a real game-changer. You want something intuitive that doesn’t take a tech wizard to operate.

Don’t overlook the added features—things like educational tools can be really helpful if you’re still learning the ropes. Stash, for instance, provides learning content to boost your financial know-how. If you like a bit of a social twist, Public.com lets you follow other investors and see what they’re up to.

Take a moment to align your choice with personal goals. Looking for something hands-off? Managed portfolios on Wealthsimple or Acorns might be your thing. Want a bit more hands-on control? Platforms like M1 Finance allow you to customize your strategy and choose what works best for you.

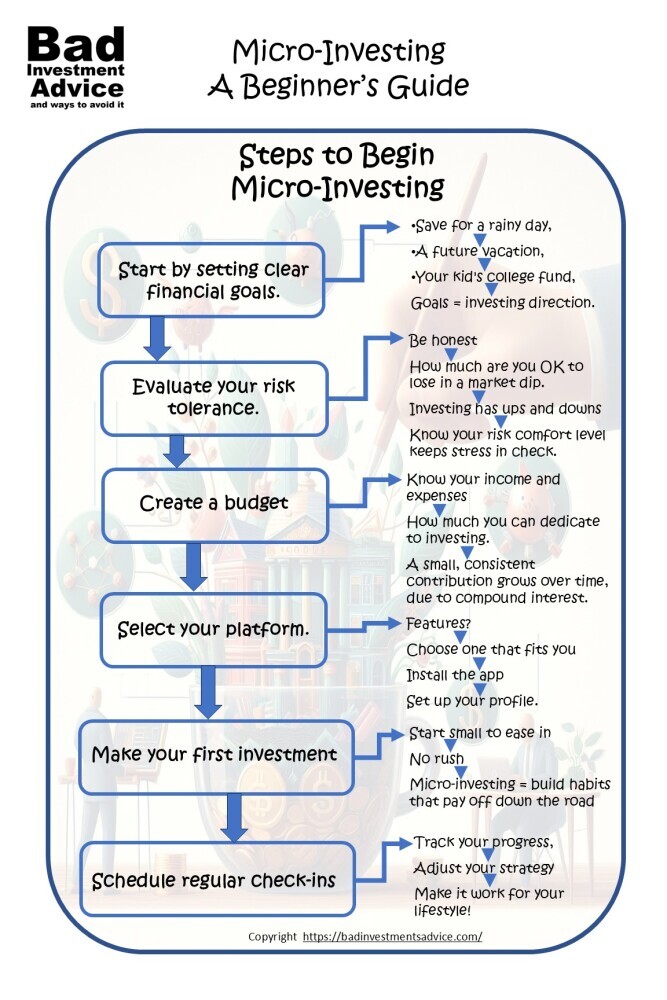

Steps to Begin Your Micro-Investing Journey: Building a Strong Foundation

Dipping your toes into investing through micro-investing is super approachable, but there’s value in laying a solid groundwork.

- Start by setting clear financial goals. Whether you aim to save for a rainy day, a future vacation, or your kid’s college fund, having a goal gives your investing more direction.

- Next, evaluate your risk tolerance. Be honest with yourself about how much you’re willing to lose should the market take a dip. Remember, investing comes with ups and downs, and knowing your risk comfort level helps keep stress in check.

- Creating a budget is a must-do. Ensure you have a handle on your income and expenses so you can identify just how much you can comfortably dedicate to investing. Even a small, consistent contribution can grow substantially over time, thanks to compound interest.

- Selecting your platform comes next. By now, you’ve got a sense of the features and goals each service caters to. Choose one that feels like a fit, install the app, and spend some time setting up your profile.

- Making your first investment can feel both exhilarating and nerve-wracking. Start small to ease in, and remember, there’s no rush. Micro-investing is about building habits that pay off down the road.

- It’s wise to schedule regular check-ins to track your progress, which might prompt adjustments in your strategy. It’s your journey, so make it work for you and your lifestyle!

Harnessing the Potential of Micro-Investing: Long-Term Success Strategies

Consistency and patience are your best friends in the world of micro-investing. Making a habit of regular investments—even if they’re small—can really add up over time. It’s all about thinking long-term and keeping your eyes on the prize.

Market fluctuations are part of the package deal. Staying calm during these volatile times is crucial, as panicking can lead to impulsive decisions that might hurt your progress. Remember that slow and steady often wins the race.

Taking time to review your investments periodically is important. Life changes, and so might your financial goals. Adjusting your strategy ensures it aligns with where you’re headed and helps keep your investments working towards your goals.

Education plays a huge role in growing as an investor. Keeping up with market trends, understanding economic shifts, and knowing new investment opportunities are invaluable. Investing isn’t just a transaction; it’s a learning experience.

Imagine the possibilities with consistent micro-investing. What starts as small change can eventually become a substantial fund for the future. It’s about taking small steps today to build a promising financial future. Sustainability in your approach can lead to significant growth down the line.

Questions and Answers

Q. What is micro investing and how does it work?

A. Micro-Investing is the process of investing small sums of money regularly and consistently over time. By adopting this low-risk disciplined approach substantial sums can be built over the long-term.

Q. What is an example of micro investing?

A. An example of micro-investing would be to set aside $100 a month into an ETF tracking a major market index such as the Standard and Poor’s 500 index. At an annual return rate of 9 percent, after 30 years you would accumulate $171,000.

Q. How much can you make investing $1000 a month?

A. If you invest $1000 a month for a 30 year period into an indexed fund earning 9 percent annually, you would have $1.7 million.

Q. Is micro investing profitable?

A. Micro-investing is profitable, if you can regularly and consistently set aside funds into an investment account.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you!

It has often been said that there is no better investment than your own financial education. One great way to accelerate your financial education and your investing success is with the American Association of Individual Investors, the AAII. When you join the AAII, you get access to reports, courses on investing, risk management, asset allocation, retirement planning, managing retirement finances, and other resources, all for a single annual membership fee.

Single-page Summary

Here is a single-page summary of Micro-Investing, a Beginner’s Guide. You can download a pdf here.

I hope you found this article interesting and useful. Do leave me a comment, a question, an opinion, or a suggestion and I will reply soonest. And if you are inclined to do me a favor, scroll down a bit and click on one of the social media buttons, and share it with your friends. They may just thank you for it.

You can also subscribe to email notifications. We will send you a short email when a new post is published.

Disclaimer: I am not a financial professional. All the information on this website and in this article is for information purposes only and should not be taken as personalized investment advice, good or bad. You should check with your financial advisor before making any investment decisions to ensure they are suitable for you.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you

Thanks, Andy, for sharing this information on micro-investing and providing all the necessary details to get started. I was not familiar with these platforms before, so I will do some research. I will save your article to share with family and friends as well.

Thanks Joseph. I am glad you found it useful. Best regards, Andy

Hey Andy this is a really an easy article to follow. It makes micro-investing a piece of cake! Your break-down of how-to and what to watch out for is well written and for anyone who is looking to take this route, will really benefit from all the advice you offer.

A lot of the buying and selling shares, goes right over my head, and for those who don’t have a clue, like me allowing someone else to do all that sounds right up my street, especially how to invest small if you are worried, and see how it prospers, and you take it from there!

Thanks for sharing this super article, it’s definitely an eye opener!

Julia.😊

Hi Julia, Thanks for taking the time to leave this encouraging positive feedback. I am glad you found it an easy read. Best regards Andy