Is investing in precious metals wise? A question many people are asking these days. But you might be disappointed if you are hoping for a simple answer.

Just scout around the internet a little and you will see the complete spectrum of responses on this issue. From one extreme, telling you to stay well away, from the other telling you to convert your entire nest egg into gold this minute.

So which is it?

OK, nobody really likes a tease, so here it is.

The answer

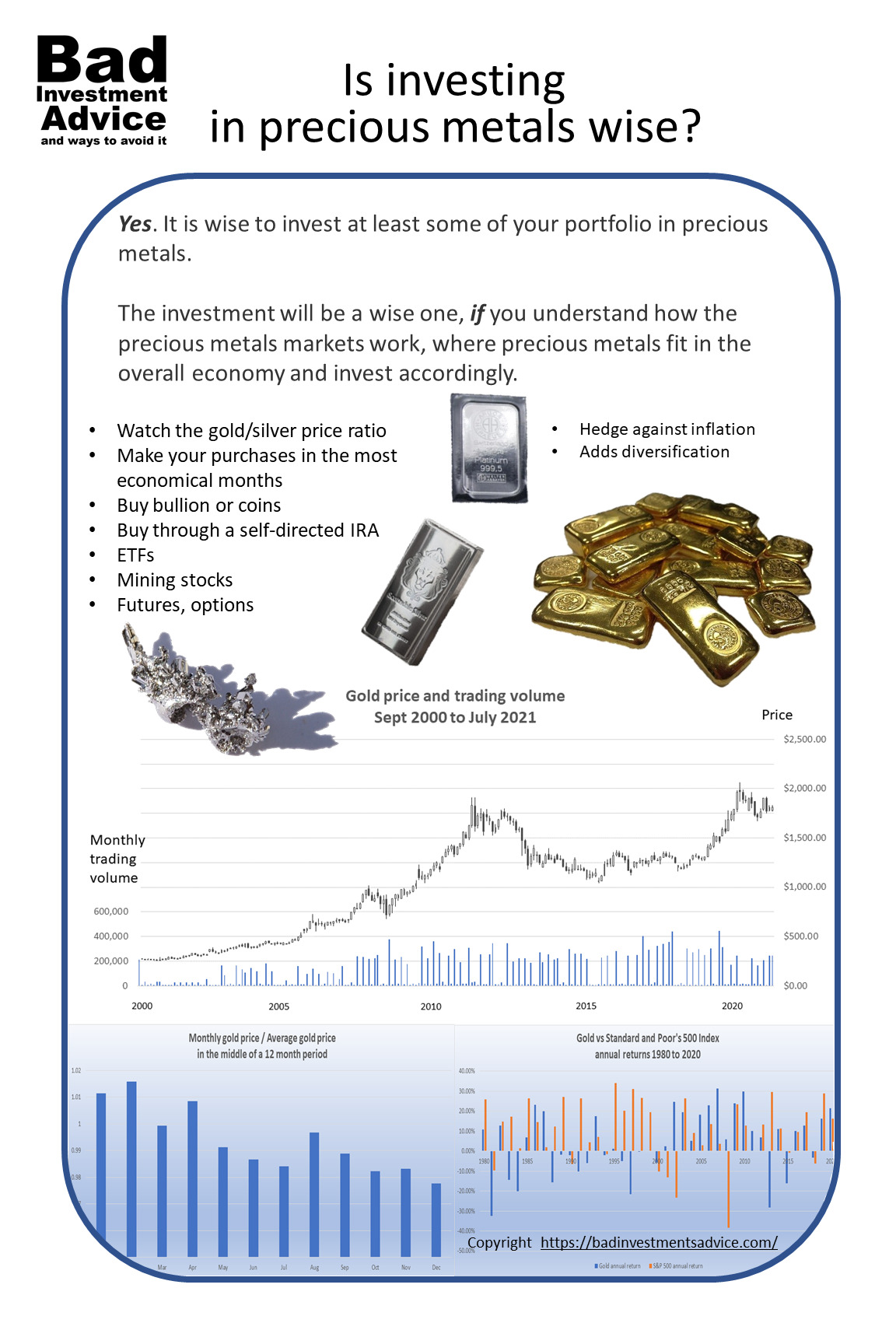

Yes. It is wise to invest at least some of your portfolio in precious metals.

What will make the investment a wise one, is understanding how the precious metals markets work, where precious metals fit in the overall economy and investing accordingly.

Right now, well into 2021, there are signs that the stock market is topping. How long that process takes before the economic cycle tips into the next phase is anyone’s guess. When that happens commodities with precious metals among them are likely to see a surge. Also looking back over the last decade, gold, in particular, has been in a lull. A price rise for gold is probably overdue.

And a price rise in gold will likely pull the prices of the other major precious metals with it.

Which metals are precious

When we say precious metals we tend to mean these four.

- Gold

- Silver

- Platinum

- Palladium

There are other metals that are rare and precious in that they are expensive because they are rare. But they are often less stable and really only of interest to chemists and labs. What sets gold, silver, platinum, and palladium apart is that they are widely used as investments and stores of value.

We’ve all heard of gold and silver and most of us are aware of platinum being used in jewelry but there are industrial uses of these metals too.

Gold is used widely to make contacts in electronics but also in dentistry.

Silver has been used in photography for many years but that has all but stopped because of digital photography. Silver is also used in electronics but is also in high demand for silverware and jewelry.

Platinum is used in catalytic converters principally in diesel engines. It is also used in jewelry and in medical applications. It is very rare and hence currently more valuable than gold of equal weight.

Palladium is used in catalytic converters for gasoline engines. It is also used in jewelry and dentistry. Currently, palladium is the most valuable of these precious metals that are widely held as investments.

The price of palladium has increased recently because of tightening regulations on vehicle emissions around the world. The current level of supply is unable to keep up with demand so the price has risen.

Palladium metal 1)Source:Hi-Res Images of Chemical Elements, CC BY 3.0 , via Wikimedia Commons

This article explains precious metals in more detail.

Price driver for gold

This is one of the main differences between what drives the price of gold versus the other precious metals.

The gold price is driven primarily by the desire of investors and central banks to hold gold. I suppose we should say hoard because that is what it really is.

The amount of gold that is mined every year and that goes into jewelry and industrial uses is small in comparison to the amount of gold held for investment. So any change in demand from the industrial side or the jewelry side is much less significant than any change in investor sentiment.

If investors start to feel more at ease and less miserly, they will be willing to sell their gold and buy a yacht or another vacation home perhaps. That will tend to increase the gold supply and that will depress the gold price.

On the other hand, if investors are feeling less secure, and think the economy is about to collapse, then they will want to buy more gold and that will drive the price of gold up.

Price drivers; silver platinum, and palladium

Unlike gold, whose price is almost entirely driven by investor sentiment, the other three metals are more susceptible to demand from industrial uses.

Silver is a bit in the middle in this respect.

Silver is also held in large quantities as an investment but is equally in demand for industrial uses and jewelry. Because the industrial uses of silver are subject to technological change and innovation this has made the silver price more volatile than the gold price for example.

The demand for platinum and palladium is driven even more by industrial uses and much less by investors’ holdings.

The link with the dollar

Because these precious metals are traded in dollars, their prices tend to move in the opposite direction to the US dollar.

The strength of the US dollar is usually measured by the US Dollar Index which tracks its value against a basket of six other major currencies. When the US dollar is strong that tends to depress the prices of precious metals and conversely when the US dollar is weak that tends to elevate the prices of precious metals.

Here is a historical chart of the dollar price index from 1973 to 2020.

2)Source:U.S. Dollar Index – 43 Year Historical Chart

The gold to silver ratio

One ratio that precious metal investors watch closely is the ratio of the price of gold to the price of silver. Since the major currencies dropped the gold standard in the early 1970s, and gold and silver have been traded as commodities, the gold to silver ratio has fluctuated widely.

The gold to silver price ratio is interesting for a number of reasons.

3)Source: https://www.investing.com/commodities/silver-historical-data

Gold and silver prices tend to move either up or down together. So in that sense, the gold to silver price ratio is a measure of the balance or imbalance of the relative prices of the two precious metals.4)Source: https://www.usmoneyreserve.com/blog/gold-to-silver-ratio-questions/

Throughout the 20th century, the ratio has averaged 47. That means, on average it would cost you 47 ounces of silver to buy one ounce of gold. There were times during that 100 year period when the ratio was as low as 12 or 13. The ratio has reached as high as 124. Right now in mid-2021, the ratio is around 75.

The gold to silver price ratio is important because, if you are buying precious metals, the ratio can be used as an indicator of whether gold or silver is relatively cheap.

Know your metal

Like with all investments, it pays to know how they work before you invest.

As an example, gold tends to be less expensive during certain months of the year. So let’s say you have an investment plan that involves the regular purchase of a set US dollar amount of precious metals every year, it would probably be a good idea to make much of your purchases during the months when the prices are historically at their lowest.

The chart below shows the monthly closing price for gold divided by the average price over the 12 month period covering the previous 6 months and the next 6 months. The dataset covers the period from December 2004 to July 2021. That may sound a bit convoluted but essentially we are looking for the times of the year when we would get the lowest prices.

5)Source: Historical stock price data: Yahoo Finance, all charts and calculations Bad Investment Advice.

From this chart, the best months to buy would be December and July.

Similarly, if you watch the gold to silver price ratio and see that it tends to vary between extremes, then it may make sense to purchase proportionally more of the less expensive metal when you are making your regular purchase of precious metals.

Where gold has been

Just to look at the price and volume of gold trades for the last 20 years shows us an interesting price formation.

6)Source: Historical stock price data: Yahoo Finance, all charts and calculations Bad Investment Advice.

Looking at this price chart it is easy to say, from the perspective of technical analysis that gold has been building a large base over the last ten years.

This is the first of two articles that explains the basics of technical analysis.

What we are actually looking at here could very well be the base of a classic and very large cup and handle price formation. Here is an article that explains the cup and handle formation.

If we were to see the gold price breaking out to new highs on increasing volume this could be a good indicator that the price will continue to rise beyond its previous all-time high.

Inflation fears

One of the biggest drivers of the sentiments of investors in precious metals has to be the fear of inflation.

If you are comfortable ignoring and contradicting what federal bankers are saying and projecting, then there are plenty of reasons to think that we are likely to see inflation rise.

We’ve seen some stubborn price rises during what we could now call the economic recovery from the COVID crash. The official published projections for the Consumer Price Index have risen from one quarter to the next.7)https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm

In addition to the increases in commodity prices that we have all seen, you could also take the classic view that rising wages will lead to higher prices. The fact that most manufacturing now happens overseas just means that for service economies rising wages will likely result in higher costs for services.

One of the big unanswered questions is where all the new money the government has pumped into the economy is going to go? Economist Stephen Ratner has been sounding loud warnings that too many government officials are playing down the risks of rising inflation. 8)https://stevenrattner.com/article/too-many-smart-people-are-being-too-dismissive-of-inflation/

Another important development is clear signs that the Federal Reserve is intending to slow down its monthly purchases of Treasury Bonds later in 2021. 9)https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20210728.pdf That will likely unsettle the markets, or rather it already has unsettled the markets.

The case for precious metals

So … the case for a rise in the prices of precious metals is that

- A price rise is long overdue

- Inflation pressures are building, irrespective of what government officials claim

- Fears of inflation are rising

- The stock market bull run has just about exhausted itself

- The economic cycle is about to turn in favor of commodities, including precious metals.

So what do the naysayers say?

The case against precious metals

There is one way to look at the stock market and draw the conclusion that the bulls aren’t entirely defeated yet.

These could be famous last words of course.

But when you look at which sectors are doing well in the last few months, this is what we see.

10)Source: https://stockcharts.com/freecharts/perf.php?[SECT]

This chart compares the performance of the 11 main sectors ETFs that make up the Standard and Poor’s 500 Index over the last two months from mid-June through mid-August.

If we had looked at the same chart a few months back, mid-April to mid-June, this is what we would have seen.

11)Source: https://stockcharts.com/freecharts/perf.php?[SECT]

It isn’t immediately obvious but some of the sectors have changed dramatically. Right now the energy sector is the worst performer, two months ago it was the best performer. Two months ago technology was roughly on a par with the Index, right now it is one of the strongest performers.

That suggests that the institutions haven’t quite made their minds up yet which sectors to favor. However, what we don’t see is a flight into the traditional safe sectors, like utilities, healthcare, or consumer non-discretionary.

Two months ago you could say that the bulls were still in charge because they were favoring risky sectors. Now I think the situation is less clear-cut. It is more of a mixed bag, though we haven’t yet seen a stampede for safe assets.

Mind you, if you did wait to see the stampede for safe assets you’d probably be left in the dust. But that is a short-term view.

Long-term returns

Taking a longer-term view we can look at the returns from gold, which is the most widely traded precious metal over the last 20 years.

12)Source: Historical stock price data: Yahoo Finance, all charts and calculations Bad Investment Advice.

Like other volatile assets, we can see gold goes up some years and drops in other years. The average over the last 20 years works out at 10.35%

The well-known and popular personal finance advisor, Dave Ramsey says to stay away from precious metals.13)Source: https://www.ramseysolutions.com/retirement/investing-in-precious-metals He points to the fact that precious metals do not pay dividends, rent, or coupons, and looked at over the very long-term, they have not performed well as investments.

I think his assumption is also that the individual investor is not going to be able to time their investments in precious metals and will be bound to an inevitability of long-term comparatively low returns.

Timing

I would argue that over a definite time period, you can determine whether precious metals are comparatively under-valued or overvalued with respect to other assets. A simple way to look at this is to compare the returns of the Standard and Poor’s 500 Index with the returns of gold over the last 20 years.

14)Source https://www.investing.com/indices/us-spx-500-historical-data

So looking over the last 20 years in fact gold averaged a healthy annual return of 10.35% whereas the S&P 500 index didn’t do as well and averaged an annual return of 5.60% excluding dividends.

We could argue we are being someone tough on the Standard and Poor’s 500 since we include the dot com crash of the early 2000s, the financial meltdown of 2008/2009, and then most recently the Corinavirus crash.

Also because we are cutting off 2021 we are missing the spectacular recovery and doubling of the index since the Covid-low of 23 March 2020.

OK. so let’s see what happens if we take a longer time frame, say forty years from 1980 to 2020. Here’s what that looks like

15)Source: https://www.investing.com/indices/us-spx-500-futures-historical-data?cid=1175153

This paints quite a different picture. Over the whole period, the average annual return of gold was 4.41% while the Standard and Poor’s 500 Index was 10.29% excluding dividends. The other important aspect revealed in this chart is that the annual returns on gold and on the Standard and Poor’s 500 are not correlated. So adding gold to your investments portfolio is a way to add diversification.

What does that tell us?

This is going to depend on your time horizon. If you think that the stock market has experienced unusually high returns recently and gold has not, then you would likely see this as a good time to gain more exposure in your portfolio to gold and possibly other precious metals.

How much exposure

There are different ways to buy precious metals.

There are obvious ways to buy coins or bullion. Another way is to buy shares of mining companies. The advantage of shares in mining companies is that they may pay dividends. Another important aspect of mining shares is that the shares can be very sensitive to the commodity price of the precious metal.

Specific mining companies often have a number of mines, each one of which will have a specific cost of extraction per ounce of metal. A drop in the price of the metal can mean that a mine that was profitable is no longer profitable. Conversely, a small percentage rise in the price of the metal can easily double or treble the profitability of the mine.

Clearly, institutional investors in precious metal mining companies know the impact of price changes on the profitability of the mines and so share prices will usually reflect forward-looking market expectations of the metal prices. So any unexpected change in metal price can cause large swings in the share prices of the mining companies.

Another way to gain exposure to precious metals for your portfolio is to buy Exchange-Traded Funds or ETFs that specialize in precious metals. There is also an ETF that tracks the gold price for example.

Yet another way to gain exposure to precious metals is to trade futures or options. This is going to be much more speculative than buying coins of course.

An increasingly popular way, that is also tax-efficient, safe, and secure way to buy precious metals is through a self-directed IRA.

Bound for hell in a hand-basket?

If you have come to the conclusion that the economy is straining, that the stock market is topping, that inflation will rise and the Federal Reserve and the US Government will not have the will to combat it, then you may be interested in building a position in precious metals.

Affiliate Disclosure: This article contains affiliate links, if you purchase through a link on this site, I may receive a commission.

A secure and tax-efficient way to do that is through a self-directed IRA like Goldco.

Questions and answers

Q. What percentage of investments should be in precious metals?

A. Most advisors would recommend holding no more than 5 to 10% of your portfolio in precious metals.

Q. What is one disadvantage of investing in precious metals?

A. One disadvantage of precious metal coins or bullion is that they do not generate income, they don’t pay dividends, coupons or rent. Another disadvantage is you need a safe and secure location to hold precious metals. That will come at a cost.

Q. What is a benefit of investing in precious metals?

A. The returns on precious metals are not closely correlated with the stock market or the bond market. Investing in precious metals adds diversification to an investment portfolio and can be a good hedge against inflation.

Single-page summary

Here is a single-page PDF summary of is investing in precious metals wise.

I hope you found this article interesting and useful. Do leave me a comment, a question, an opinion, or a suggestion and I will reply soonest. And if you are inclined to do me a favor, scroll down a bit and click on one of the social media buttons, and share it with your friends. They may just thank you for it.

You can also subscribe to email notifications. We will send you a short email when a new post is published.

Disclaimer: I am not a financial professional. All the information on this website and in this article is for information purposes only and should not be taken as personalized investment advice, good or bad. You should check with your financial advisor before making any investment decisions to ensure they are suitable for you.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you

References

| ↑1 | Source:Hi-Res Images of Chemical Elements, CC BY 3.0 , via Wikimedia Commons |

|---|---|

| ↑2 | Source:U.S. Dollar Index – 43 Year Historical Chart |

| ↑3 | Source: https://www.investing.com/commodities/silver-historical-data |

| ↑4 | Source: https://www.usmoneyreserve.com/blog/gold-to-silver-ratio-questions/ |

| ↑5, ↑6, ↑12 | Source: Historical stock price data: Yahoo Finance, all charts and calculations Bad Investment Advice. |

| ↑7 | https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm |

| ↑8 | https://stevenrattner.com/article/too-many-smart-people-are-being-too-dismissive-of-inflation/ |

| ↑9 | https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20210728.pdf |

| ↑10, ↑11 | Source: https://stockcharts.com/freecharts/perf.php?[SECT] |

| ↑13 | Source: https://www.ramseysolutions.com/retirement/investing-in-precious-metals |

| ↑14 | Source https://www.investing.com/indices/us-spx-500-historical-data |

| ↑15 | Source: https://www.investing.com/indices/us-spx-500-futures-historical-data?cid=1175153 |

Thank you for writing the article.

Metals companies largely fall into two categories:

Those focused on precious metals like gold and silver

Those that produce or use industrial metals such as iron ore, aluminum, and copper

So, metals companies have different sensitivities to the global economy, according to their area of focus.

Industrial metals’ demand and prices tend to rise and fall with the global economy. Given the inverse relationships between these types of metals, investors might want to consider pairing a company that focuses on industrial metals with one that focuses on precious metals to help smooth out returns. I valued your review, and I hope my feedback supports your article.

Hi John and thanks for the comment. You make a very good point. If someone is looking to gain exposure to metals and smooth the returns then investing in a company that is diversified across both industrial metals and precious metals is one way to do that. Investing in a broad materials ETF can also achieve this. Sometimes though, someone may want the exposure to just precious metals in which case they need to be more selective. I agree with you, it is about doing your due diligence and understanding how your portfolio is likely to respond to different economic conditions going forward and then either riding out the changes or adjusting accordingly. Best regards, Andy

I have to agree that there are no simple answers for this as well as many other issues. I have always favored a diversified portfolio, but any investment does require sufficient due diligence so that one has sufficient knowledge before making a decision to invest. I appreciate this education into the precious metals market. Understanding price drivers is really valuable. I appreciate the education.

Hi Joseph and thanks for the comment. I am very pleased you found this article informative. Best regards, Andy

I am extremely happy to come across this article. It was an in-depth read and I happily shared it on Facebook. The complex topics of investing are illustrated clearly by charts and diagrams. The cup handle diagram is enjoyable to speculate the entry point for me. The chart of the monthly gold price over average price is an eye-opener for me.

I had a gold investment as ETF. It was down and no money was made from it. As soon as the price went up I was impatient to sell the position with 10% profit and never tried again. However, I have a piece of jewelry bought in ~1995 at quite a low price. It had gone up by many folds.

Thank you for a detailed article on investing in rare metals with a snapshot of the market movements.

Hi and thanks for the comment. I think your experience is very common. When we buy a position that drops soon thereafter, it is easy to get caught up in a hasty emotion to sell as soon as it goes positive. That is why it is important to know your target exit prices, both with a loss and with a profit for every position. If that is based on fundamental conditions, then you have to watch whether those conditions change and adjust accordingly. Thanks again and best regards, Andy

I know that a crisis is around the corner. But I have been struggling to make up my mind on what to invest. I know that it has always been advice to invest in gold in times like these. But I have also began to see with increasing interest the crypto world. However, I know that gold is a proven method, I don’t know what will happen with crypto. So, I believe gold is my best option.

Hi and thanks for the comment. I think there is no reason why you have to place all your bets on just one horse. Personally, I think it makes sense to have some exposure to both gold and crypto. As for whether an economic and financial crisis is heading our way, I think we will see a downturn and it could well qualify as a recession but how deep that will be and how quick the post-recession recovery will be is up in the air. Thanks again for the comment, best regards, Andy

HI Andy. Thank you for another great article. I always learn something new form your blog and always looking here answers for my investment questions. Personally I invest part of my money in gold, as it seems safer and more stable then stock market. It is long term investment but at the same time it guarantee to have better protection of your assets.

Hi Cogito and thanks for the comment. I agree that gold is a good bet at the moment and is likely to see a rise and possibly a significant rise over the next year or two. Good luck with your investments and best regards, Andy

This was absolutely fascinating – though, being a bear of very little brain, there was much I did not understand. I want to add that I thought palladium was a theatre somewhere in the West End. Some very impressive research lies behind this article, however, Andy; it must have taken you ages.

Hi Mate! Yes, indeed the Palladium is a theatre in the West End. Coincidentally, it appears the Palladium has hosted runs of Cats, as in the show, and not moggies with digestive challenges, though not when I was in the habit of visiting my dad after the performance when I was on trips to London from Germany. I think it was playing in the New London Theatre at the time. But of course, this is completely irrelevant to the post and only indirectly relevant to your comment in a tangential way. So there we go. Fun nevertheless, Cheers, Andy

I think when it comes to precious metals if you ask most people almost all of them will tell you gold and this says something. Gold has been the most safe way to invest in a precious metal and not running the risk of loosing but I get its not all about gold. It’s just people are not familiar with other metals enough unless you are in the field and know about them. I think if anyone would like to invest to a precious metal it needs some research beforehand as it is easy to say “I will invest in gold” when things can be slightly more complicated than that.

Hi and thanks for the comment. As with precious metals, like all investments, it pays to do your research. Best regards, Andy

Hello, you are totally correct in that the price of gold is mostly determined by the desire of investors and central banks to hold gold. Unfortunately, they are not selling gold as much as they should. Investors, as you mentioned, have a negative impression of the economy, believing that it could collapse at any time. I believe that putting their fears aside and using their gold is a far better option than keeping them at that point.

Thank you very much.

Hi and thanks for the comment you highlight an important point. I think it is easy to get caught up in trying to understand the causes of market sentiment and work out whether the reasons for public panic or public euphoria are justified or not. We may be better off just understanding what the market sentiment is, observe the effects it having and then invest accordingly. I do think it will be interesting to see what happens to the prices of precious metals later this year and into 2022. Thanks again for your comment. Best regards, Andy

Investing in something is like building a house. Investments are your bricks and the result is something like a building or sometimes just a load of broken bricks.

Hi and thanks for the comment. Precious metals have done very well lately. Also with the prospect of increasing inflation, it is even more likely that precious metals will retain their value. As you say it is quite possible to end up with a pile of bricks rather than a coherent structure if you make unwise investment choices.