There is one issue the beginning investor has to tackle to get started and that’s how to have a diversified portfolio. On the subject of diversification if there is one classic piece of bad investment advice I’ve heard and read a few times over it’s this – don’t diversify, it will dilute your upside potential.

That might be true for the gambler and there is some validity in that statement for small business entrepreneurs who have to choose where to focus their scarce resources and attention, but diversification is one of the most important aspects of an investment portfolio. So let’s see how to build a portfolio of diversified stocks.

Why diversify

You’ve probably heard such buzz phrases as asset allocation and asset classes and the principle of risk-reward. The fundamental logic and rationale for diversification is not putting all your eggs in one basket.

Essentially, different assets and financial instruments i.e. stocks, bonds, precious metals, commodities, currencies, and their derivatives across different industry and market sectors and across different countries rise and fall in value in response to different triggers and causes.

So some assets will rise in response to certain market stimuli while others will fall and yet others will do nothing.

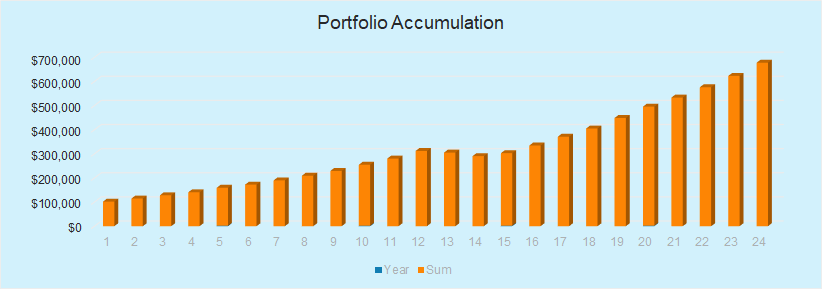

Generally, the idea in building a portfolio is to select assets that will appreciate in value over time at a rate that exceeds the interest you would get on a savings account at a regular bank.

An asset either pays you income while you still own it, like a dividend-paying stock or bond, or real estate you own and rent out, or it appreciates in value over time so you expect to sell it at a higher price than you paid for it. All pretty simple stuff yes.

Of course, everyone else is out there chasing the same assets, and if the general opinion is that an asset’s value will increase either because it is expected to deliver more income than previously anticipated, alternatively that the demand for the asset will increase more than previously anticipated. The result is that the price goes up.

A diversified stock portfolio

Like many people who grew up without an education in how markets work, I assumed the only approach to stock market investment was to find stocks you liked, buy them and hold them and watch and hope. I remember overhearing family conversations between those adult males in-the-know arguing over the relative merits of their favorite stocks.

Certain companies were emotionally easier to back than others. I mean who could argue with you if you were backing Sony, IBM, or GE. But the reality is that this approach is more like backing a racehorse There is as much pure logic to this as backing a sports team – not that I am saying that’s a bad thing except there are no games or tournaments to watch in the stock market. I guess even without a match to watch at least you could enjoy routing for your favorite company and feel the satisfaction of team loyalty even if its market price sags or otherwise disappoints.

The fact is you can’t really build a diversified portfolio from stocks that you happen to like. You just won’t know and like enough company’s stocks to achieve diversification. And emotional attachment to any stock is only going to undermine your chances of making gains.

In effect many people today still pursue elements of the same approach – picking stocks of companies they like, holding onto them, and hoping for the best. After all, the market price of every stock reflects the collective wisdom, knowledge, and hysteria for that matter of all the people buying and selling that stock. So from that point of view, you might as well own the stock of one company as own the stock of a similar company doing much the same kind of business.

Following this approach its just a matter of picking a stock or two from a broad range of sectors, of differing sizes i.e. market capitalizations and across different countries, throw in some exposure to real estate – the easy way is to add a REIT or two – Real Estate Investment Trusts and hey presto there’s a diversified stock portfolio.

Let’s say for argument’s sake that we are going to buy and hold stocks for as long as the combined opinion of market experts says either buy or hold and when that opinion shift to sell, we sell.

How many stocks do you need to be diversified

Different experts have different answers to this question. Some say an individual investor needs a portfolio of 30 some say 40 on the reverse side some say as few as 10. The mathematics of bell curves and standard deviations suggests that 30 is a good number.

Years ago, OK when I started in this game one consideration was commissions on stock trades. The more stocks you held in a small portfolio the more you would end up shelling out in commissions. Especially since to stay diversified you need to rebalance your portfolio at least once a year which is always going to involve selling some positions and buying others. And the commissions on those trades would add up.

Now with zero commissions on stock trades and fractional share trading that is no longer a concern.

OK so let’s go with the middle figure and say a stock portfolio needs 30 stocks of around the same size to be diversified.

Domestic vs international

Another area of diversification is across markets and countries. Fortunately, across most sectors many large-cap companies will seek diversification across markets for their own purposes. The same will be true of many mid-cap companies but it’s less likely with small-cap companies.

The conclusion is to achieve diversification across countries we will need to check the mix of domestic and international revenues of each stock we consider for the portfolio.

A spread of industry sectors and company sizes

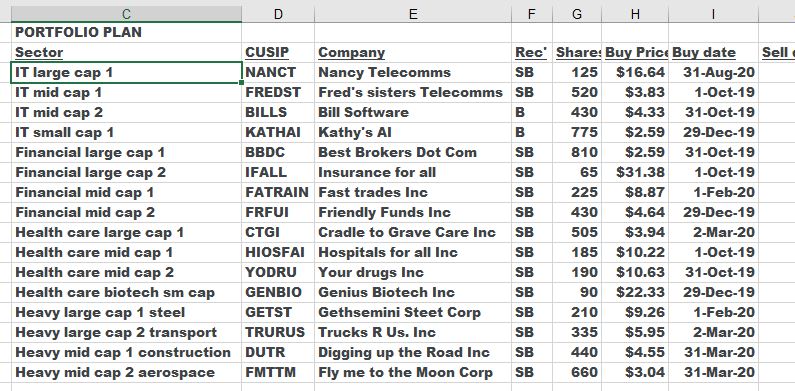

Thinking this approach through, we would pick out some obvious industry sectors:

The large sectors by stock market capitalization are comprised of:

- Information Technology

- Financial Services

- Health Care

- Heavy industries

Those 4 big ones account for more than half the capitalization of global stock markets. So. if we need to get half of our portfolio of around 30 stock the simple way would be to buy 4 stocks in each of those 4 making 16 stock positions. From each sector, I would pick two large-cap, two mid-cap, and one small-cap. Actually if I wanted to be more aggressive I would choose two small-cap, two mid -ap, and one large-cap. Because I like small-cap. No particular rationale for that – there’s emotion coming into the picture again.

The next group of sectors in terms of market size consist of:

- Consumer discretionary – which is everything individual consumers buy but don’t need.

- Communications Services

- Consumer Stables – which is everything individual consumers buy and need to.

- Energy

These account for another third of global stock market capitalization in more or less even proportions. So. if we were to buy three of each of these – a large-cap, a mid-cap, and a small-cap that would be another 12 bringing our portfolio to 28 stocks.

The smaller sectors of the market are comprised of:

- Materials – these are all the mining, forestry and chemicals companies

- Utilities

- Real Estate – a REIT is the easiest way to buy into real estate.

Since these three need to comprise approximately the remaining 15 percent of our portfolio, two stocks from each sector should suffice. That would give us a total portfolio of 34 stocks.

Rebalancing and turnover

The next task is to monitor the stocks in our portfolio.

We said our approach was to hold each stock as long as the majority of expert opinion was giving us buy or hold signals. Every major financial service provider will distill expert opinion for you so this shouldn’t be difficult. For example, E*Trade, my provider allows me to research stocks by sector and industry and find all the top strong buy recommended stocks.

I would recommend checking at least every quarter. As soon as expert opinion moves towards “sell” for any one position then sell and replace with the next one in the same sector with a majority “buy’ opinion.

To rebalance – once a year make adjustments so that each position is roughly the same size. With 34 stocks each should account for about 3 percent of the total value. I wouldn’t recommend making any change unless they have moved to more than 4 percent or less than 2 percent. Remember, we will only be buying more or keeping the position if the majority expert opinion says to hold.

The other decision on rebalancing tradings is the size of each trade. If your broker provides fractional shares and zero commissions this is less of a concern, but when you are starting out it doesn’t make a great deal of sense to be doing a vast number of tiny trades. Personally I wouldn’t trade for less than $500 in the early years. There is always the spread to consider. That is more of a concern for small-cap trades.

Other ways to diversify

There are other ways to achieve diversified investments. One is to buy a few broad market ETFs or mutual funds that are in themselves already diversified as they are comprised of different stocks from different sectors.

Know before you go

But before you start building a portfolio there are a few more steps to developing a financial plan. Those steps are covered here.

To learn more about diversification including some frightening math – check here.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you!

Hi,

I started buying stocks last year and had no idea what I was doing at the start. I put almost all my money into about 4 different stocks and apparently that was the wrong approach. I lost a lot of money. I then started doing research and noticed everyone says diversify. So now I make sure to put in a little money everywhere and I have finally made more money than I put in. Your strategies are great and I will try them asap. Thanks

Thanks for your comment. I think this is a very common problem. Many new investors know they should diversify but don’t know how to go about it. There is also the feeling that it will be difficult to manage a portfolio with a large number of stocks and prefer to keep a small number so they can know and watch each one individually. A better and less risky approach is having a solid system in place to buy, rebalance and importantly sell stocks in a systematic and disciplined way. Good luck and thanks for your comment.

What a nice post you wrote Andy! I really enjoyed reading it and could not be silent about your post so I decided to leave my comment here and say Thank You for sharing this quality post. Actually I was looking for information about the how to have a diversified portfolio and when I landed on your website and read this post, it answered all my questions in details and it was exactly what I wanted to know.

I’m happy that you’ve decided to write about this topic and share it with others. It’s very useful post in my opinion and can definitely be used as a great source for everyone who is interested to know about this topic.

I will definitely come back to your site again to read more posts. Keep up quality articles! 🙂

Best,

Ali

Thank you for your very kind comments Ali. I am glad that you found the article useful.I will be adding more articles on the same topic of building a portfolio and investing. Thanks again and best wishes to you. Andy

This is a very helpful article for anybody who wants to manage their own investments or who wants to have a good base to make sure their financial advisers are doing their job. I like the fact that includes definition for key words as well as a link to get additional information. This is pretty good!

Thanks Mirlay, I appreciate your positive comments. As you say gaining an understanding of what diversification means in a practical sense for investments you may hold can be useful when discussing your situation with a financial adviser. Keep them on their toes. Thanks and best regards, Andy

Great post, thanks for this. I have typically invested in mutual funds which are diversified and part of the attraction of them, but in recent years I have wanted to get into investing in stocks on my own more. Great post to keep in mind. Cheers

Thanks for the comment Rob. I’ve had mutual funds too for a long time and as you say they have the advantage of being diversified. You do have to be careful though if you hold a number of mutual funds that their asset bases and strategies are distinct, otherwise you could undermine your own diversification. Building your own portfolio is more seat-of-the-pants but can be more profitable as long as you adopt a systematic and disciplined approach. Good luck and thanks again for the comment, Best regards Andy

Hey Andy, Thank you for this great article. I tried stock investments some time ago but gave up because I didn’t really get the hang of it. But I am thinking of starting it again and the knowledge you share is invaluable. I saved your blog and will keep dropping by to get new knowledge.

Thanks Rajith. Many people have similar experiences. Investing in stocks can be a daunting experience. There is no substitute for learning and more learning. Well up to a point that is. Most of the large brokerage firms have plenty of accessible learning materials that will get you started. Good luck and thanks for the comment. Best regards Andy

Hi Andy,

I was relieved to read your advice about diversification. Much of what you detailed here is what our investment manager says.

Now the big concern is the drop in all stocks due to this Covid-19. And when you’re in your sixties like us, it’s a very scary time.

I just pray it bounces back before we need it…

Cheers

Suzanne

Hi Suzanne, All I can do is echo what you say very loudly. We can look at history and see that the market has always bounced back especially over the long term. And in your sixties you are still in it for the long-term. We all just have to hold tight. Thanks for the comment and stay well and safe. Best regards Andy