The stock market is like a big marketplace where people buy and sell shares in companies, known as stocks. This marketplace plays a huge role in the economy by helping businesses get cash to grow, while giving people a chance to invest and earn returns. When a company wants to expand, they might sell shares in the company to the public.

Everyone from individual investors to big institutions can participate as buyers or sellers of stocks. Wait a minute, how does that last sentence make sense? If you approach the stock market as a first-time individual investor it is easy to see how you can buy stocks but how could you sell stocks if you don’t already own any? Let’s put this aside for the moment, but if you really have to know, here is an article that explains short selling.

To navigate the world of investing, understanding how stock markets work is essential. Stocks are traded on stock exchanges, where buyers and sellers come together. Some of the most famous include the New York Stock Exchange (NYSE) and NASDAQ. Each exchange has its rules about how stocks are traded, and they provide a platform for transactions to take place smoothly. Each exchange also has rules that companies need to follow in order for their stocks to be listed as tradable on the exchange.

A sprinkle of jargon comes with the territory. Terms like ‘bull market’, which describes a period of rising stock prices, and ‘bear market’, indicating falling prices, pop up frequently. Other terms such as ‘IPO’ (Initial Public Offering), ‘market cap’ (market capitalization), and ‘dividends’ also crop up. Getting familiar with these and many more terms is like learning a new language but crucial for making informed decisions.

Grasping the fundamentals of stock markets isn’t just for seasoned investors. It’s for anyone keen on understanding how money circulates in the economy. Knowing these basics sets the foundation for recognizing investment opportunities and managing financial assets and risks wisely. As you get familiar with these basics, you pave your way towards making better financial choices.

Key Players and Mechanisms

Navigating the stock market means getting to know who’s who in the arena.

Investors are individuals or entities who buy stocks for potential financial returns,

Traders try to profit from short-term market movements. Sometimes the line between being and investor or being a trader can become blurred. As you gain experience and exposure as an investor, it is quite possible that the idea of becoming a trader is very attractive. The hard truth is that very few people have the acumen and emotional control necessary to be successful traders over the long-term. But the reality is that most of us need to go through the experience of learning this lesson for ourselves. I sincerely hope that your journey turns out to be less expensive than mine was.

Be that as it may, back to the players.

Brokers act as intermediaries, providing the platform and services to buy and sell stocks. They earn a commission or fee for facilitating these transactions.

Regulators play a critical role in ensuring the market runs smoothly and fairly. Organizations like the Securities and Exchange Commission (SEC) are tasked with overseeing and maintaining market integrity. They create rules to prevent fraudulent activity and protect investors’ interests.

Stock indices serve as barometers of the market’s health. You’ve likely heard names like the Dow Jones Industrial Average or the S&P 500. These indices are collections of stocks that are used to measure the performance of a segment of the stock market, giving investors a snapshot of the market’s trajectory. Grasping these indices helps insert some clarity into the often chaotic world of stock prices.

Market makers are entities that provide liquidity by buying and selling stocks. They ensure trades can occur smoothly without significant price changes, even when volume is low. By doing so, they create a dynamic and continuous market, making it easier for buyers and sellers to complete transactions effortlessly.

Transactions in the stock market happen rapidly, but several mechanisms guide them. Different order types, like market orders and limit orders, dictate how trades are executed. While market orders aim for immediate execution at current prices, limit orders allow investors to specify prices, adding another strategic layer to trading decisions.

How to Invest in Stocks

Starting your journey in stock investing begins with opening a brokerage account. This account acts as your gateway to buying and selling stocks. Brokers offer various platforms with different features and fee structures, so picking one that fits your needs and investment style is crucial.

Once set up, the next step is shaping your investment strategy. Some folks prefer short-term trading, which involves buying and selling stocks frequently to capitalize on price fluctuations. Others are in it for the long haul, holding stocks with the expectation that they’ll grow over time. Both approaches have their merits, depending on your financial goals and risk appetite.

A golden rule in investing is diversification. By spreading your investments across a range of assets, you reduce the risk of any single investment hurting your portfolio. This strategy can help protect against market volatility and ensure steadier growth.

Risk management is just as important as making gains. It involves assessing how much risk you’re willing to take and structuring your portfolio accordingly. Tools like stop-loss orders can help limit potential losses by automatically selling a stock when it reaches a certain price, protecting your investments from excessive downturns.

Harnessing the power of compound interest and dividends can significantly impact your portfolio’s growth. Dividends are payments some companies make to shareholders, often providing a regular income stream. When reinvested, these dividends can compound over time, generating more income and increasing your stock holdings without spending additional money. This reinvestment strategy can result in exponential growth, boosting your overall returns.

Factors Influencing Stock Market Movements

Stock market movements are like a dance, influenced by numerous factors that investors need to stay aware of. Economic indicators are major players in this dance. For starters, inflation and interest rates are closely watched because they affect borrowing costs and consumer spending. High inflation usually pressures stock prices as it erodes purchasing power, while interest rate hikes can slow economic growth, impacting corporate profits.

Political developments also weigh heavily on market sentiment. Government policies, tax laws, and geopolitical tensions all have potential effects on investor confidence and market behavior. Changes in leadership or new regulations often lead to shifts in market dynamics, creating either opportunities or uncertainties for investors.

One phrase you will frequently hear is that markets don’t like uncertainty. So when markets are not able to determine with certainty the likely outcome or impact of a political development, this tends to have the effect of depressing market prices.

Market sentiment, the overall attitude or mood of investors, significantly impacts stock prices as well. It can be driven by emotions, expectations, or even rumors. A positive sentiment often leads to rising prices, while negative sentiment might trigger sell-offs, regardless of underlying fundamentals. Understanding this sentiment is key in predicting potential market trends.

Market sentiment also follows long-term cycles. So in periods where market sentiment is predominantly bearish, even positive news has trouble moving prices upwards. Conversely, in periods of predominantly bullish market sentiment, prices continue to rise even when there may be bad news.

On a broader scale, global events, including natural disasters or pandemics, ripple through the stock markets with impactful force. These events can disrupt supply chains, shift consumer behavior, and create broad economic challenges affecting stock performance worldwide. Staying informed about global news is crucial for investors seeking to navigate short-term disruptions and capture long-term opportunities.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you!

It has often been said that there is no better investment than your own financial education. One great way to accelerate your financial education and your investing success is with the American Association of Individual Investors, the AAII. When you join the AAII, you get access to reports, courses on investing, risk management, asset allocation, retirement planning, managing retirement finances, and other resources, all for a single annual membership fee.

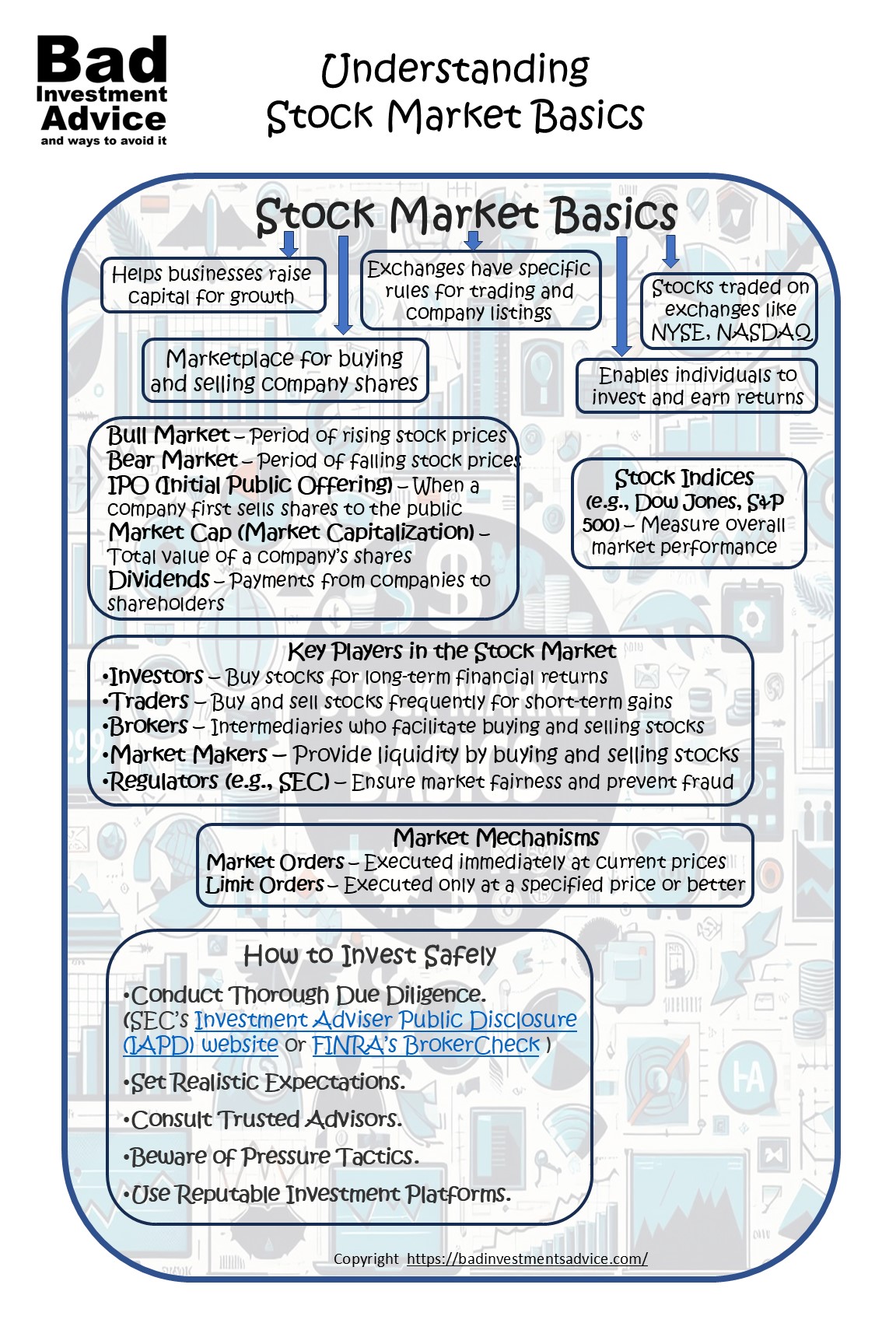

Single-page summary

Here is a single-page summary of Understanding Stock Market Basics. You can download a PDF here.

I hope you found this article interesting and useful. Do leave me a comment, a question, an opinion, or a suggestion and I will reply soonest. And if you are inclined to do me a favor, scroll down a bit and click on one of the social media buttons, and share it with your friends. They may just thank you for it.

You can also subscribe to email notifications. We will send you a short email when a new post is published.

Disclaimer: I am not a financial professional. All the information on this website and in this article is for information purposes only and should not be taken as personalized investment advice, good or bad. You should check with your financial advisor before making any investment decisions to ensure they are suitable for you.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you

This article provides a great overview of the stock market, but I have a question about the role of market makers. You mention that they provide liquidity by buying and selling stocks, ensuring smooth transactions. How do they determine the prices at which they buy and sell? Also, do market makers ever take on significant risks when holding stocks, or do they primarily profit from the spread between buying and selling prices?

Hi and thanks for the question. Market makers determine the price by matching the overlap between the prices buyers are willing to offer and the prices sellers are willing to accept. If a buyer or seller enters a market order, which means they want to execute the trade whatever the best available price is, then the market maker will execute that trade providing the best price first and if that quantity is exhausted, then proceed to the next available best price etc. until the full order is filled. Market makers do profit from the buy and sell price spreads, they can also profit from arbitrage opportunities between markets when differences develop between the prices at which stocks are trading. They can simply shift stock from the market trading at a lower price to the market trading at a higher price.

Andy – I enjoyed reading this and found it easy to understand. I have always been fascinated with stocks and the stock market. When I was a kid, I spent a week at a summer camp that provided a “stock market” activity day.

They gathered us in the main meeting center with about 20 booths representing a business that sold stocks. They gave us play money, everyone started with the same amount. When the stock market opened, we could buy from the companies and trade with each other.

There were different economic factors they would impose throughout the day that would impact the stock prices. A weather event impacted crops, a business report predicted a shortage of certain products causing certain stocks to go up.

It took me a while to understand but it was really a fun event. At the end of the day, they tallied up each persons total value to announce a winner. I wish I remembered more details, but I was hooked ever since.

The stock market can be intimidating for the average person, your article provides an easy to understand approach, well done.

Hey Scott, that game sounds like a lot of fun. What a fantastic way to introduce kids to the concepts of financial markets and investing. I think my parent’s generation were much more skeptical about the stock market and regarded it as a casino for the rich. Actually they also regarded casino’s as only for rich people with surplus money to lose. Thanks for reading and thanks for the comment.

This is a great crash course for anyone just starting to explore the stock market, or even those who need a solid refresher. I love how the article breaks everything down into simpler concepts and emphasizes the importance of long-term thinking rather than chasing quick gains. The reminders about risk management and emotional discipline are especially helpful, since those are things new investors often overlook. Thanks for putting this guide together, it really makes a potentially confusing topic feel way more approachable!

Hi and thanks for the positive feedback. I am glad you enjoyed the article.

That was really well written – clear and easy to follow (even by me!)

I am so glad you found it an easy read. Thanks for the comment.