Could TD Ameritrade be the best trading platform for beginners? This is a review of TD Ameritrade’s services the pros and cons and what it does for the beginning trader.

- Name: TD Ameritrade

- Services provided: Extensive range of financial services.

- Price/Fees: zero commissions on some trades, low on others

- Website: https://www.tdameritrade.com/ (in the USA, depends on your country)

- Main features: Financial services for individual investors, savers, and small businesses.

- My rating: 4 out of 5

TD Ameritrade at a glance – for the beginning trader.

- Standard brokerage: Yes

- Cryptocurrencies: Yes

- Fractional shares: Yes

- Research tools: 10 / 10

- Tutorial resources: 10 / 10

- Support: 7 / 10

TD Ameritrade – who is it for?

TD Ameritrade has financial services for all kinds of customers:

- Brokerage accounts

- Retirement accounts

- Retirement income solutions

- Small business retirement solutions

- Managed portfolios

- Cash management accounts

Individual Investors and Traders

TD Ameritrade’s brokerage account offers the investor access to its trading platforms with zero commissions.

TD Ameritrade Web Platform allows you to customize your trading platform dashboard. You have access to extensive educational materials and third party expert reviews. It has a feature called Snapticket allowing you to see the latest price change on specific securities you are watching. This is clearly aimed at the active trader.

Thinkorswim is TD Ameritrade’s elite trading platform. This is aimed at the active and professional trader and has all the usual stocks, ETFs, options, futures, and options on futures trading. If you are able to cover the risks you may also qualify for margin trading and you may be allowed to trade options and futures in an IRA.

Thinkorswim gives you access to a vast array of charts and for those with object-oriented coding skills, you can build your own programed orders and test how scenarios would play out under different market circumstances. It also has a mobile app version for your smartphone synced with your desktop of course.

Does this sound like beginner territory? – not to me, certainly not, but I guess its good to know that whatever platform you start with will be able to support your trading activity as your experience and knowledge build and you demand more from your trading platform.

Retirement accounts

TD Ameritrade offers a full range of accounts for retirement needs:

- Traditional IRA – currently, in 2020 you can save up to $6,000 a year in tax-deferred income into a traditional IRA. If your spouse is not earning you can also transfer another $6,000 earned income into a separate IRA

- Roth IRA – your payments into a Roth IRA are not tax-deductible but all withdrawals you make when you are eligible to start withdrawing will not be taxed

TD Ameritrade has a useful tool that helps you decide whether you should opt for a Traditional IRA or a Roth IRA. If you convert a traditional IRA to a Roth IRA you will pay income taxes on the taxable amount being transferred.

- Rollover 401k plans into an IRA allowing more flexibility, and the option to include in a future employer’s retirement plan.

- SEP IRA – for self-employed individuals and small business owners and their employees.

- Solo 401k plans. provides the highest contribution limits and flexible options for self-employed individuals and for family members.

Small business retirement accounts

TD Ameritrade offers plans for small businesses.

- SIMPLE IRA – low cost easy to administer, for small businesses with a steady income and no other retirement plans for businesses with 100 or fewer employees.

- Pension or profit plan accounts – including 401k Keogh, profit-sharing plans, money purchase pension plans, defined benefits plans, defined contribution plans, and retirement trusts.

Education savings accounts

- 529 plans – for college savings. Each state sets its own limits on these plans.

- Coverdell ESA – Coverdell Educational Savings Accounts are like 529 plans with minor differences. A Coverdell ESA belongs to and is controlled by the beneficiary when eligible withdrawals are made whereas a 529 plan belongs to and is controlled by the account owner. Contributions to Coverdell ESAs are not tax-deductible.

- UGMA custodial accounts – the Custodial Uniform Gift to Minors Act and the Uniform Transfer to Minors Act created custodial accounts whereby a minor owns the assets in the account that is controlled by the custodian of the account.

Specialty Accounts

Sole Proprietorship, Trusts, Limited Partnerships, Partnerships, Investment Clubs, Limited Liability, Corporate and Non-Incorporated are all types of accounts that can be opened at TD Ameritrade. Again this is unlikely to be something that a beginning trader or investor is going to need.

Managed portfolio types

Like other large financial services providers, TD Ameritrade will manage your portfolio for you – at a fee of course. The types of managed accounts are

- Essential Portfolio – this is the entry point for managed accounts. A minimum of $500 will give you access to five index ETFs each with its own strategic goal. Your portfolio will be managed automatically and you will pay 0.30 percent annual fees.

- Selective Portfolios – this is the next flavor of managed portfolios. A minimum investment of $25,000 gives you access to a broader array of mutual funds and ETFs selected to meet your objectives with ongoing monitoring and rebalancing.

- Personalized Portfolios – for a minimum investment of $250,000 a dedicated financial consultant will create a portfolio tailored to your personal financial circumstances. The annual fees will vary according to the assets in your portfolio and the investment amount.

Guidance

TD Ameritrade’s process to set you up with a plan starts with Goal Planning. This leads you through gathering all the usual information about you, current age, expected retirement age, current asset, and outgoings, your risk tolerance. And once all that information is gathered TD Ameritrade simulates the types of outcomes you can expect under varying scenarios. You then go back and flex various parameters like changing your contributions into a plan or adjusting your risk tolerance to again see the probability of you achieving your objectives.

TD Ameritrade provides a financial consultant to do this Goal Planning for their clients as a complimentary service.

Advisor referral – is a service that puts you in touch with an Independent Registered Investment Advisor (RIA) The RIA will then work with you to develop your plan for a fee of course.

Again these services are unlikely to be what a beginning investor or trader is looking for.

Education

Like its competitors, TD Ameritrade has strong educational materials on its platform. The educational resources are available at no cost to account holders and include

- Immersive curriculum – lessons tailored to your needs

- Articles – topics include: Market News, Investing strategies and approaches, trading from basics to advanced options strategies, retirement planning, personal finance including money management, research tools – all the tools available in the Thinkorswim platform

- Videos – on a range of subjects including stocks, tax-efficient investing, options, ETFs and retirement planning

- Webcasts – more resources from those new to investing, demonstrations of the TD Ameritrade platforms to active and advanced trading techniques and strategies.

- TD Ameritrade Network – a live-streaming network of TV market news.

- In-Person Events – one-day crash courses from Pros following a schedule of events at major US cities.

- Talking Green Podcast – in-depth discussions on finance and economics. Green is a reference to the logo color.

- Personal Finance – a sequence of tutorials aimed at getting you to understand how to manage your money

- New to Investing – it is what it says it is.

- Planning for Retirement – again no surprises what this is.

- Investing for College – explains all the options available to save and invest for college, what they cover, and their tax advantages.

- Account Types & Investment Products – there are links to descriptions of TD Ameritrade accounts, already explained above and then explanations of 529 Plans, Bonds & CDs, ETFs, Forex, Futures, IRAs, Mutual Funds, Options, and Stocks.

- Taxes – gives an overview of the tax calendar and the main tax forms you would need to file.

- Inherited Accounts – explains how your accounts will be handled after you have moved on to the great trading platform in the sky.

Research

Now that you have learned everything you ever wanted to know and then some about investing, its time to put all that knowledge to use. Here is what TD Ameritrade has to offer:

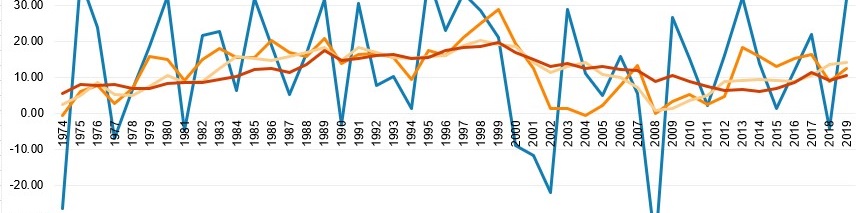

- Markets – charts, and links to related news items moving all markets. Showing indices, Sectors and industries, a forward-looking calendar, and analyst reports.

- Stocks – allows you to drill into the details of any listed stock.

- Options – more explanations of options trading strategies

- Mutual Funds – gives different research views of funds by Premier List, Families, Categories, Profile, Compare Funds – allows you to compare one fund with another and Commentary – which displays all recent commentary related to a specific fund.

- ETFs – offers the same way of viewing and comparing ETFs and recent news commentary about them.

- Bonds & CDs – gives you explanations of different bonds and CDs and ways to find ones that suit your needs.

- Screeners – pre-defined or create your own for stocks, options, mutual funds, and ETFs.

- Ideas – TD Ameritrade’s selection of investing ideas from a variety of news and analyst sources.

- Investor Movement Index (IMX) – This is TD Ameritrade’s own propriety index which shows the actual behavior of individual investors. It measures what retail investors are buying and selling. So if you are looking to reserve your spot ready to jump off the cliff with all the other investors, this is the place to go.

Acquisition

In November 2019 Charles Schwab announced it was acquiring TD Ameritrade in an all-stock acquisition. The deal is expected to be completed in the latter half of 2020. The announcement indicated that the two companies will merge. This is a huge consolidation in the discount brokerage business and is likely to push commission rates lower among competing brokers.

TD Ameritrade – the pros – for the beginner

TD Ameritrade has powerful trading platforms, guidance, and educational materials and research tools. If you chose to start trading with TD Ameritrade you will enjoy all their extensive resources and you can operate with zero commissions depending on what you are trading.

TD Ameritrade – the cons – for the beginner

There are quite a number of complaints against TD Ameritrade on the Better Business Bureau site which point to some systemic issues.

One is that in times of high market instability as experienced in March 2020, trades sometimes fail to be executed resulting in losses.

Another notable pattern to complaints is poor or slow customer support. Often those complaints seem to be from customers of managed accounts.

TD Ameritrade – how does it rank?

I’m giving TD Ameritrade an overall 4 out of 5. It is a powerful platform with plenty of resources and services but the unresolved customer complaints should not be ignored. To see how TD Ameritrade compares with its main competitors, check here.

My recommendation

If you are a beginning investor or trader looking for a brokerage account, TD Ameritrade could be a good choice. But what is going to happen after the acquisition?

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you!

Wow! This is great to see here and thank you. This TD ameritrade seems quite good enough as a platform since it encompasses not just trading of one unit but deals with quite a lot more. This is really good and thanks for sharing. Personally! I like every bit of details you have shared about it here and what it entails. Thumbs up to you for sharing this out here.

Thanks Angela. I am glad you found the article informative. I’m not a customer but it is a broker with a robust reputation. I would just be nervous about how the Schwab acquisition will go. Assuming that does go ahead. Thanks for engaging. Best regards Andy

Hello Andy, nice to see your information about this trading platform but I have never seen it before so it’s hard to agree with your claim that it is the best out there. Although I am a beginner, I have seen some information about some platforms too. This one seems to to tick it out for beginners though and I’m thinking I should start off with it. The features that they have for everyone is really nice. Cool stuff.

Hi Riley. I’m not sure I would say this particular broker is the best choice at the moment. I found it quite disturbing all the recent complaints since the announcement of the takeover by Schwab. With any merger of big service providers it is always going to be the backroom support where they look for economies of scale. Mind you if I already was a customer I would not jump ship. Thanks for your comments. Best regards Andy

I am blessed to see such an informative article. I appreciated this post very much. Here you have discussed in detail about Best trading platform for beginners. TD Ameritrade is the best trading platform for beginners. This is aimed at the active and professional trader and has a Best trading platform for beginners. Like its major competitors, TD Ameritrade offers brokerage accounts for trading all types of securities and derivatives including stocks, bonds, options, futures, ETFs, mutual funds, forex, annuities, cryptocurrencies, and IPOs. In my opinion, It is better than any other option. Thanks for presenting beautifully. I think this article is useful for beginners.

Lastly, I would like to share this post on my social media so everyone can know about the Best trading platform for beginners. Thanks

Hi Tanvir. Even though many of the services TD Ameritrade has to offer are indeed for experienced traders and investors if you are beginner it is important to chose a platform that will give you educational materials, research resources and high performance analytical tools – because as you learn more you will start to need those features and you will not want to move your portfolio to another platform, Best regards Andy

Thanks for the extensive information about TD Ameritrade. Looks like you rate them highly. I appreciate that you pointed out both the positive and negative aspects. As a beginning investor, I need as much information as I can find. I’m glad to have found your article which very helpful. I can create an IRA for myself and education funding for my kids. Those are important to me. Keep up the good work. Take care.

Bob

Thanks Bob. Certainly if you want to educate yourself about investing one of the major brokers like TD Ameritrade is a great place to learn. Thanks for your comments. All the best, Andy

Very informative article! Sounds like this platform has a lot of very useful tools. I’ve been looking into the Robinhood platform lately. Any ideas on how TD Ameritrade compares?

Hi Chris, I will be doing a detailed review of Robinhood. But in summary in comparison with TD Ameritrade and other similar full service providers Robonhood does not offer tax advantaged retirement saving, nor mutual funds, nor bonds. Robinhood does have crypto currency trading and zero commissions on stock and options trading will keep your costs down. Other advantages of Robinhood is they allow fractional share trading. This means if you are either starting investing a relatively small amount you will still be able to build a diversified portfolio also you can easily sweep up cash keeping your porfolio fully invested. It looks as if Robinhood would be good for beginning active traders who want to educate themselves and do it themselves. You may find yourself on your own and have to look outside if you need advice. The lack of retirement accounts and tax advantaged accounts means you might want to build those elsewhere i.e. through other providers unless you are already making full use an employer scheme e.g. a 401k. Thanks for the comment and best regards, Andy

This is a very informative article relating to TD Ameritrade. I appreciate you defining terms throughout your article that I wouldn’t have really known otherwise. Also, I appreciate you stating the pros and cons instead of painting this in a perfect light without any negative aspects. This is a great article, and keep up the good work.

-Joseph

Thanks Joseph for the encouragement and for your comments. Trying to deliver a meaningful and fair assessment takes a careful approach. Best regards to you. Andy

Very informative article! Sounds like this platform has a lot of very useful tools. I’ve never been into finance and trading but with all info here, I’m sure I could learn. Good website

Lyne

Thanks for your comment. TD Ameritrade is one of the most competitive financial service providers. They will provide all the help you would need to get you started. Thanks for the comment and best regards. Andy