Investors are always searching for reliable ways to identify companies poised for long-term success. Financial ratios provide a powerful tool to assess a business’s financial health and predict stock performance. But which ratios matter the most? In this post, we’ll explore the top five financial ratios that have historically correlated with strong business performance, examine case studies of winning companies, and discuss best practices for using these ratios in investment decisions.

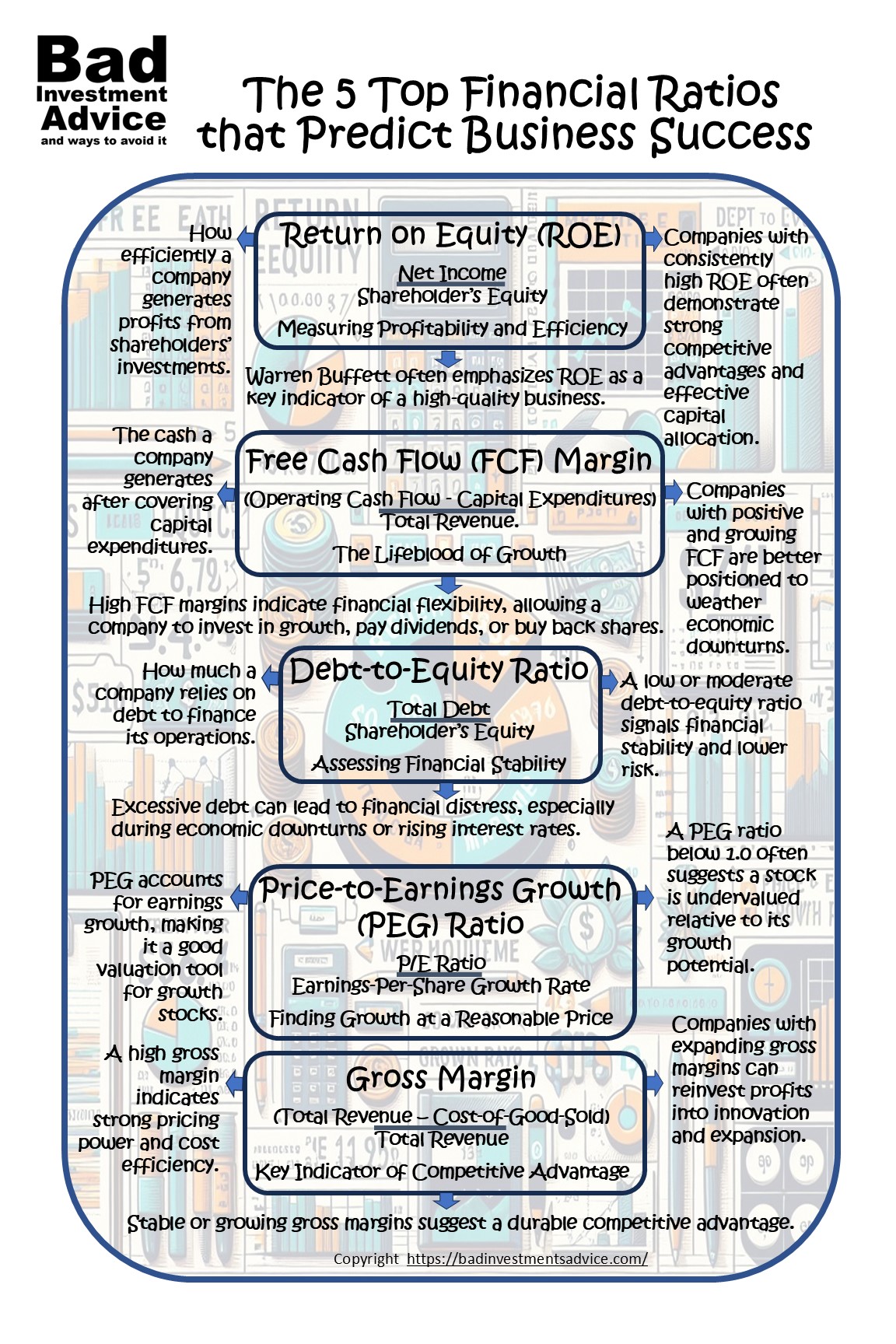

1. Return on Equity (ROE): Measuring Profitability and Efficiency

Formula: ROE = Net Income / Shareholder’s Equity

Why It Matters:

- ROE measures how efficiently a company generates profits from shareholders’ investments.

- Companies with consistently high ROE often demonstrate strong competitive advantages and effective capital allocation.

- Warren Buffett often emphasizes ROE as a key indicator of a high-quality business.

Case Study: Apple Inc. (AAPL) Apple has maintained an ROE above 40% in recent years, reflecting its profitability and efficient use of capital. Strong brand power, high margins, and smart capital deployment have made it a long-term winner in the stock market.

2. Free Cash Flow (FCF) Margin: The Lifeblood of Growth

Formula: FCF = (Operating Cash Flow – Capital Expenditures) / Total Revenue.

Why It Matters:

- FCF measures the cash a company generates after covering capital expenditures.

- High FCF margins indicate financial flexibility, allowing a company to invest in growth, pay dividends, or buy back shares.

- Companies with positive and growing FCF are better positioned to weather economic downturns.

Case Study: Microsoft Corporation (MSFT) Microsoft has maintained strong free cash flow margins of over 30% in recent years. This financial strength has enabled it to fund cloud expansion, pay dividends, and execute strategic acquisitions like LinkedIn and Activision Blizzard.

3. Debt-to-Equity Ratio: Assessing Financial Stability

Formula: Debt-to-Equity = Total Debt / Shareholder’s Equity

Why It Matters:

- This ratio shows how much a company relies on debt to finance its operations.

- A low or moderate debt-to-equity ratio signals financial stability and lower risk.

- Excessive debt can lead to financial distress, especially during economic downturns or rising interest rates.

Case Study: Johnson & Johnson (JNJ) With a debt-to-equity ratio consistently under 0.5, Johnson & Johnson has maintained strong credit ratings and steady dividend payouts, making it a favorite among long-term investors.

4. Price-to-Earnings Growth (PEG) Ratio: Finding Growth at a Reasonable Price

Formula: PEG = P/E Ratio / Earnings-Per-Share Growth Rate

Why It Matters:

- Unlike the standard P/E ratio, PEG accounts for earnings growth, making it a better valuation tool for growth stocks.

- A PEG ratio below 1.0 often suggests a stock is undervalued relative to its growth potential.

Case Study: Amazon.com Inc. (AMZN) During its early years, Amazon had a high P/E ratio, but a low PEG ratio, reflecting its explosive earnings growth. Investors who recognized this were rewarded as Amazon became one of the most valuable companies in the world.

5. Gross Margin: A Key Indicator of Competitive Advantage

Formula: Gross Margin = (Total Revenue – Cost-of-Good-Sold) / Total Revenue

Why It Matters:

- A high gross margin indicates strong pricing power and cost efficiency.

- Companies with expanding gross margins can reinvest profits into innovation and expansion.

- Stable or growing gross margins suggest a durable competitive advantage.

Case Study: NVIDIA Corporation (NVDA) NVIDIA has maintained gross margins above 60%, demonstrating its ability to command premium pricing in the semiconductor industry. This advantage has fueled consistent revenue and earnings growth.

How to Use Historical Data to Test Ratio Effectiveness

To validate the importance of these ratios, investors can:

- Backtest Stocks: Analyze historical financial data and compare ratio trends with stock performance.

- Compare Industry Leaders: Study how high-performing companies maintain superior financial ratios over time.

- Track Market Cycles: Evaluate how companies with strong financials perform during recessions and bull markets.

By looking at long-term stock trends, investors can see clear correlations between these financial ratios and sustained business success.

Common Pitfalls in Relying on Financial Ratios

While financial ratios are powerful, they have limitations:

- Ignoring Industry Differences: A “good” ratio varies by sector. For example, tech companies often have higher P/E ratios than utility companies.

- Overlooking Non-Financial Factors: Strong management, innovation, and brand value also drive business success.

- Focusing on Short-Term Data: One good quarter doesn’t indicate long-term strength. Look at trends over multiple years.

Best Practices for Integrating Ratios into Investment Decisions

To maximize the predictive power of financial ratios:

- Use Multiple Ratios: No single metric tells the whole story. Combining ROE, FCF, debt levels, and valuation metrics gives a well-rounded view.

- Compare Against Peers: Always assess ratios relative to industry benchmarks.

- Monitor Trends: Look at how ratios change over time rather than just a single snapshot.

- Supplement with Qualitative Analysis: Consider factors like competitive advantages, management quality, and industry trends.

Conclusion

The top five financial ratios—Return on Equity, Free Cash Flow Margin, Debt-to-Equity, PEG Ratio, and Gross Margin—offer powerful insights into a company’s long-term success. By analyzing historical data, avoiding common pitfalls, and integrating ratios with broader research, investors can make smarter decisions and identify winning stocks.

Next Steps:

- Download our Investor Ratio Cheat Sheet

- Learn more about Advanced Stock Analysis Techniques

- Subscribe for more investment insights!

By using these ratios effectively, you’ll be well on your way to making informed, high-conviction investment decisions. Happy investing!

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you!

It has often been said that there is no better investment than your own financial education. One great way to accelerate your financial education and your investing success is with the American Association of Individual Investors, the AAII. When you join the AAII, you get access to reports, courses on investing, risk management, asset allocation, retirement planning, managing retirement finances, and other resources, all for a single annual membership fee.

Single-page Summary

Here is a single-page summary of The Top 5 Financial Ratios that Predict Business Success. You can download a pdf here.

I hope you found this article interesting and useful. Do leave me a comment, a question, an opinion, or a suggestion and I will reply soonest. And if you are inclined to do me a favor, scroll down a bit and click on one of the social media buttons, and share it with your friends. They may just thank you for it.

You can also subscribe to email notifications. We will send you a short email when a new post is published.

Disclaimer: I am not a financial professional. All the information on this website and in this article is for information purposes only and should not be taken as personalized investment advice, good or bad. You should check with your financial advisor before making any investment decisions to ensure they are suitable for you.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you.