Ever feel like you’re behind in life? You scroll through social media and see someone your age, or younger, driving luxury cars, flashing Rolex watches, or claiming they just made six figures from their latest investment. Meanwhile, you’re still figuring out how to make ends meet, let alone build wealth.

Ever feel like you’re behind in life? You scroll through social media and see someone your age, or younger, driving luxury cars, flashing Rolex watches, or claiming they just made six figures from their latest investment. Meanwhile, you’re still figuring out how to make ends meet, let alone build wealth.

Before you let panic set in, take a deep breath. The truth is, most of what you see online is either exaggerated, inherited, or built on a foundation of luck and privilege. Real, sustainable wealth doesn’t come from quick wins, it comes from smart, consistent financial decisions over time.

Let’s break down why you might not be as financially ahead as you’d like to be and, more importantly, what you can do about it starting today.

The Illusion of Instant Wealth

Social Media vs. Reality

It is easy to overlook this but social media algorithms know they will hook us in and keep our attention by portraying success stories, not failures. The result is we cultivate unrealistic expectations. The fact is that many “rich” influencers are renting their luxury lifestyle to be able to show it in their content. More often that not, true wealth is quiet. The large majority of millionaires do not flaunt their wealth.

Survivorship Bias: Seeing Only the Winners

One simple fact you will neither hear nor read about very often is that for every person who struck it rich in crypto or day trading, thousands lost everything.

There are profitable business models built around this simple fact. for example, if you’re holding ether for the long-term, and you are willing to put up a portion as higher risk collateral, you can join pools and effectively together with others in your pool, you take the other side of traders’ crypto trades. Yes, it’s higher risk than just regular staking, but the general principle is that around 90 % of traders lose overall eventually.

Because the media and influencers are geared towards supporting advertisers and selling goods and services, their content is less likely to show stories of failures because failure doesn’t sell. Long-term investing and financial discipline are what truly create wealth.

The Real Timeline of Wealth Building

The majority of millionaires didn’t get there overnight, most built their wealth steadily over decades. The average self-made millionaire reaches that status in their 50s, not their 20s. The key is patience and long-term strategy, not high-risk speculation. Even those who did achieve their riches through one lucky strike. Lost many times before that.

The Power of Starting Now

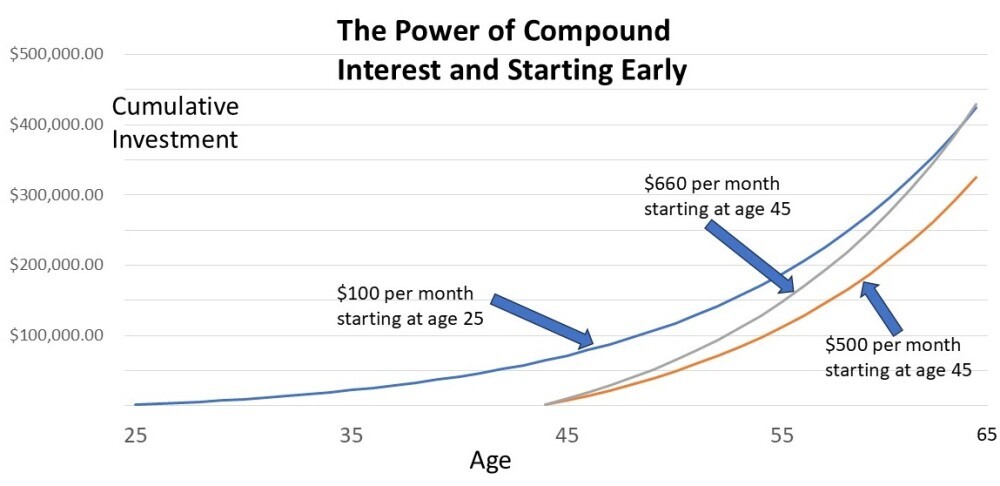

Time is your greatest asset. Compound interest is the real wealth builder as it multiplies your money over time. The earlier you start, the less you have to invest to reach financial independence.

A person investing $100/month at 25 will have significantly more by the time they reach 65 years old than someone investing $500/month starting at 45. In fact the math is quite surprising. If both were investing in a fund that returns an average of 9% a year, the person who started at 45 would have to invest $660 per month to catch up with the one who started at age 25 with $100 per month. Here’s what all that looks like.

Source: Bad Investment Advice

But that isn’t all. If you start regular monthly instalments at age 25, investing over a 40 year period, you will be more certain of reaching your goal because steady annualized returns over a 40 year period are going to be less subject to market risk. Whereas if you start at 45, with only 20 years of investing, your overall return will be subject to greater risk.

Here is an article that looks into investment strategies for retirement.

Procrastination costs you money. Delaying investing by just a few years can mean missing out on hundreds of thousands of dollars at the end of your investing period.

What’s more, inflation eats away at cash savings. Funds held in a non-interest bearing account erode over time. Investing is necessary to grow wealth. The longer you wait, the harder it becomes to catch up.

Small steps lead to big gains. You don’t need thousands to start investing, just start with what you can afford. Make sure you use tax-advantaged accounts like 401(k)s and IRAs to maximize growth. If you are employed, make the most of any matching that your employer offers: its fee money. Automate your investments to remove the temptation of spending the money instead.

The Dangers of Comparing Your Finances to Others

Personal financial journeys are unique. Everyone starts from a different place. Inheritance, debt, education, and income all play roles. Some people have financial help from family, while others have to start from zero. Comparing your financial beginning to someone else’s financial peak is a losing game.

Ever heard of lifestyle inflation? It’s a silent wealth killer. Trying to “keep up” leads to overspending and debt, not wealth. Many high-income earners are actually broke because they spend everything they make. Beware if you live in an area where the norm is to live beyond your means. The social pressures to keep up with neighbors and peers can be hard to resist. The answer is to focus on increasing your net worth, not just income or material possessions.

You need to measure your own progress. Set realistic financial goals based on your own situation. Track your net worth instead of your income or spending. And let’s remember to celebrate small wins like saving your first $1,000 or investing your first $10,000.

How to Get on the Right Path Today

The first thing to do is start tracking your income and your expenses. You can either use plain old spreadsheets, or budgeting apps to show you where your money goes. Then identify areas where you can cut unnecessary expenses. Now reallocate spending towards savings and investments.

You will thank yourself years down the line if you automate savings and investments. Look at it as paying yourself first. Set up automatic transfers to savings and investment accounts. Use dollar-cost averaging to invest consistently. This way you won’t have to worry about market timing.

And don’t put off taking advantage of employer-sponsored retirement plans and matching contributions.

Set yourself achievable financial milestones. Aim for short-term goals for example saving your first $1,000. A medium-term goal might be paying off debt, and your long-term goal could be retirement investing.

Starting out use the 50/30/20 rule: 50% for your needs, 30% can go to wants, while 20% is dedicated to savings and investing. Don’t forget to increase your savings and investing percentages as your income grows. This will help you avoid lifestyle inflation.

Invest in your own personal financial education by learning from the right sources. Follow credible financial educators, not flashy influencers selling dreams. Read books like The Simple Path to Wealth by JL Collins and I Will Teach You to Be Rich by Ramit Sethi. Surround yourself with financially savvy people who encourage smart decisions. Here is an article that examines the collected wisdom of successful stock market investors.

Final Thoughts

The fact that you’re still here and capable of making financial changes means it’s not too late. Don’t get discouraged by what you see on social media—real wealth isn’t about fast cars and luxury vacations. It’s about financial freedom, security, and the ability to live life on your terms.

You don’t need a big income or a perfect financial plan to start—just small, consistent steps in the right direction. Start today, stick with it, and you’ll be amazed at where you are in five, ten, or twenty years.

The real question isn’t why someone else is rich while you’re broke—it’s what you’re willing to do today to change that.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you!

It has often been said that there is no better investment than your own financial education. One great way to accelerate your financial education and your investing success is with the American Association of Individual Investors, the AAII. When you join the AAII, you get access to reports, courses on investing, risk management, asset allocation, retirement planning, managing retirement finances, and other resources, all for a single annual membership fee.

Single-page Summary

Here is a single-page summary of why others are getting rich and you’re still broke. You can download a pdf here.

I hope you found this article interesting and useful. Do leave me a comment, a question, an opinion, or a suggestion and I will reply soonest. And if you are inclined to do me a favor, scroll down a bit and click on one of the social media buttons, and share it with your friends. They may just thank you for it.

You can also subscribe to email notifications. We will send you a short email when a new post is published.

Disclaimer: I am not a financial professional. All the information on this website and in this article is for information purposes only and should not be taken as personalized investment advice, good or bad. You should check with your financial advisor before making any investment decisions to ensure they are suitable for you.

Affiliate Disclosure: This article contains affiliate links. If you click on a link and buy something, I may receive a commission. You will pay no more so please go ahead and feel free to make a purchase. Thank you.

-Great article on a common topic: wealth. 😉 -The 50/30/20 rule seems like a rule that can be applied to anything, not just money. -I might have wished to have started 3 years ago with compound interest; but I am not worried about it either which way. -I will remember everything you said about social media being a hoax when it comes to flaunting wealth and such. -Best, ALEJANDRO G.

thanks for your positive feedback. I’m glad you liked the article. If you are only 3 years late starting with compound interest then that isn’t so bad. There is no time like the present though. Best regards, Andy

So much good sense in this piece, Andy.

I’m glad you enjoyed it. Must admit I had a lot of fun with this one too.